Get the free Net Operating Loss Addition Modification Sheet - dor mo

Get, Create, Make and Sign net operating loss addition

Editing net operating loss addition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out net operating loss addition

How to fill out mo-5090 new operating loss

Who needs mo-5090 new operating loss?

Understanding the MO-5090 New Operating Loss Form

Understanding the MO-5090 New Operating Loss Form

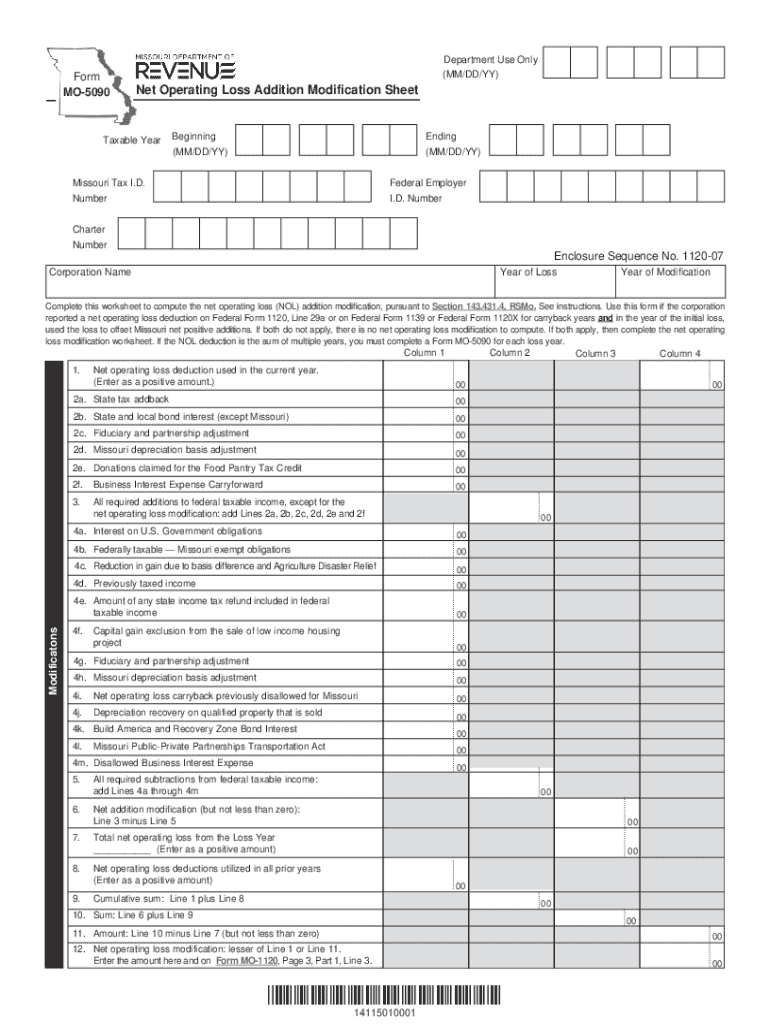

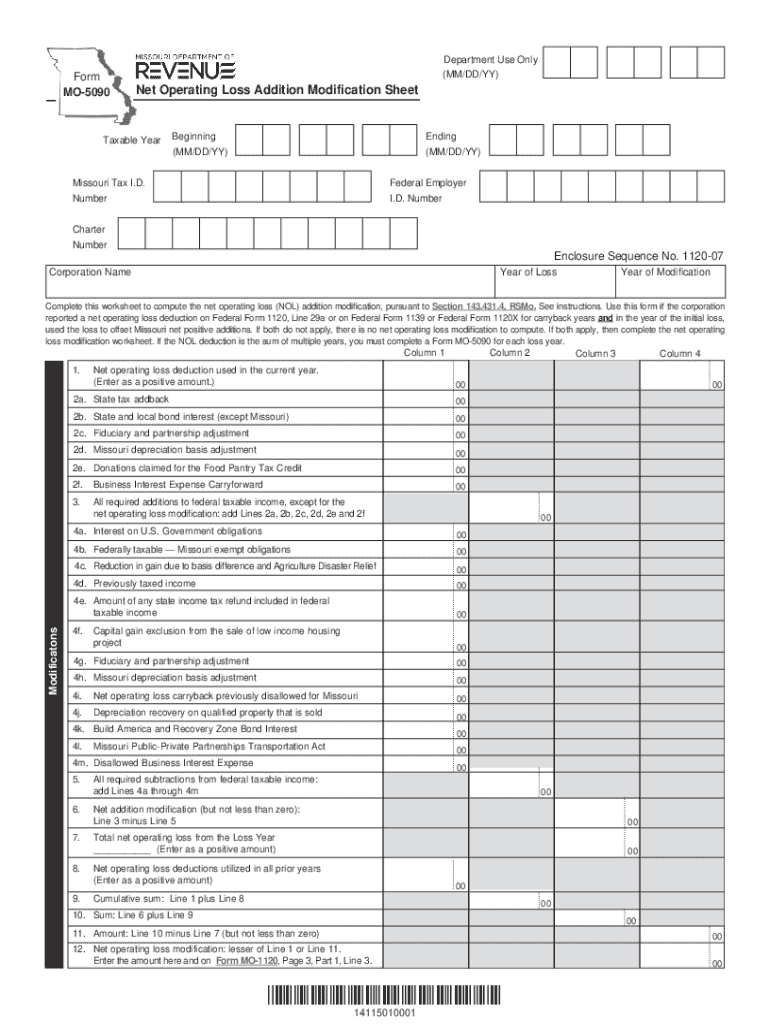

The MO-5090 New Operating Loss Form is a crucial document for individuals and businesses operating in Missouri who have incurred operating losses. This form allows taxpayers to claim deductions for losses sustained during a tax year, helping to reduce their overall taxable income. By accurately completing this form, taxpayers can ensure they benefit from tax relief opportunities available under Missouri tax laws.

The importance of submitting the MO-5090 cannot be understated. Not only does it facilitate tax deductions, but it also provides a pathway for businesses to recover from financial setbacks. Submitting this form can greatly alleviate the tax burden during challenging financial periods, making it essential for those eligible to utilize it effectively.

Eligibility for the MO-5090 typically includes individuals and businesses who have experienced a net operating loss during the tax year. This may encompass various scenarios, such as reduced sales, increased expenses, or other qualifying financial setbacks. Understanding the eligibility criteria is vital to ensure compliance and to maximize the potential benefits of this form.

Key features of the MO-5090 form

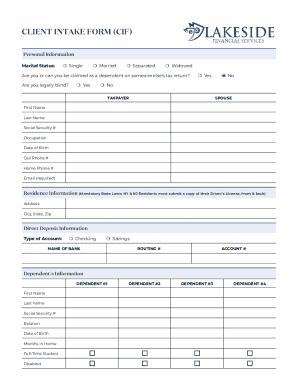

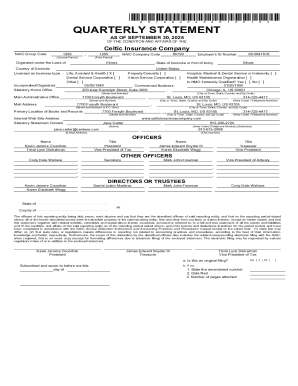

The MO-5090 New Operating Loss Form comprises several key components that need to be addressed to ensure accurate submission. These components include personal information, financial statements, and calculations related to operating losses. Each section is designed to capture necessary data that supports your claim for tax deductions.

