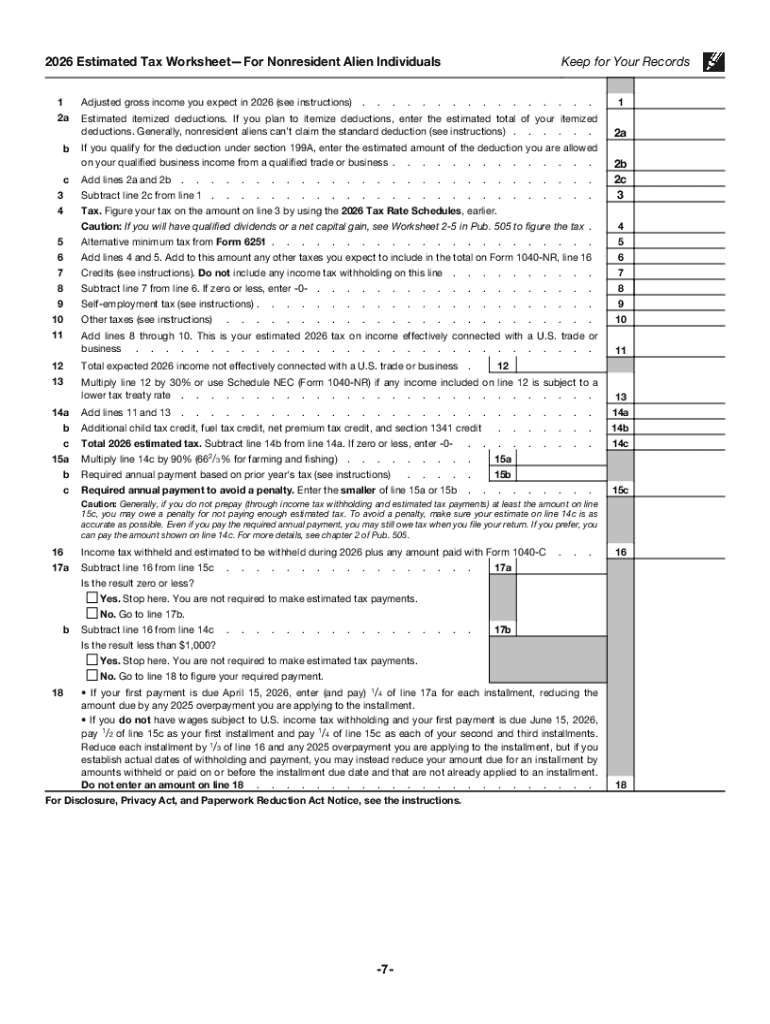

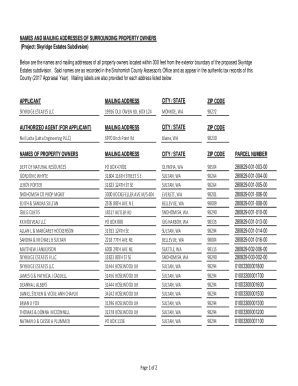

Get the free 2026 Form 1040-ES (NR). Estimated Tax Worksheet-For Nonresident Alien Individuals

Get, Create, Make and Sign 2026 form 1040-es nr

Editing 2026 form 1040-es nr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 form 1040-es nr

How to fill out 2026 form 1040-es nr

Who needs 2026 form 1040-es nr?

A Comprehensive Guide to the 2026 Form 1040-ES NR Form

Understanding the 2026 Form 1040-ES NR

The 2026 Form 1040-ES NR is a specialized tax document designed for non-resident aliens who earn income sourced from the United States. This form serves the purpose of estimating and reporting taxes that non-residents need to pay on various types of U.S.-sourced income. Unlike the Form 1040-ES, which is used by residents of the U.S., the 1040-ES NR specifically addresses the unique tax situation of non-residents, ensuring they comply with U.S. tax regulations while accounting for their distinct circumstances.

Non-resident aliens typically find themselves in varying tax scenarios. The 1040-ES NR accommodates individuals who might receive salaries, wages, or earnings from investments in the U.S. Understanding this form is critical for non-residents who want to avoid penalties associated with underpayment of taxes. By correctly using the 2026 Form 1040-ES NR, filers can make informed estimates of their tax liabilities, thus facilitating accurate annual tax returns when they file their 1040 NR at the end of the tax year.

Key components of Form 1040-ES NR

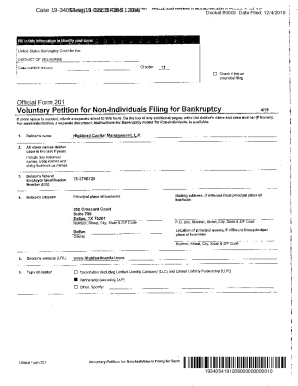

Filing out the 2026 Form 1040-ES NR requires attention to several key components. Each section of the form has specific requirements that obtain necessary information about your financial situation and potential liabilities. Firstly, you'll need to provide personal information, including your name, address, and identification numbers. Properly filing this personal data is vital to avoid any delays or complications with the IRS.

