Get the free Online MO-1040ES - 2026 Declaration of Estimated Tax ... - dor mo

Get, Create, Make and Sign online mo-1040es - 2026

Editing online mo-1040es - 2026 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online mo-1040es - 2026

How to fill out mo-1040es - 2026 declaration

Who needs mo-1040es - 2026 declaration?

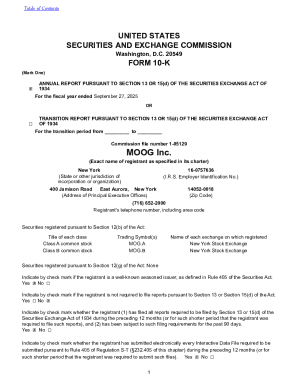

Comprehensive Guide to the MO-1040ES - 2026 Declaration Form

Overview of the MO-1040ES Declaration Form

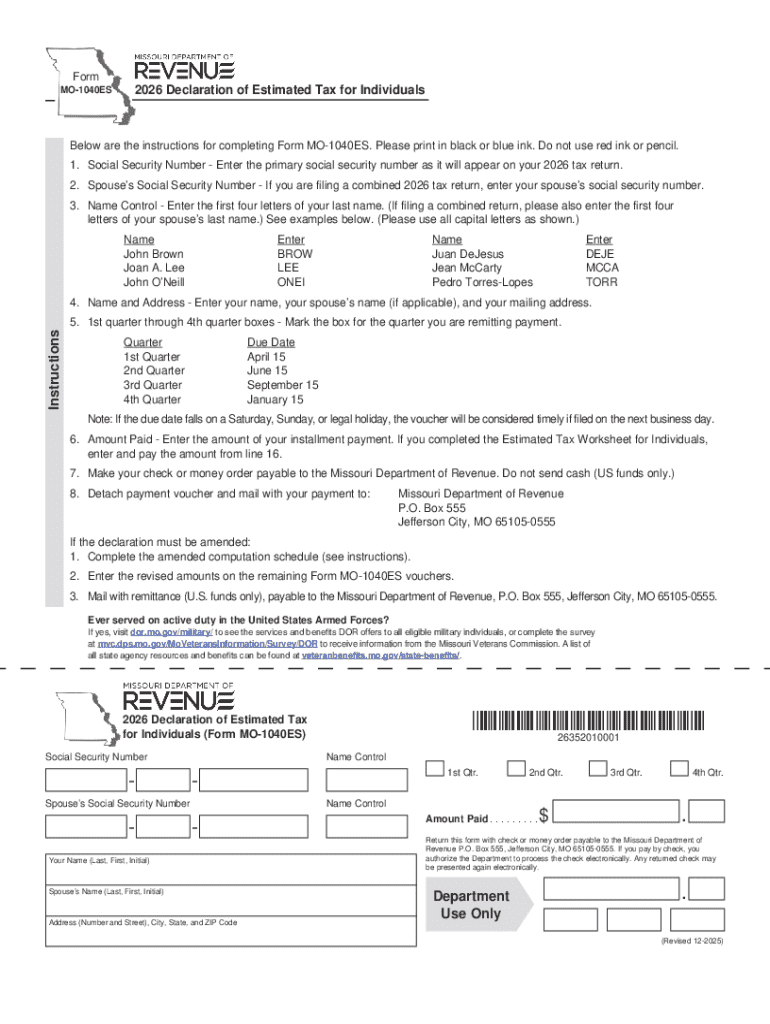

The MO-1040ES Declaration Form serves as a crucial document for individuals and businesses making estimated tax payments in Missouri. Estimated tax payments are necessary for taxpayers who expect to owe tax of $500 or more when filing their returns. This form ensures that you pay your share of taxes on income not subject to withholding, such as self-employment income, interest, dividends, and rental income.

For Missouri residents, understanding the MO-1040ES is vital for compliance and avoiding unnecessary penalties from the state. Each tax season, taxpayers must navigate adjustments to tax rules, deductions, and credits, making it essential to be aware of the MO-1040ES updates that continue to evolve year by year.

