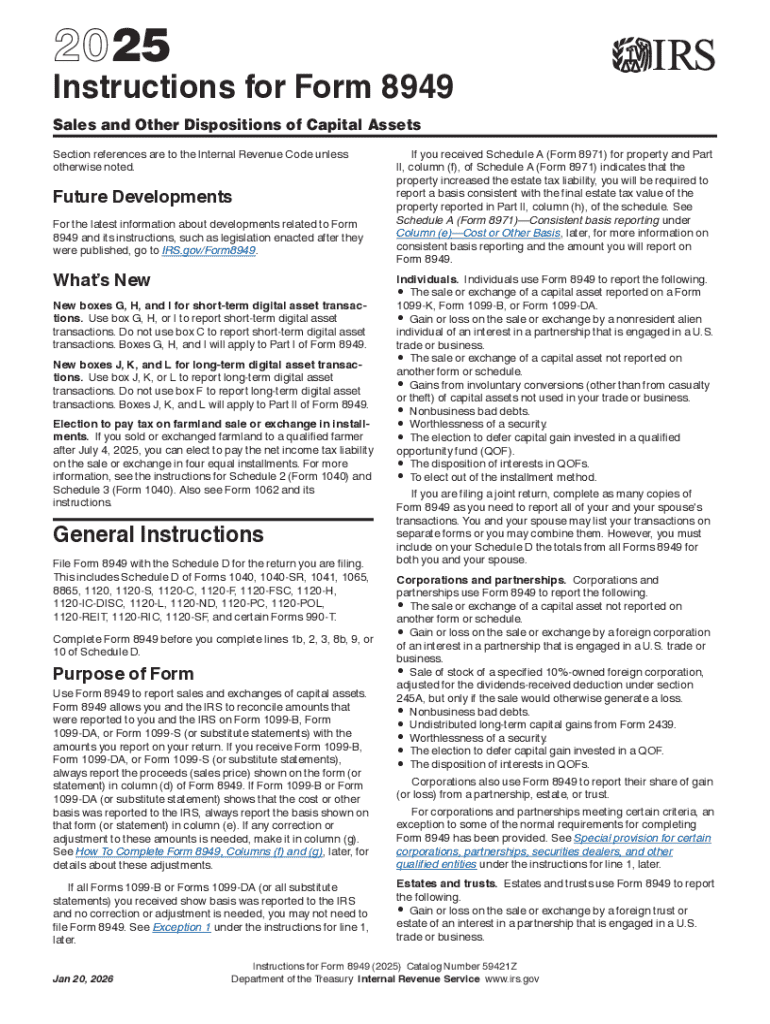

Get the free Form 8949, Sales and Other Dispositions of Capital Assets

Get, Create, Make and Sign form 8949 sales and

Editing form 8949 sales and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8949 sales and

How to fill out form 8949 sales and

Who needs form 8949 sales and?

Form 8949 Sales and Form: A Comprehensive Guide

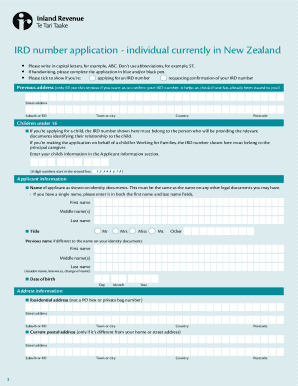

Understanding IRS Form 8949

IRS Form 8949 is a crucial document used for reporting capital gains and losses to the Internal Revenue Service (IRS). It serves as a detailed record of your capital asset transactions, allowing taxpayers to differentiate among various types of sales, which can greatly affect tax calculations. Essentially, this form provides the IRS with the necessary information to ensure that you are accurately reporting your financial activities related to investments.

Individuals and businesses who engage in the buying and selling of assets, such as stocks, bonds, and real estate, may find themselves required to fill out Form 8949. This ensures that both gains and losses from such sales are properly documented and taxed, which is especially relevant in stock trading, rental property sales, or selling other investment assets.

Who needs to file Form 8949?

Any taxpayer who has engaged in the sale or exchange of a capital asset must file Form 8949. This includes individuals engaged in personal stock trading, businesses selling assets, and investors liquidating properties. Specific situations that require filing include:

Detailed breakdown of Form 8949

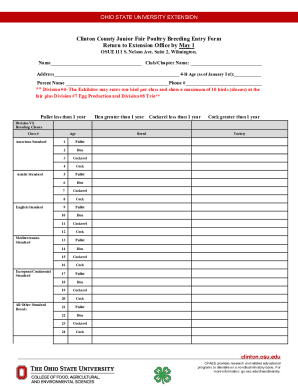

Form 8949 is structured with several key sections that help categorize and report different types of transactions. The form primarily includes three columns for each asset transaction, where taxpayers detail the descriptions of the assets sold, proceeds from the sale, and the cost basis. Additionally, there are specific checkboxes for indicating whether a transaction is reported under the short-term or long-term categories.

