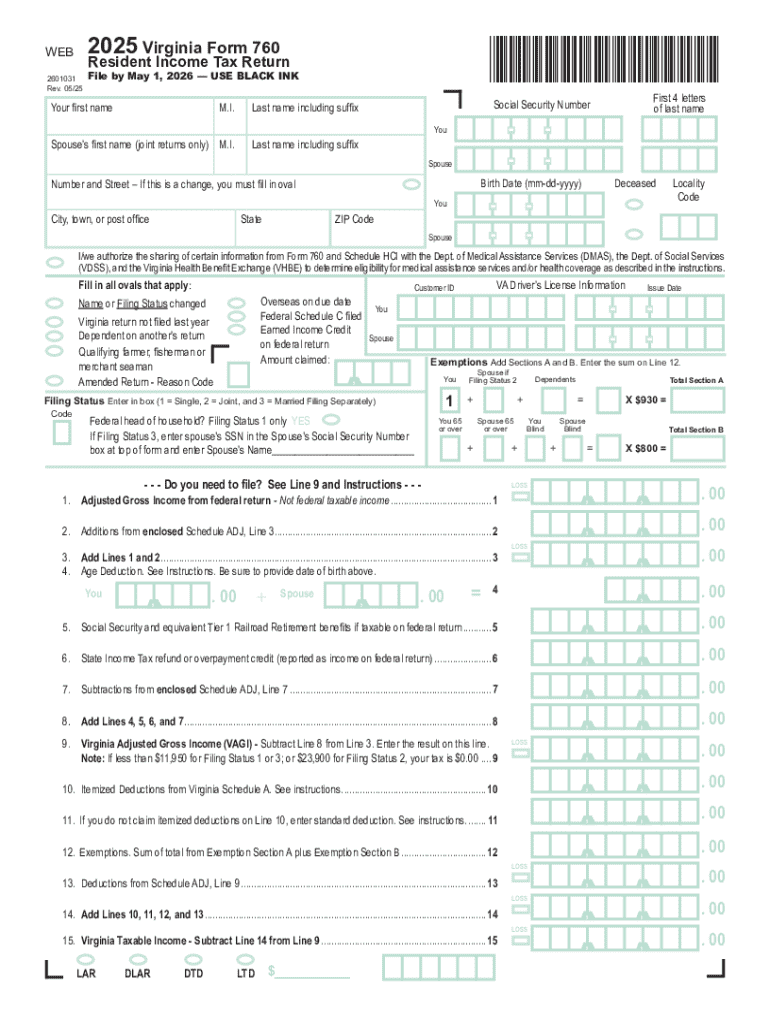

VA DoT 760 2025-2026 free printable template

Instructions and Help about VA DoT 760

How to edit VA DoT 760

How to fill out VA DoT 760

Latest updates to VA DoT 760

All You Need to Know About VA DoT 760

What is VA DoT 760?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about VA DoT 760

What should I do if I need to correct an error on my VA DoT 760 after submission?

If you need to correct mistakes on your VA DoT 760 after it has been submitted, you should file an amended form as soon as possible. Ensure that you indicate that it is a correction and clearly mark the changes made. Keep records of both the original and amended submissions for your documentation.

How can I verify if my VA DoT 760 has been received and processed?

To verify the receipt and processing of your VA DoT 760, check the status through the designated online portal or contact the relevant office. Common e-file rejection codes can help you understand if there were issues, and you can address them swiftly if necessary.

Are e-signatures accepted when filing the VA DoT 760?

Yes, e-signatures are acceptable when submitting the VA DoT 760 electronically, provided that you follow the required authentication procedures. It is important to ensure that your chosen e-filing method complies with all digital signature requirements.

What are some common errors to avoid when filing the VA DoT 760?

Common errors when filing the VA DoT 760 include incorrect information entry, missing required fields, and not providing appropriate supporting documents. Reviewing your form thoroughly before submission can help mitigate these issues.

What should I do if I receive a notice or audit related to my VA DoT 760?

If you receive a notice or an audit concerning your VA DoT 760, it's essential to respond promptly and thoroughly. Prepare any necessary documentation to support your filing and seek assistance from a tax professional if needed to ensure your response is accurate.