Get the free BENNETT v. COMMI. OF HUMAN SERVICES, A09-442 (Minn ...

Get, Create, Make and Sign bennett v commi of

How to edit bennett v commi of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bennett v commi of

How to fill out bennett v commi of

Who needs bennett v commi of?

Bennett . Comm'r of Form: A Comprehensive Guide

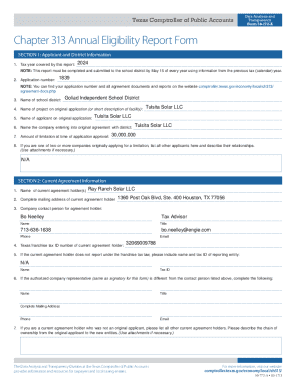

Overview of Bennett . Comm'r of Form

Bennett v. Comm'r of Form is a pivotal case in the realm of tax law that illustrates the complexities of tax compliance and form submission. The key players in this case were Bennett, an individual taxpayer, and the Commissioner of Internal Revenue who served as the regulatory authority for tax compliance. This case emerged against a backdrop of evolving tax regulations that impact individual taxpayers and businesses alike.

The significance of this case lies in its implications for the interpretation of tax forms and the obligations of individuals in filing accurate returns. Legal precedents established prior to this case underscore the relationship between taxpayers and the IRS, particularly regarding the submission of tax forms and the consequences of misreporting.

Understanding tax forms related to the case

In Bennett v. Comm'r of Form, specific tax forms played a critical role in the court's examination of compliance. The most pertinent forms included Form 1040, the U.S. Individual Income Tax Return, and Schedule C, which details Profit or Loss from Business. These forms are foundational for individual taxpayers and small business owners, serving as the primary documents for reporting income, expenses, and calculating tax obligations.

The ruling emphasized the accuracy of the information submitted on these forms, advocating for a more vigilant approach to tax reporting. Since the case, many individuals have streamlined their processes to ensure compliance, reflecting the increased scrutiny by the IRS that was brought to light through this case.

Legal precedents and implications

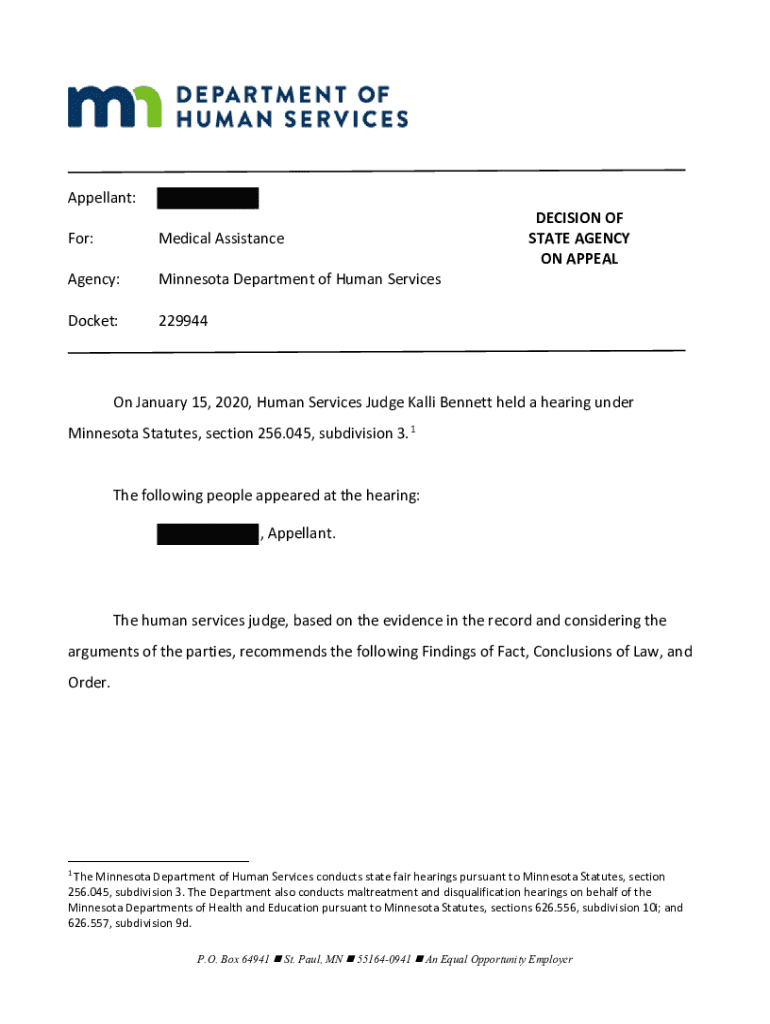

Several legal precedents formed the bedrock for Bennett v. Comm'r of Form. Past rulings established foundational concepts such as 'reasonable cause' and the standards for penalties relating to underreported income. Prior cases often highlighted the tension between taxpayer rights and the IRS's duty to enforce the law effectively, setting the stage for further scrutiny in the Bennett decision.

