Get the free MO MO-1041 2022-2026 - Fill and Sign Printable Template ... - dor mo

Get, Create, Make and Sign mo mo-1041 2022-2026

Editing mo mo-1041 2022-2026 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo mo-1041 2022-2026

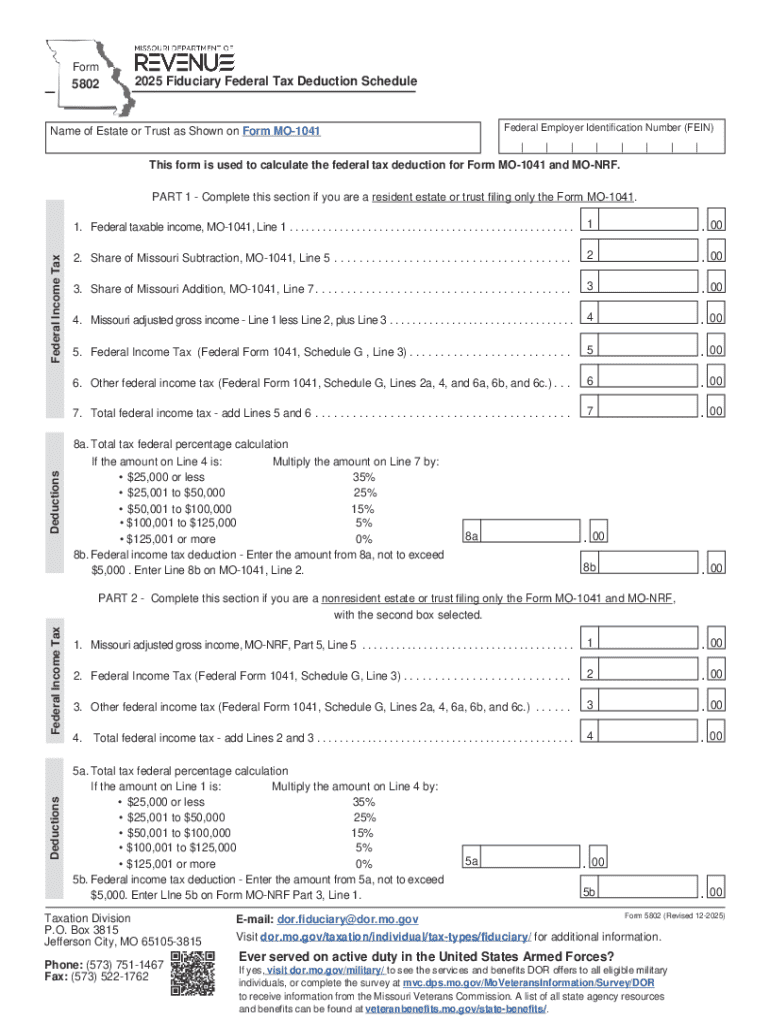

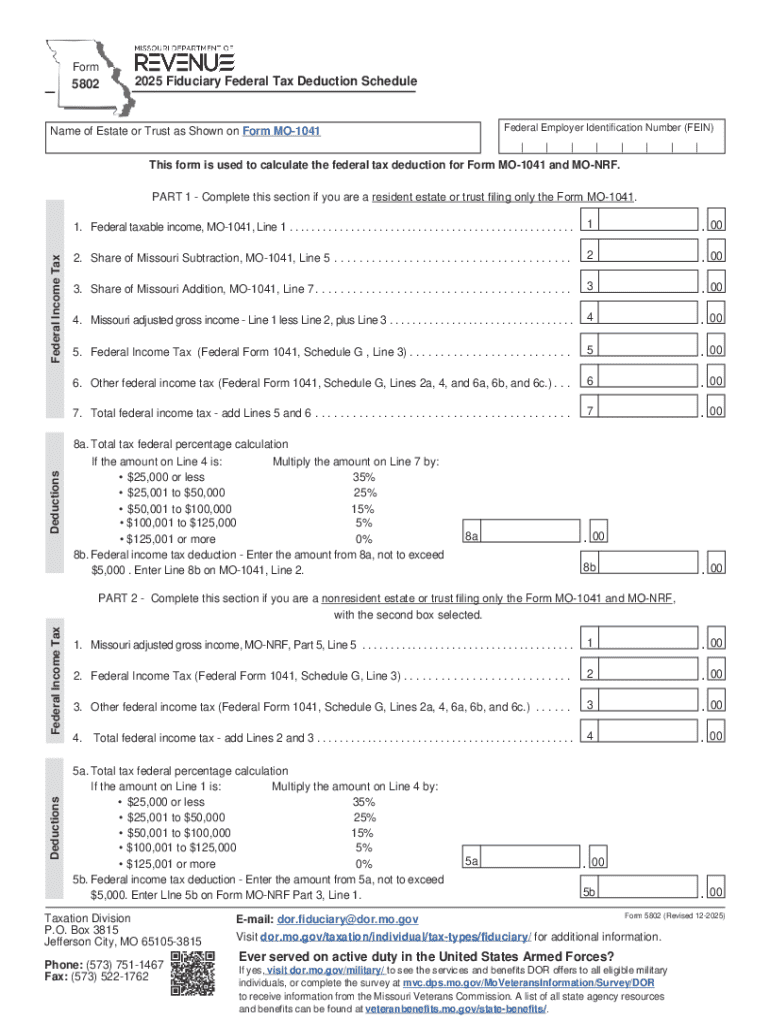

How to fill out 5802 - 2025 fiduciary

Who needs 5802 - 2025 fiduciary?

5802 - 2025 fiduciary form: A comprehensive guide

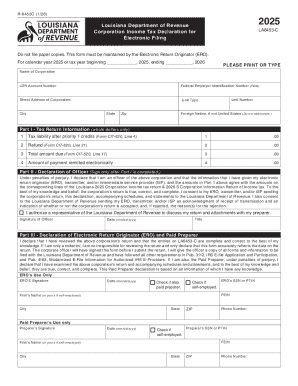

Understanding the 5802 - 2025 fiduciary form

The 5802 - 2025 fiduciary form is essential in the realm of financial management, specifically for fiduciaries who manage the assets and obligations of entities such as estates and trusts. This form provides a structured format to report financial transactions, ensuring adherence to tax obligations and other regulatory demands.

The importance of the 5802 - 2025 fiduciary form cannot be overstated. It ensures transparency and accountability in financial dealings, which is crucial for maintaining trust with beneficiaries and stakeholders. Moreover, proper completion of this form avoids legal complications that may arise from erroneous financial reporting.

Key features of the 5802 - 2025 fiduciary form include detailed sections for income reporting, expense deductions, and the requirements for accurate tax information. Understanding these features is vital for anyone tasked with fiduciary duties.

When to use the 5802 - 2025 fiduciary form

The 5802 - 2025 fiduciary form is used in various scenarios that revolve around estate management, trust administration, and tax filing responsibilities. Each situation requires precise completion of the form to ensure compliance with legal standards and protect the interests of all parties involved.

Typical scenarios for usage include: reporting income generated from trust assets, detailing expenses associated with managing an estate, or fulfilling tax obligations for fiduciary entities. Notably, individuals, financial advisors, and legal professionals are usually responsible for filing the 5802 - 2025 fiduciary form.

Step-by-step guide to filling out the 5802 - 2025 fiduciary form

Filling out the 5802 - 2025 fiduciary form requires careful attention to detail. First, gather all the necessary information, including personal details, financial statements, and tax identification numbers. This preparation phase is crucial to ensure a smooth completion of the form.

Next, you will encounter several key sections of the form. Each section has specific instructions that must be followed accurately:

Common mistakes when filling out the form include incorrect data entry and missing documentation. To avoid these pitfalls, double-check your entries, and ensure all supporting documents are included.

