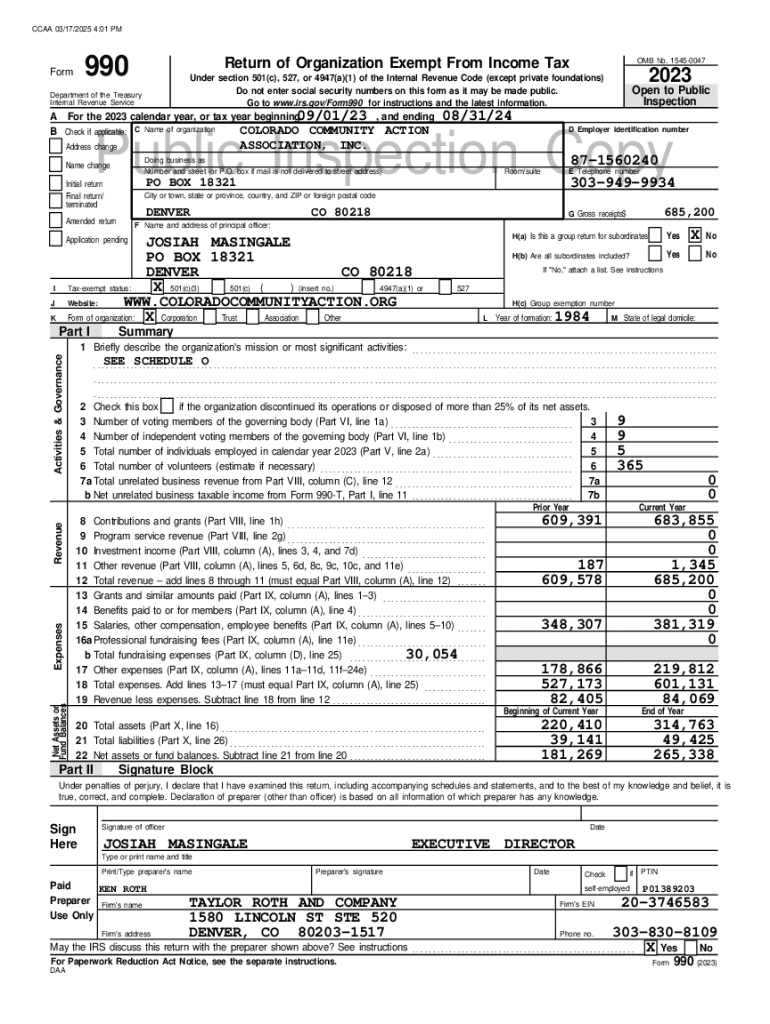

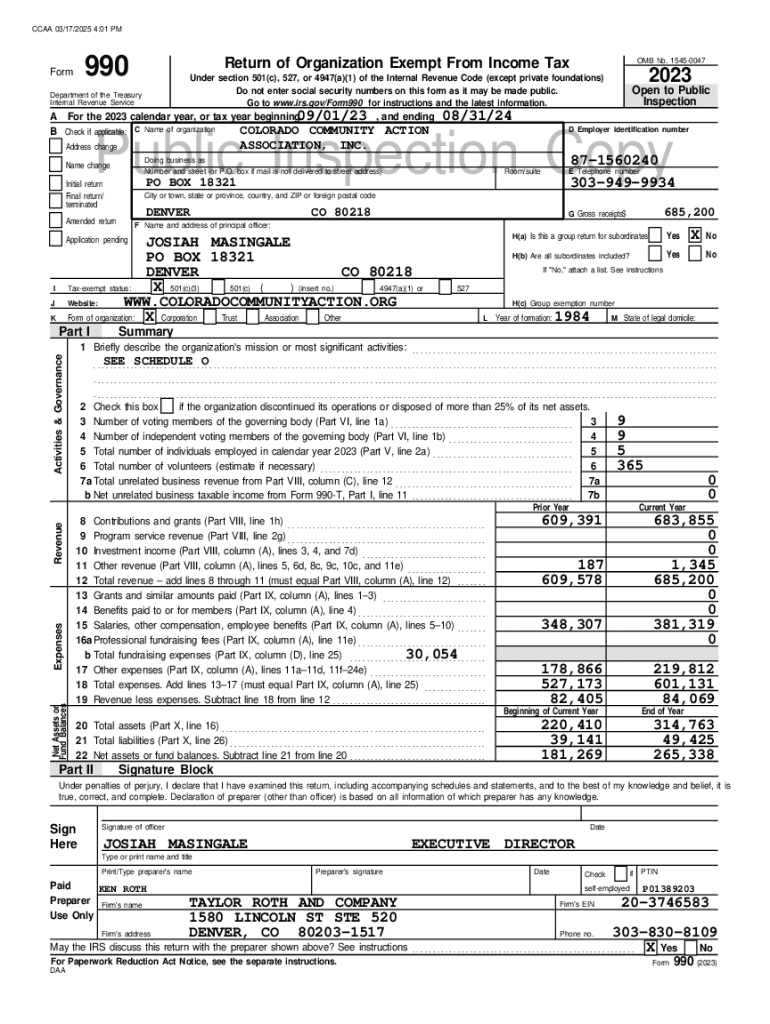

Get the free A For the 2023 calendar year, or tax year beginning09/01/23 , and ending

Get, Create, Make and Sign a for form 2023

How to edit a for form 2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a for form 2023

How to fill out a for form 2023

Who needs a for form 2023?

A complete guide to A for form 2023

Overview of A for form 2023

The A for form 2023 is a critical document used primarily by taxpayers in California to report their income and calculate state tax liabilities. As a foundational element of the state's income tax system, this form serves to provide detailed information necessary for the assessment of taxes owed by individuals or households. Understanding the specifications of the A for form 2023 is essential for accurate reporting, ensuring compliance with California's tax laws.

Correctly using the A for form 2023 is vital for ensuring taxpayers meet their obligations without facing unnecessary penalties. Utilizing this form accurately can lead to smoother processing by the California tax authorities and can help prevent delays in tax refunds or unexpected audits.

Who should use A for form 2023?

Eligibility for filing the A for form 2023 encompasses various categories of individuals. Primarily, residents of California who have generated income within the state are required to complete this form. This includes both employees earning wages and self-employed individuals reporting business income. Additionally, specific groups, such as non-resident individuals earning income sourced from California, may also find themselves needing to fill out this form.

Common scenarios calling for the A for form 2023 include those who received any form of taxable income, such as wages, rental income, or investment dividends. Taxpayers who qualify for deductions or credits based on their earnings will also need to utilize this form when filing their state income tax returns.

Key features of A for form 2023