Additionally, the form seeks detailed information about the types of income you receive, whether it be from wages, dividends, or royalties. Non-residents may also want to take advantage of certain deductions and credits available to them. Understanding these will ensure you don't overlook any significant tax benefits. Key terms such as 'non-resident alien' and 'withholding' also feature heavily in this context, defining your status and the amount of tax that should be withheld from your income.

Step-by-step guide to filling out Form 1040-ES NR

Filling out the 2026 Form 1040-ES NR can seem daunting, but breaking it down into manageable steps makes the process simpler. Start by gathering all necessary documents, which include your W-2 forms, 1099s, and any documentation that evidences your income. Having these at hand ensures that the information is accurate and prevents you from missing important income sources.

Next, navigate through the form methodically. Each section demands careful attention to detail. You’ll need to fill in your personal information and income sources accurately. When it comes to calculating estimated taxes, refer to the worksheets provided within the form's instructions, which guide you through how to estimate your total taxable income and calculate the appropriate tax payments. Payment options include electronic transfer, check, or money order to ensure that your payment reaches the IRS on time.

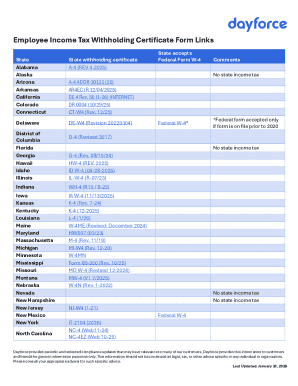

Key deadlines to remember

Adhering to deadlines is crucial to staying compliant with U.S. tax laws. For the 2026 tax year, non-residents using Form 1040-ES NR must be aware of quarterly payment due dates. The deadlines are typically staggered throughout the year, allowing for timely tax payments aimed at offsetting your overall liability for the year. Keeping track of these dates can help avoid late penalties that can rapidly accumulate over time.

Generally, the payment deadlines for estimated taxes are set for April 15, June 15, September 15, and January 15 of the following year. Failing to pay your estimated taxes on any of these due dates may result in financial penalties, including interest on unpaid amounts. It’s critical to prepare your estimates well in advance to ensure on-time payment.

Filing and e-filing options

When it comes to submitting your 2026 Form 1040-ES NR, you have options for both traditional mailing and e-filing. While mailing your form may feel familiar, e-filing offers many advantages, especially for non-residents. Electronic submissions tend to process faster, are more secure, and reduce the risk of paperwork errors that might delay your filing.

One effective tool is pdfFiller, which simplifies the process of filling out, editing, and submitting the Form 1040-ES NR. Through pdfFiller’s cloud-based platform, users can leverage interactive tools that perform tax calculations and generate accurate forms. This platform eases the burden of tax filing and provides features such as electronic signatures and collaboration tools, enhancing your overall experience.

Common mistakes to avoid

Even minor errors can lead to problems when submitting your 2026 Form 1040-ES NR. It’s essential to be aware of common mistakes to prevent issues. Frequent errors include incorrect Social Security numbers, miscalculations, and neglecting to report all income sources. Recognizing these pitfalls means you can take steps to avoid them during your form completion.

If your form is flagged or rejected for any reason, traffic through your options promptly. The IRS will often send notifications regarding necessary corrections. Responding quickly and accurately is critical in maintaining compliance and avoiding penalties—making careful form completion essential for a smooth tax experience.

Frequently asked questions about the 2026 form 1040-ES NR

As with any tax-related topic, understanding the nuances of the 2026 Form 1040-ES NR can lead to many questions. One common inquiry revolves around tax residency status. Non-resident aliens must comprehend how their residency impacts their filing obligations, especially with respect to income sourced in the U.S. Questions about what constitutes U.S. income and whether certain deductions apply remain frequent among filers.

Additionally, individuals often wonder how to amend their forms after submission. If you discover an error after your 1040-ES NR has been sent, it's crucial to follow a specific process to make necessary corrections. Detailed guidance surrounding amendments and changes ensures that taxpayers remain compliant with their obligations even post-submission.

Resources for further assistance

Navigating the tax landscape can be complex, especially for non-resident aliens. The IRS provides a wealth of resources dedicated to helping individuals understand their filing requirements, particularly those related to Form 1040-ES NR. Official publications and guidelines furnish essential information, ensuring you stay informed about your tax obligations.

Moreover, leveraging tools like pdfFiller can enhance your support systems. The platform not only facilitates document management but also offers ongoing assistance throughout the tax year. From filling forms to facilitating communication with tax professionals, it empowers individuals and teams to handle their paperwork and compliance efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2026 form 1040-es nr without leaving Google Drive?

How can I get 2026 form 1040-es nr?

How do I make changes in 2026 form 1040-es nr?

What is 2026 form 1040-es nr?

Who is required to file 2026 form 1040-es nr?

How to fill out 2026 form 1040-es nr?

What is the purpose of 2026 form 1040-es nr?

What information must be reported on 2026 form 1040-es nr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.