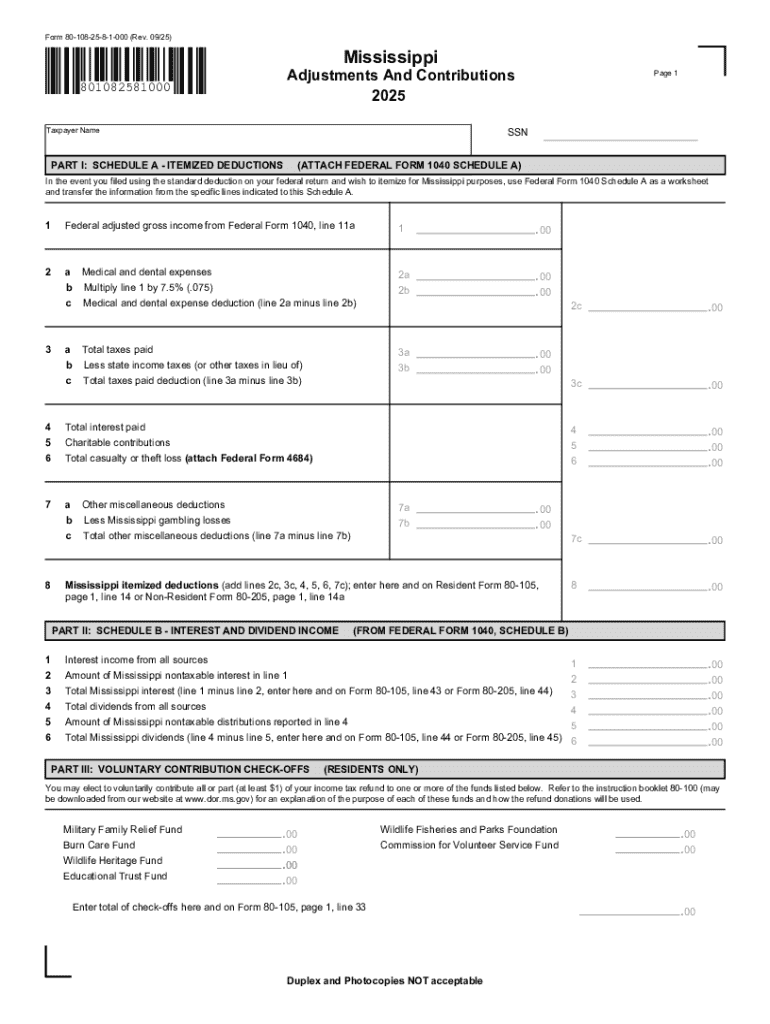

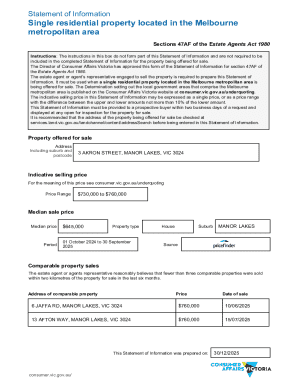

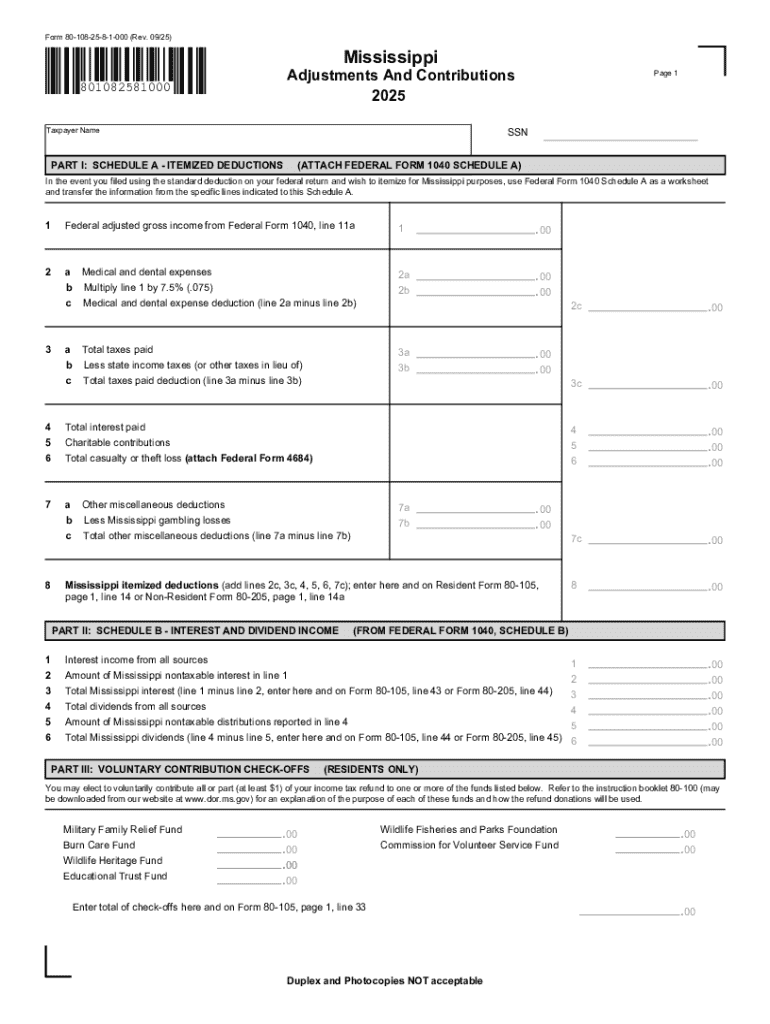

MS DoR Form 80-108 2025-2026 free printable template

Get, Create, Make and Sign MS DoR Form 80-108

How to edit MS DoR Form 80-108 online

Uncompromising security for your PDF editing and eSignature needs

MS DoR Form 80-108 Form Versions

How to fill out MS DoR Form 80-108

How to fill out 80108251

Who needs 80108251?

Comprehensive Guide to the 80108251 Form

Understanding the 80108251 form

The 80108251 form is a crucial document primarily used for [insert primary usage context here, e.g., tax purposes, loan applications, etc.]. This form facilitates the efficient collection and presentation of necessary data required by [insert relevant authorities or organizations].

Common uses of the 80108251 form include [list specific purposes, such as applying for government benefits, filing taxes, or requesting for personal services]. Its structure and sections are designed to capture all relevant information that helps streamline processes. Utilizing this form properly can save individuals and organizations a significant amount of time and effort while ensuring compliance with statutory requirements.

Who should complete the 80108251 form?

The target audience for the 80108251 form generally includes individuals seeking to file taxes, apply for loans, or request particular benefits from government agencies. This form caters to both personal and professional needs; hence, anyone who fits these criteria should consider using it. Businesses, especially small and medium-sized enterprises, often find themselves filling out this form due to compliance or reporting obligations.