The implications of the court's ruling extend beyond just this case. It has the potential to influence IRS guidelines, making it critical for future tax disputes and shaping how taxpayers approach form submissions. The judgment serves as a reminder that accurate reporting and compliance are paramount to avoid penalties.

Analyzing the decision

The judicial decision in Bennett v. Comm'r was multifaceted, considering various factors including the intent behind the omissions on tax returns. The court weighed evidence regarding Bennett's claims of misreporting due to misunderstanding tax regulations against the strict standards set by the IRS. The complexities of tax law added difficulty in determining the proper outcome.

Legal experts have noted a split in opinion, with some arguing for a more lenient interpretation of taxpayer intent. The dissenting opinions underscored the importance of maintaining robust compliance mechanisms to deter future underreporting. This balancing act of taxpayer protection versus regulatory enforcement remains a critical discussion point in tax law.

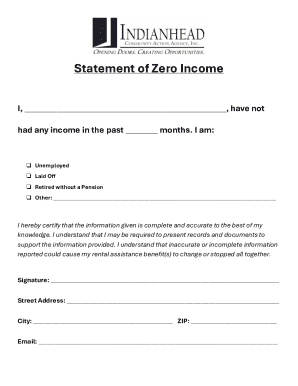

Practical application: Filling out related tax forms post-Bennett

Following Bennett v. Comm'r, accurately completing tax forms like Form 1040 and Schedule C is more critical than ever. To ensure compliance, follow these steps: determine your income sources, collate supporting documents, and review IRS instructions for updates related to the case ruling. A rigorous approach to data entry will help mitigate the risk of errors.

Common pitfalls in filing include neglecting to report all income, miscalculating expenses, and failing to maintain adequate documentation. To avoid these issues, establish a checklist of required documentation and double-check calculations. Best practices include consulting tax professionals or using dedicated tax software that integrates changes in tax laws resulting from cases like Bennett.

Resources for continued learning

For individuals seeking to deepen their understanding of Bennett v. Comm'r of Form and its implications, a range of resources are available. The IRS website offers comprehensive guides and updates specific to new rulings. Legal commentaries from tax law experts can provide nuanced perspectives that can be invaluable for understanding the implications of this case. Additionally, interactive tools and templates available on pdfFiller can simplify the filing process for taxpayers.

Accessing these resources can empower individuals and teams to stay informed about ongoing changes in tax law, ensuring compliance in an evolving regulatory landscape. FAQs or online forums may also provide insights from other taxpayers who have navigated similar challenges.

Conclusion: The ongoing relevance of Bennett . Comm'r of Form

Bennett v. Comm'r of Form has emerged as a landmark case that influences the current tax landscape, highlighting the necessity for accuracy and compliance in tax filings. Its relevance is underscored by the rising complexities of tax laws that mandate taxpayers take proactive measures in understanding their filing obligations. Awareness and education are crucial for avoiding penalties that could arise from misinterpretations of the law.

As individuals and teams navigate tax document management in a post-Bennett world, it is vital to remain informed about changes in tax regulations and the implications of legal interpretations. Leveraging resources such as pdfFiller can significantly ease the document management process, enhancing compliance while minimizing the risk of errors in an ever-evolving tax environment.

Interactive tools and document management solutions

pdfFiller stands out as a cloud-based platform designed to facilitate the management of tax documents and forms seamlessly. Its features allow users to edit PDFs, eSign documents, and collaborate with others efficiently. Accessible from anywhere, pdfFiller combines innovative technology with practicality, making it an essential tool for individual taxpayers and businesses alike.

To effectively use pdfFiller, users can start by accessing the platform and selecting the forms needed for tax filing. The step-by-step interface guides users through filling out and editing forms while ensuring that they adhere to IRS regulations. Success stories from users illustrate how various taxpayers have overcome challenges in tax filing by utilizing pdfFiller's functionalities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bennett v commi of directly from Gmail?

How can I edit bennett v commi of from Google Drive?

How do I complete bennett v commi of on an iOS device?

What is bennett v commi of?

Who is required to file bennett v commi of?

How to fill out bennett v commi of?

What is the purpose of bennett v commi of?

What information must be reported on bennett v commi of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.