Get the free Fuel Refund Claim (Form 4923)

Get, Create, Make and Sign fuel refund claim form

How to edit fuel refund claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fuel refund claim form

How to fill out form 4923 - non-highway

Who needs form 4923 - non-highway?

Understanding Form 4923 - Non-Highway Form: A Comprehensive Guide

Understanding Form 4923: Non-Highway Form

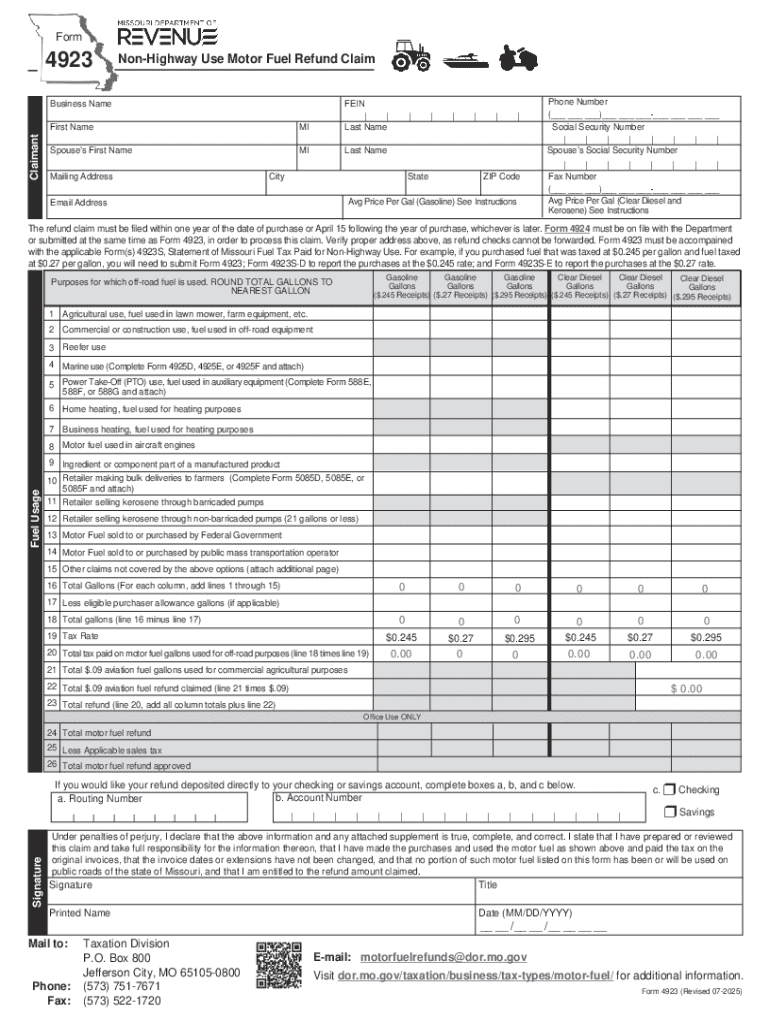

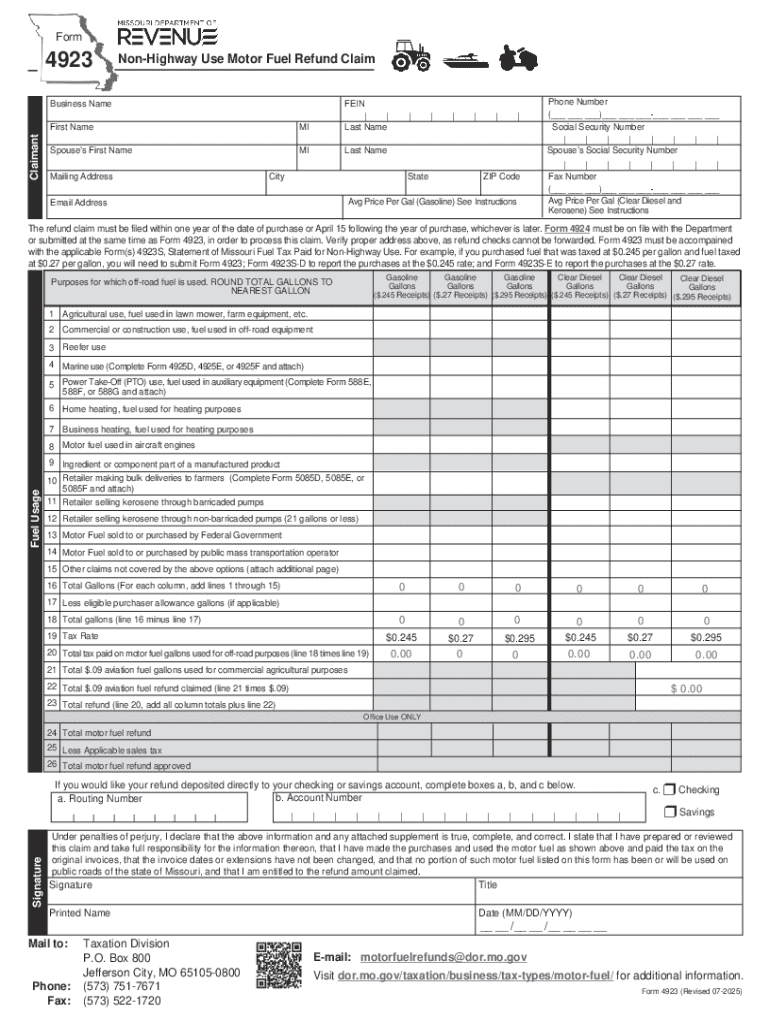

Form 4923, known as the Non-Highway Form, is specifically designed for the reporting of vehicles that are primarily used off-road or in non-highway circumstances. It is vital for entities who need to declare their vehicle usage accurately, as the information provided can directly influence tax duties, operational compliance, and eligibility for specific tax credits or deductions.

The importance of this form lies in its role within regulatory frameworks governing vehicle usage. It allows for a clear delineation of vehicles and their uses, helping to ensure compliance with federal and state requirements. Understanding key terms such as 'non-highway vehicle' and 'vehicle identification number' is integral to navigating Form 4923 efficiently.

Who needs to use Form 4923?

Form 4923 is essential for individuals and teams that operate non-highway vehicles, particularly in sectors where vehicle use is primarily off-road. This includes agricultural operations, construction sites, and landscaping businesses where utility vehicles perform critical functions, not intended for public roadways.

