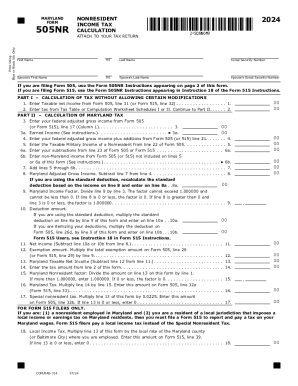

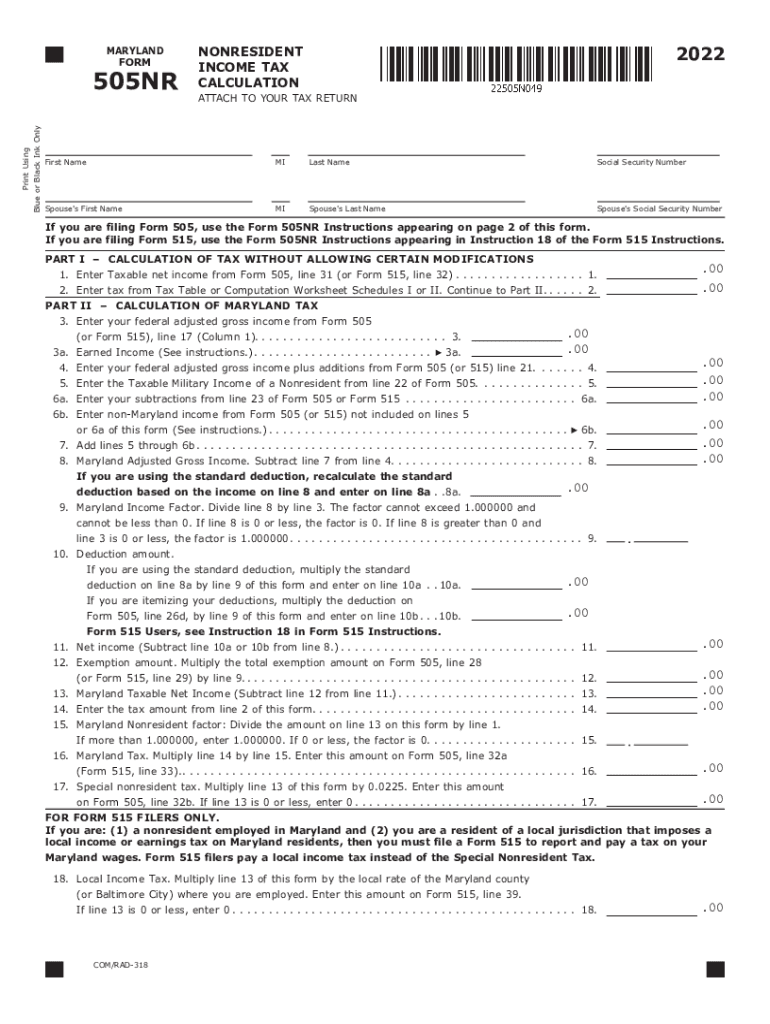

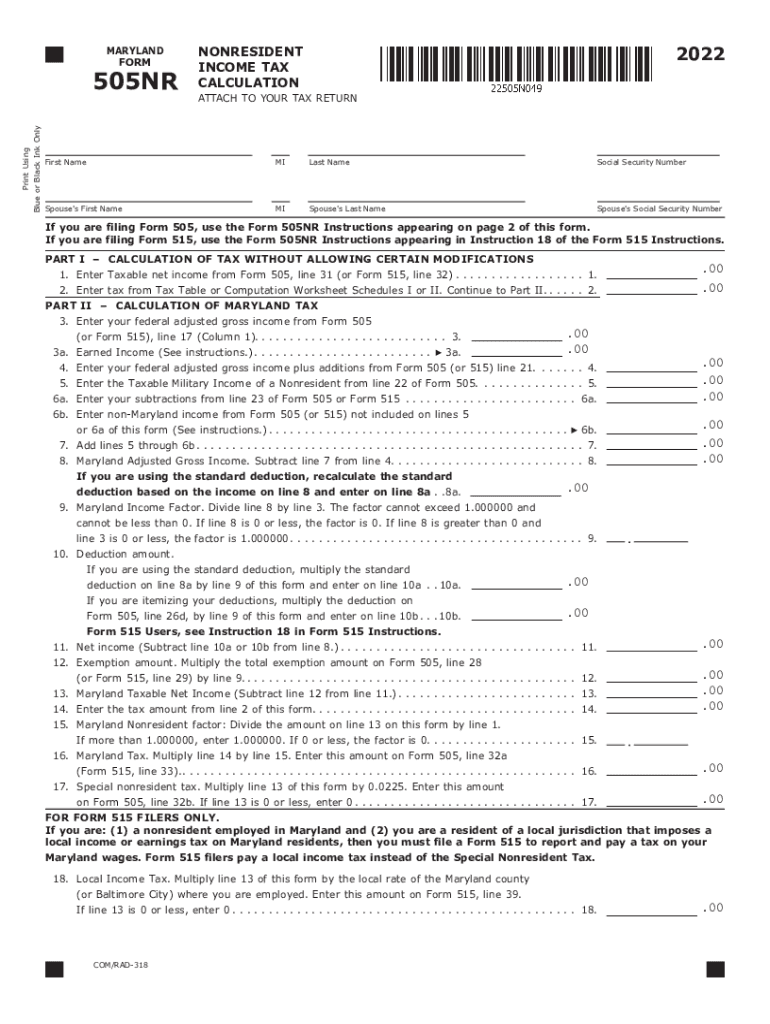

MD 505NR 2022 free printable template

Show details

MARYLAND

Footprint Using

Blue or Black Ink Only505NR2022NONRESIDENT

INCOME TAX

CALCULATIONATTACH TO YOUR TAX Returners NameMILast Asocial Security NumberSpouse\'s First NameMISpouse\'s Last Espouse\'s

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD 505NR

Edit your MD 505NR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD 505NR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD 505NR online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MD 505NR. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD 505NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD 505NR

How to fill out MD 505NR

01

Begin by gathering all necessary personal and financial information.

02

Download the MD 505NR form from the Maryland Department of Assessments and Taxation website.

03

Fill in your name and contact information at the top of the form.

04

Provide your tax identification number (TIN) or Social Security number where required.

05

Complete the sections detailing your income, deductions, and credits for the specified tax year.

06

Review your entries for accuracy to avoid delays.

07

Sign and date the form at the bottom to certify it is a true representation of your finances.

08

Submit the form to the appropriate Maryland tax authority address as indicated in the instructions.

Who needs MD 505NR?

01

Individuals who are filing their Maryland income taxes.

02

Business owners who need to report their business income in Maryland.

03

Taxpayers claiming certain deductions or credits related to their income.

Fill

form

: Try Risk Free

People Also Ask about

Where do I file Form 510 in Maryland?

Comptroller of Maryland, Revenue Administration. Division, 110 Carroll Street, Annapolis, Maryland 21411- 0001.

What is a Maryland 502 form?

All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

Can I file Maryland form 505 online?

You can file both your Maryland and federal tax returns online using approved software on your personal computer.

Where do I mail my MD Form 500?

Mail Maryland Form 500E to the following address: Controller of Maryland Revenue Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001.

Can I file Maryland Form 505 online?

You can file both your Maryland and federal tax returns online using approved software on your personal computer.

Why would the Comptroller of Maryland send me a letter?

If you have not paid your taxes due in full, or have not filed a Maryland return that we believe you should have, you will receive an income tax notice from the Comptroller of Maryland. If you do not respond to the first notice, an assessment notice will be issued.

