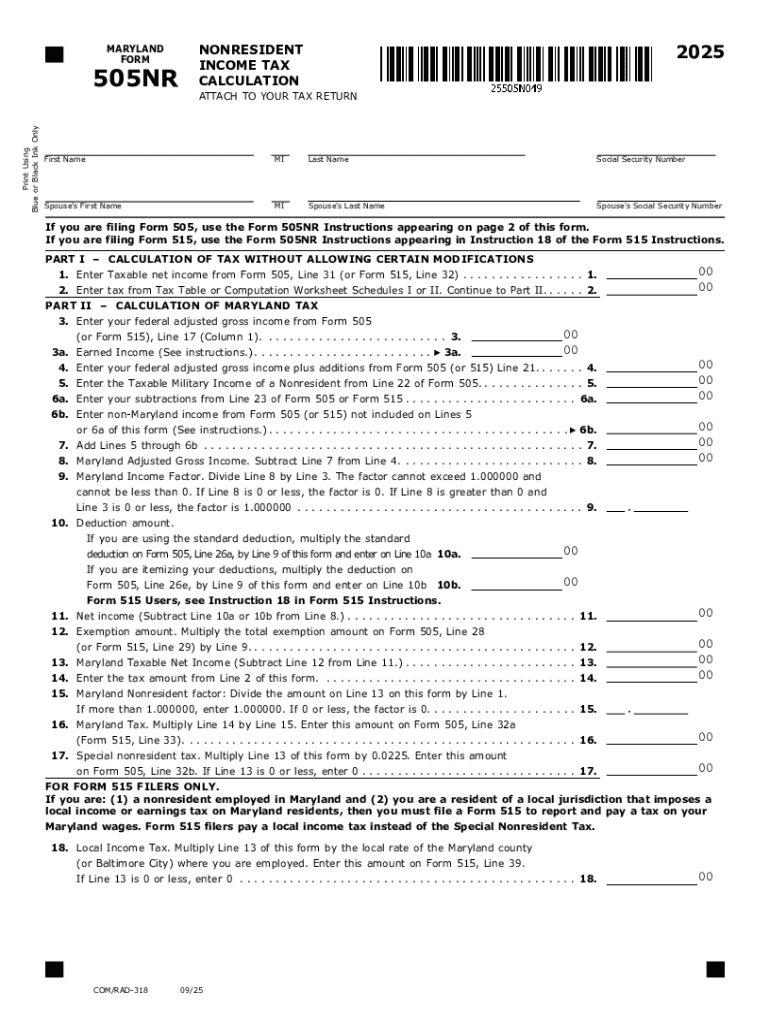

MD 505NR 2025-2026 free printable template

Get, Create, Make and Sign MD 505NR

Editing MD 505NR online

Uncompromising security for your PDF editing and eSignature needs

MD 505NR Form Versions

How to fill out MD 505NR

How to fill out 2025 maryland form 505nr

Who needs 2025 maryland form 505nr?

Comprehensive Guide to the 2025 Maryland Form 505NR

Understanding the 2025 Maryland Form 505NR

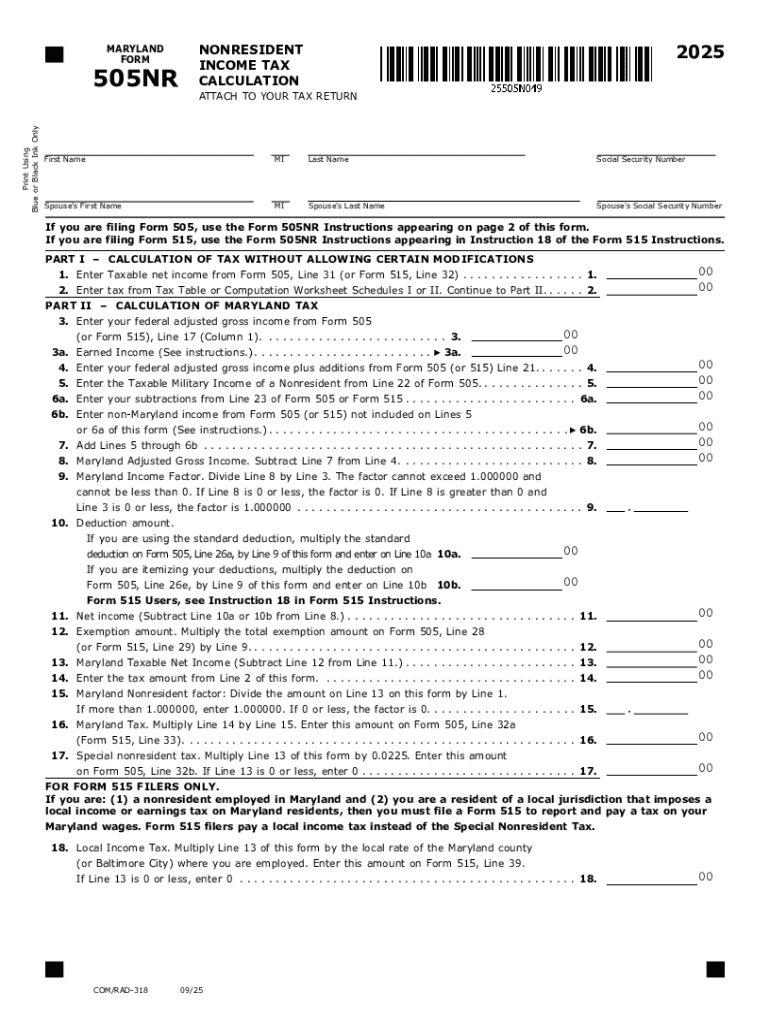

The 2025 Maryland Form 505NR is a state tax form specifically designed for non-residents of Maryland who earn income within the state. This form allows non-resident taxpayers to report their Maryland-source income and pay any applicable state taxes. It is an essential tool for ensuring compliance with Maryland tax laws and avoiding penalties for underreporting income.

