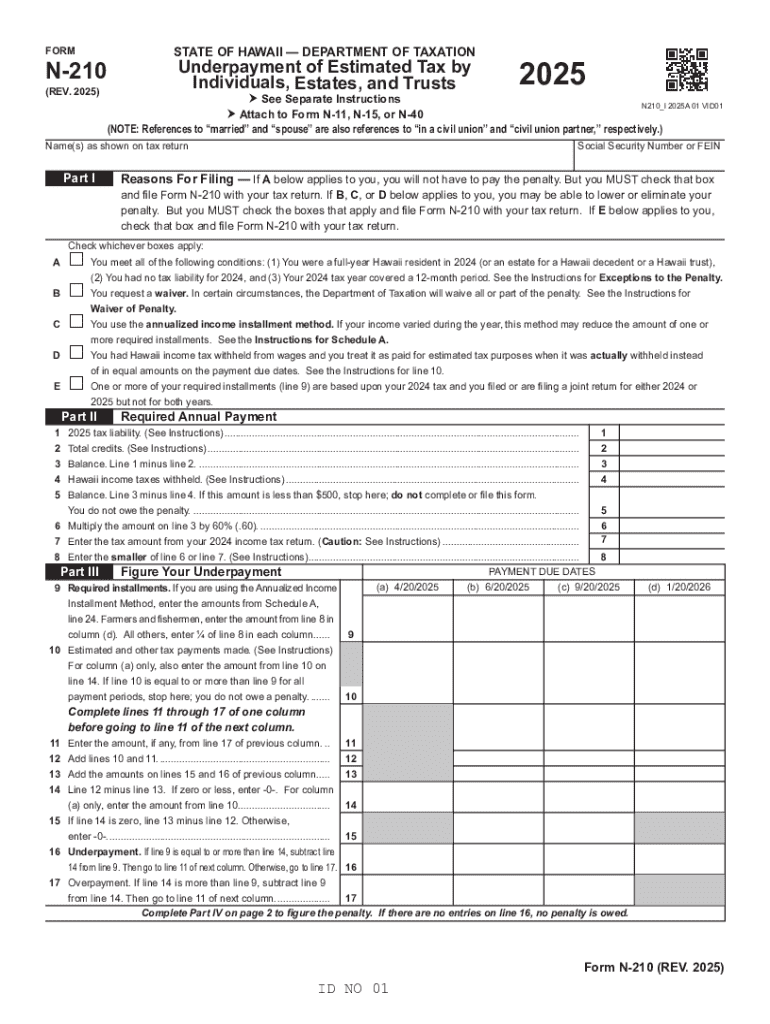

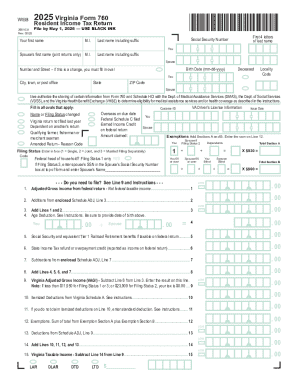

Get the free form n-210, rev. 2025, underpayment of estimated tax by individuals, estates, and tr...

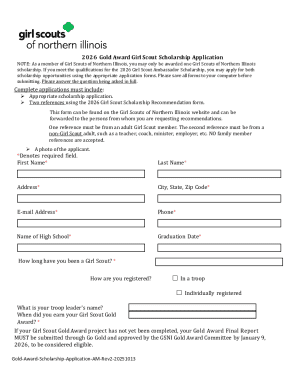

Get, Create, Make and Sign form n-210 rev 2025

How to edit form n-210 rev 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form n-210 rev 2025

How to fill out form n-210 rev 2025

Who needs form n-210 rev 2025?