One of the benefits of utilizing the 80108251 form is that it provides a standardized method to communicate required information. This not only reduces the risk of errors but also increases the likelihood of acceptance upon submission. Especially important is the clarity of the form, which aids users in presenting their information clearly and accurately.

Preparing to fill out the 80108251 form

Before tackling the 80108251 form, it’s essential to gather the required information and documentation. Essential details include personal identification, such as your social security number, financial data relevant to the application, and any other supporting documentation that could support the claims or data presented in the form.

Supporting documents might include pay stubs, tax returns, identification proof, or other financial statements. Having these documents on hand can facilitate a smoother filling process, reduce the chance of errors, and enhance the overall effectiveness of your submissions.

Tools and resources available

pdfFiller offers a variety of features that streamline the entire form-filling process. With interactive forms, users can fill out their details seamlessly alongside specialized tools for document editing and e-signing. This platform allows you to access your documents from anywhere, ensuring that necessary forms like the 80108251 form can be completed efficiently and effectively.

Additionally, pdfFiller offers tutorials and help guides that cover every aspect of filling out the 80108251 form, providing users with step-by-step assistance, making it easier for both individuals and teams navigating document creation.

Step-by-step instructions for completing the 80108251 form

Accessing the 80108251 form online is straightforward. Users can find the form by visiting pdfFiller's website and either searching for it directly or navigating through the comprehensive list of available templates.