Key features of the 2026 Declaration Form

The 2026 iteration of the MO-1040ES includes updates that reflect changes in state tax law. Taxpayers will notice improved guidance on calculating estimated payments, updated tables for proposed income and deduction thresholds, and enhanced user-friendly layouts designed for efficient completion.

Understanding estimated tax payments

Estimated taxes are payments made to the state throughout the year, rather than waiting until the tax return is filed. This is particularly important for individuals who earn income without adequate withholding. For example, freelance professionals, business owners, and investors typically fall into this category. By paying estimated taxes using the MO-1040ES, taxpayers can avoid a hefty tax bill and possible penalties later.

It's essential to determine whether you need to file the MO-1040ES. Individuals need to make estimated tax payments if they expect to have a tax liability of $500 or more after subtracting withholding and credits. Businesses generally need to file if they owe more than $100 in taxes. Failure to submit estimated taxes can lead to significant penalties, plus interest on any amounts underpaid.

Preparing to fill out the MO-1040ES form

Before you fill out the MO-1040ES, gather all the necessary documentation. This includes all income sources, any expected tax liabilities, and detailed records such as last year's tax return. Having this information at hand will streamline the process, making it easier to calculate your estimated payments.

Utilize digital tools such as tax calculators and software to help project your tax liability accurately. Website pdfFiller offers interactive tools that allow you to compute estimates based on your specific financial situation. Using such resources ensures precision while minimizing errors in your calculations efforts.

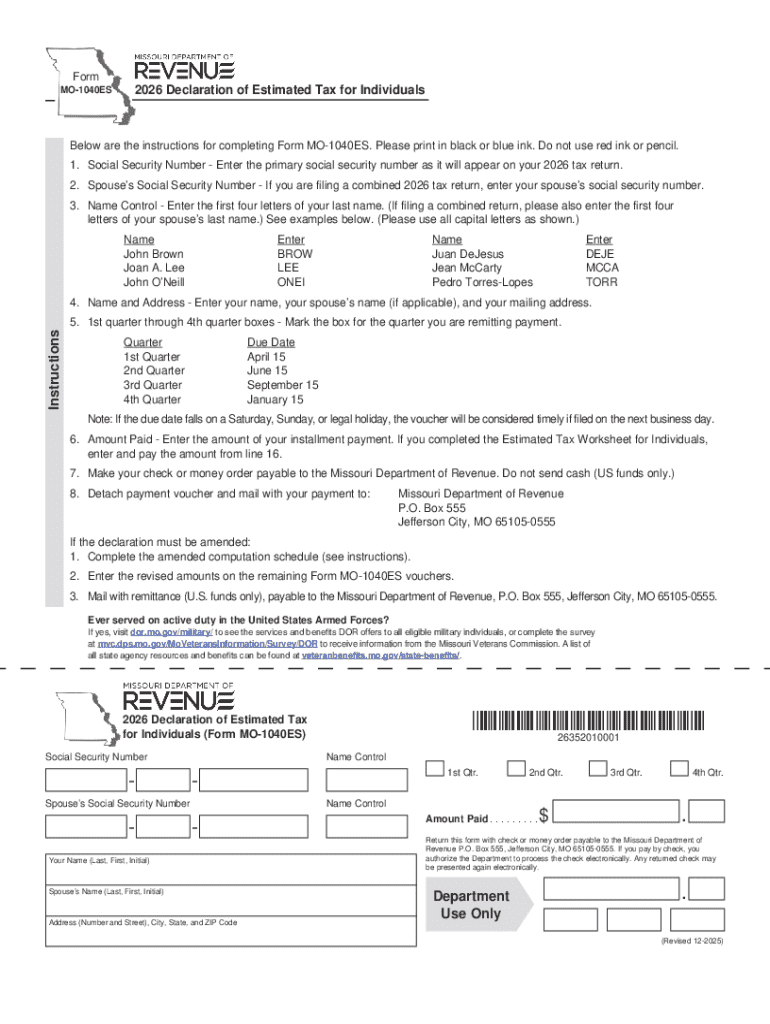

Step-by-step instructions for filling out the MO-1040ES

Filling out the MO-1040ES can seem overwhelming, but it can be tackled easily with methodical steps. Start with Section 1, which requires taxpayer information like your name, address, and Social Security Number. Ensure that these details are correct, as discrepancies can lead to processing delays.

