Get the free Kotak Energy Opportunities Fund KIM.cdr

Get, Create, Make and Sign kotak energy opportunities fund

How to edit kotak energy opportunities fund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kotak energy opportunities fund

How to fill out kotak energy opportunities fund

Who needs kotak energy opportunities fund?

Kotak Energy Opportunities Fund Form: A Comprehensive Guide to Sustainable Investing

Understanding the Kotak Energy Opportunities Fund

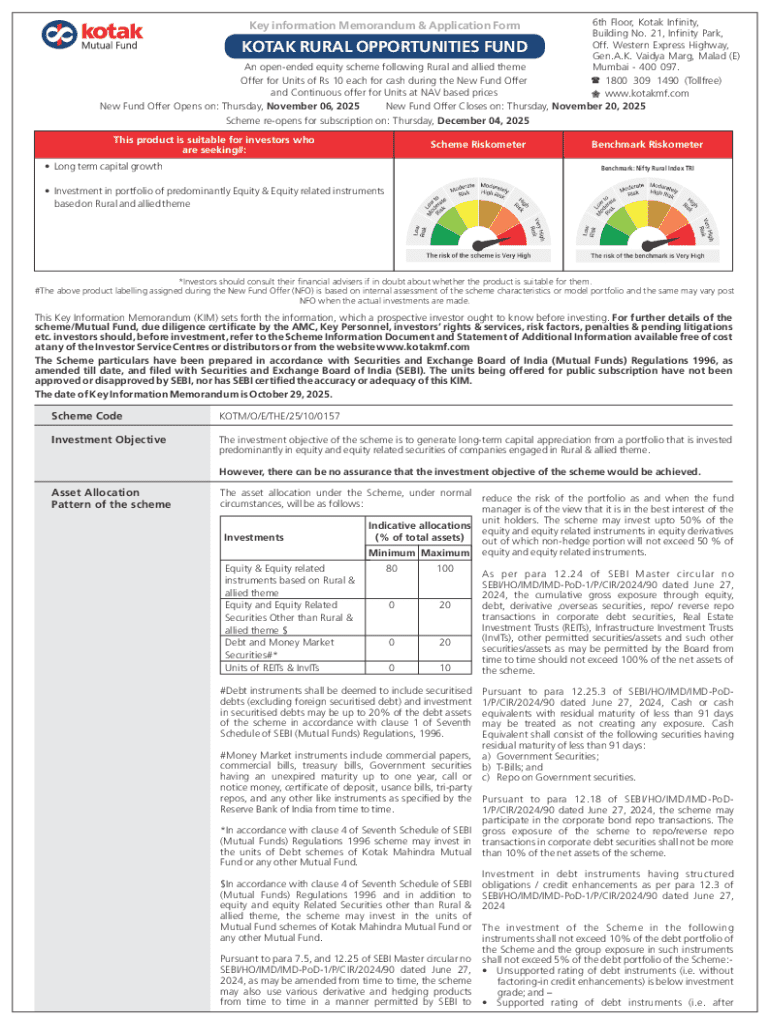

The Kotak Energy Opportunities Fund is a specialized mutual fund that focuses on investing in the renewable energy sector. This fund serves the dual purpose of providing capital for sustainable energy projects while offering attractive returns to its investors. Established as part of the growing recognition of climate change and the urgent need for cleaner energy sources, this fund has evolved over the years, aligning itself with global sustainability trends.

The fund’s performance has shown resilience and growth, reflecting the increasing demand for green energy solutions. With the transition from fossil fuels to renewables, investments in solar, wind, and other clean technologies have become not just environmentally but also economically viable. Tracking the historical performance reveals a steady upward trend, consistent with broader market movements towards sustainability.

Importance of sustainable energy investments

The relevance of sustainable energy investments has never been more critical, particularly in light of recent data showcasing a rise in global temperatures and the dire need for a transition to renewables. Current trends illustrate a robust global commitment to reducing carbon emissions, with significant investments flowing into renewable energy technologies. Governments, investors, and consumers are increasingly prioritizing sustainability, nudging traditional sectors to adapt.

The role of renewables in shaping future investment strategies cannot be overstated. Solar, wind, and other renewable sources are projected to dominate the energy landscape. This shift presents a unique opportunity for investors to capitalize on the growth potential in the renewable sector, leading to long-term, sustainable financial and environmental returns.

