Get the free Kotak Nifty Chemicals ETF: A Worthy Proposition?

Get, Create, Make and Sign kotak nifty chemicals etf

Editing kotak nifty chemicals etf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kotak nifty chemicals etf

How to fill out kotak nifty chemicals etf

Who needs kotak nifty chemicals etf?

Kotak Nifty Chemicals ETF Form: A Comprehensive How-to Guide

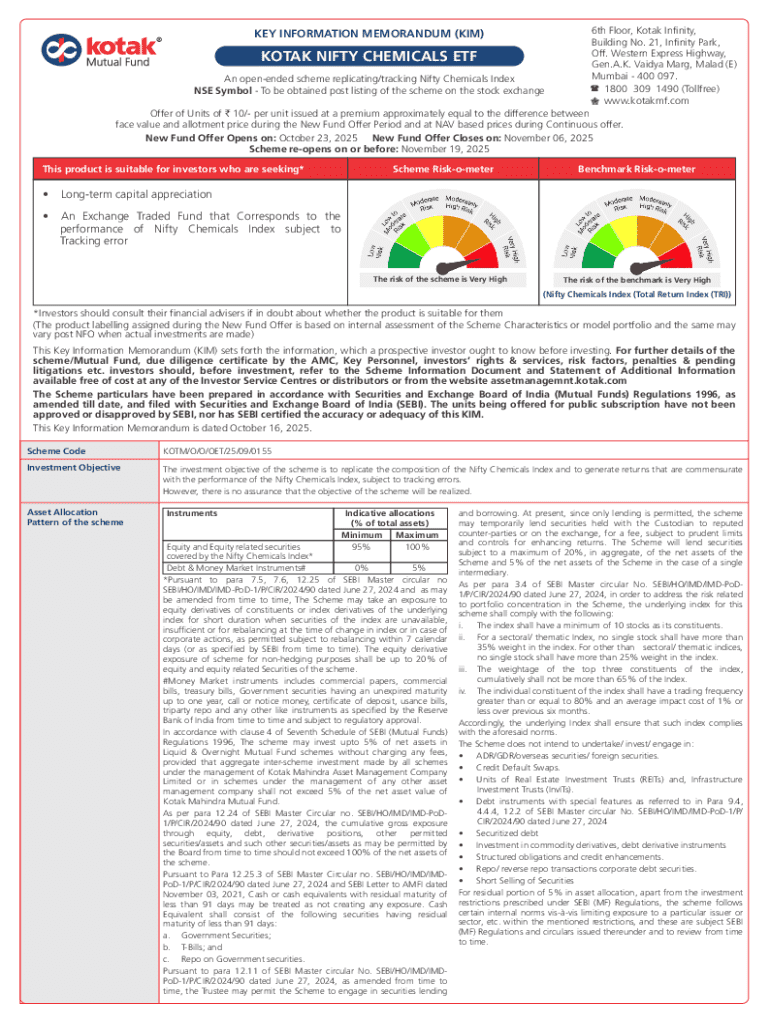

Understanding the Kotak Nifty Chemicals ETF

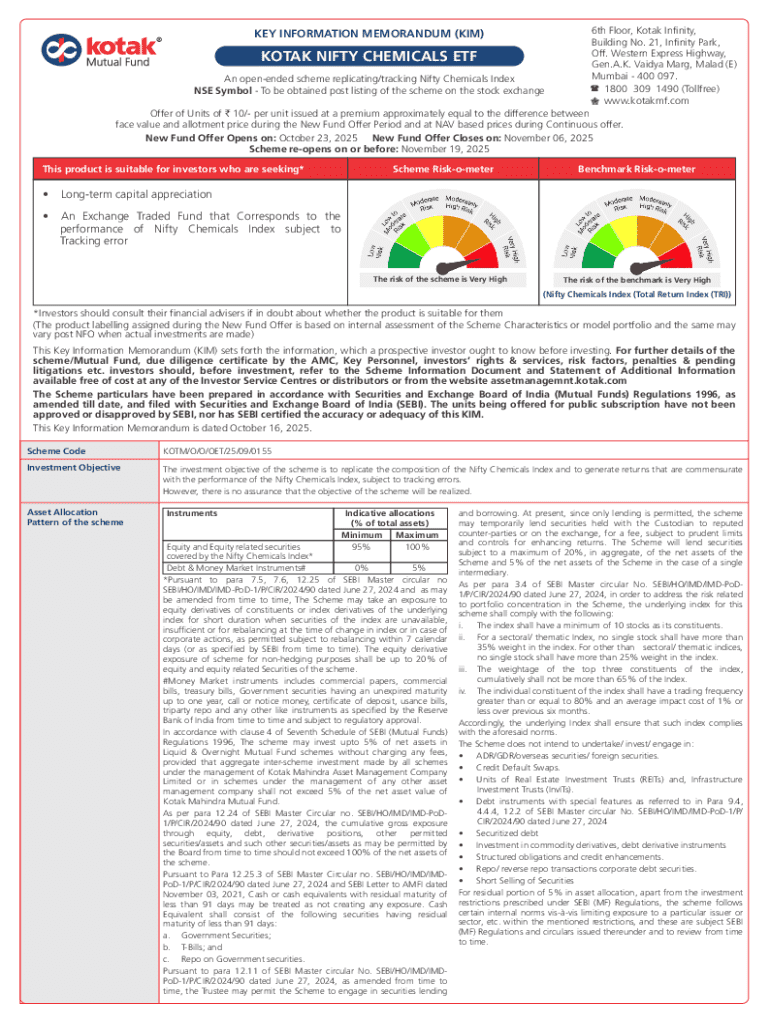

Exchange-Traded Funds (ETFs) represent a unique investment vehicle that combines aspects of mutual funds and stock trading. They allow investors to pool their money into a diversified portfolio of stocks, commodities, or other assets, which can be traded on exchange like a stock. The Kotak Nifty Chemicals ETF specifically targets the chemicals sector of the Indian economy, offering investors exposure to a carefully selected set of companies represented within the Nifty Chemicals Index.

Sector-specific ETFs are gaining traction among investors due to their ability to mitigate risk while providing targeted exposure. The Kotak Nifty Chemicals ETF has gained attention for its performance, reflecting the growth and resilience of the chemicals industry, a critical segment of the Indian economy. Understanding its performance and mechanics is essential for any potential investor.

Fund performance analysis

The historical returns of the Kotak Nifty Chemicals ETF are key indicators of its viability as an investment. Evaluating metrics such as annualized returns and total return over various periods provides insight into its performance against other sector ETFs. For instance, the ETF has consistently mirrored the index it tracks, making it a reliable option for investors interested in the chemicals sector.

Tracking error, or the deviation between the ETF's returns and its benchmark index, is another important metric to consider. A low tracking error indicates that the ETF closely follows the performance of the benchmark, thus validating its utility for investors looking for performance consistency. Historical data indicates that the Kotak Nifty Chemicals ETF maintains a relatively low tracking error, enhancing its attractiveness.

