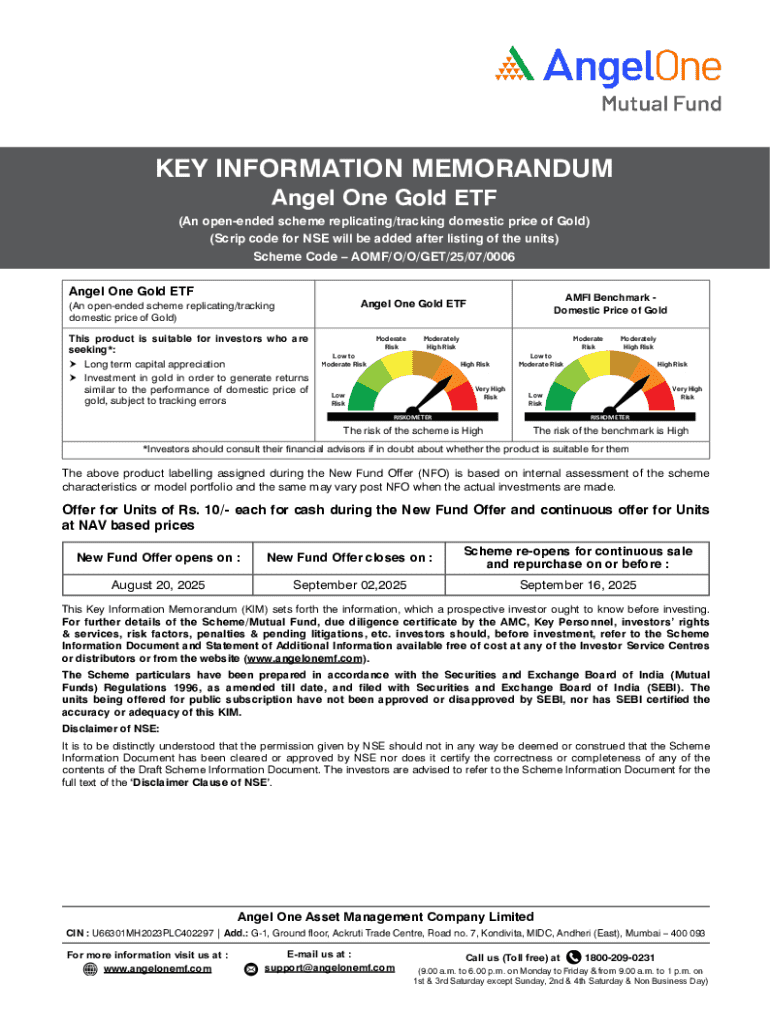

Get the free Invest Smartly & Grow Wealth - Angel One Mutual Fund

Get, Create, Make and Sign invest smartly amp grow

Editing invest smartly amp grow online

Uncompromising security for your PDF editing and eSignature needs

How to fill out invest smartly amp grow

How to fill out invest smartly amp grow

Who needs invest smartly amp grow?

Invest smartly and grow with forms

Understanding the importance of smart investments

Smart investments are foundational to financial growth, but they require meticulous planning and organization. The role of documentation in investment strategies cannot be overstated; a structured approach can mean the difference between profit and loss. For instance, having organized information enhances decision-making. Investors can evaluate their options more efficiently, track their investment's performance, and adjust strategies based on data-backed insights.

Leveraging forms for streamlined investment processes is key. Forms help in maintaining clarity and focus throughout the investment journey. By creating and utilizing specific forms tailored for various investment aspects, investors can manage their portfolios with greater ease, using comprehensive snapshots of their financial health to inform future actions.

Key types of forms for investment

Investment proposal forms

Investment proposal forms are crucial documents that outline the details of a proposed investment, including objectives, strategies, and projected returns. Essential components of an effective investment proposal include a clear executive summary, detailed financial forecasts, and a risk analysis. Creating this form requires critical thinking and precise detailing of all potential gains and challenges.

Steps to create an effective investment proposal: 1. Start with a compelling executive summary. 2. Clearly delineate the investment goals. 3. Offer nuanced financial projections. 4. Include a thorough risk assessment. 5. Gather supporting data and research to validate your proposal. This structured approach ensures you present a well-rounded view to stakeholders.

Capital allocation forms

Capital allocation processes reflect how investors decide to distribute available financial resources across various investment opportunities. Best practices involve using capital allocation forms that delineate categories for each investment type, including growth assets, income assets, bonds, and funds. Completing these forms correctly helps visualize how resources are being utilized and can prompt a more strategic distribution for optimal returns.

Risk assessment forms

Identifying potential risks is essential for informed investment decisions. A comprehensive risk assessment form should outline various risk factors, including market volatility, economic shifts, and specific industry threats. Structuring a risk assessment involves: 1. Listing identifiable risks. 2. Assessing the likelihood of occurrence. 3. Evaluating the potential impact. 4. Formulating risk mitigation strategies. Such forms serve to safeguard investments by preparing investors for various scenarios.

