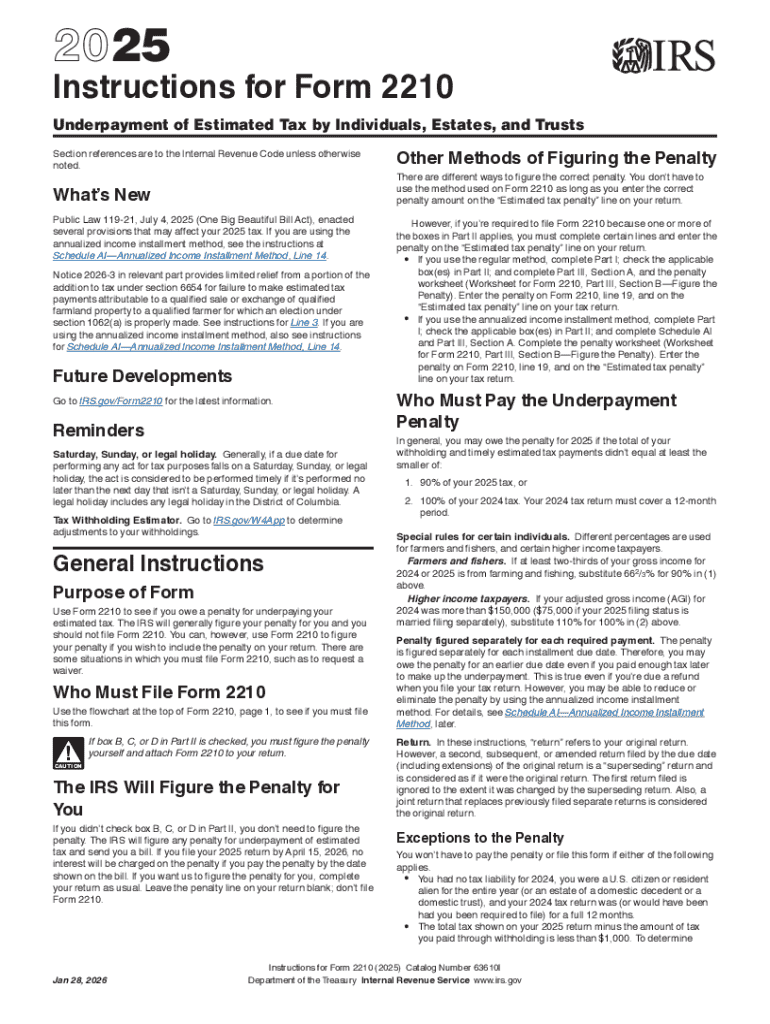

Get the free Instructions for Form 2210, underpayment of estimated tax by ...

Get, Create, Make and Sign instructions for form 2210

Editing instructions for form 2210 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 2210

How to fill out instructions for form 2210

Who needs instructions for form 2210?

