Get the free Form MO-2210 - 2025 Underpayment of Estimated Tax By ... - dor mo

Get, Create, Make and Sign form mo-2210 - 2025

How to edit form mo-2210 - 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form mo-2210 - 2025

How to fill out form mo-2210 - 2025

Who needs form mo-2210 - 2025?

Form MO-2210 - 2025 Form: A Comprehensive Guide

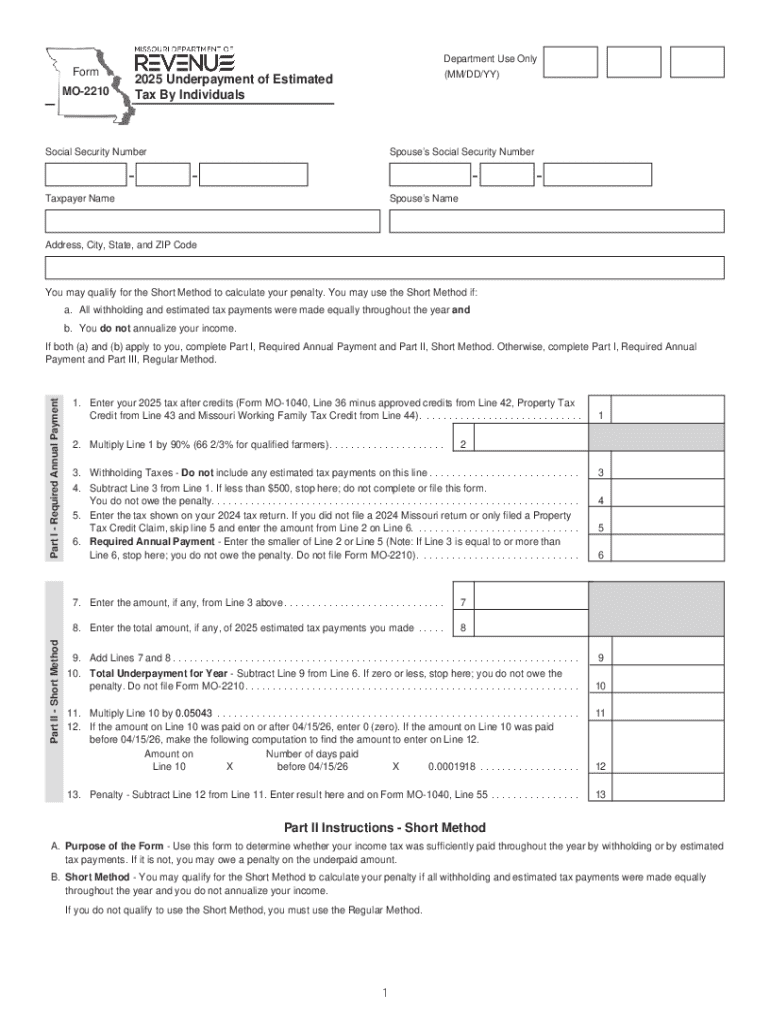

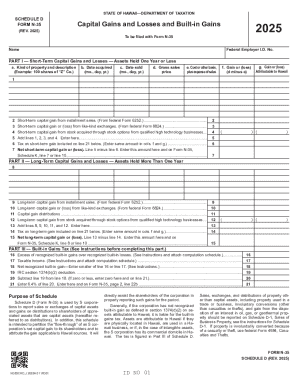

Understanding the MO-2210 form

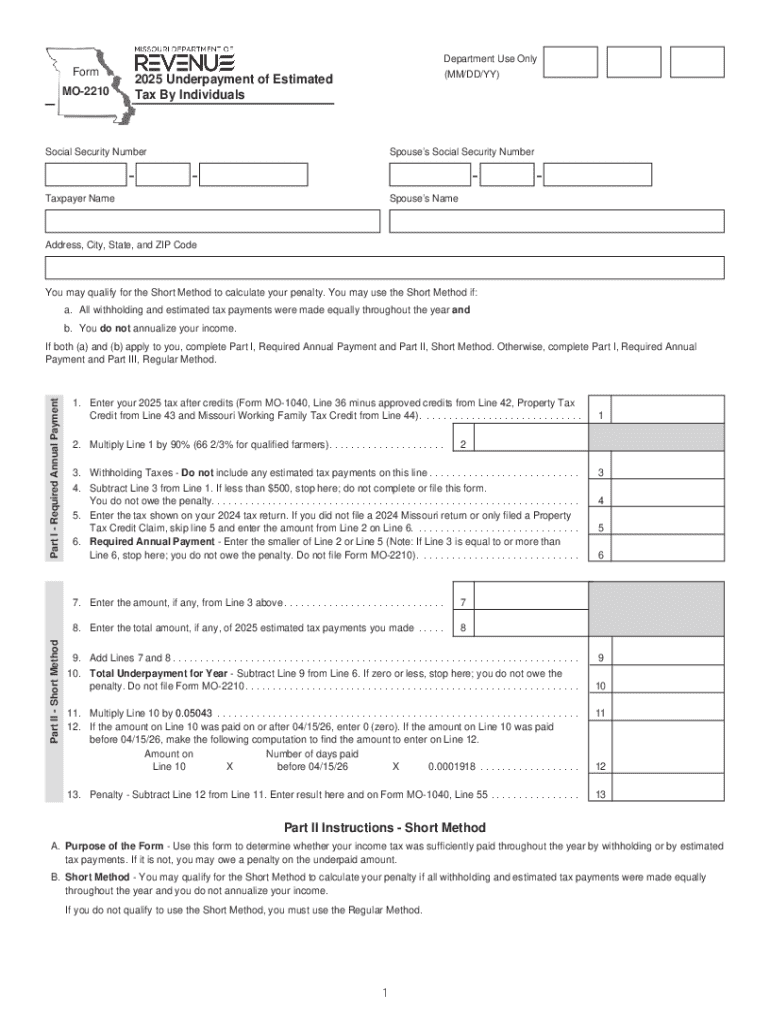

The MO-2210 form is a critical document used by taxpayers in Missouri to calculate underpayment penalties for the state income tax. It helps individuals and businesses determine if they owe a penalty due to insufficient estimated tax payments or withholding during the tax year. The overarching purpose of the MO-2210 form is to ensure taxpayers comply with state tax regulations while offering a structured method for calculating any associated penalties.

Who needs to file the MO-2210 form? Primarily, individuals, businesses, and certain organizations that owe tax and have underpaid estimated taxes or withholding are required to submit this form. Specifically, if you owe $500 or more in taxes after credits and withholding, filing the MO-2210 is essential to avoid or minimize penalties.

Key deadlines for filing the MO-2210 are typically the same as the state tax deadlines. For the 2025 tax year, taxpayers must file their returns by April 15, 2026. If you need additional time, filing an extension can push this date further, but you'll still need the MO-2210 by the original due date.

Detailed overview of the MO-2210 form components

