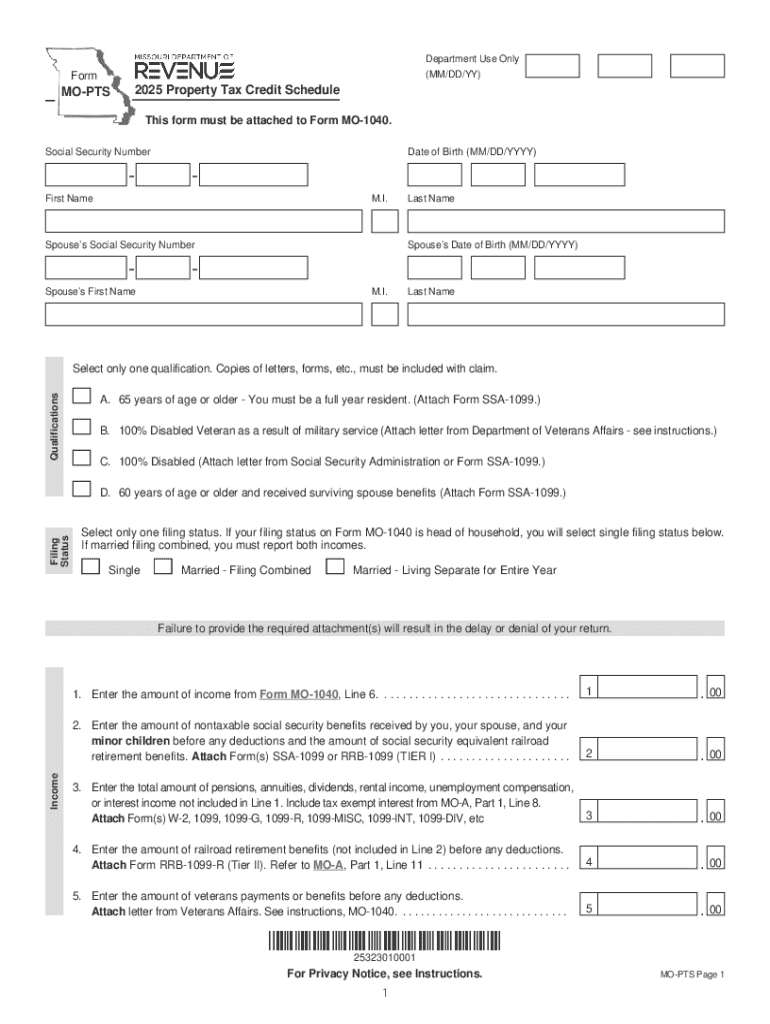

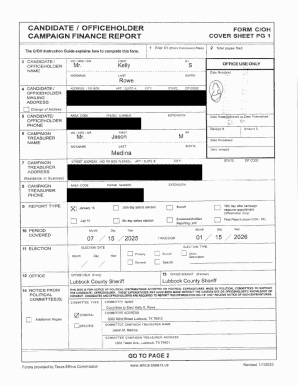

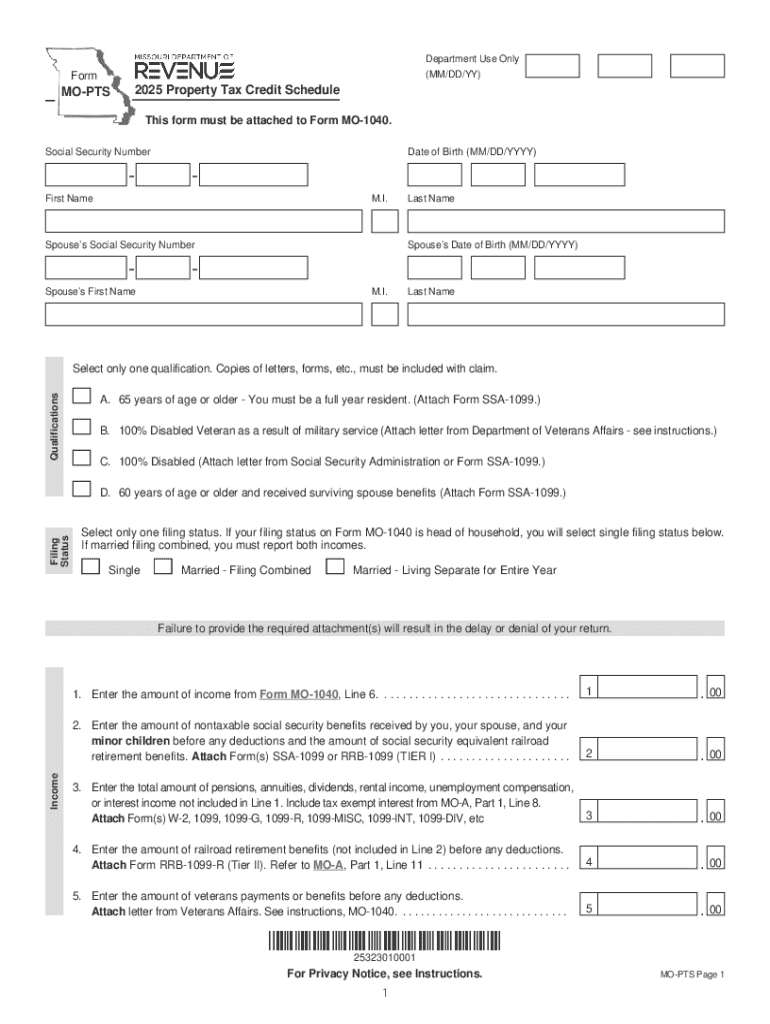

MO DoR MO-PTS 2025-2026 free printable template

Get, Create, Make and Sign MO DoR MO-PTS

How to edit MO DoR MO-PTS online

Uncompromising security for your PDF editing and eSignature needs

MO DoR MO-PTS Form Versions

How to fill out MO DoR MO-PTS

How to fill out form mo-pts - 2025

Who needs form mo-pts - 2025?

Form Mo-PTS - 2025 Form: A Comprehensive Guide

Understanding the Mo-PTS - 2025 Form

The Mo-PTS - 2025 Form serves as a pivotal document for various administrative and procedural applications. It is designed to capture critical information requisite for processing requests, applications, or notifications within specific governmental or corporate frameworks. The form's significance lies in its ability to streamline information collection and ensure compliance with required guidelines and regulations.

Applications of the Mo-PTS - 2025 Form primarily include tax purposes, social services applications, and instances where official documentation is mandated to validate claims or requests. Its effectiveness in enhancing productivity and minimizing errors is noteworthy, making it an essential instrument for both individuals and organizations.

Who needs to fill out the Mo-PTS - 2025 Form?

The Mo-PTS - 2025 Form targets a diverse audience comprising individuals, businesses, and entities that require formal documentation for a range of transactions and applications. Individuals seeking to apply for government benefits or loans, as well as organizations needing to file compliance reports and tax documentation, fall under the target demographic.

Common reasons for filling out the Mo-PTS - 2025 Form include applying for social security benefits, requesting tax credits, or submitting documentation for funding applications. Understanding whether you fit the eligibility criteria is vital before undertaking the task of completing this form.