For non-residents, filing Form 505NR is crucial not only for legal compliance but also for ensuring accurate representation of their tax obligations. This includes any wages, salaries, or other income earned within Maryland while being a legal resident of another state.

Who needs to file Form 505NR?

Generally, individuals who meet the following criteria must file the 2025 Maryland Form 505NR:

Key features of the 2025 Maryland Form 505NR

An understanding of the key features and sections of the Form 505NR is crucial for a successful filing. The form is structured in several distinct sections, each addressing different aspects of your tax situation.

Breakdown of the form sections

The main sections of the 2025 Maryland Form 505NR include:

Common filing errors to avoid

Taxpayers often make mistakes that can result in delays or penalties. Here are common errors to avoid:

Step-by-step instructions for completing the form

Completing the 2025 Maryland Form 505NR requires careful attention to detail. Here's a breakdown of the steps.

Gather necessary documentation

Before you start filling out the form, make sure you have all necessary documents ready. This may include:

Step 1: Filling out personal information

Start by carefully filling out your personal information in the designated sections. Ensure accuracy with your name, address, and Social Security number to avoid processing issues.

Step 2: Reporting income

Report all Maryland-source income accurately. Make sure to include wages, interest, dividends, and any other applicable sources. Be thorough, as the state requires a complete account of your earnings.

Step 3: Claiming deductions and credits

Carefully examine the deductions and credits section. Ensure you claim all applicable deductions, as these can significantly lower your taxable income.

Step 4: Completing the signature section

Finally, remember to sign and date the form. If you are filing jointly, ensure both parties sign to validate the submission.

Options for editing and signing your form

To ease the process of completing your 2025 Maryland Form 505NR, pdfFiller offers various features for editing and signing.

Using pdfFiller for seamless editing

To upload and edit the Form 505NR, simply follow these steps:

eSigning your form

The eSignature process in pdfFiller is straightforward and adds a layer of convenience.

Benefits of eSigning for secure and fast submission include:

Submitting your 2025 Maryland Form 505NR

When your form is filled out and signed, the next step is submission. Understanding the different methods for filing is essential.

Filing methods explained

You have multiple options for submitting your 2025 Maryland Form 505NR:

Deadline for submission

It’s critical to file your 2025 Maryland Form 505NR by the designated deadlines to avoid penalties. For most taxpayers, the filing deadline coincides with the federal tax deadline.

Post-submission management

After submitting your form, it's wise to manage the aftermath effectively.

Tracking your submission

You can confirm receipt of your form by contacting the Maryland State Comptroller or checking your e-filing account if you filed online.

Responding to IRS inquiries

In case the tax authorities require additional information, it's vital to respond promptly to avoid complications.

Dealing with common FAQs

As with any tax-related process, questions often arise. Here are some frequently asked questions:

What if made an error after filing?

If you discover an error after submitting your Form 505NR, you can amend it by submitting a corrected return using Form 505NRX.

How to handle overpayments or underpayments?

Understanding credits and refunds relates directly to how you handle payments. If you overpay, you can request a refund; if you underpay, making prompt payment can prevent interest and penalties.

Is professional help recommended?

Consulting a tax professional may be beneficial if your tax situation is complex or if you are uncertain about how to proceed with filing.

Maximizing your use of pdfFiller with Form 505NR

Utilizing pdfFiller's collaborative features can greatly enhance the experience of filling out the Form 505NR.

Collaborative features for team filing

Multiple team members can access, edit, and collaborate on the document in real time, ensuring every member's input is considered.

Benefits of a cloud-based document management system

Access to forms and documents anytime, anywhere combines convenience with efficiency, allowing users to manage their forms on the go.

Insights and tips for a successful tax season

Preparing for tax season can sometimes feel overwhelming, especially for non-residents. However, with proper organization and planning, you can ease the burden.

Tax planning tips for non-residents

Here are some strategies that can help non-residents minimize tax liability:

Staying informed on Maryland state tax changes

Tax laws can shift from year to year, making it important for non-residents to stay informed about changes that might affect them. Regularly check resources provided by the Maryland State Comptroller’s office for updates.

People Also Ask about

Where do I file Form 510 in Maryland?

What is a Maryland 502 form?

Can I file Maryland form 505 online?

Where do I mail my MD Form 500?

Can I file Maryland Form 505 online?

Why would the Comptroller of Maryland send me a letter?

Do I need to file a Maryland nonresident return?

Do I need to file a Maryland nonresident return?

What is a Maryland 505 form?

How do I get my Maryland state tax transcript?

Can I file my 540 online?

What is the Maryland minimum filing requirement?

How do I file a nonresident state tax return in Maryland?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MD 505NR online?

How do I edit MD 505NR on an Android device?

How do I complete MD 505NR on an Android device?

What is 2025 maryland form 505nr?

Who is required to file 2025 maryland form 505nr?

How to fill out 2025 maryland form 505nr?

What is the purpose of 2025 maryland form 505nr?

What information must be reported on 2025 maryland form 505nr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.