The 2023 iteration of the A for form introduces several significant changes aimed at enhancing usability and compliance. Among these updates, there’s a streamlined section for reporting various sources of income, reducing confusion for taxpayers. This form has simplified line instructions, making it easier than ever to follow the prescribed format when detailing income, deductions, and credits.

In comparison with previous versions, one noteworthy enhancement involves the integration of specific instructions that guide taxpayers through common pitfalls—fostering a better understanding of filing requirements as tax law evolves to suit changing economic conditions. Thus, using the A for form 2023 facilitates not only accurate reporting but also encourages proactive tax planning.

When to use A for form 2023

Knowing when to file the A for form 2023 is crucial for taxpayers. The key deadline for submission generally aligns with the annual income tax filing deadline, which typically falls on April 15 of the following year. For individuals and residents in California, this date is particularly noteworthy, as it marks the transition from financial reporting to tax obligations.

Additionally, taxpayers should be aware of common events that can influence their decision to file. For instance, changes in marital status, job changes, or significant taxable income events like inheritances can all prompt the necessity of filing the A for form. Staying ahead of timelines ensures that taxpayers are fully compliant and can potentially maximize any due refunds.

Preparing to file A for form 2023

Preparation for filing the A for form 2023 plays a crucial role in successful submission. Taxpayers should start by gathering relevant documents, such as W-2 forms from employers, 1099 forms for any freelance or additional income, and documentation related to claimed deductions like mortgage interest or medical expenses.

Having these documents at hand, a checklist for preparation should be created to ensure all required information is complete. Double-checking personal information, confirming income accuracy, and ensuring appropriate deductions are recorded will minimize errors and streamline the filing process. Taking time to organize and review all information can significantly ease the anxiety often associated with tax season.

