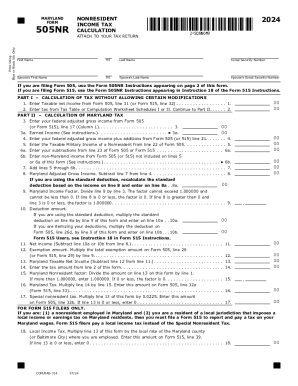

MD 505NR 2020 free printable template

Show details

MARYLAND

Footprint Using

Blue or Black Ink Only505NR2020NONRESIDENT

INCOME TAX

CALCULATIONATTACH TO YOUR TAX Returners NameMILast Asocial Security NumberSpouse\'s First NameMISpouse\'s Last Espouse\'s

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD 505NR

Edit your MD 505NR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD 505NR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MD 505NR online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MD 505NR. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD 505NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD 505NR

How to fill out MD 505NR

01

Obtain the MD 505NR form from the appropriate government website or office.

02

Fill in your personal information at the top of the form, including name, address, and contact details.

03

Provide your Social Security Number or Tax Identification Number as required.

04

Indicate the purpose of the form by checking the relevant boxes or completing the necessary sections.

05

Review the form for any additional information that may need to be included based on your specific situation.

06

Sign and date the form at the designated area.

07

Submit the completed form as instructed, either online or by mailing it to the appropriate address.

Who needs MD 505NR?

01

Individuals who are applying for a specific license or permit in Maryland.

02

Taxpayers who need to report certain information to the state.

03

Anyone seeking to clarify their tax status or resolve tax-related issues.

Fill

form

: Try Risk Free

People Also Ask about

Where do I file Form 510 in Maryland?

Comptroller of Maryland, Revenue Administration. Division, 110 Carroll Street, Annapolis, Maryland 21411- 0001.

What is a Maryland 502 form?

All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

Can I file Maryland form 505 online?

You can file both your Maryland and federal tax returns online using approved software on your personal computer.

Where do I mail my MD Form 500?

Mail Maryland Form 500E to the following address: Controller of Maryland Revenue Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001.

Can I file Maryland Form 505 online?

You can file both your Maryland and federal tax returns online using approved software on your personal computer.

Why would the Comptroller of Maryland send me a letter?

If you have not paid your taxes due in full, or have not filed a Maryland return that we believe you should have, you will receive an income tax notice from the Comptroller of Maryland. If you do not respond to the first notice, an assessment notice will be issued.

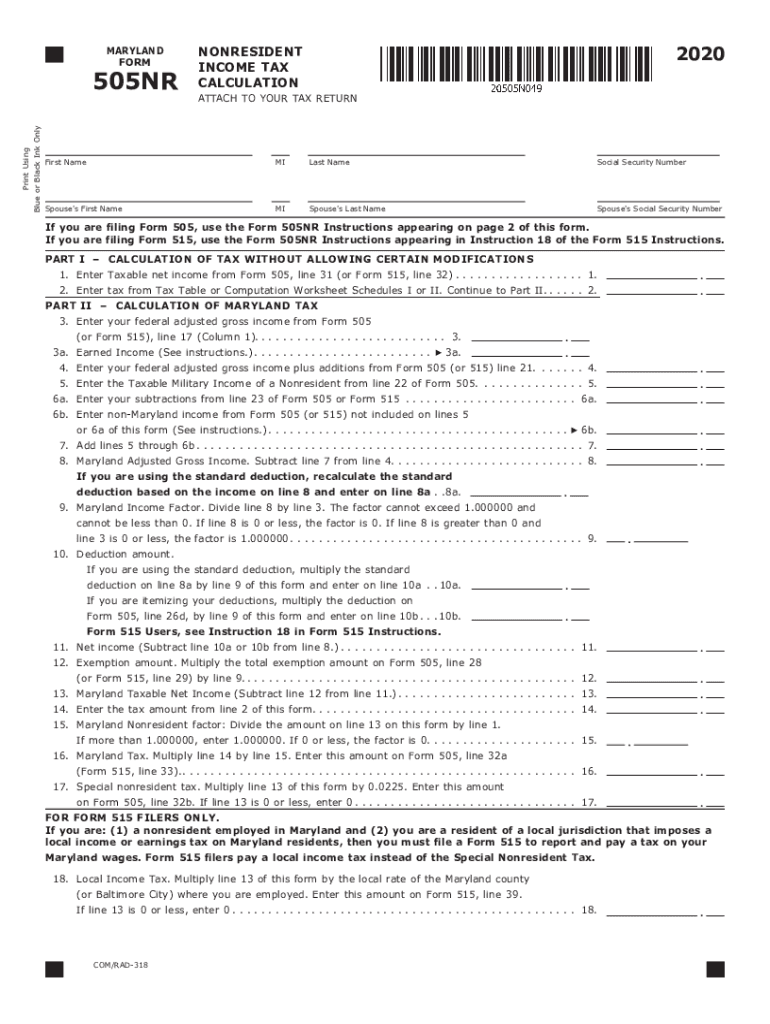

Do I need to file a Maryland nonresident return?

You will need to file a nonresident income tax return to Maryland, using Form 505 and Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.

Do I need to file a Maryland nonresident return?

Remember, if your federal gross income is more than the federal minimum filing requirement for your filing status, you are required to file a Maryland return, even if the income attributable to Maryland is less than the federal filing requirement.

What is a Maryland 505 form?

FORM. 505. NONRESIDENT INCOME. TAX RETURN. DIRECT DEPOSIT OF REFUND (See Instruction 22.)

How do I get my Maryland state tax transcript?

To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax. Please include your name, address, Social Security number, the tax year you are requesting and your signature.

Can I file my 540 online?

Accepted forms Forms you can e-file for an individual: California Resident Income Tax Return (Form 540)

What is the Maryland minimum filing requirement?

Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.

How do I file a nonresident state tax return in Maryland?

You will need to file a nonresident income tax return to Maryland, using Form 505 and Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MD 505NR without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your MD 505NR into a dynamic fillable form that you can manage and eSign from anywhere.

How do I fill out the MD 505NR form on my smartphone?

Use the pdfFiller mobile app to fill out and sign MD 505NR. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out MD 505NR on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your MD 505NR, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is MD 505NR?

MD 505NR is a tax form used by non-residents in the state of Maryland to report their income and calculate the taxes owed to the state.

Who is required to file MD 505NR?

Non-residents who have earned income from Maryland sources, such as wages or business income, are required to file MD 505NR.

How to fill out MD 505NR?

To fill out MD 505NR, individuals must provide personal information, income details, tax calculations, and any applicable deductions or credits.

What is the purpose of MD 505NR?

The purpose of MD 505NR is to ensure that non-residents report their taxable income earned in Maryland and fulfill their tax obligations to the state.

What information must be reported on MD 505NR?

MD 505NR requires reporting of personal identification details, income types, total income earned, and calculation of taxes owed or refund due.

Fill out your MD 505NR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD 505nr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.