Key fundamentals to consider

While examining an ETF, it’s crucial to consider its expense ratios and management fees. The Kotak Nifty Chemicals ETF generally boasts lower fees relative to actively managed funds, which is appealing to cost-conscious investors. Lower fees can significantly impact net returns, so assessing these costs before investing is essential.

Additionally, understanding the dividend distribution history of the ETF can provide insight into its income-generating potential. The Kotak Nifty Chemicals ETF has historically offered regular dividends, which can serve as a source of passive income for investors. This characteristic can enhance the overall investment appeal, especially for those focusing on long-term gains.

Sector insights: The chemicals market

Current trends in the chemicals sector are largely driven by increasing demand for specialty chemicals and growing industrial applications. Factors such as urbanization, the shift towards sustainable practices, and advancements in technology are playing a pivotal role in this market. Investors in the Kotak Nifty Chemicals ETF should stay updated on these trends to understand their potential impact on fund performance.

Key players within the Nifty Chemicals Index include major corporations and leading firms known for their innovative practices and market presence. Profiles of these companies can provide a clearer picture of market dynamics, as their performance largely influences the ETF’s returns. Notably, companies with large market capitalization can have a substantial impact on overall sector performance.

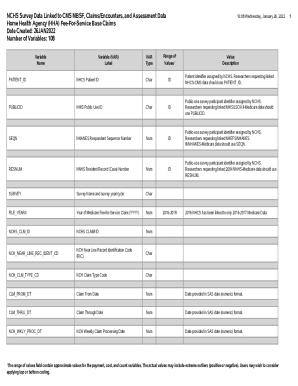

Holdings breakdown of the Kotak Nifty Chemicals ETF

A detailed exploration of the top holdings within the Kotak Nifty Chemicals ETF reveals which companies are leading the charge in terms of contribution to performance. The top holdings typically include household names that dominate the chemicals market, making up a significant percentage of the ETF. A close examination of these contributions can help investors understand where the ETF’s strength lies.