Key features of the Mo-PTS - 2025 Form

The Mo-PTS - 2025 Form is constructed with several essential components that ensure effective data capture. Each section within the form has its unique purpose and relevance, contributing to the overall integrity of the data collected. The form is usually divided into basic categories: Personal Information, Financial Information, and Declaration Details.

Understanding these components is crucial. The Personal Information section captures identifying data, the Financial Information section mandates the declaration of income or asset details, and the Affirmation and Signatures section solidifies the validity of the submission. Each section requires meticulous attention to detail to avoid processing delays.

Interactive tools available on pdfFiller

Utilizing pdfFiller transforms the process of completing the Mo-PTS - 2025 Form into a seamless experience. This platform provides an array of interactive tools designed to assist users in form completion, including editing functionalities, eSigning options, and real-time document collaboration.

The advantages of pdfFiller are significant: editing features allow users to refine entries easily, widget integration permits modifications on the fly, and the eSigning functionality can ensure that documents are securely signed without the need for physical presence. Such tools are particularly beneficial for teams and individuals requiring collaborative input on the same document.

Step-by-step guide to filling out the Mo-PTS - 2025 Form

Preparing to fill out the form

Before beginning the task of filling out the Mo-PTS - 2025 Form, preparation is key. Gather all the necessary documents such as identification, income statements, and other relevant information that you will need to accurately fill the form. It is also recommended to review examples of completed forms to familiarize yourself with the data needed.

