MO DoR MO-1040V 2025-2026 free printable template

Get, Create, Make and Sign MO DoR MO-1040V

Editing MO DoR MO-1040V online

Uncompromising security for your PDF editing and eSignature needs

MO DoR MO-1040V Form Versions

How to fill out MO DoR MO-1040V

How to fill out form mo-1040v - 2025

Who needs form mo-1040v - 2025?

MO-1040V - 2025 Form: A Comprehensive Guide

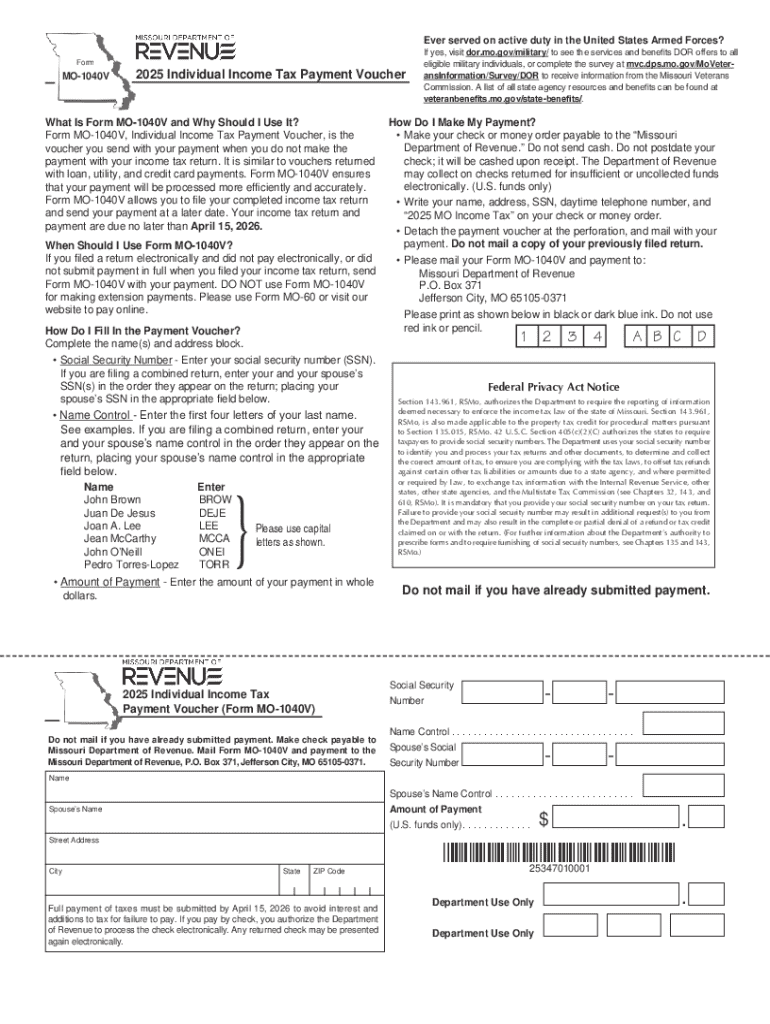

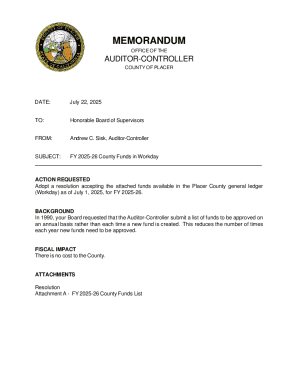

Overview of the MO-1040V - 2025 Form

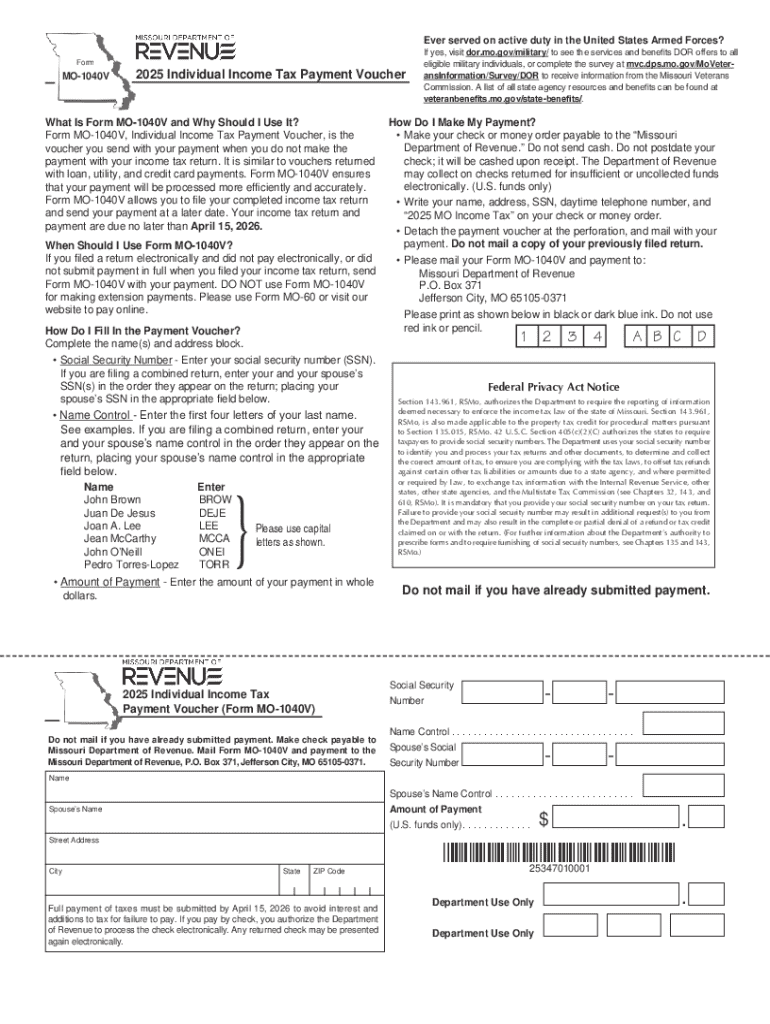

The MO-1040V - 2025 Form is a vital document for taxpayers in Missouri, utilized when submitting payments accompanying the state income tax return. Its primary purpose is to ensure that the state receives timely payment, which can help avoid penalties for late submissions. Proper completion of this form is essential for anyone filing a state tax return in 2025, especially for those who owe amounts when they file.

Understanding when and why you need the MO-1040V is critical. If you owe taxes and choose to submit payment alongside your filed tax return, this form provides a structured way to report that payment. Additionally, 2025 may bring alterations in tax laws, highlighting the need for accurate compliance to avoid issues.

Detailed breakdown of the MO-1040V - 2025 Form sections

The MO-1040V - 2025 Form is divided into several critical sections, each requiring careful attention to detail. Let's explore these sections:

Section 1 focuses on Personal Information. It's crucial to provide accurate details such as your name, address, and Social Security Number or ITIN. Mistakes in these areas can lead to significant delays in processing and potential complications with your tax account.

Section 2 involves Income Reporting. Taxpayers must report all sources of income, including wages, self-employment income, dividends, and interest. Preparedness is key, so gather the necessary documentation such as W-2 forms and 1099 statements to support your claims.

In Section 3, taxpayers can report Deductions and Credits. Common deductions include those for mortgage interest, property taxes, and state taxes already paid. Understanding how to claim your available credits can maximize your potential refunds, making this section pivotal.

Interactive tools: Utilizing pdfFiller for your MO-1040V - 2025 Form

pdfFiller provides an intuitive platform for managing your MO-1040V - 2025 Form. Getting started is as simple as accessing the form on the pdfFiller website, where users can fill out, edit, and sign the document all within a cloud-based interface.

Once you have accessed the form, pdfFiller allows you to upload any supporting documents or evidence needed for your submission. You can easily add eSignatures to finalize your form, making submissions quick and compliant with state requirements.

With storage solutions provided by pdfFiller, you can manage your forms conveniently, ensuring they’re all accessible whenever needed. This feature is particularly beneficial during tax season, as it allows you to keep track of past returns and related documents effortlessly.

