Get the free Lodging Tax advisory CommitteeAberdeen, WA

Get, Create, Make and Sign lodging tax advisory committeeaberdeen

How to edit lodging tax advisory committeeaberdeen online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lodging tax advisory committeeaberdeen

How to fill out lodging tax advisory committeeaberdeen

Who needs lodging tax advisory committeeaberdeen?

A comprehensive guide to the lodging tax advisory committee Aberdeen form

Understanding the lodging tax advisory committee

The Lodging Tax Advisory Committee (LTAC) plays a crucial role in managing and allocating funds generated from lodging taxes collected in Aberdeen. This committee aims to boost local economies, particularly through tourism and hospitality sectors, by ensuring that lodging tax revenue is used effectively to promote community interests.

Lodging taxes are essential for local governments as they provide necessary funding for public services, community development, and infrastructure improvements. The effective allocation of these funds can enhance visitor experiences and contribute significantly to the overall vitality of the local economy.

Structure and membership

The LTAC is typically comprised of a diverse group of stakeholders, including members from the hospitality industry, local business owners, and city officials. Each member is tasked with bringing their unique perspectives to the table, ensuring that a wide array of interests are represented in discussions regarding lodging tax expenditures.

Committee members hold specific positions that encourage collaboration and transparency, requiring regular meetings to assess financial reports, evaluate community impact, and propose initiatives that align with the committee’s objectives. Members not only share insights but also contribute to strategic decisions that shape the tourism landscape in Aberdeen.

Overview of the lodging tax advisory committee Aberdeen form

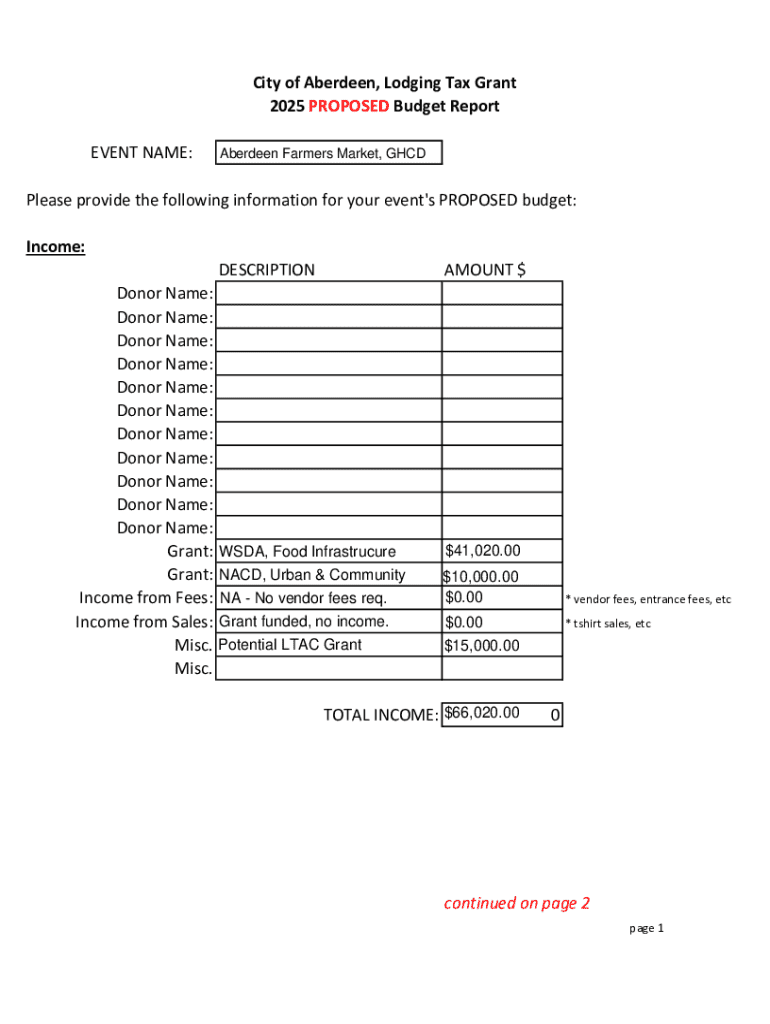

The Lodging Tax Advisory Committee Aberdeen form serves as a vital tool for collecting and disseminating information regarding the distribution and utilization of lodging tax revenues. This form is integral to the LTAC’s operations, ensuring that all necessary data is compiled accurately for review and accountability.

Anyone involved in the management or use of lodging taxes, such as hotel operators, event planners, and community organizations, is encouraged to fill out this form. By providing comprehensive and truthful information, stakeholders ensure that the LTAC can make informed decisions about funding allocations and community projects.

Types of reports and information required

The information required on the form includes financial data, such as tax collections and expenditures, focusing on how these funds benefit the local community. Additionally, non-financial contributions such as community outreach efforts and impact assessments play a vital role in conveying the broader effects of lodging taxes.

Essential insights into local initiatives funded by lodging tax revenue also provide valuable input for the committee, helping them evaluate previous successes and shaping future investments. Thus, this form is not merely a reporting tool; it is a strategic instrument for promoting transparency and effective cooperation among stakeholders.