Leveraging technology for form management

Cloud-based platforms: why they matter for investors

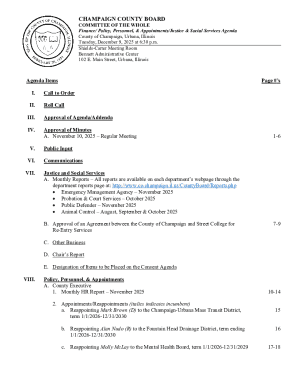

Investors increasingly rely on cloud-based platforms like pdfFiller for managing their documentation. These platforms offer numerous benefits, including accessibility — users can access documents anywhere, making it easier for teams to collaborate on investments in real time. Features such as document sharing and version control enhance collaboration, ensuring all team members are on the same page.

eSigning capabilities

The significance of eSignatures in investment agreements cannot be understated. They streamline the process of signing agreements and contracts, which is critical for ensuring deals are executed swiftly. However, security measures must also be contemplated when eSigning documents. Using platforms like pdfFiller, users benefit from secure pathways for signatures, safeguarding sensitive information and maintaining compliance.

Interactive tools for investment growth

Investment calculators

Investment calculators provide vital insights for investors aiming to track their progress over time. Various types exist, including ROI calculators and growth rate calculators, each serving a distinct purpose. Using calculators effectively within forms allows investors to project future earnings based on historical data and specific inputs, offering a clearer understanding of potential returns and guiding strategies.

Portfolio management forms

A strong portfolio management strategy starts with a comprehensive structure. Portfolio management forms should include components such as asset allocation, performance tracking reports, and diversification strategies. Templates that offer space for documenting current holdings, as well as projected growth, are invaluable for maintaining a balanced and profitable portfolio.

Best practices for editing and managing investment forms

Editing strategies

Efficient editing of investment-related documents requires attention and a systematic approach. Minimizing errors necessitates a thorough review process; employing techniques such as proofreading, leveraging tools for grammar checks, and utilizing templates can contribute to improved accuracy. Avoid common pitfalls, such as overlooking details related to fees or fund allocations, which can skew the overall viability of an investment.

Collaboration features

Utilizing sharing tools for team discussions can enhance collaboration around investment documents. Platforms like pdfFiller come with tracking changes and revision features that allow collaborators to see who made specific edits, ensuring transparency. This function is crucial when multiple parties are involved in the investment process, fostering a shared understanding of each investment's strengths and weaknesses.

Legal and compliance considerations

Understanding regulatory requirements for investment forms is critical. Businesses must ensure compliance throughout the form-filling process to avoid penalties or setbacks. Utilizing pdfFiller's tools helps maintain legal integrity by offering document templates that conform to specific regulations. This includes features such as automated compliance checks that can alert users about potential regulatory issues before formal submissions.

Real-world scenarios and use cases

Successful investments are often underpinned by meticulous documentation and structured forms. Numerous case studies highlight the effectiveness of proper form usage in developing successful investment strategies. For instance, a start-up that utilized detailed investment proposal forms was able to secure funding more efficiently, showcasing how organized information and clarity can attract investor interest.

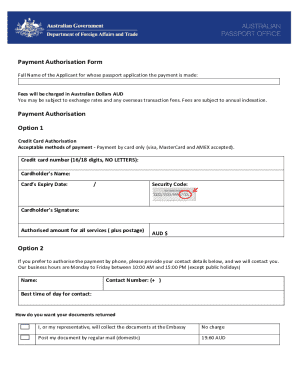

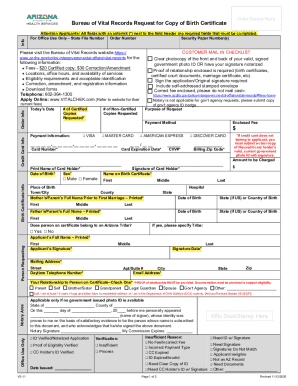

Filling out forms effectively

Filling out investment forms is an art that combines preparation and attention to detail. Begin with a step-by-step guide: 1. Review the form requirements. 2. Prepare the necessary financial documents beforehand. 3. Ensure clarity and consistency in your input. 4. Double-check all figures and estimates for accuracy.

Common mistakes to avoid include oversights on critical data like investment timelines and risk factors, which can lead to incomplete information narratives. Utilizing interactive elements in pdfFiller enhances efficiency, enabling users to easily navigate the form-filling process.

Enhancing investor collaboration

Forms can significantly improve collaboration in investment teams. By leveraging forms in team settings, members can express thoughts collaboratively, surrounding key points gathered through documentation. Setting up formal discussions around investment documents allows for varying perspectives, ensuring all aspects of a case are evaluated.

Evaluating investment returns using forms

Tracking performance metrics is essential for evaluating investments. Using customizable forms can aid in this process, ensuring all relevant data points are included. Include tools for tracking returns over time, and ensure your forms evolve as your financial situation changes, maintaining relevance and accuracy.

Additional insights

Frequent updates in investment documentation and trends highlight the need for continuous learning and adaptation. Encourage feedback loops for improvement; forms are not static and should evolve to reflect new knowledge and regulations, ensuring that users can invest smartly and grow over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit invest smartly amp grow online?

How do I make edits in invest smartly amp grow without leaving Chrome?

How do I edit invest smartly amp grow on an Android device?

What is invest smartly amp grow?

Who is required to file invest smartly amp grow?

How to fill out invest smartly amp grow?

What is the purpose of invest smartly amp grow?

What information must be reported on invest smartly amp grow?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.