The personal information section gathers details about the taxpayer, including name, address, Social Security number, and other identifying facts. The financial statements section is critical, as it gives insight into the business's financial performance, highlighting areas that led to the operating loss. Calculating the operating loss accurately is essential, as this number directly influences the potential tax benefits.

Moreover, the MO-5090 form features interactive elements like fillable fields for easy input and automated calculations. This ensures that users can complete the form efficiently and with fewer chances of errors, streamlining the overall process of claiming an operating loss.

Step-by-step guide to filling out the MO-5090 form

To ensure a thorough understanding of the MO-5090 form, let’s delve into a step-by-step guide on how to complete it accurately. Preparation is key, and it begins with gathering the necessary documentation. Required tax documents include IRS tax returns, profit and loss statements, and any documentation that supports your claimed losses.

Completing the MO-5090 form itself can be broken down into several sections. First, fill in your personal information, ensuring that all details are accurate. Next, move to the financial data section, where you'll input the relevant figures that illustrate your operating losses. Finally, calculate your operating loss; this may require cross-referencing with financial documents and ensuring that the calculations align correctly.

Reviewing your submission is crucial. Common errors to watch out for include typos in personal information, miscalculations of financial data, and failure to attach necessary supporting documents. To ensure accurate reporting, double-check figures and consider having a second set of eyes review the form before submitting.