Step-by-step guide to filling out the form

Pre-preparation steps: Gathering necessary documents

Before filling out the Lodging Tax Advisory Committee Aberdeen form, it is crucial to gather all necessary documents. This includes financial statements, previous reports on lodging tax usage, and any community assessments that may influence funding decisions. Having these documents handy ensures a smoother and more accurate submission process.

Recommended tools for efficient data gathering include spreadsheets for organizing financial data and templates for community impact reports. Utilizing these resources can save time and reduce errors while enhancing the overall quality of the submission.

Detailed instructions for completing each section

Section A: Basic information

Section A requires basic details such as the name of the organization, contact information, and the purpose of the lodging tax request. Common pitfalls in this section include neglecting to provide complete contact details or mislabeling purposes, which can lead to confusion during the review process.

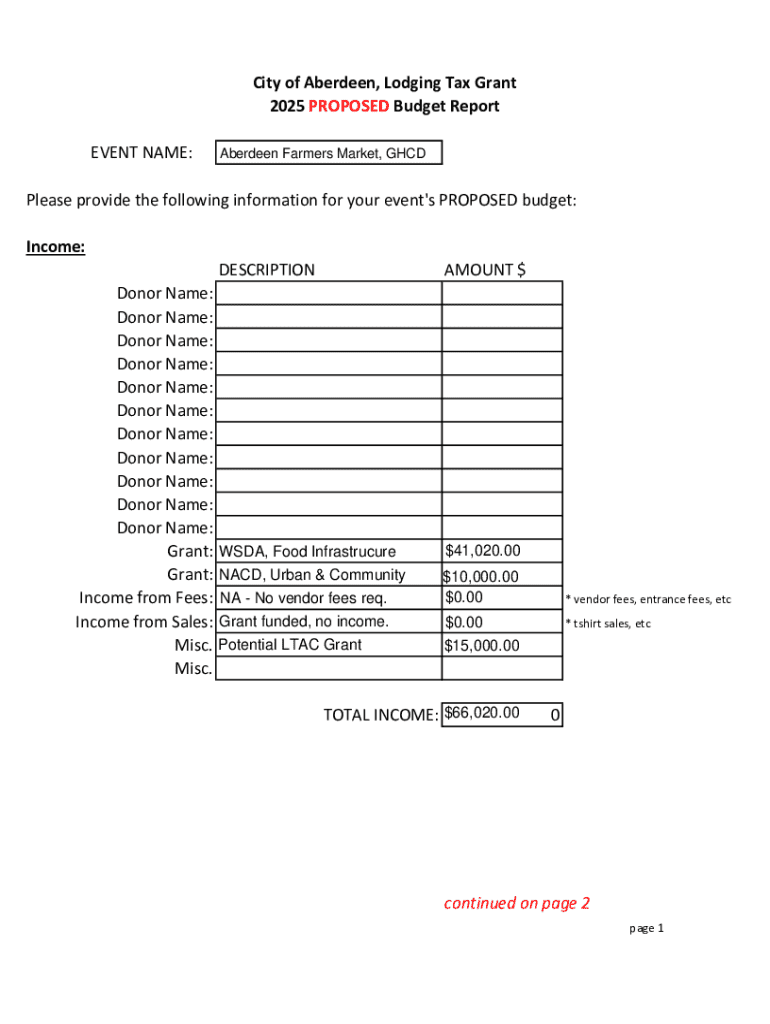

Section B: Financial summary

This segment demands a breakdown of tax income and expenditures. It is essential to ensure figures are accurate and reflect the true financial state regarding the lodging tax. Proper categorization of expenses — such as marketing, community events, and infrastructure improvements — can significantly impact funding decisions and should be meticulously detailed.

Section : Community and economic impact

In this section, articulating the direct and indirect impacts that lodging taxes have on the community is crucial. Stakeholders should discuss aspects like job creation, enhanced services for residents, and tourism growth. Providing compelling narratives backed by statistics can strengthen the case for funding requests, showcasing the multifaceted benefits of lodging tax revenue.

Techniques for editing and reviewing your submission

Best practices for editing

Editing is a vital component of preparing the lodging tax advisory committee Aberdeen form. Focus on clarity and professionalism in presentation; avoid jargon or overly complex language. Peer review is also an effective technique, allowing colleagues to offer feedback and catch errors that may have been overlooked.

Having a standardized format can enhance readability; utilizing bullet points or numbered lists where appropriate makes key information stand out. Consistency in font and spacing is equally important, ensuring that the document appears cohesive and polished.

Utilizing pdfFiller tools for effortless management

pdfFiller offers numerous features that simplify document editing and collaboration. Its intuitive interface allows users to seamlessly edit PDFs, add comments, and track changes. The platform also enables easy sharing and signing of documents, making collaboration with team members straightforward and efficient.

Using pdfFiller to collect feedback is another way to streamline the review process. Stakeholders can annotate directly on the document, ensuring that their insights are captured clearly and in context, ultimately leading to a more refined final submission.