The MO-2210 form is divided into several sections, each playing a vital role in the tax calculation process. Understanding each component is essential for accurate filing, and it begins with the personal information section.

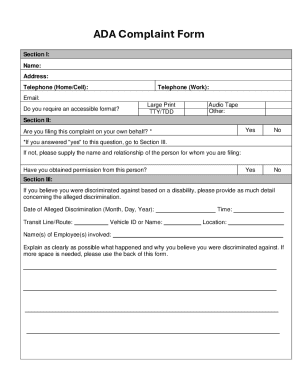

Personal information

This section requires detailed information about the taxpayer, including name, address, and Social Security number. To ensure smooth processing, it's critical to double-check your input for accuracy. Common pitfalls to avoid include transposing numbers and incorrect spellings.

Income details

Next is the income section, where you report all sources of income including wages, dividends, interest, and business income. Each type of income has unique reporting requirements, and failure to report all income accurately can lead to penalties and interest.

Deductions and tax credits

Deductions such as state income taxes, mortgage interest, and certain charitable contributions can be claimed here. Understanding what qualifies can significantly reduce your tax liability. Exploring state-specific credits provides additional opportunities for savings.

Penalty calculation

Lastly, the penalty calculation section determines any penalties due to underpayment. This is calculated based on the total tax due and payments made throughout the year. Knowing how to compute these penalties with precision can help you avoid unexpected expenses come tax time.

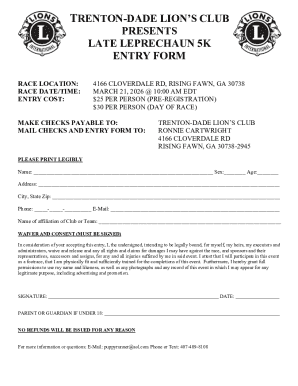

Step-by-step instructions for filling out the MO-2210 form

Step 1: Gathering necessary information

To fill out the MO-2210 form accurately, gather important documents such as W-2s, 1099s, previous tax returns, and records of estimated tax payments. This foundational data ensures that your income details and potential deductions are captured appropriately.