Understanding the distinctions among short-term, long-term, and ordinary gains/losses is essential when filling out the form. Short-term transactions are typically those involving assets held for one year or less, while long-term transactions involve assets held for more than one year. Properly categorizing these transactions helps determine the applicable tax rates.

Step-by-step guide to filling out Form 8949

Filling out Form 8949 may sound daunting, but with a clear approach, you can complete it accurately and efficiently. Begin by gathering all necessary financial records related to your transactions. You’ll need important information, such as the purchase date and sale date of each asset, as well as the amounts received and paid.

Next, establish your cost basis and the proceeds from the sale. The cost basis is typically the purchase price plus any additional costs (like commissions) incurred during the acquisition. Once you have this data, you can proceed to enter it line by line on the form, taking special care to:

To further clarify this process, reviewing an annotated sample of a completed Form 8949 can provide insight into how each section should appear, highlighting common pitfalls to avoid.

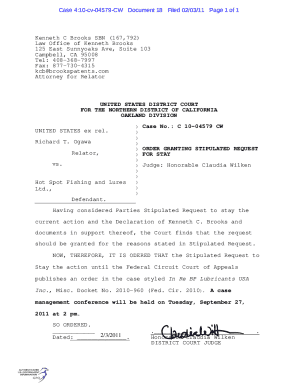

Important considerations when filing

While filling out Form 8949, certain adjustments and special cases must be taken into account. For instance, if you sold stocks at a loss and repurchased them within 30 days, you need to report this as a wash sale, which affects the amount you can deduct. Cryptocurrency transactions have gained prominence recently, requiring accurate reporting of gains and losses due to their nature as property per IRS guidelines.

Staying updated on IRS regulations is essential, as changes to Form 8949 requirements can occur. Be mindful of key deadlines to avoid penalties, ensuring that you file your tax returns timely. This proactive approach can streamline the filing process, avoiding complications.

Frequently asked questions about Form 8949

Addressing common queries surrounding Form 8949 can simplify your experience. For instance, many wonder if they must submit Form 8949 with their tax return; generally, the form is indeed required to be filed alongside Schedule D (Capital Gains and Losses). Additionally, if you sold your stocks at a loss, you may still report those losses on the form and potentially offset them against any gains.

Clarification on terms is significant. Cost basis, for example, refers to the original value of an asset, modified for specifics like depreciation. Another frequent question is how to report capital gains from inherited property, which is subject to different rules and may use the fair market value as the cost basis.

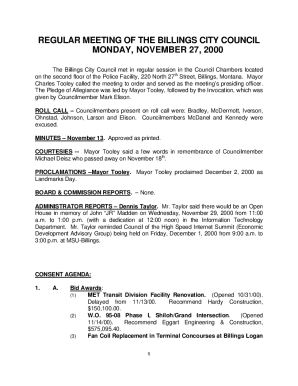

Interactive tools and resources for managing Form 8949

Utilizing advancements in document management software, such as pdfFiller's document tools, can greatly facilitate the process of managing Form 8949. With features that allow you to upload and edit the form, you can streamline your filing experience. eSigning capabilities ensure that any transactions are secure and legally binding, further enhancing your efficiency.

Collaboration features enable tax advisors and clients to work together on the form, with functionalities for sharing forms and tracking changes. This makes it easier to ensure that all information is accurate and up to date, reinforcing the importance of thoroughness in tax reporting.

The bottom line on Form 8949 sales

In summary, Form 8949 plays a vital role in reporting your capital gains and losses with the IRS, ensuring accurate taxation. Through diligent record-keeping, awareness of regulations, and utilizing effective tools like pdfFiller, you can mitigate the complexities of filing. Emphasizing accuracy not only preserves compliance but also leverages opportunities for potential tax savings.

Related tax forms and resources

Understanding related tax forms can enhance your tax filing experience. For instance, Form 4797 deals with the sale of business property, while Form 8960 addresses the net investment income tax. Familiarity with these related forms can guide you in fulfilling various tax obligations seamlessly. Additionally, access to support resources, such as the IRS website and dedicated help lines, keeps you informed of any changes and provides assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8949 sales and for eSignature?

Can I create an electronic signature for signing my form 8949 sales and in Gmail?

Can I edit form 8949 sales and on an iOS device?

What is form 8949 sales and?

Who is required to file form 8949 sales and?

How to fill out form 8949 sales and?

What is the purpose of form 8949 sales and?

What information must be reported on form 8949 sales and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.