Editing the 5802 - 2025 fiduciary form

Editing the 5802 - 2025 fiduciary form can easily be achieved using pdfFiller. The platform provides intuitive features to simplify this process, ensuring that any necessary adjustments can be made efficiently.

To edit your form, start by uploading the document onto the pdfFiller platform. Once uploaded, you can utilize the various editing tools available, such as highlighting text, filling in blanks, and changing formatting as needed. After you’ve made your desired changes, save them securely within your pdfFiller account.

The benefits of cloud-based editing are significant. You can access your documents from any location, collaborate with team members, and maintain an organized document repository without needing to worry about local software limitations.

Signing the 5802 - 2025 fiduciary form

Every fiduciary form requires a signature, which validates the information provided before submission. Understanding the signature requirements is paramount, as different jurisdictions may have varying rules regarding e-signatures and handwritten signatures.

Using pdfFiller to eSign your form is straightforward. Begin by navigating to the eSigning feature on the platform, and follow the step-by-step instructions to create your signature. After signing, you can optionally add a date and other necessary information. Security measures are ingrained within the eSigning process, safeguarding your identity and the integrity of your signed documents.

Collaborating with teams on the 5802 - 2025 fiduciary form

Collaboration enhances the accuracy of filling out fiduciary forms, especially in team settings. With pdfFiller, inviting team members to edit the 5802 - 2025 fiduciary form is seamless.

You can assign roles and permissions to ensure that all team members contribute appropriately while maintaining document security. Implementing best practices for document collaboration includes regular updates and communication regarding changes made to the form, which helps mitigate confusion and ensures everyone is on the same page.

Managing your 5802 - 2025 fiduciary form

Once filled and signed, managing the 5802 - 2025 fiduciary form effectively is just as important as the completion process. pdfFiller offers robust storage solutions that allow you to categorize and locate your forms with ease.

Version control features provide a detailed history of changes made to the document, allowing for easy tracking and recovery of previous versions if needed. The convenience of accessing your form from anywhere ensures that you remain organized, even while on the go.

Frequently asked questions about the 5802 - 2025 fiduciary form

Errors can occur during the form-filling process. If you make an error on the 5802 - 2025 fiduciary form, it is essential to correct it accurately, either by striking through the error and writing the correct information, or by using the editor in pdfFiller to make changes directly.

Once completed, the form must be submitted according to the guidelines set by the governing authority, which typically involves either uploading it electronically or mailing in hard copies. Deadlines for filing the 5802 - 2025 fiduciary form vary depending on specific requirements and should be checked against local tax laws to ensure compliance.

Additional tools and resources

Leveraging interactive tools can facilitate better financial management. Financial calculators can help assess the worth of an estate or trust, while templates can provide ready-made forms for similar fiduciary tasks.

Understanding other important forms related to fiduciary duties is also beneficial. Familiarizing yourself with these forms ensures that you are well-prepared to manage various aspects of fiduciary responsibilities effectively.

Navigating the pdfFiller platform

pdfFiller is equipped with features that streamline the document management process. The platform allows users to find forms and templates efficiently, making it an indispensable tool for managing the 5802 - 2025 fiduciary form and others.

Additionally, the customer support options are extensive, offering help through live chat, email, and a comprehensive help center. This support enables users to resolve any questions or issues swiftly, enhancing their experience on the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in mo mo-1041 2022-2026 without leaving Chrome?

How can I fill out mo mo-1041 2022-2026 on an iOS device?

How do I fill out mo mo-1041 2022-2026 on an Android device?

What is 5802 - 2025 fiduciary?

Who is required to file 5802 - 2025 fiduciary?

How to fill out 5802 - 2025 fiduciary?

What is the purpose of 5802 - 2025 fiduciary?

What information must be reported on 5802 - 2025 fiduciary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.