Get the free Filing Form 990: A Guide for Nonprofit Organizations

Get, Create, Make and Sign filing form 990 a

How to edit filing form 990 a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out filing form 990 a

How to fill out filing form 990 a

Who needs filing form 990 a?

Filing Form 990 A: A Comprehensive Guide for Nonprofits

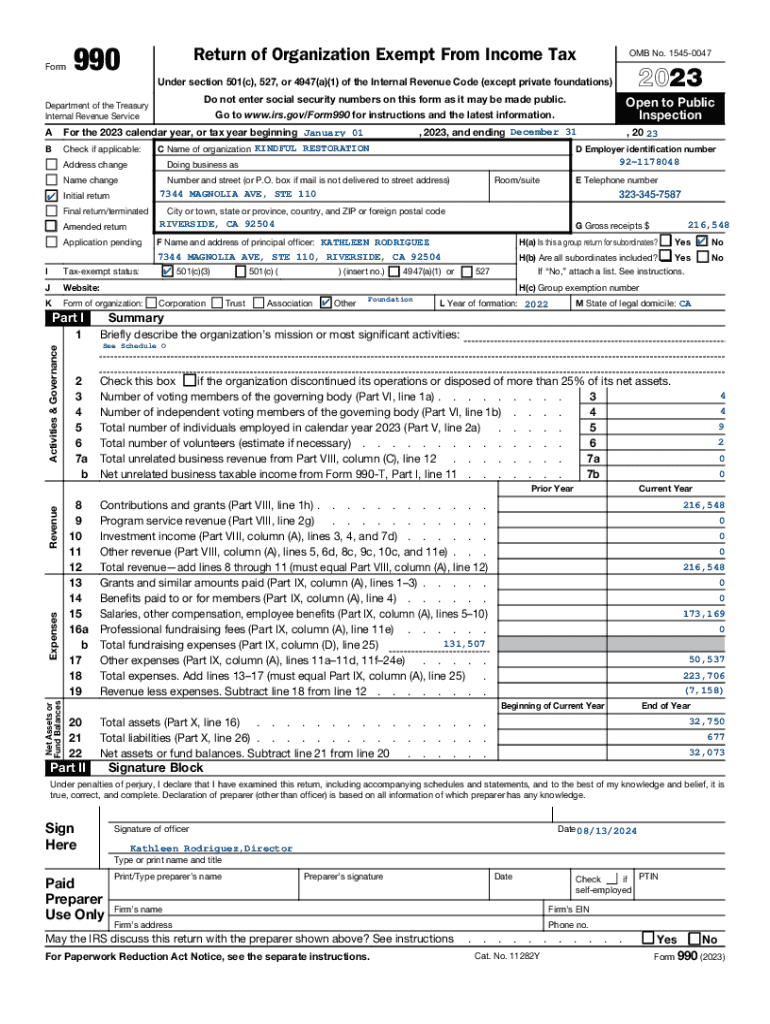

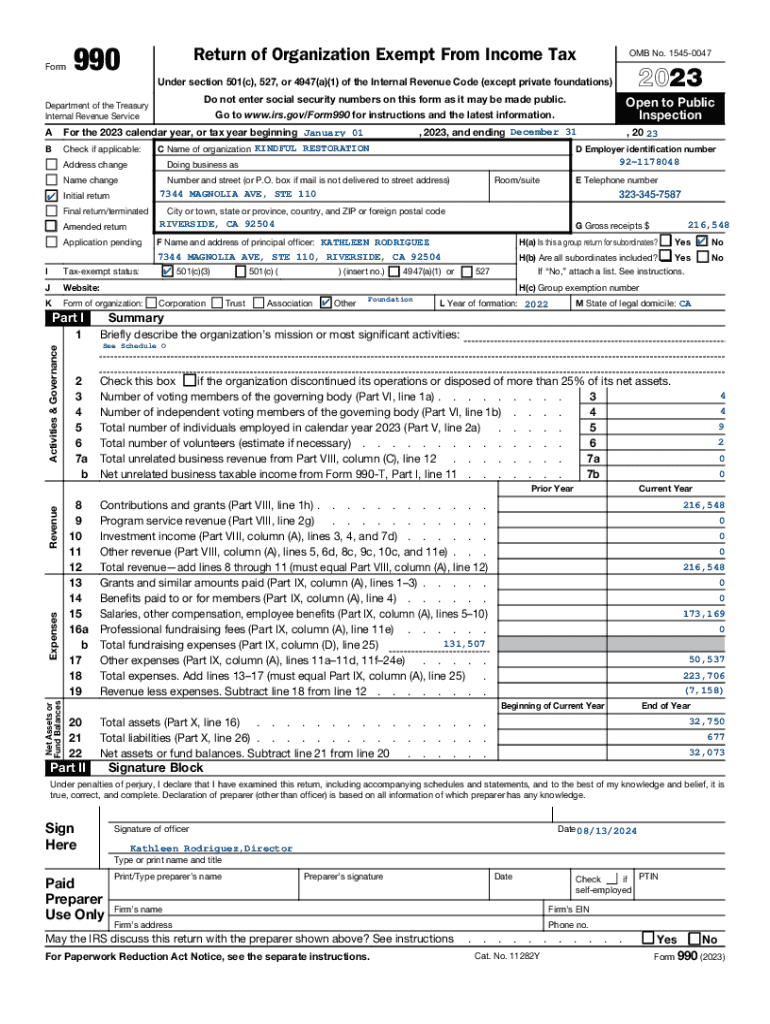

Understanding Form 990 A

IRS Form 990 A, often simply referred to as Form 990 A, is a vital document for nonprofit organizations. It serves as an annual information return that provides the IRS and the public with detailed insights into a nonprofit's financial health, activities, and governance. The completion and submission of Form 990 A is not only a legal requirement but also an excellent opportunity for nonprofits to showcase their programs and their impact on the communities they serve.

The importance of Form 990 A can't be overstated for nonprofit organizations; it covers a broad spectrum of financial metrics, governance practices, and operational transparency. By filing this form, nonprofits uphold accountability and transparency, which are fundamental to maintaining public trust and support. Furthermore, accurate filings can lead to stronger funding prospects, as they reflect an organization's commitment to proper management and ethical practices.

Preparing to file Form 990 A

Before diving into the form itself, it’s crucial to prepare adequately. Gathering the necessary documents and information is the first step in ensuring a smooth filing process. This includes your nonprofit's financial statements, details about your organizational structure, and an accurate list of board members and key personnel. Having this information readily available will save you time and reduce the likelihood of errors in the form.

Understanding the form's various sections and requirements is just as vital. Here's an overview of what you will encounter in Form 990 A:

Step-by-step instructions for filling out Form 990 A

Filling out Form 990 A can be a meticulous process. Here is a detailed guide on how to navigate through each section effectively.