In Section 2, you will determine your estimated tax by breaking down your anticipated income and applicable deductions. This is where precise numbers from previous tax returns come in handy. The form provides worksheets and tables that guide you through this process, ensuring that you don't overlook any critical information. Subsequently, Section 3 requires you to specify your estimated payment amounts, which you should calculate based on your projected yearly tax basis.

Lastly, Section 4 involves signing and submitting the MO-1040ES. You can take advantage of pdfFiller's eSigning features for a seamless signing process. After completing the form, you have several submission methods: mailing the form to the tax authority or filing electronically through approved platforms.

Common mistakes to avoid

When filling out the MO-1040ES, accuracy is critical. One of the most common mistakes is miscalculating estimated payments. Always double-check figures and utilize available resources to ensure correctness. Another frequent error involves failing to update your information regarding income and deductions. Changes in your earnings can significantly affect your estimated tax liability, so keeping your records current is crucial.

Managing your MO-1040ES after submission

Once you've submitted your MO-1040ES, it's important to keep track of your payments. You can regularly check your payment status through the Missouri Department of Revenue website. If your income situation changes during the year, be prepared to adjust your estimated payments. The state allows modifications if you foresee significant changes in your earnings to avoid any penalties.

Be proactive in handling audits or discrepancies. If the IRS or Missouri Department of Revenue questions your figures, respond promptly and provide necessary documentation to substantiate your calculations. Engaging a tax professional can also be beneficial when dealing with contentious issues.

Interactive tools and resources

By using pdfFiller's innovative features, filling out and managing the MO-1040ES becomes an efficient experience. You can edit, share, and store your form securely in cloud storage, which makes document management exceptionally easy. Besides, these capabilities enable collaboration, perfect for teams working together on tax-related documents.

You can also access additional resources from the Missouri Department of Revenue that complement the MO-1040ES. These resources provide further insights into changes in state tax regulations, deadlines, and payment options. It is advisable to stay informed through these official channels to maximize your compliance.

Frequently asked questions (FAQs)

Many clients often have questions about the MO-1040ES. One common query is what to do if you missed the submission deadline. If this happens, it is advisable to submit your MO-1040ES as soon as possible to limit penalties. Another concern relates to making payments if you owe taxes. Missouri offers various options for payment, including online, by mail, or over the phone, to make the process convenient.

For those requiring assistance, reaching out to tax professionals or utilizing state resources can provide invaluable help. This is particularly useful when navigating complex tax scenarios or when exploring potential tax-saving strategies.

Native integration with pdfFiller for seamless document management

pdfFiller provides a comprehensive document management solution that significantly simplifies tax preparation tasks. Users can collaborate on forms like the MO-1040ES with others in real time, ensuring that feedback and revisions are handled seamlessly. The platform's cloud-based feature allows access to documents from any device, enabling on-the-go productivity.

Moreover, utilizing a cloud-based platform for tax documentation not only enhances security—but it also streamlines the entire process. All your important forms are organized and accessible whenever needed, giving you peace of mind as tax deadline approaches.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit online mo-1040es - 2026 straight from my smartphone?

How do I complete online mo-1040es - 2026 on an iOS device?

Can I edit online mo-1040es - 2026 on an Android device?

What is mo-1040es - 2026 declaration?

Who is required to file mo-1040es - 2026 declaration?

How to fill out mo-1040es - 2026 declaration?

What is the purpose of mo-1040es - 2026 declaration?

What information must be reported on mo-1040es - 2026 declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.