Comprehensive guide to completing the MO-1040V - 2025 Form

Completing the MO-1040V requires precision and attention to details. Start by verifying all entries against your supporting documents to ensure accuracy. Common mistakes include miscalculating owed amounts or incorrectly entering personal information, which could delay your filing or create issues with the state.

For best practices, maintain well-organized records of income, deductions, and correspondence received from the state regarding your taxes. This habit not only prepares you for filing but can also assist if your forms are ever audited.

Frequently asked questions help further illuminate the complexities surrounding the MO-1040V - 2025 Form. Common inquiries include clarifications on filing deadlines, how to handle changes post-submission, and specific deductions that can be claimed. Engaging with these FAQ sections can provide invaluable insights that aid in your successful completion of your goals.

Advanced document management techniques

Utilizing pdfFiller's cloud features can streamline your MO-1040V documentation process dramatically. By storing all related documents in a single, accessible location, users can boost efficiency and minimize the stress often associated with tax preparations. Cloud storage mitigates the risks of losing paper records and helps maintain organized files.

To further enhance organization, consider tagging or categorizing your documents based on year or type of form. This method enables rapid retrieval, saving you time in future filing seasons. Securing these electronically stored documents is crucial; pdfFiller employs industry-standard encryption to ensure your sensitive information remains protected.

Troubleshooting common issues

Errors on your MO-1040V form can lead to processing delays or outright rejections. If you encounter issues, first check for the most common mistakes such as incorrect personal information or mismatched payment amounts. Resubmission may be necessary if errors are found post-filing.

For any complications related to using pdfFiller, their support team is readily available. Offering assistance through chat or email, they can help you navigate their platform and troubleshoot issues with your forms. If amendments are needed after submission, understanding how to fill out and submit an amended return is critical for staying in compliance.

Additional features and benefits of using pdfFiller

pdfFiller offers a robust suite of advantages for managing your MO-1040V documents efficiently. Its cloud-based system keeps everything integrated, reducing the hassle of juggling multiple platforms. This integration allows for streamlined processes, making it easy to move from editing to eSigning all in one environment.

Moreover, pdfFiller can integrate with other platforms you may already use, reinforcing your workflow. Customizable templates allow users to approach their document needs with a personal touch, ensuring high functionality without sacrificing personalization.

Real user experiences and testimonials

Hearing success stories from users who have efficiently completed the MO-1040V - 2025 Form using pdfFiller can provide reassurance and guidance. Many users have noted how its user-friendly interface and seamless eSignature features have significantly reduced their filing stress.

Testimonials commonly highlight how the ability to access documents from anywhere facilitated last-minute filing, allowing taxpayers to meet deadlines without the usual chaos often associated with tax season. The convenience of pdfFiller emerges as a recurring theme, further emphasizing its value.

Future trends in document management and eSigning

Looking ahead, the dynamics of tax forms and filing processes are set to evolve. The increasing integration of technology within state tax systems might simplify compliance through more accessible electronic filing options, catering to an ever-growing digital audience.

As needs progress, platforms like pdfFiller are anticipated to adapt by enhancing their features, making digital document handling more intuitive and user-centered. Staying informed on these developments ensures that users can continue to effectively manage their forms without falling behind.

Next steps with pdfFiller

If you're ready to tackle your MO-1040V - 2025 Form using pdfFiller, begin by registering for a free trial or choosing a subscription that meets your needs. Taking this step could profoundly impact the ease with which you manage your tax documentation.

After registration, explore a variety of document templates available on pdfFiller to streamline your filing process. Also, be prepared for continuous updates and feature enhancements that will ensure that your document management remains cutting-edge and aligned with current tax requirements, ultimately leading to more manageable tax seasons.

People Also Ask about

What is a purpose of a Form 1040-V?

Is Form 1040-V required?

Can I download and print tax forms?

Do I need a 1040v?

Why do I need a Mo-1040?

What is a mo 1040V?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MO DoR MO-1040V directly from Gmail?

How can I edit MO DoR MO-1040V from Google Drive?

Can I edit MO DoR MO-1040V on an iOS device?

What is form mo-1040v - 2025?

Who is required to file form mo-1040v - 2025?

How to fill out form mo-1040v - 2025?

What is the purpose of form mo-1040v - 2025?

What information must be reported on form mo-1040v - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.