Do I need to file a Maryland nonresident return?

You will need to file a nonresident income tax return to Maryland, using Form 505 and Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.

Do I need to file a Maryland nonresident return?

Remember, if your federal gross income is more than the federal minimum filing requirement for your filing status, you are required to file a Maryland return, even if the income attributable to Maryland is less than the federal filing requirement.

What is a Maryland 505 form?

FORM. 505. NONRESIDENT INCOME. TAX RETURN. DIRECT DEPOSIT OF REFUND (See Instruction 22.)

How do I get my Maryland state tax transcript?

To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax. Please include your name, address, Social Security number, the tax year you are requesting and your signature.

Can I file my 540 online?

Accepted forms Forms you can e-file for an individual: California Resident Income Tax Return (Form 540)

What is the Maryland minimum filing requirement?

Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.

How do I file a nonresident state tax return in Maryland?

You will need to file a nonresident income tax return to Maryland, using Form 505 and Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MD 505NR for eSignature?

Once you are ready to share your MD 505NR, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the MD 505NR in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your MD 505NR in seconds.

How do I fill out MD 505NR on an Android device?

Complete your MD 505NR and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is MD 505NR?

MD 505NR is a form used for non-resident individuals to report their income and calculate their Maryland state tax obligations.

Who is required to file MD 505NR?

Non-resident individuals who have income sourced from Maryland and meet certain thresholds are required to file MD 505NR.

How to fill out MD 505NR?

To fill out MD 505NR, individuals need to provide their personal information, report Maryland-sourced income, claim any deductions or credits, and calculate their tax liability.

What is the purpose of MD 505NR?

The purpose of MD 505NR is to ensure that non-residents report their income earned in Maryland and pay the appropriate state taxes.

What information must be reported on MD 505NR?

MD 505NR requires reporting personal details, total income earned in Maryland, deductions, credits, and the resulting tax due or refund.

Fill out your MD 505NR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD 505nr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.