Editing and collaborating on your MO-5090 form

Using pdfFiller's editing tools can simplify the process of managing your MO-5090 new operating loss form. With robust text editing features, you can easily make adjustments to your document without hassles. Additionally, pdfFiller allows users to add comments and annotations, which can be beneficial for collaborative efforts.

Collaboration features within pdfFiller provide an efficient way to manage the completion of forms by teams. Real-time collaboration enables multiple users to work on the document simultaneously, making it easy to integrate feedback from various stakeholders. Furthermore, with flexible permission settings, users can manage who accesses or edits the form, ensuring that critical information remains secure.

Signing and submitting the MO-5090 form

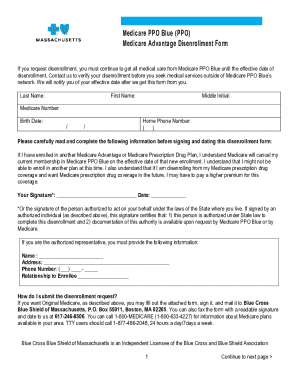

Once the MO-5090 form is filled out properly, the next step is to sign and submit it. pdfFiller offers multiple eSignature options, enhancing the process of signing documents quickly and securely. Users can utilize electronic signatures that comply with state regulations, ensuring that your submission meets all legal requirements.

The submission process to state authorities should be carried out carefully, paying attention to guidelines provided by the Missouri Department of Revenue. Ensure that all supporting documents are attached, and confirm that all fields on the MO-5090 form are thoroughly completed. After submission, tracking your submission status can be accomplished via the online platform, giving peace of mind while awaiting a response from the tax authorities.

Managing your MO-5090 form and related documents

Proper management of your MO-5090 form and any other related documents is crucial for efficient record-keeping. pdfFiller provides a state-of-the-art platform for organizing forms, allowing users to categorize and manage their documents systematically. This ensures that important paperwork is easily retrievable when required.

Additionally, storing documents digitally within pdfFiller comes with advantages like version control and history tracking. This feature allows users to access previous versions of the MO-5090 form and see changes over time, which can be invaluable for audits or re-submitting if needed. This robust document management capability is key for anyone involved in frequent tax submissions.

FAQs about the MO-5090 new operating loss form

As with any tax-related form, questions often arise about the MO-5090 form, particularly regarding errors and amendments. If a mistake occurs on your submitted form, it is essential to remain calm and understand the steps necessary to rectify the issue. You may need to file an amendment to correct the entry, ensuring that you report accurate information to the state revenue service.

Another common concern is the timeline for processing the MO-5090 form. The timeframe can vary based on several factors, including submission method and current workload at the tax authority. Generally, being proactive in following up on the status of your claim can provide clarity and peace of mind.

Additional support and resources

For individuals navigating the complexities of the MO-5090 form, accessing additional support and resources is beneficial. pdfFiller offers customer support options aimed at assisting users with document management and any specific questions about the form. Engaging with tutorials and webinars can expand your understanding of the platform and help in seamlessly handling forms.

Participating in community forums can also provide insights and shared experiences from other users facing similar challenges. These resources can empower users and enhance their confidence in managing tax documents efficiently within the pdfFiller environment.

Navigating the process of operating loss claims

Navigating the various regulations surrounding operating loss claims can be daunting, particularly in Missouri. Recent changes to the operating loss guidelines may have updated the process for filing and what qualifies as a loss. Understanding these regulations is crucial for compliance and ensuring that your claim is valid.

Consider seeking professional tax help to navigate more complex scenarios or when dealing with significant amounts. Experienced tax professionals can offer tailored guidance and ensure that all aspects of your claim meet the requirements set forth by the Missouri Department of Revenue.

Appendix

To provide further clarity and assistance with the MO-5090 form, the appendix includes a sample completed MO-5090 form to act as a visual guide for users. Additionally, a glossary of terms related to operating loss forms will help demystify specific phrases and jargon that may arise during the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send net operating loss addition for eSignature?

How do I edit net operating loss addition on an iOS device?

How do I complete net operating loss addition on an iOS device?

What is mo-5090 new operating loss?

Who is required to file mo-5090 new operating loss?

How to fill out mo-5090 new operating loss?

What is the purpose of mo-5090 new operating loss?

What information must be reported on mo-5090 new operating loss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.