Scenarios warranting the use of Form 4923 could include a farmer reporting the usage of an ATV for fieldwork or a construction company needing to account for their machinery usage. Common industries utilizing Form 4923 include:

Preparing to fill out Form 4923

Before beginning to fill out Form 4923, it’s vital to gather all necessary documents and information. This includes ownership documents for the vehicle, previous mileage logs, and any relevant data pertaining to non-highway operations. Being well-prepared can streamline the process significantly.

To gather the required data efficiently, consider using a checklist to track each piece of information. Familiarizing yourself with the layout of Form 4923 will also help tremendously. The form's structure typically includes several sections focusing on vehicle details, usage, and necessary certification.

Step-by-step instructions for completing Form 4923

Filling out Form 4923 involves several key sections, each requiring specific information. Below is a breakdown of the sections and what to include:

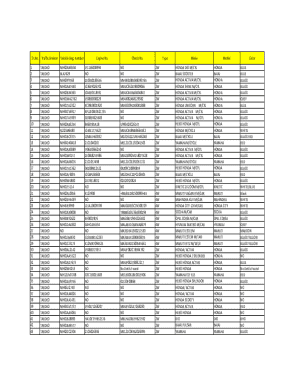

Section 1: Vehicle Information

Start by entering the vehicle's identification details. This includes the make, model, and VIN. You also need to provide a description of how the vehicle is utilized outside of public roadways.