Best practices for preparation include creating a checklist of all required fields and information. This will help you ensure that no essential details are overlooked when you start completing the form.

Detailed instructions for each section

Using pdfFiller tools during completion

pdfFiller provides numerous tools designed for ease of completion. Users can easily edit specific entries that may require adjustments without starting fresh, ensuring a less disruptive workflow. Additionally, pdfFiller saves progress automatically, which means you can access your work from multiple devices, providing the flexibility to complete the form anytime and anywhere.

Moreover, features like clear instructions and helpful tips pop up as you navigate through the form, ensuring you understand exactly what is required at each step.

Common mistakes to avoid

While filling out the Mo-PTS - 2025 Form, there are several common errors to be mindful of, to prevent delays or rejections. Missing signatures, incorrect information, or incomplete sections are the most frequent mistakes that users encounter. These missteps not only prolong the process but also reduce the likelihood of approval.

To visualize the differences, examining examples of well-filled forms can be enlightening. Consider using pdfFiller’s templates to see the correct versus incorrect entries exemplified. This will help you understand formatting and data representation effectively.

FAQs about the Mo-PTS - 2025 Form

Inquiries surrounding the Mo-PTS - 2025 Form frequently arise, especially regarding its purpose and submission timelines. Many users often ask how long the processing time is or what specific documentation is required alongside the form. Understanding these elements can significantly streamline the completion process.

Another common area of concern involves technical support queries related to pdfFiller. Users frequently face issues with file uploads or signing errors. pdfFiller provides a dedicated support section filled with resources, including troubleshooting tips and best practices to resolve these commonly asked questions.

Filing your Mo-PTS - 2025 Form

Filing your Mo-PTS - 2025 Form requires careful attention to submission guidelines. Once your form is completed, you must determine how to submit it properly. Options typically include online submissions through a designated portal or physical mail to the appropriate agency. Each submission type has distinct protocols that should be understood beforehand to avoid complications.

Furthermore, tracking submission statuses can also be valuable. Most agencies provide confirmation once they receive your form, and users can often track the progress through their online portals, allowing for peace of mind during the waiting period.

Collaborating on the Mo-PTS - 2025 Form

For teams working together on the Mo-PTS - 2025 Form, pdfFiller enhances collaboration through its intuitive sharing options. Multiple users can access the form, make edits, and provide input simultaneously, which streamlines the workflow significantly. This allows for efficient teamwork, especially in scenarios where numerous individuals must contribute information.

Effective communication during this collaborative process is vital. Using comments or annotations within pdfFiller enables all team members to see updates in real-time, aligning everyone's input towards a cohesive end result.

Advanced features for managing the Mo-PTS - 2025 Form

Managing the Mo-PTS - 2025 Form is simplified through advanced features in pdfFiller like version control and history tracking. This allows users to monitor changes made over time and compare previous edits to current iterations. Maintaining a record of updates can be crucial for accountability and transparency, especially in team-oriented projects.

Additionally, secure storage options are available to protect sensitive information captured within the Mo-PTS - 2025 Form. Utilizing encryption and access controls enhances confidentiality, ensuring that personal data remains safeguarded against unauthorized access or breaches.

Final thoughts on the Mo-PTS - 2025 Form Process

Using the Mo-PTS - 2025 Form can initially seem daunting, but with the right tools, it becomes a manageable and efficient process. pdfFiller significantly enhances the experience by providing resources, tools, and functionalities that simplify form completion, editing, and submission.

By leveraging the capabilities of pdfFiller, users can enhance productivity, reduce errors, and engage in streamlined workflows. Embracing such helpful tools can make the transition into digital document handling seamless, fostering greater flexibility and efficiency in addressing your document needs.

People Also Ask about

What is form mo 948?

How do I get a personal property tax exemption in Missouri?

Who qualifies for MO PTS?

Who is exempt from personal property tax in Missouri?

Can I file Mo PTC online?

What is a MO PTS form?

Who is eligible for Missouri property tax credit?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MO DoR MO-PTS directly from Gmail?

How do I complete MO DoR MO-PTS online?

How do I fill out MO DoR MO-PTS on an Android device?

What is form mo-pts - 2025?

Who is required to file form mo-pts - 2025?

How to fill out form mo-pts - 2025?

What is the purpose of form mo-pts - 2025?

What information must be reported on form mo-pts - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.