Legal considerations and compliance

Understanding legal obligations

Filing the lodging tax advisory committee Aberdeen form comes with specific legal obligations. It’s essential for applicants to be aware of laws governing lodging tax submissions, ensuring compliance to avoid penalties or legal disputes. This aspect is especially important as non-compliance can jeopardize funding opportunities and community projects.

Common legal issues faced by applicants often revolve around incomplete information or misreporting tax figures, leading to unnecessary complications. Understanding the nuances of local regulations will help mitigate such risks and streamline the submission process.

Ensuring compliance with local regulations

Aberdeen-specific lodging tax regulations may vary, so being informed about updates and changes is vital. Users must familiarize themselves with the local legislation surrounding lodging taxes to ensure their submissions are compliant and reflective of current standards.

Resources such as local government websites, community bulletins, and seminars hosted by the LTAC can provide ongoing education. Keeping abreast of these developments ensures that stakeholders remain informed and can adapt as required.

Collaborating with stakeholders and team members

Creating a collaborative environment

Fostering a collaborative environment is essential when preparing the lodging tax advisory committee Aberdeen form. Utilizing tools within pdfFiller, team members can work together in real-time, leading to more productive discussions and inputs. Facilitate regular meetings to ensure everyone can voice their opinions and contribute effectively.

Best practices for communication include outlining clear roles within the committee positions and adhering to timelines. Establishing a shared document with accessible information can help streamline processes further, maximizing efficiency and inclusivity.

Engaging with community leaders and stakeholders

Gaining input from community leaders and stakeholders is vital for successful lodging tax projects. Techniques for gathering support can include organizing community meetings, conducting surveys, or hosting informational presentations to discuss the potential uses of lodging tax revenues.

Presenting your filled form to stakeholders effectively can influence their engagement in the process. Utilizing visual aids or summary documents can help articulate key points, ensuring community leaders understand the benefits and implications of proposed initiatives.

Common challenges and solutions

Frequent issues encountered

Some of the most common challenges in submitting the lodging tax advisory committee Aberdeen form include technical difficulties with the submission platform and confusion regarding specific sections of the form. Misunderstandings about what data is required can lead to incomplete applications, delaying the review process.

Furthermore, applicants may struggle with gathering precise financial information or community assessments, which are crucial for demonstrating the effective use of lodging tax revenues. It’s vital to have a clear strategy in place to address these issues promptly.

Solutions and expert tips

Troubleshooting common problems starts with knowing how to navigate the submission platform effectively. Taking advantage of tech support resources offered by pdfFiller can clarify any technical issues. Additionally, prepare a checklist of required data before starting your submission to ensure you have all necessary information at hand.

If confusion arises over certain sections, consulting with experienced committee members or advisors can offer insights that simplify the process. Furthermore, local councils can provide guidance on best practices that enhance submission quality.

Success stories and case studies

Real-life examples of successful submissions

Successful initiatives driven by lodging taxes in Aberdeen often highlight how effectively the funds have been utilized. For instance, the recent expansion of community parks and tourism programs showcases the direct positive impacts these programs have on local residents and businesses.

Testimonials from committee members emphasize the importance of the lodging tax in fostering community engagement and economic growth. These accounts serve as inspiration for new applicants, showcasing how successful submissions can lead to significant improvements in community infrastructure and services.

Lessons learned from previous submissions

Analyzing submissions that faced rejection provides invaluable lessons. Common reasons for rejection typically include insufficient data, unclear objectives, or failure to demonstrate community impacts. These pitfalls underscore the importance of thorough preparation and precise articulation of intentions in applications.

Strategies for improving future applications include careful review processes and seeking feedback from officers or experienced members of the lodging tax committee. Investing time in understanding expectations can greatly increase chances of approval.

Future trends in lodging tax regulation

Anticipated changes in tax legislation

As legislative frameworks around lodging taxes evolve, stakeholders must stay informed about changes that may impact their contributions. Anticipated changes could include revisions to how tax revenue is allocated or adjustments in the percentage of revenue directed toward community programs.

Preparing for potential shifts in obligations involves monitoring local government announcements and participating in community forums where these topics are discussed. Staying proactive in these discussions will ensure organizations adapt efficiently to new expectations.

Innovations in document management and submission

Technological advancements in document management will continue to shape the future of lodging tax submissions. Enhanced data collection methods, automated reporting tools, and user-friendly submission platforms are some innovations on the horizon that promise to simplify processes for stakeholders.

pdfFiller remains at the forefront of these developments, providing robust solutions that empower users to manage lodging tax documents efficiently. Keeping an eye on such innovations will help users remain competitive and compliant in the evolving landscape of lodging taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lodging tax advisory committeeaberdeen to be eSigned by others?

How do I edit lodging tax advisory committeeaberdeen online?

How do I edit lodging tax advisory committeeaberdeen in Chrome?

What is lodging tax advisory committeeaberdeen?

Who is required to file lodging tax advisory committeeaberdeen?

How to fill out lodging tax advisory committeeaberdeen?

What is the purpose of lodging tax advisory committeeaberdeen?

What information must be reported on lodging tax advisory committeeaberdeen?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.