MO MO-1120V 2025-2026 free printable template

Get, Create, Make and Sign MO MO-1120V

Editing MO MO-1120V online

Uncompromising security for your PDF editing and eSignature needs

MO MO-1120V Form Versions

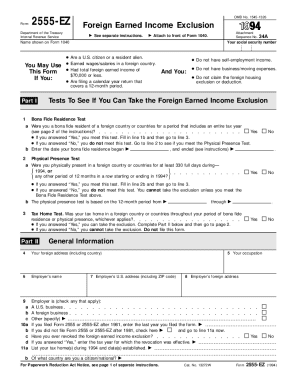

How to fill out MO MO-1120V

How to fill out mo-1120v 2022 corporation income

Who needs mo-1120v 2022 corporation income?

Comprehensive Guide to the MO-1120V 2022 Corporation Income Form

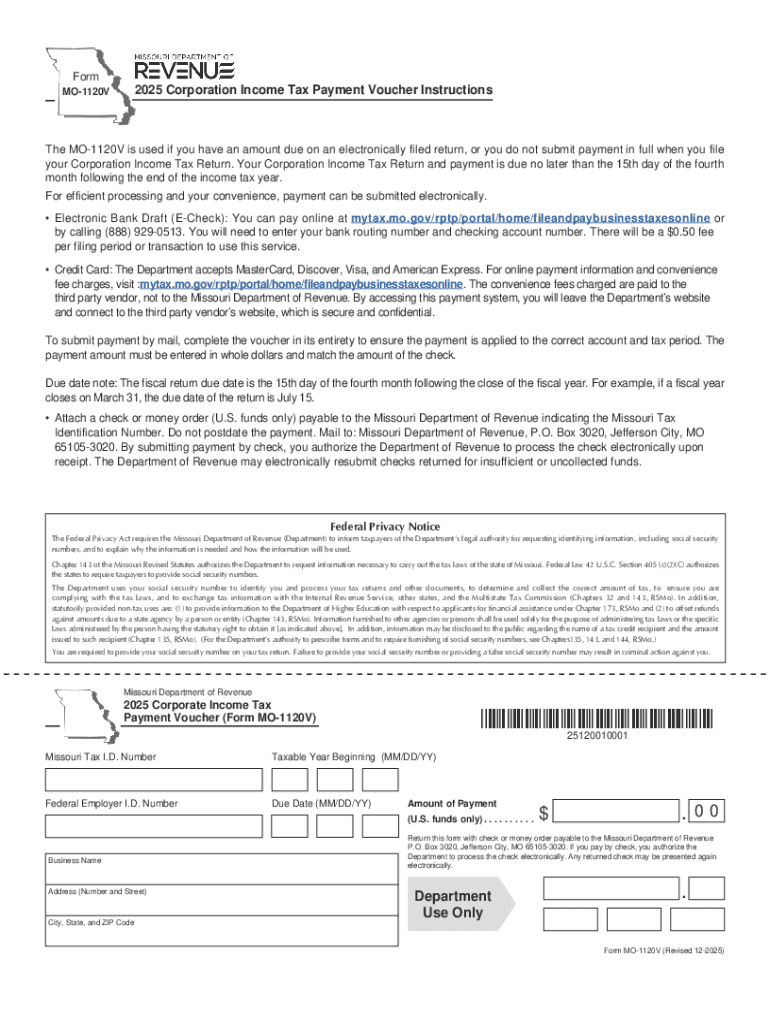

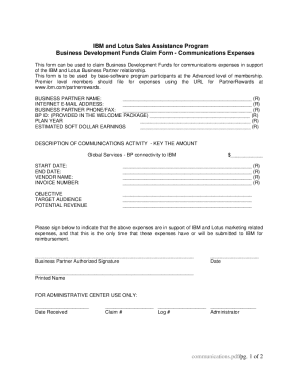

Overview of the MO-1120V 2022 Corporation Income Form

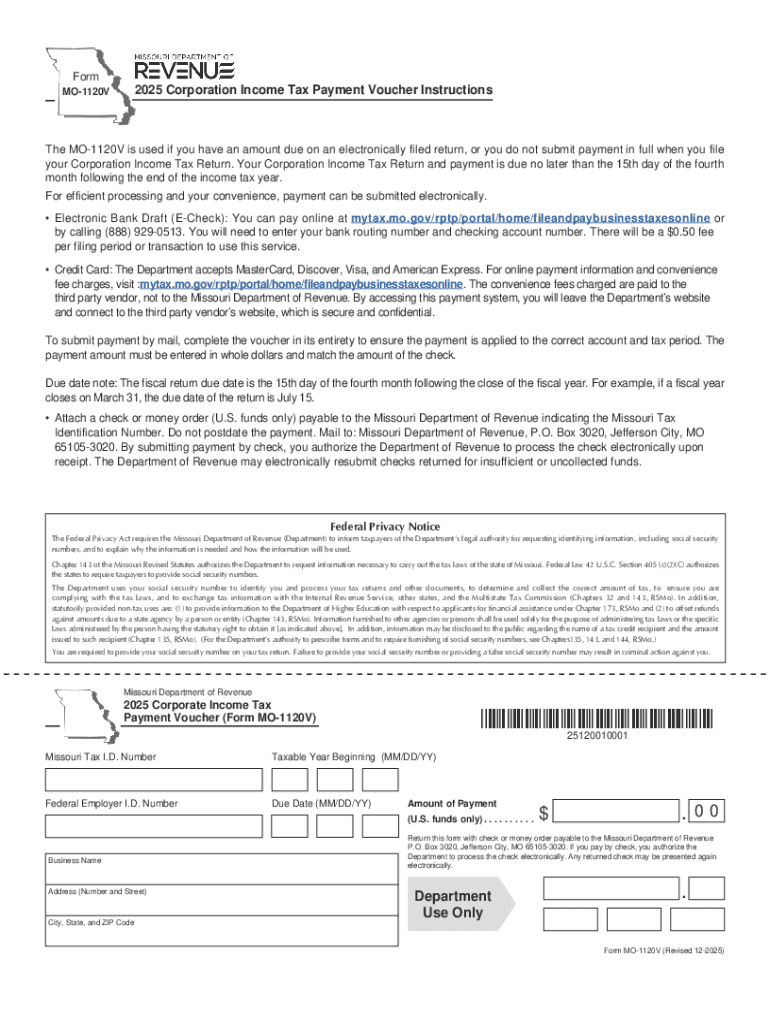

The MO-1120V form is an essential document required by corporations operating in Missouri for the tax year 2022. This form serves as a corporation's income return, detailing its total income, deductions, and tax liability. Filing the MO-1120V is critical not only for compliance with state tax laws but also for maintaining the corporation's good standing with regulatory authorities.

Understanding the importance of this form involves recognizing the implications of timely and accurate filings. Corporations that fail to submit the MO-1120V in a timely manner may face penalties and interest on unpaid taxes. Key deadlines for the 2022 tax year typically align with the federal filing dates, reinforcing the need for precise planning.

Understanding the MO-1120V Form Structure

The MO-1120V form consists of various sections, each designed to capture specific financial information related to the corporation's operations. Properly understanding these sections is crucial for accurate submissions.

The first section involves header information, which includes the corporation's name, address, and identification details such as the Employer Identification Number (EIN). Providing accurate information in this section eliminates confusion and streamlines processing.

Next, the income section outlines the types of income reported, including gross receipts and other income sources. Deductions and credits also play a crucial role here, detailing the allowable expenses that can reduce the overall taxable income. The tax computation section will then provide the applicable tax rates based on the reported income, followed by a signature and verification section.

How to Fill Out the MO-1120V Form: Step-by-Step Instructions

Filling out the MO-1120V form can appear daunting, but following a structured approach can simplify the process significantly.

Step 1 involves gathering required documentation. Essential documents include financial statements, previous tax returns, and detailed records of income and deductions. Being organized will save time and reduce errors during the filling process.

In Step 2, focus on the header section. Ensure that the corporation’s name and address are correctly entered to match what’s registered with the state. This prevents any miscommunication with tax authorities.