Step 2: Completing the personal information section

Start by accurately filling out the personal information section. Verify all information before submission, ensuring names are consistent with your Social Security card. Errors in this area can lead to processing delays.

Step 3: Inputting income information

Report all types of income in the designated sections. Use the corresponding documents to ensure complete and correct reporting. Failure to do so could not only lead to penalties but also trigger audits from tax authorities.

Step 4: Deductions and tax credits

Apply common deductions available in Missouri, such as educational credits and property tax exemptions. Thoroughly research available deductions to maximize your tax benefit.

Step 5: Calculating your tax liability

Follow the worksheets included with the MO-2210 form to calculate your tax accurately. This may involve several calculations to assess your total liability after deductions and credits. Pay attention to all steps; minor miscalculations can result in substantial penalties.

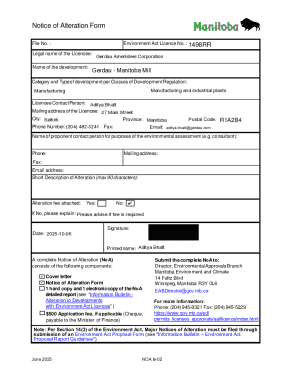

Step 6: Filing the form

Once completed, you can submit your form either electronically or via traditional mail. E-filing is often faster and more efficient, allowing for quicker processing of your refund, if applicable.

Interactive tools for MO-2210 form completion

pdfFiller offers a variety of interactive tools designed to make the completion of the MO-2210 form seamless and efficient. Users can easily upload the form, fill out necessary fields, and ensure compliance with state requirements.

Overview of tools available on pdfFiller for document management

The platform provides various functionalities, including document templates, electronic signing capabilities, and secure storage for all tax-related documents. These features cater to individuals and businesses aiming for efficiency in tax preparation.

How to use the form signing features for easy submission

pdfFiller's form signing feature allows users to eSign documents with ease. This is not only legally binding but also speeds up the submission process significantly. Users can collaborate in real-time, making it easier to handle complex tax filings.

Collaboration tools for teams and users

For teams, pdfFiller includes collaboration tools that enable multiple users to work on a document simultaneously. This is particularly beneficial for businesses managing multiple tax filings or for individuals seeking advice from tax professionals.

Common FAQs about the MO-2210 form

Understanding the nuances of the MO-2210 can help avoid common pitfalls. Below are some frequently asked questions.

Tips for managing your taxes with the MO-2210 form

Maintaining accurate records throughout the year is essential for managing taxes effectively. Tracking all payments and deductions can significantly impact your liability.

Utilize pdfFiller to organize documents in one secure location. The platform allows you to easily retrieve necessary documents when filing taxes, which is crucial for completeness and accuracy.

Keeping abreast of changes in tax laws will also benefit your filing process. Subscribe to updates from the Missouri Department of Revenue to stay informed on any changes that may affect your tax calculations.

Resources and support for filing the MO-2210 form

For additional assistance, taxpayers can contact their local state tax office. They offer direct support for queries related to the MO-2210 form and filing procedures.

Online workshops and webinars are frequently hosted to educate taxpayers about the filing process and common errors to avoid, providing a great opportunity for learning.

Joining forums can also facilitate community support. Engaging with other taxpayers experiencing the same challenges can provide valuable insights and solutions.

Conclusion: Maximizing your filing process with pdfFiller

Navigating the complexities of the MO-2210 form becomes manageable with the right tools and guidance. pdfFiller simplifies the entire process, from document creation to managing submissions securely.

Leveraging the functionalities provided by pdfFiller can lead to a more efficient tax filing experience, ensuring accuracy and compliance without hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form mo-2210 - 2025 in Gmail?

How do I edit form mo-2210 - 2025 straight from my smartphone?

How do I complete form mo-2210 - 2025 on an Android device?

What is form mo-2210 - 2025?

Who is required to file form mo-2210 - 2025?

How to fill out form mo-2210 - 2025?

What is the purpose of form mo-2210 - 2025?

What information must be reported on form mo-2210 - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.