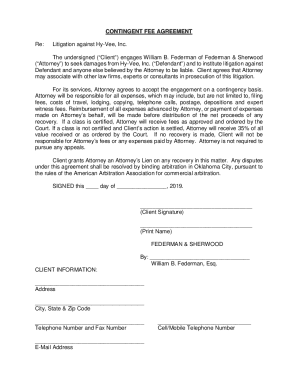

Get the free Form CT-2210, Underpayment of Estimated Income Tax by ...

Get, Create, Make and Sign form ct-2210 underpayment of

Editing form ct-2210 underpayment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ct-2210 underpayment of

How to fill out form ct-2210 underpayment of

Who needs form ct-2210 underpayment of?

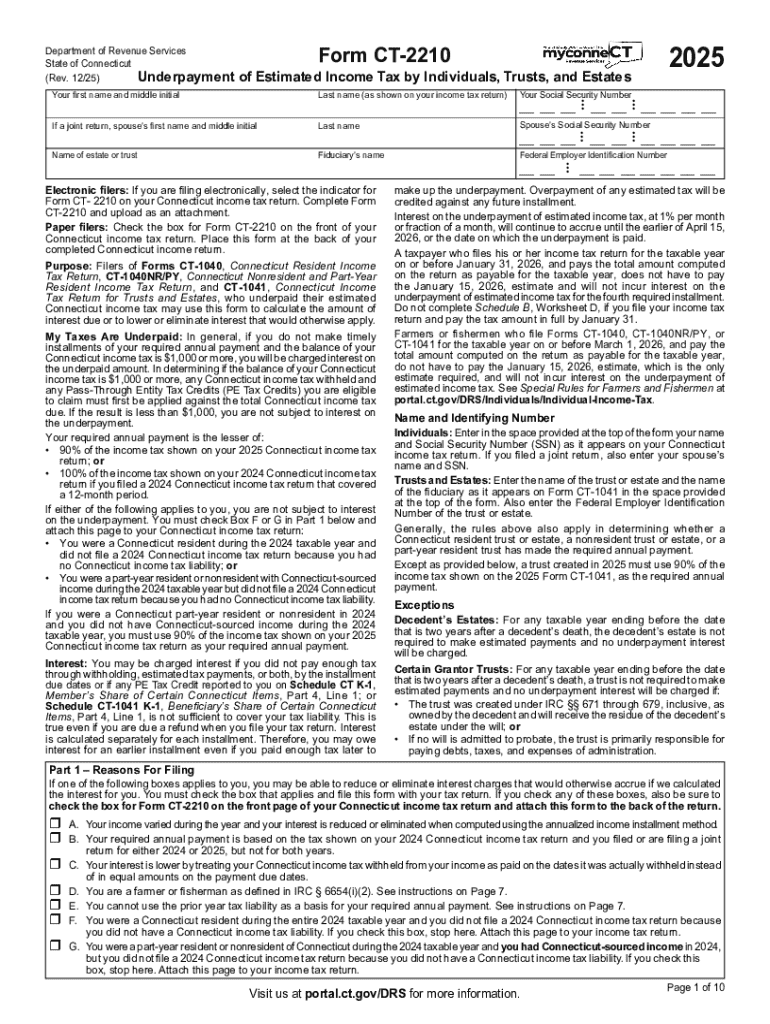

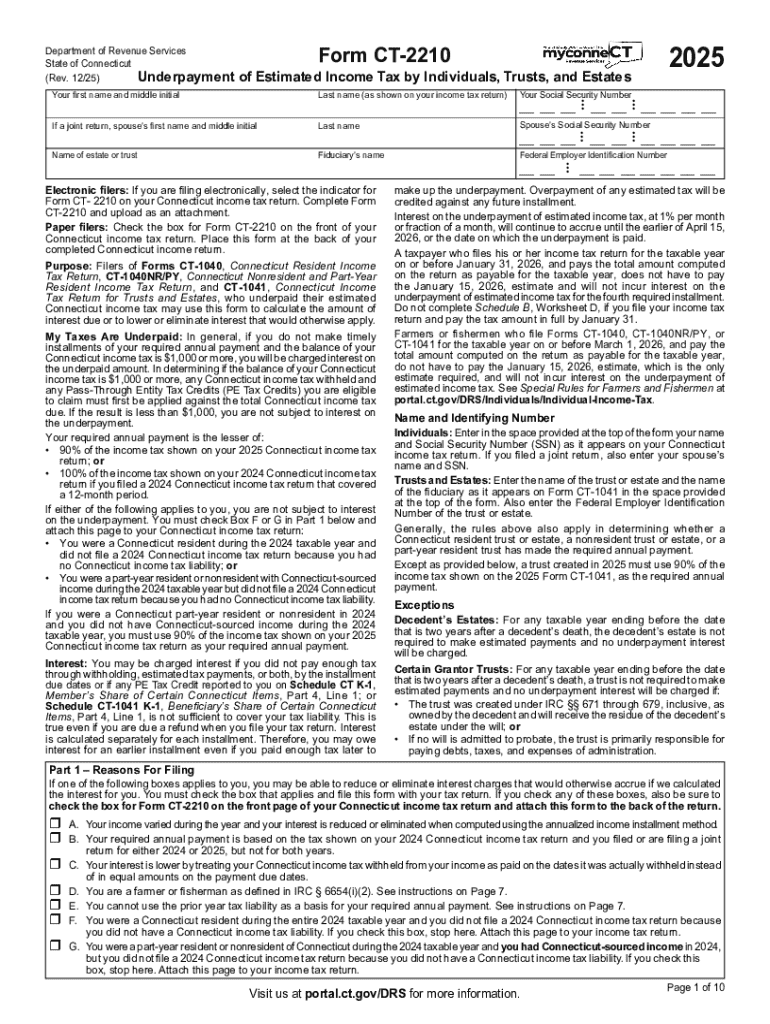

Understanding Form CT-2210: A Comprehensive Guide to Underpayment of Form

Understanding Form CT-2210

Form CT-2210 is designed for taxpayers in Connecticut who may have underpaid their state income taxes. This form is critical for those looking to report underpayment penalties accurately and ensure compliance with state tax laws. The primary purpose of Form CT-2210 is to calculate any potential penalties you may owe due to underpayment of estimated taxes, allowing you to rectify your tax filing timely and avoid further penalties.