Instructions for Form 2210: A Comprehensive Guide

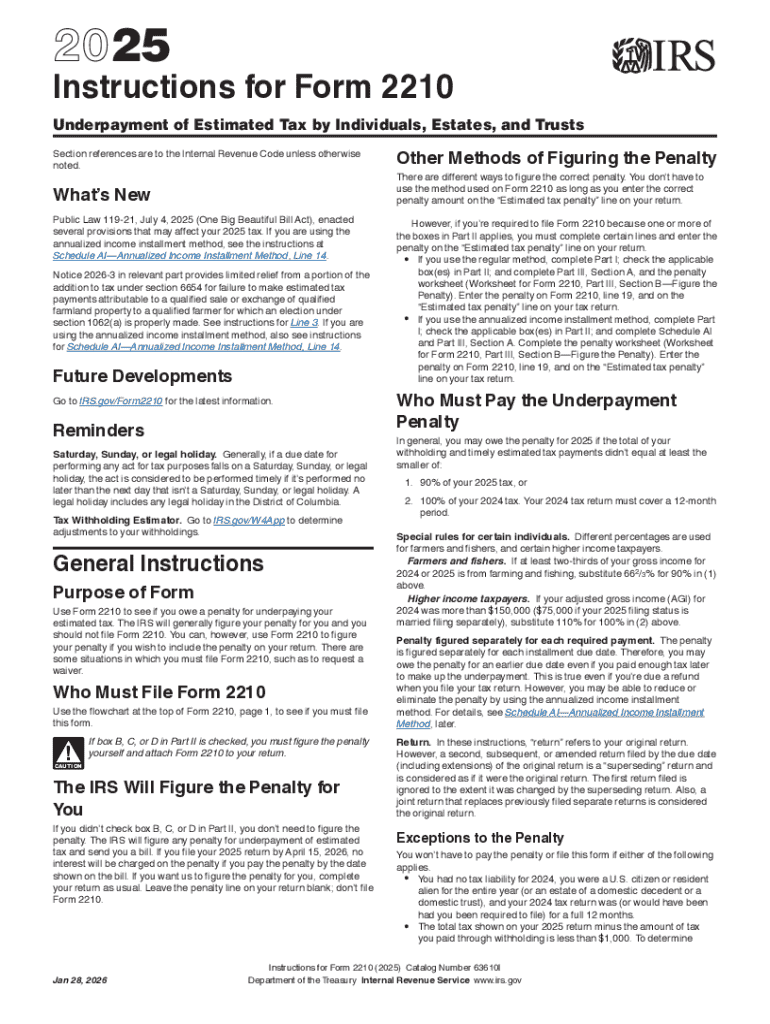

Understanding Form 2210: A Comprehensive Overview

Form 2210 serves as a critical tool for taxpayers who have not met their estimated tax payment obligations throughout the year. It plays an essential role in calculating underpayment penalties and helps individuals and businesses manage their tax liabilities effectively. The primary purpose of Form 2210 is to determine whether you owe a penalty for underpayment of estimated tax and to figure out the amount of that penalty. This form is particularly essential for self-employed individuals, freelancers, and high-income earners who might not have automatic withholding from their income.

Accurate estimated tax payments are crucial because the IRS requires taxpayers to pay taxes on income as it is earned. Failing to meet these requirements can lead to substantial penalties, making it vital to understand the implications of Form 2210.

Who should consider filing Form 2210?

Understanding the categories of filers who might need to submit Form 2210 is essential. Primarily, self-employed individuals often find themselves in need of this form due to the lack of regular withholdings from their income. Freelancers and gig workers are similarly affected; they must often calculate their estimates based on projected earnings, which can fluctuate significantly.

High-income earners might also face underpayment penalties simply due to the progressive nature of tax brackets and the way income fluctuates. Key criteria for filing include having a tax liability for the current year that exceeds $1,000 after subtracting withholding and refundable credits, and if your estimated tax payments and withholding do not meet a certain percentage of your previous year's tax.

Common reasons for using Form 2210

The underpayment penalties can often catch taxpayers by surprise. The IRS usually imposes a penalty if you fail to pay at least 90% of your current year’s tax liability or 100% of your previous year’s tax, depending on your income. Filing Form 2210 helps to clearly outline the situations that may lead to an underpayment penalty, helping you to avoid these costly mistakes.

Common situations that necessitate the use of Form 2210 include having multiple income streams, misestimating your tax liability, or late distributions from trusts or estates. Correctly using the form allows taxpayers to articulate these claims better and may help them avoid penalties altogether, or at the very least, reduce them.

Step-by-step instructions for completing Form 2210

Completing Form 2210 can seem daunting at first, but breaking it into sections can simplify the process significantly. In Section 1, provide your identifying information including your name, Social Security number, and filing status. These details are crucial for the IRS to match the form with your tax return.

Next, in Part I, you will compute the penalty amount. This involves calculating your total tax liability and your total payments. The penalty is determined based on the difference, so accuracy in estimated payments is vital. This section uses a simple formula: calculate the total amount you were required to pay throughout the year and see how it compares to what you actually paid.

Part II details the conditions under which you may waive the penalty. Specific circumstances, such as natural disasters or other life-altering events, may allow you to request a waiver. Documentation will often be required to substantiate your claims.

Finally, Part III is devoted to those who choose to use the annualized income installment method. This method is beneficial if your income significantly varies throughout the year, allowing for a more nuanced payment schedule.

Tips for avoiding common mistakes on Form 2210

When completing Form 2210, certain frequent errors can lead to delays or penalties. One of the most common mistakes includes miscalculating due dates for payments. Ensure that you are aware of all deadlines, especially if you have made adjustments to your estimated payments. Additionally, double-check personal information such as your Social Security number and address to avoid processing errors.