Section 2: Usage and Mileage

Calculating non-highway mileage accurately is critical and typically requires maintaining a detailed log during the usage period. This log should ideally capture dates, mileage, and purposes of the trips. Ensure that supporting documents are organized to validate these figures.

Section 3: Certification and Submission

Finally, ensure that the form is certified by the appropriate person or authority within your organization. This section requires signatures that validate the provided information. Submission methods include mailing the form or utilizing online services, which can streamline the process.

Common mistakes to avoid when filling out Form 4923

Filling out Form 4923 might seem straightforward, but there are several pitfalls to steer clear of. One common mistake is misreporting vehicle usage, which can lead to financial penalties or compliance issues.

Additionally, failing to provide required documentation, such as mileage logs or operation records, can result in a rejected form. It's equally important to ensure accurate calculations of non-highway mileage to avoid discrepancies that could complicate tax matters.

Editing and managing your Form 4923

Once your Form 4923 is completed, you may need to make adjustments or edits. pdfFiller offers several tools that simplify this process. For instance, if you notice an error after submission, revisiting the form for adjustments is possible.

Using pdfFiller’s editing tools allows for comprehensive modifications to your form. An essential aspect to consider is the importance of saving and storing the document securely, ensuring easy access for future reference.

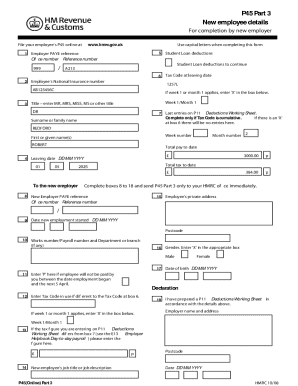

eSigning and collaborating on Form 4923

In today's digital environment, the importance of eSigning forms cannot be overstated. Form 4923 is no exception; accurate signatures on official documents validate assertions and ensure compliance. Using pdfFiller, eSigning is streamlined, allowing you to sign electronically with ease.

Moreover, collaborating with team members during the document management process enhances efficiency. pdfFiller enables teams to work together, share updates, and keep records centralized, reducing the potential for miscommunication.

FAQs about Form 4923

As with any official form, questions often arise regarding its proper use. For instance, 'What happens if I make a mistake on the form?' It's crucial to acknowledge errors early; you can usually correct mistakes before the final submission. However, addressing errors promptly is critical to maintaining compliance.

Another common question pertains to tracking the status of submitted Form 4923. Utilizing tracking features available on pdfFiller can offer insights into your submission’s processing stage. Understandably, users may also want to know if there are fees associated with filing Form 4923, which can vary based on submission methods and regional regulations.

Additional support and resources for Form 4923

For further assistance with Form 4923, access to official guidelines and resources is essential. Most state and federal regulatory websites provide detailed instructions and frequently asked questions sections. pdfFiller also offers customer support tailored to help users navigate the form and related processes.

Engaging in community forums and user groups can also be incredibly beneficial. Such platforms allow users to share experiences, tips, and advice, thus enriching the collective knowledge around Form 4923.

Advantages of using pdfFiller for Form 4923

pdfFiller stands out as an all-in-one platform for document management, particularly for forms like 4923. Its cloud-based access allows users to work from anywhere, making it increasingly essential for remote teams and individuals who need flexibility in their operations.

The collaboration features further enhance usability by allowing multiple team members to access, edit, and review the form simultaneously. In today’s fast-paced digital environment, such efficiency is not just beneficial but vital.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my fuel refund claim form in Gmail?

How can I edit fuel refund claim form on a smartphone?

How can I fill out fuel refund claim form on an iOS device?

What is form 4923 - non-highway?

Who is required to file form 4923 - non-highway?

How to fill out form 4923 - non-highway?

What is the purpose of form 4923 - non-highway?

What information must be reported on form 4923 - non-highway?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.