Once you’ve located the form, the next step is to fill out each designated section meticulously to avoid common mistakes. This includes:

Section 1: Personal information

Inputting accurate personal details, such as your full name, address, and contact information, is critical. Failing to provide correct information may delay processing or lead to outright rejection of the submission. Common pitfalls include typographical errors and missing information, so double-check your entries.

Section 2: Financial information

In this section, you will be required to provide detailed financial data. Guidelines to follow include ensuring that all figures are entered without omissions, and it’s wise to refer to your gathered documents for accuracy. If calculations are to be made, double-check for consistency with supporting documents.

Section 3: Signatures and acknowledgments

The final section involves signing the document electronically if using pdfFiller. Valid signatures are crucial for the legitimacy of the submission. It’s important to understand the legal binding of your signature, thus ensuring it matches the name provided in the personal information section. With pdfFiller, adding a signature can be done easily with the eSign feature, making this the last step in completing your form.

Editing and modifying the 80108251 form

Utilizing pdfFiller’s editing features allows users to make changes after their initial completion of the 80108251 form effortlessly. If you notice an error or wish to update information, they offer dynamic tools to ensure the document remains accurate and up-to-date, catering to growing needs or adapting to new information.

Saving your document in pdfFiller can be accomplished through various methods, such as saving it to your profile for future access or exporting it to different formats. Keeping your forms organized is essential, especially if you need to reference them in the future. pdfFiller enables users to manage all their documents efficiently giving access to them anytime, anywhere.

Submitting the 80108251 form

Understanding submission options is essential when it comes to the 80108251 form. Users can choose between electronic submission via pdfFiller or traditionally submitting it via mail. Each method has its pros and cons; electronic submissions tend to be faster while paper submissions might be necessary for certain formalities.

After submission, tracking your status is crucial, especially if deadlines are involved. pdfFiller provides notifications and tracking tools so you can monitor your submission and ensure your form has been received and is being processed correctly.

Common challenges and solutions

Filling out the 80108251 form can come with its set of challenges, ranging from misunderstanding prompts to clerical errors. A frequently encountered issue is the omission of critical information, which can lead to the denial of applications or processing delays. Always double-check your entries before finalizing.

Troubleshooting tips include maintaining a checklist of required fields, using the guided editor available on pdfFiller, and familiarizing yourself with common errors experienced by other users. These practical steps can save time and enhance the user experience significantly.

Best practices for document management

When it comes to securely storing your forms, it’s imperative to understand the importance of document security. Storing completed forms in a secure manner prevents unauthorized access and protects sensitive information contained within. Utilizing platforms like pdfFiller enhances security through encryption and secure access protocols.

Organizing your forms for quick access can also improve efficiency. Implementing folders, consistent naming conventions, and tagging features available in pdfFiller can aid in swift retrieval of documents. Efficient management strategies like these can save considerable time and effort, particularly during peak filing seasons.

Support and additional help

Accessing help resources on pdfFiller can significantly enhance your experience with the 80108251 form. They provide excellent help guides, video tutorials, and FAQ sections that cover common questions and intricacies involved in filling out the form. Leveraging these resources can demystify the filling process.

For users requiring personalized assistance, contacting customer support is straightforward. Whether through email, chat, or phone, reaching out to customer support can provide quick resolutions to any issues faced while filling out the 80108251 form.

People Also Ask about

Does Mississippi have a state tax form?

How do I check my refund status with IRS?

How long does it take to get state tax refund in MS?

How do I pay my MS state taxes?

What happens if you don't pay Mississippi State taxes?

Where can I pick up IRS forms?

How do I pay my state taxes in Mississippi?

Who do I call about my MS state tax refund?

Can I call to check on my tax refund?

Do I have to pay Mississippi state taxes?

What app can I check my tax refund status?

How can I check my taxes online?

When can I expect my refund 2022?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MS DoR Form 80-108 directly from Gmail?

How do I execute MS DoR Form 80-108 online?

How do I edit MS DoR Form 80-108 online?

What is 80108251?

Who is required to file 80108251?

How to fill out 80108251?

What is the purpose of 80108251?

What information must be reported on 80108251?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.