Comprehensive Guide to Form N-210 Rev 2025 Form

Overview of Form N-210 Rev 2025

Form N-210 is a crucial document used for specific tax-related reporting in the 2025 tax year. The form serves as a platform for individuals and organizations to provide necessary information to tax authorities, ensuring compliance with local regulations. The significance of Form N-210 lies in its role in facilitating accurate tax assessments and maintaining transparency in financial reporting.

The revisions in 2025 introduce enhancements aimed at making the form user-friendly and aligning it with current tax regulations. Key updates include simplified section layouts and clearer instructions, allowing users to fill out the form with greater ease.

Important deadlines and submission guidelines

For the 2025 tax year, the deadline for submitting Form N-210 is April 15, 2026. It is crucial to adhere to this timeline to avoid late fees and penalties. Individuals and teams can submit the form electronically or through traditional mail, depending on their preference for filing.

Submitting Form N-210 is straightforward. It can be sent to the designated tax authority specific to your locale. Ensure that all sections are fully completed to avoid delays. Note that there may be fees associated with filing, such as processing fees or fees for electronic submissions, depending on your method.

Who needs to file Form N-210?

Eligibility to file Form N-210 typically includes individuals who have income that must be reported to tax authorities, as well as businesses that have financial obligations where reporting is mandatory. Specific scenarios that require filing may include receiving certain types of income, applying for particular deductions, or clarifying financial status during audits.

In certain cases, exemptions may apply. For example, if an individual's income falls below a certain threshold or if specific tax credits cover their obligations, they may not need to file this form. It's essential to be aware of your situation and determine eligibility accordingly.

Step-by-step guide to filling out Form N-210

A. Section-by-section breakdown

Filling out Form N-210 involves several sections, each designed to capture specific information effectively.

B. Tips for accuracy and compliance

When filling out Form N-210, ensuring accuracy is vital. Common pitfalls to avoid include incorrect calculations and failing to double-check personal details, which can lead to unnecessary delays. Comprehensive checklists can be helpful in confirming that all necessary sections are completed and that all required information is accurate.

Editing and managing your Form N-210

A. Using pdfFiller for document management

pdfFiller offers streamlined tools for editing PDFs, which facilitates the management of Form N-210. Users can easily upload the PDF version of Form N-210 to the platform, allowing for direct editing. This feature enhances collaboration, enabling teams to work together efficiently on the form.

B. eSigning Form N-210

Once completed, users can sign Form N-210 electronically using the eSigning feature on pdfFiller. This method is legally valid and offers significant convenience. To secure your submissions, make sure to follow best practices for eSigning to maintain the integrity of your document.

FAQs about Form N-210 Rev 2025

Common questions individuals have regarding Form N-210 include:

Interactive tools available on pdfFiller

pdfFiller provides a variety of interactive tools to assist users with Form N-210. These include step-by-step walkthroughs, helpful resources, and customizable templates that can enhance your filling process.

Comparison with other similar forms

When comparing Form N-210 with similar forms, it’s essential to recognize the distinctions in terms of applicability and requirements. For instance, while other forms may cater to different types of income, Form N-210 is specifically designed for a niche set of financial reporting situations.

This focused approach to filing makes Form N-210 the right choice for those who meet its criteria, providing clarity and specific guidance tailored to your reporting needs.

Additional insights and best practices for Form N-210

Strategies for maximizing your tax refunds often revolve around accurately reporting income and claiming every eligible deduction. Keeping abreast of tax legislation related to Form N-210 is crucial, as changes can directly influence your filing and potential liabilities.

For a successful filing experience, maintain a checklist of documents and supporting information, as thorough documentation can enhance accuracy and compliance, leading to smoother interactions with tax authorities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form n-210 rev 2025?

Can I sign the form n-210 rev 2025 electronically in Chrome?

How do I complete form n-210 rev 2025 on an iOS device?

What is form n-210 rev 2025?

Who is required to file form n-210 rev 2025?

How to fill out form n-210 rev 2025?

What is the purpose of form n-210 rev 2025?

What information must be reported on form n-210 rev 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.