Regularly reviewing and updating your tax information is imperative, especially if you have experienced a significant life change such as marriage, divorce, or a new job. Keeping current records will help you complete Form 2210 accurately and avoid potential complications.

Special rules and exceptions applicable to Form 2210

There are nuances in tax law that can impact your eligibility for penalties or waivers under Form 2210. For instance, if you are over age 62 or if your income is lower than expected due to a life-changing event, you may qualify for exceptions that can lessen penalties. The IRS also sometimes updates guidelines, so staying informed about new tax laws is essential.

Additionally, there may be state-level variations in how penalties are applied, requiring individuals to be aware of local tax regulations. Understanding these rules ensures you can strategically use Form 2210 to your advantage and potentially avoid unnecessary penalties.

Navigating changes in your financial situation

Taxpayers should continually reassess their estimated tax payments, especially if experiencing significant changes in financial circumstances. A decrease in income, for instance, can lessen the amount of tax liability and alter your estimated payments. If your job situation changes, or if unexpected payments come in, it’s important to adjust your estimated payments accordingly to maintain compliance.

Failing to adjust your tax payments in reaction to life changes may lead to underpayment penalties. Keeping track of changes and reassessing their implications can ultimately save you time and money during tax season.

Handling missed payments or underpayment situations

If you find yourself facing missed payments or underpayment situations, immediate steps are crucial. Begin by assessing how much you owe to avoid further penalties. The consequences of late payments can escalate quickly, resulting in additional interest on your tax liability.

To rectify these issues, you may need to file both Form 2210 to calculate penalties and make arrangements for payment. Engaging with a tax professional can also provide you with guidance tailored to your unique situation, helping navigate the complexities of guidance.

Final review and submission of Form 2210

Before submitting Form 2210, conduct a thorough final review of your document. Double-check all sections for accuracy, ensuring that your computations are correct and that all required information is included. This checklist approach helps confirm you haven’t overlooked any critical details. Submission options vary as you can choose to e-file or mail your form. Each method has its advantages, so consider what fits your needs best.

After submission, keep a record and confirmation of your filing, as this will serve as important documentation. Proper records will aid in resolving future discrepancies or issues with your tax filings.

Utilizing pdfFiller to streamline the Form 2210 process

pdfFiller offers an efficient platform for managing Form 2210. Users can utilize features for document management that allow for easy editing, eSigning, and collaboration directly from a cloud-based interface. Interactive tools assist in completing complex forms, ensuring users don't miss any critical details while reducing potential errors.

The benefits of eSigning through pdfFiller are noteworthy; it simplifies the submission process, allowing documents to be signed and sent swiftly, enhancing the overall filing experience. Thus, pdfFiller’s tailored solutions can significantly reduce the headaches often associated with managing tax documents.

Frequently asked questions about Form 2210

Many taxpayers have queries when it comes to Form 2210. One common question is about determining whether you need to file the form in the first place. If you think your estimated payments and withholding will lead to an underpayment, it's wise to consult the guidelines on Form 2210 to assess your potential need.

Another common inquiry involves the consequences of failing to file Form 2210 when required. The penalties can accumulate, impacting your tax burden significantly. Additionally, many taxpayers wonder whether Form 2210 can be filed electronically, and the answer is yes, it is possible, simplifying the submission process immensely.

Expert insights on estimated tax obligations

Staying informed about your estimated tax obligations is crucial for smooth financial management. Tax professionals emphasize the importance of keeping up with IRS guidelines and changes in tax laws. Engaging with these experts can also help in understanding your obligations and taking proactive steps to avoid penalties.

Regularly reviewing your financial situation and tax strategies can lead to beneficial reforms in how you handle your obligations. Don't hesitate to reach out for professional advice, and utilize resources like pdfFiller to help manage your documentation effectively and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in instructions for form 2210 without leaving Chrome?

How can I edit instructions for form 2210 on a smartphone?

How do I edit instructions for form 2210 on an Android device?

What is instructions for form 2210?

Who is required to file instructions for form 2210?

How to fill out instructions for form 2210?

What is the purpose of instructions for form 2210?

What information must be reported on instructions for form 2210?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.