Moving to Step 3, accurately reporting the income is vital. Categorize various income sources such as sales and interest income, and list allowable deductions clearly to minimize taxable income. Step 4 involves calculating taxes owed, using the current rates applicable to your corporation's income. Finally, Step 5 emphasizes the importance of review, where a checklist can help catch common mistakes.

Interactive Tools for Filing the MO-1120V

Utilizing online form-filling tools can significantly ease the preparation of the MO-1120V. Digital platforms offer user-friendly interfaces that guide corporations through each section of the form.

pdfFiller stands out as a powerful tool in this regard, providing features to streamline writing, editing, signing, and managing the form. By leveraging pdfFiller, you can easily access the MO-1120V form digitally, fill it out step-by-step, and save your changes securely in the cloud.

Embracing these interactive tools not only enhances document management but also reduces the likelihood of errors typically associated with manual entry. As tax time approaches, incorporating such technologies can offer significant benefits.

Best Practices for Filing the MO-1120V Form

To successfully navigate the MO-1120V filing process, adhering to best practices is essential. Timeliness is crucial—ensuring your form is submitted by the deadline can help you avoid penalties and interest on unpaid taxes.

Additionally, employing effective tax planning strategies throughout the year can prepare your corporation for a smooth filing experience. This may include regularly updating financial records, implementing strong bookkeeping practices, and consulting with tax professionals as necessary.

Keeping thorough records also plays a significant role in sustaining compliance. Related documents not only support the entries made on the MO-1120V form but also provide necessary evidence in case of an audit.

Troubleshooting Common Issues with the MO-1120V

Even with due diligence, issues may arise during the MO-1120V filing process. Common errors include incorrect reporting of income or deductions, which can trigger audits or reassessments from tax authorities.

If you miss the filing deadline, it's imperative to act quickly. Filing a late return can incur additional penalties, but proactively reaching out to the tax authority may sometimes help in waiving these penalties.

For any disputes or issues with the IRS or state authorities, adequate resources and guidance are available. Consulting with tax professionals who are familiar with Missouri’s specific requirements can provide invaluable support and clarification.

Frequently Asked Questions (FAQs) about the MO-1120V

Corporations often have questions about how to handle the intricacies of the MO-1120V form. For instance, if a corporation realizes it has filed wrong information, it can amend its return. Consulting the state tax authority’s website can provide updated procedures for filing amendments.

Another common question is whether the MO-1120V form differs from federal requirements. State and federal forms may have varying criteria, making it essential to review both specifically to comply fully.

Case Studies: Successful Filing Scenarios

Various corporation types encounter specific circumstances when filing the MO-1120V. For example, a small retail business successfully filed its MO-1120V by leveraging robust financial software, ensuring accurate income reporting and deduction categorization.

Lessons from real-world applications reveal that maintaining up-to-date financial records throughout the year makes the process much more manageable. Another corporation focused on consulting with tax advisors early in the fiscal year, which enabled them to maximize their deductions and file on time.

Conclusion: Elevating Your Tax Filing Experience with pdfFiller

Navigating through the intricacies of the MO-1120V 2022 Corporation Income Form doesn’t have to be overwhelming. Using pdfFiller’s innovative solution enhances both efficiency and accuracy during the filing process. Its streamlined features empower users to edit PDFs, collaborate on documents, and manage tax forms securely.

Customer testimonials consistently highlight the intuitive interface and time-saving capabilities of pdfFiller’s tools, making it the preferred choice for businesses aiming to optimize their tax filing experience. Embracing digital solutions like pdfFiller can ultimately make the completion of the MO-1120V form a straightforward and efficient process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MO MO-1120V from Google Drive?

How can I send MO MO-1120V to be eSigned by others?

How do I fill out MO MO-1120V on an Android device?

What is mo-1120v 2022 corporation income?

Who is required to file mo-1120v 2022 corporation income?

How to fill out mo-1120v 2022 corporation income?

What is the purpose of mo-1120v 2022 corporation income?

What information must be reported on mo-1120v 2022 corporation income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.