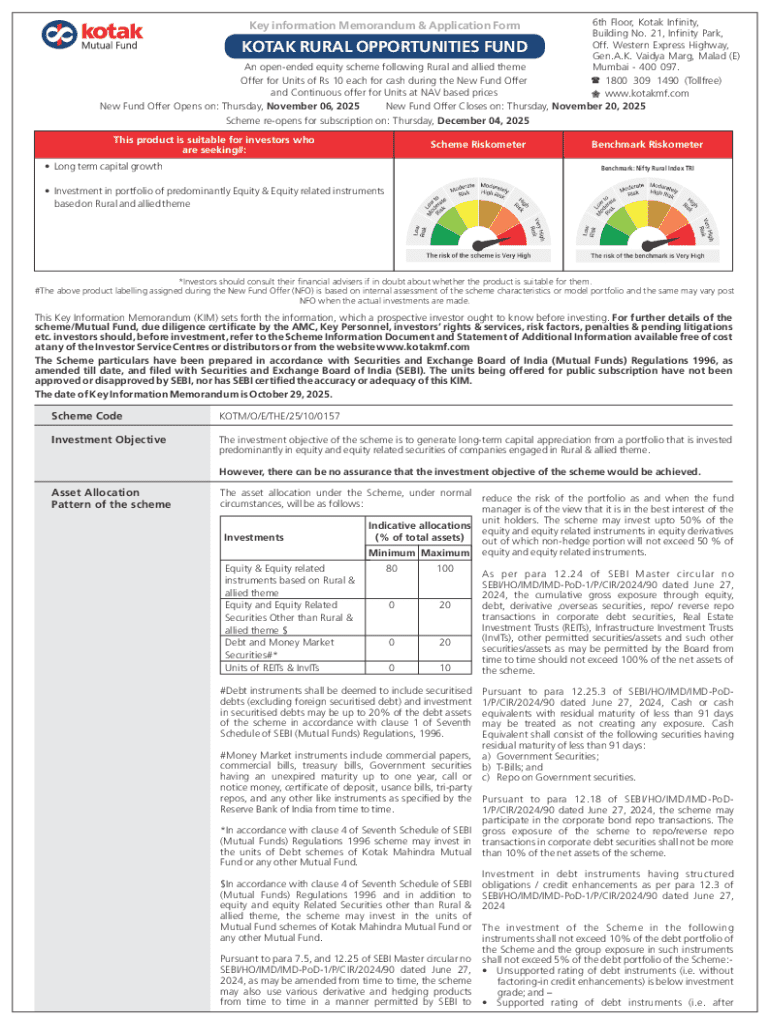

Key features of the Kotak Energy Opportunities Fund

Understanding the key features of the Kotak Energy Opportunities Fund can help potential investors determine its alignment with their financial goals. The fund primarily invests in equity and equity-related instruments of companies that are involved in the renewable energy sector. This provides exposure to various segments, including solar and wind energy developers, manufacturers of clean energy technologies, and companies focusing on energy efficiency solutions.

Scheme details

The investment horizon for the Kotak Energy Opportunities Fund is classified as medium to long-term, making it suitable for investors willing to align their capital with the growth of the renewable sector over time. The risk profile is moderate, reflecting the volatility associated with equity investments but balanced by the social impact focus on sustainability.

Asset allocation

Inside the fund, the asset allocation is diverse. Typically, the fund allocates a significant portion to large-cap companies that are leaders in the renewable sector. The breakdown may include up to 70% in equities and 30% in debt instruments, which helps to manage risk while maintaining growth potential. Historical performance has shown that this mix not only yields competitive returns but also aligns well with the changing dynamics of the global energy market.

Investment objective

The primary goal of the Kotak Energy Opportunities Fund is to generate long-term capital appreciation while contributing to sustainable development. The expected returns align with benchmarks set for equity mutual funds focusing on renewable energy. Investors should expect reasonable gains over a minimum period of five years, significantly surpassing conventional investment avenues due to the expanding market for renewable energy.

How to fill out the Kotak Energy Opportunities Fund form

Completing the Kotak Energy Opportunities Fund Form is a straightforward process, designed to gather essential information that assesses your suitability for investment. Follow this step-by-step guide to ensure you complete the form accurately.

Step-by-step guide to form completion

1. **Gathering necessary information**: Before you begin filling out the form, collect all required personal and financial details. This includes your full name, contact information, income information, and financial goals.

2. **Understanding fund suitability**: Assess whether the Kotak Energy Opportunities Fund aligns with your investment preferences and risk tolerance. This fund is ideal for investors excited about renewable energy and willing to invest longer-term.

3. **Detailed instructions for each section**: The form will typically consist of three main sections:

Common pitfalls and how to avoid them

When filling out the Kotak Energy Opportunities Fund form, common pitfalls include misunderstanding your investment objectives and submitting incomplete or inaccurate information. Take the time to review your answers thoroughly and ensure all sections are filled out, as omissions could delay processing.

