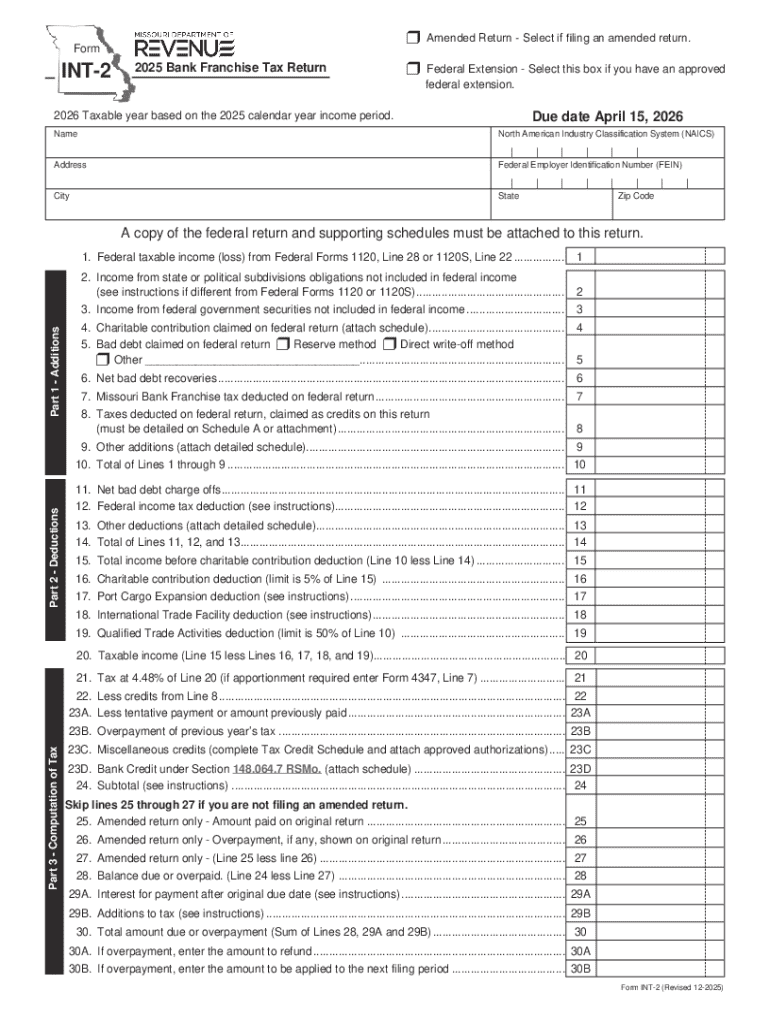

Get the free Form INT-2 - 2025 Bank Franchise Tax Return - dor mo

Get, Create, Make and Sign form int-2 - 2025

Editing form int-2 - 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form int-2 - 2025

How to fill out form int-2 - 2025

Who needs form int-2 - 2025?