Common mistakes to avoid when filing Form 990 A

Filing Form 990 A is crucial, and making errors can have significant repercussions. Here are some common pitfalls to avoid:

How to use pdfFiller for effortless Form 990 A submission

pdfFiller is an essential tool for nonprofits looking to simplify the Form 990 A filing process. Its cloud-based platform offers several features that streamline document management.

Key features include:

To use pdfFiller for Form 990 A, follow this simple guide:

Analyzing your Form 990 A

Once you have submitted Form 990 A, it’s crucial to ensure that your organization continues to meet compliance and transparency standards.

Post-submission steps include:

FAQs about Form 990 A

Understanding Form 990 A intricacies often prompts questions among nonprofit organizations. Here are some frequently asked questions:

Form 990 A resources on pdfFiller

To further assist users in the submission and management of Form 990 A, pdfFiller offers various resources.

Interactive tools available include:

Staying updated on IRS regulations related to Form 990 A

Continuously evolving IRS regulations necessitate that nonprofit organizations stay informed about any changes that could impact their reporting practices.

Keeping abreast of recent changes is essential for compliance and could significantly affect how nonprofits operate, particularly in response to challenges posed by the COVID-19 pandemic. It’s important to regularly review IRS guidelines and participate in training sessions or webinars related to nonprofit management, helping to ensure that your organization remains in good standing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit filing form 990 a from Google Drive?

How can I send filing form 990 a to be eSigned by others?

How do I edit filing form 990 a in Chrome?

What is filing form 990 a?

Who is required to file filing form 990 a?

How to fill out filing form 990 a?

What is the purpose of filing form 990 a?

What information must be reported on filing form 990 a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.