Detailed instructions for completing A for form 2023

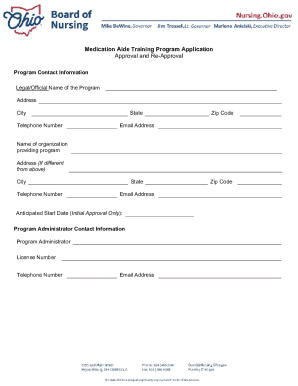

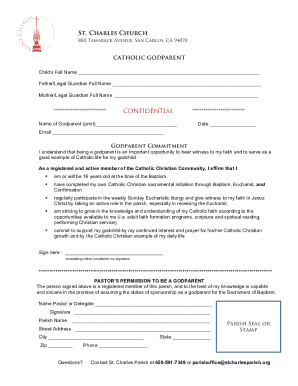

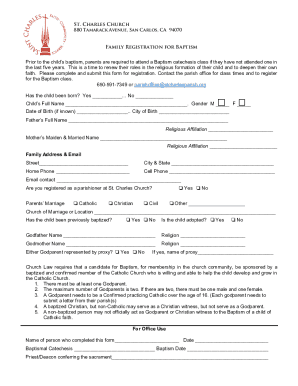

Filling out the A for form 2023 can be broken down into several manageable steps. Each part of the form has specific instructions that detail what needs to be entered. The first sections typically request personal information, such as name, address, and Social Security number for all taxpayers involved. Following this, the primary income section should be accurately filled, detailing all forms of income reported throughout the year.

Common mistakes to avoid include misreporting income or failing to include all necessary deductions. To effectively fill out the A for form 2023, utilizing pdfFiller’s tools can enhance the experience. Their editing tools allow users to seamlessly input data into the form, and integration of eSignature simplifies the signing process electronically, saving time and effort compared to traditional methods.

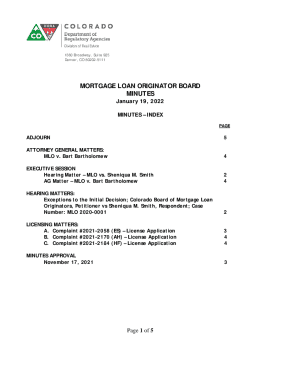

Submitting A for form 2023

Submission of the A for form 2023 should be done through the appropriate channels to guarantee acceptance. Taxpayers can choose to file either physically or digitally. For physical submissions, it’s crucial to send the filled form to the correct address provided by the California Department of Tax and Fee Administration, while digital submissions can succeed via online platforms endorsed by tax authorities.

Best practices for ensuring a timely submission include sending physical forms via certified mail to receive confirmation of delivery and keeping records of all submitted documents. When filing electronically, using the official portals designated for tax submission can provide real-time tracking and confirmation of successful filing.

Managing your A for form 2023 submission

Post-submission, tracking the status of your A for form 2023 can help alleviate concerns regarding acceptance. Taxpayers often have access to online tools provided by California’s tax authorities that allow for tracking submission status and expected timelines. Regularly checking this status can preemptively address any issues that may arise during processing.

If taxpayers find delays, reaching out through service numbers provided by the state or utilizing FAQs available on their website can furnish necessary information. Should the tax officials request additional information or corrections, promptly addressing these inquiries is crucial to avoid further delays in processing your tax returns.

Troubleshooting common issues with A for form 2023

As with any official document, complications related to the A for form 2023 can arise. Common questions include inquiries about the necessary documentation, eligibility criteria, or specifics about deductions. These FAQs can often be resolved through the California tax authority’s website, where many common issues have been addressed.

Identifying typical filing issues, such as incorrect calculations or missing information, is essential for a smooth filing process. In case complications arise, seeking assistance from tax advisors or utilizing resources provided by states can clarify misunderstandings and provide pathways to resolve any challenges encountered.

Enhancing document management for A for form 2023

Document management plays an integral role in handling forms like the A for form 2023 effectively. pdfFiller offers a versatile platform that empowers users to create, edit, and store documents in a centralized cloud-based system. This access-from-anywhere feature allows taxpayers to manage their forms and associated documents seamlessly.

Utilizing collaborative tools on pdfFiller can further streamline the process for teams or individuals working with advisors in tax preparation. Engaging with shared documents fosters communication, ensuring all parties are on the same page as deadlines approach. This collaborative approach enhances efficiency, timely submissions, and adherence to tax compliance.

Other related forms and resources

Navigating the tax landscape often requires interaction with multiple forms beyond the A for form 2023. Taxpayers may encounter forms for various exemptions, deductions, or credits relevant to their unique financial situations. Keeping track of additional resource materials and forms can aid in fully understanding and managing one's tax obligations.

Using pdfFiller's platform, users can access templates for all relevant forms and have the support to navigate through filing procedures effectively. This holistic approach to form management ensures both accuracy and compliance when handling state income tax returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my a for form 2023 directly from Gmail?

How can I modify a for form 2023 without leaving Google Drive?

Can I create an eSignature for the a for form 2023 in Gmail?

What is a for form 2023?

Who is required to file a for form 2023?

How to fill out a for form 2023?

What is the purpose of a for form 2023?

What information must be reported on a for form 2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.