Form int-2 - 2025 Form: A Comprehensive Guide for Individuals and Teams

Overview of Form int-2 - 2025

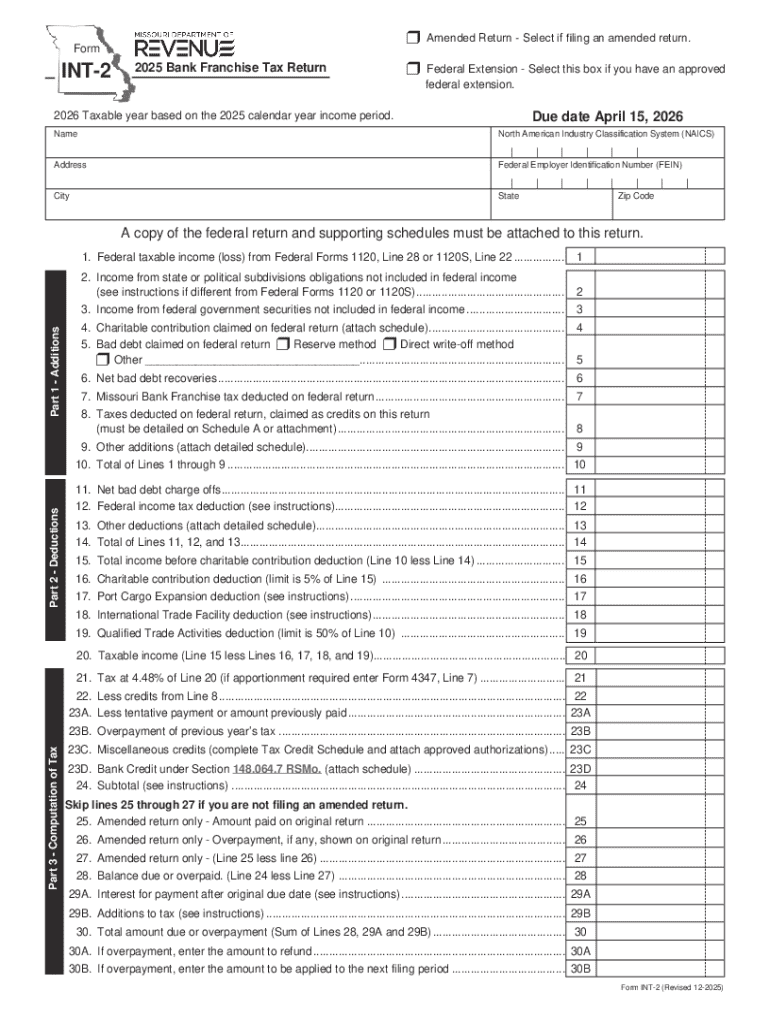

Form int-2 - 2025 is a pivotal document designed to streamline and standardize income reporting for various individuals and organizations. Its primary purpose is to gather crucial information related to income sources, deductions, and applicable credits that may influence tax liabilities or financial assessments. In 2025, this form gains significant relevance as changes in tax legislation and financial regulations require clarity and accuracy in reporting incomes, making it essential for efficient financial management.

The importance of Form int-2 cannot be overstated. As tax laws evolve and financial landscapes shift, individuals and teams must remain compliant with regulations to avoid penalties and ensure accurate financial forecasting. Consequently, Form int-2 serves not only as a tool for compliance but also as a means to optimize financial decisions.

Understanding the structure of Form int-2

To navigate Form int-2 effectively, it's essential to comprehend its structure. The form is organized into several key sections, each designed to capture specific information pertinent to financial disclosures.

Familiarity with terms used in the form can further ease the filing process. Key terminologies may include 'adjusted gross income', 'tax brackets', and 'exemptions'. Understanding these definitions aids in accurately responding to each section's inquiries.

Step-by-step guide on filling out Form int-2

Completing Form int-2 requires careful preparation and organization. Here’s a step-by-step guide to help simplify the process.

Particular attention should be given to each section’s requirements to avoid common pitfalls, especially in income and deductions where details can significantly influence calculations. Utilize pdfFiller for a streamlined eSigning process, providing a modern alternative to traditional paper signatures.

Editing and customizing your Form int-2

After initially filling out Form int-2, you may need to make edits or add additional information. pdfFiller provides a suite of editing tools tailored for this purpose.

Once editing is complete, saving your changes securely is crucial. pdfFiller not only supports different formats for saving but also ensures your information remains protected throughout.

Submitting Form int-2

Submitting Form int-2 is a crucial step, as it sets the foundational step for any financial evaluations or tax submissions. There are a few methods available for this.

pdfFiller significantly simplifies the submission process through its integration features, allowing you to manage submissions in one interface. Additionally, you can track the status of your submission in real-time, enhancing transparency and peace of mind.

Managing your Form int-2

Post-submission, it’s vital to organize and manage Form int-2 effectively for future reference. pdfFiller offers numerous features aimed at facilitating better management.

Troubleshooting common issues with Form int-2

Even with careful completion, challenges can arise during the submission process. Addressing these common issues proactively can save time and effort.

Frequently asked questions (FAQs)

Additional features of pdfFiller for form management

The benefits of utilizing a cloud-based document solution like pdfFiller extend beyond mere form filling. It offers a wide range of integrated tools.

User testimonials

Success stories from individuals and teams illustrate the effectiveness of Form int-2 with pdfFiller.

Interactive tools for enhanced user experience

In addition to standard editing and submission capabilities, pdfFiller enhances user interaction through innovative tools.

Conclusion and next steps

As we approach 2025, understanding and effectively managing Form int-2 becomes increasingly important for individuals and organizations alike. Accurate reporting and tool utilization, such as pdfFiller, can significantly simplify what often feels like an overwhelming task. By embracing these modern solutions, users can navigate financial obligations with greater efficiency and confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form int-2 - 2025?

Can I edit form int-2 - 2025 on an iOS device?

Can I edit form int-2 - 2025 on an Android device?

What is form int-2 - 2025?

Who is required to file form int-2 - 2025?

How to fill out form int-2 - 2025?

What is the purpose of form int-2 - 2025?

What information must be reported on form int-2 - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.