Anyone who has paid less than the required amount of taxes throughout the year may need to file Form CT-2210. This includes both individuals and businesses who fail to meet the estimated tax payment thresholds set by the state. Understanding who needs to file this form can save you from incurring unnecessary penalties and interest.

Filing deadlines for Form CT-2210 coincide with the state income tax return due dates, typically April 15 for most taxpayers. However, if you are filing for an extension, you may have additional time but should remain vigilant in assessing your tax obligations.

Assessing underpayment of Connecticut taxes

Underpayment, in the context of Connecticut taxes, refers to the situation where taxpayers fail to pay the minimum required estimated taxes throughout the year. This could result from various factors, such as unexpected changes in income, incorrect estimations, or even changes in tax law that were not accounted for during tax planning.

The criteria for determining underpayment are fairly straightforward. A taxpayer is deemed to have underpaid if their total withholding and estimated payments are less than either 90% of the current year’s tax liability or 100% of the previous year’s tax liability, provided the prior year was a full 12-month period.

The impact of underpayment can be significant. Not only could you be subject to penalties, but you may also incur interest on these penalties until they are paid in full.

When to use Form CT-2210

You’ll most likely need to use Form CT-2210 in specific scenarios. For instance, if you find yourself unable to meet estimated tax payments after a sudden change in income or personal factors, this form is integral to ensure compliance and manage penalties.

Some common scenarios that trigger the need for Form CT-2210 include:

Form CT-2210 should also be contrasted with the standard CT-1040 form. While CT-1040 is the main annual tax return, CT-2210 addresses specific underpayment issues related to estimated taxes. Because of this, the two forms cannot be filed interchangeably.

Step-by-step guide to filling out Form CT-2210

Filling out Form CT-2210 accurately is crucial for effective tax management. First, familiarize yourself with the layout of the form to make the process smoother. The form is divided into several sections, each focusing on different aspects of tax underpayment.

Here is a detailed breakdown of each section:

Common mistakes include inaccurate penalty calculations and failure to consider exceptions. To ensure accuracy, double-check calculations and consult the Connecticut Department of Revenue Services’ guidelines or seek professional tax assistance if needed.

Tools and resources for managing your taxes

Managing your tax obligations becomes more straightforward with the right tools. For anyone dealing with Form CT-2210, having access to a reliable tax management solution can enhance your filing experience significantly. Interactive tools, like tax calculators, are invaluable for estimating your expected tax liabilities throughout the year.

pdfFiller’s platform offers users comprehensive features for managing tax-related documents effectively. Users can access the pdfFiller platform to edit, sign, and collaborate on forms seamlessly. The following features enhance the process:

Utilizing a cloud-based solution like pdfFiller not only streamlines the filing process but also ensures that you have a backup of your important documents, ready to be accessed whenever you need.

What happens after filing Form CT-2210?

Once you've submitted Form CT-2210, there are several outcomes you may encounter. Your submission will be reviewed by the Connecticut Department of Revenue Services, which will determine any penalties incurred due to underpayment.

You might receive notifications regarding the acceptance of your form, or if discrepancies arise, you could be contacted for clarification. It is essential to maintain records of your filings and communications with the department.

Awareness of these processes will help mitigate the stress associated with filing your taxes and dealing with underpayment penalties.

Frequently asked questions (FAQs)

Taxpayers often have several questions regarding Form CT-2210, particularly about its requirements and implications. Here are some common queries that might clarify your understanding:

These questions are not exhaustive, but they highlight the critical areas taxpayers typically need to clarify. Always keep lines of communication open with tax professionals to avoid missteps.

Best practices for avoiding future underpayment

The best way to manage taxes is to stay ahead of potential underpayment situations. Here are some effective strategies that can help you avoid underpayment pitfalls in the future:

These proactive measures can significantly reduce the likelihood of facing underpayment charges and enhance your overall financial management.

Testimonial and use cases

Using pdfFiller for Form CT-2210 streamlines the process for many taxpayers. Case studies have shown that users who engaged with pdfFiller experienced fewer errors and more efficient filings.

For instance, one user noted how seamless the collaboration features were for their small business. They could pull in multiple team members to ensure the form was accurate, significantly improving the filing experience.

Such testimonials highlight the practicality and effectiveness of pdfFiller in easing the complexities associated with tax filings, particularly underpayment situations.

Navigating changes and updates in tax regulation

Tax regulations can change, affecting how Form CT-2210 is utilized. Staying updated with changes is essential for every taxpayer. Engaging in continuous learning about state tax regulations ensures you remain compliant and prepared for any new requirements that arise.

Being proactive about educational resources, such as webinars on tax updates and following reputable financial news outlets, can greatly benefit taxpayers in adapting to new regulations and requirements surrounding Form CT-2210.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form ct-2210 underpayment of to be eSigned by others?

How can I get form ct-2210 underpayment of?

How do I make edits in form ct-2210 underpayment of without leaving Chrome?

What is form ct-2210 underpayment of?

Who is required to file form ct-2210 underpayment of?

How to fill out form ct-2210 underpayment of?

What is the purpose of form ct-2210 underpayment of?

What information must be reported on form ct-2210 underpayment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.