Moreover, conducting a sector allocation analysis is vital to gauge overall risk exposure. The Kotak Nifty Chemicals ETF diversifies its holdings across various segments of the chemicals industry, which can mitigate specific risks related to individual sectors. Understanding these allocations equips investors to make informed decisions on their risk and return strategies.

Interactive tools for investors

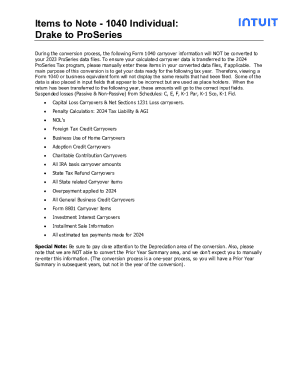

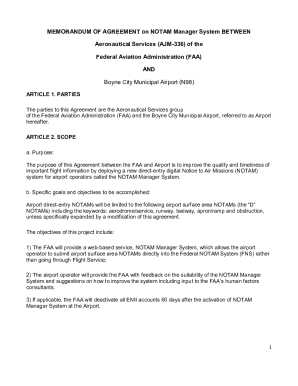

For investors interested in navigating the Kotak Nifty Chemicals ETF form, pdfFiller provides a user-friendly platform. Users can access and manage form applications seamlessly. The step-by-step instructions for using pdfFiller will guide you through the process of filling out the Kotak Nifty Chemicals ETF form, ensuring accuracy and ease.

Beyond form filling, pdfFiller’s interactive features allow users to calculate potential returns using investment calculators. This function helps investors assess the performance of their prospective investments, ensuring they make informed decisions. Utilizing pdfFiller's resources could enhance your overall investment experience.

Similar ETFs for consideration

Investors considering the Kotak Nifty Chemicals ETF may benefit from exploring alternative ETFs that provide exposure to the chemical sector. Several sector ETFs may have similar objectives but could offer varying risk profiles, fees, or historical performance. By comparing these options, investors can diversify their portfolios or choose an ETF that better aligns with their investment goals.

Performance comparisons with similar investment vehicles can reveal how the Kotak Nifty Chemicals ETF stacks up against its peers. Visual graphs and metrics allow for easy analysis of relative strengths and drawbacks, offering valuable insights which can guide investment decisions.

Selection criteria for ETF investments

Assessing the size of the ETF, particularly its Assets Under Management (AUM), is critical in the selection process. Larger funds often offer more liquidity, lower bid-ask spreads, and a degree of stability that can be attractive to investors. The Kotak Nifty Chemicals ETF’s AUM should be a significant consideration when evaluating its reliability as an investment choice.

Evaluating historical performance and risk metrics is equally crucial. Investors should consider factors such as volatility, downturn resilience, and return consistency. Past trends can guide projections, although it's equally essential to monitor market conditions as they evolve.

Completing your investment decision

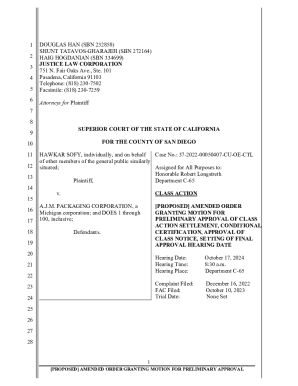

Once you have analyzed the Kotak Nifty Chemicals ETF and feel confident in your investment strategy, it's time to complete the form using pdfFiller. A detailed guide on completing the form accurately ensures that potential errors do not derail your investment journey. Accuracy in documentation is paramount, particularly in financial matters.

After submitting the form, continuous monitoring of your investment is critical. Tracking performance and staying updated on sector developments can mitigate risks and optimize returns. Utilize pdfFiller’s platform capabilities to manage documentation and track progress effectively.

Frequently asked questions (FAQs)

Many investors have common concerns about the Kotak Nifty Chemicals ETF, such as its risks and rewards. Understanding these factors is vital to making informed investment decisions. Although sector-specific ETFs can offer concentrated exposure, they may also carry higher volatility due to market dynamics.

Investors should familiarize themselves with the unique risks associated with the chemicals sector, including regulatory changes and market fluctuations. Balancing these insights with potential returns can help investors assess whether this ETF aligns with their financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit kotak nifty chemicals etf from Google Drive?

How do I edit kotak nifty chemicals etf online?

How do I complete kotak nifty chemicals etf on an Android device?

What is kotak nifty chemicals etf?

Who is required to file kotak nifty chemicals etf?

How to fill out kotak nifty chemicals etf?

What is the purpose of kotak nifty chemicals etf?

What information must be reported on kotak nifty chemicals etf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.