Managing your investment post-submission

Once your Kotak Energy Opportunities Fund form has been submitted and your investment has been processed, it is crucial to keep track of your investment performance actively. With platforms like pdfFiller, investors can use various tools for monitoring and assessing their portfolio's growth and returns.

Monitoring fund performance

Utilize the reporting features provided by pdfFiller to access performance reports at your convenience. Regularly reviewing these reports gives you insight into how your fund is performing against its benchmarks and helps you stay informed about market trends impacting your investments.

Periodic reassessments and adjustments

Investments require ongoing management—this means reassessing your investment strategy periodically. Should your financial goals or market conditions change, be prepared to adjust your investment choices. Using tools from pdfFiller, you can easily amend your information or make updates to your investment strategy as needed.

Peer comparison in renewable energy funds

Analyzing how the Kotak Energy Opportunities Fund compares with competitors can provide valuable insights for potential investors. There are several funds in the renewable energy sector that compete for investor attention, each with unique offerings and strategies.

How Kotak stands against competitors

When evaluating the Kotak Energy Opportunities Fund against similar funds, key performance benchmarks are vital. Historical comparisons reveal that this fund has maintained competitive performances relative to its peers, often being recognized for its consistency and resilience in varying market conditions.

Evaluating fees and charges

Another consideration for investors is the fees associated with the Kotak Energy Opportunities Fund. Management fees should be compared with other funds in the sector, as they can significantly impact the overall returns. When choosing a renewable energy fund, consider both the fee structures and the historical performance to make an informed decision.

Meet the fund managers

Understanding the expertise behind the Kotak Energy Opportunities Fund is vital for investor confidence. The fund is managed by a team of seasoned professionals who bring a wealth of experience in finance and renewable energy investing.

Profiles of key team members

Key team members possess diverse backgrounds, including experience in sustainability, portfolio management, and market analysis. Their collective knowledge ensures a strategic approach to investing in renewable technologies that are not only profitable but also socially responsible.

Insights from fund managers

In interviews, fund managers have expressed optimism about the future of renewable energies and the opportunities that arise from technological advancements. Their strategies emphasize long-term growth while balancing the inherent risks associated with equity markets.

Who should invest in the Kotak Energy Opportunities Fund?

The Kotak Energy Opportunities Fund is tailored for a wide range of investors, from individuals looking to diversify their portfolios to institutional players seeking sustainable investment outlets. However, understanding your risk tolerance and investment goals is essential before diving in.

Ideal profiles for investors

Investors with a moderate risk tolerance and a commitment to sustainability will find the Kotak Energy Opportunities Fund particularly appealing. Whether you are an individual investor or part of a larger investment team, the fund caters to those excited about fostering a greener future through financial participation.

Long-term vs. short-term investment perspectives

By nature, investments in renewable energies are seen as long-term commitments. The recommended investment horizon is typically five years or more, allowing for volatility and market shifts to balance out over time. For short-term investors, it may be prudent to consider the unique risks in renewable markets before committing capital.

Leveraging pdfFiller for document management

In today’s digital landscape, managing investment documents efficiently can significantly enhance the investment experience. pdfFiller stands out as a powerful tool for editing, signing, and managing important documents like the Kotak Energy Opportunities Fund form.

Streamlining document editing and signing

Utilizing features of pdfFiller enhances the investment process by providing a streamlined approach to filling out forms, allowing you to edit, eSign, and save documents quickly. The cloud-based platform ensures you can manage all documents accessibly and securely from anywhere.

Collaborating with teams

For collective investments, pdfFiller offers interactive tools that facilitate teamwork when managing investment documents. Collaborating on form submissions, shared access to key documents, and secure digital signatures simplify the experience, helping teams work together effectively on their renewable investments.

Frequently asked questions (FAQs)

Investors often have questions about the Kotak Energy Opportunities Fund, ranging from processes to performance metrics. Addressing these FAQs is essential to help demystify some of the complexities involved in sustainable investing.

Addressing common queries related to the fund

Potential investors frequently seek clarification on various processes, such as the expected timeframes for investment returns and guidelines for withdrawing funds. Information on management fees, penalties, and the impact of market fluctuations are also common inquiries.

Providing educational resources for investors

Ensuring that investors are well-informed enhances their confidence in the process. pdfFiller can provide educational material on sustainable investments, insights on market trends, and access to a wealth of information that empowers investor decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my kotak energy opportunities fund in Gmail?

How do I fill out the kotak energy opportunities fund form on my smartphone?

How do I fill out kotak energy opportunities fund on an Android device?

What is kotak energy opportunities fund?

Who is required to file kotak energy opportunities fund?

How to fill out kotak energy opportunities fund?

What is the purpose of kotak energy opportunities fund?

What information must be reported on kotak energy opportunities fund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.