MD 505NR 2017 free printable template

Show details

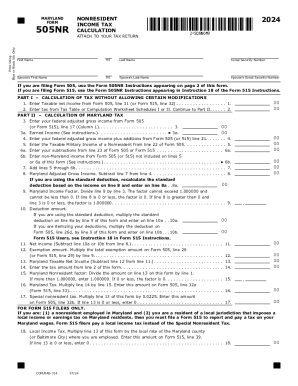

MARYLAND

Footprint Using

Blue or Black Ink Only505NR2017NONRESIDENT

INCOME TAX

CALCULATIONATTACH TO YOUR TAX Returners NameInitialLast Asocial Security NumberSpouse\'s First NameInitialSpouse\'s Last

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD 505NR

Edit your MD 505NR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD 505NR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD 505NR online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MD 505NR. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD 505NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD 505NR

How to fill out MD 505NR

01

Obtain the MD 505NR form from the appropriate website or agency.

02

Fill out personal information in section 1, including your name, address, and contact information.

03

Provide details about your current health condition in section 2, including any relevant medical history.

04

Complete section 3 with any additional information requested.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the form according to the instructions provided, either online or by mail.

Who needs MD 505NR?

01

Individuals seeking disability benefits.

02

Applicants for certain medical assistance programs.

03

Those who need to provide proof of a disability for employment or legal purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax table and how does it work?

A tax table is a chart that displays the amount of tax due based on income received. The IRS provides tax tables to help taxpayers determine how much tax they owe and how to calculate it when they file their annual tax returns. Tax tables are divided by income ranges and filing status.

How do I find my income tax?

Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by: Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.)

How do I find my income tax on 1040?

Where to find income tax on 1040 IRS Form 1040: Subtract line 46 from line 56 and enter the total. IRS Form 1040A: Subtract line 36 from line 28 and enter the total. IRS Form 1040EZ: Use Line 10.

What is the tax rate for income 2022?

There are seven tax brackets for most ordinary income for the 2022 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.”

What is the tax computation worksheet?

The second worksheet is called the “Tax Computation Worksheet.” It can be found in the instructions for 1040 Line 16. This second worksheet is used twice in the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of income tax owed.

What are NZ tax brackets 2022?

There are five PAYE tax brackets for the 2021-2022 tax year: 10.50%, 17.50%, 30%, 33% and 39%. Your tax bracket depends on your total taxable income.

How do you use an income tax table?

How tax tables work. Step 1: Determine your filing status. Step 2: Calculate your taxable income. Step 3: Determine your income bracket. Step 4: Identify your tax filing status. Step 5: Find the amount of tax you owe.

What is the tax bracket for 2022 in South Africa?

2022 tax year (1 March 2021 – 28 February 2022) Taxable income (R)Rates of tax (R)1 – 216 20018% of taxable income216 201 – 337 80038 916 + 26% of taxable income above 216 200337 801 – 467 50070 532 + 31% of taxable income above 337 800467 501 – 613 600110 739 + 36% of taxable income above 467 5003 more rows

What is income tax table?

Tax tables are a tool the IRS provides to make it easy to calculate the exact amount of taxes to report on your federal income tax return when filing by hand. States with state income tax returns also provide tax tables to aid in this portion of the tax preparation process.

What is tax computation sheet?

The Computation Report displays the Employee wise Income Tax Computation details in the Form 16 format. Along with the Total Tax payable, it also displays the balance tax payable, tax already paid and tax amount to be deducted in the subsequent month.

Where is the tax computation worksheet?

The second worksheet is called the “Tax Computation Worksheet.” It can be found in the instructions for 1040 Line 16.

What is the income tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)10%Up to $10,275Up to $20,55012%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,1003 more rows • Dec 5, 2022

What is computation of income tax?

The process of determining the different sources of Income is called 'Computation of Income'. While computing income, the different incomes are finally grouped as “Gross Total Income”. After computing income, the tax is computed based on the income tax rate applicable and the various income tax deductions allowable.

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)12%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,10032%$170,051 to $215,950$340,101 to $431,9003 more rows • 5 Dec 2022

Is 1040 the same as income tax?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

How do I find my income tax on 1040 without Schedule 2?

If there's no Schedule 2, then you subtract zero, just like if there was a Schedule 2 with nothing but zeroes on it.

How do I find my tax table?

You can find the latest tax table which you'll use in 2023 to file 2022 taxes on the IRS' website, specifically its publication named Tax Year 2022—1040 and 1040-SR Tax and Earned Income Credit Tables.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in MD 505NR?

With pdfFiller, it's easy to make changes. Open your MD 505NR in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the MD 505NR in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your MD 505NR.

How do I edit MD 505NR on an iOS device?

Create, modify, and share MD 505NR using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is MD 505NR?

MD 505NR is a tax form used by non-resident individuals and businesses to report income derived from Maryland sources.

Who is required to file MD 505NR?

Non-resident individuals and entities that earn income from Maryland sources must file MD 505NR.

How to fill out MD 505NR?

To fill out MD 505NR, gather relevant income documents, provide personal information, report Maryland source income, and calculate any tax due, then submit the form to the Maryland Comptroller.

What is the purpose of MD 505NR?

The purpose of MD 505NR is to facilitate the reporting and taxation of income earned by non-residents in Maryland.

What information must be reported on MD 505NR?

MD 505NR requires reporting of personal identification details, income details from Maryland sources, any applicable deductions, credits, and the total tax liability.

Fill out your MD 505NR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD 505nr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.