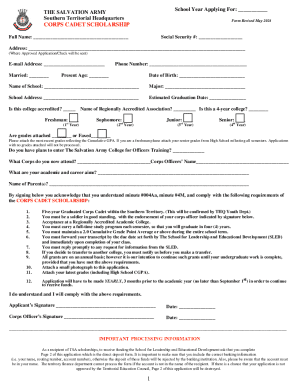

Get the free BILLS 1981 - 1982 . ' ' ' ' . T ' - ' 1550 HB 643 cont...

Get, Create, Make and Sign bills 1981 - 1982

Editing bills 1981 - 1982 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bills 1981 - 1982

How to fill out bills 1981 - 1982

Who needs bills 1981 - 1982?

Comprehensive Guide to the Bills 1981 - 1982 Form

Overview of the bills 1981 - 1982 form

The bills 1981 - 1982 form serves as a crucial document for businesses and individuals in managing and tracking billing processes for the specified periods. This form primarily encapsulates essential billing information in a structured format, facilitating effective communication between parties involved.

Understanding the billing period is significant as it precisely defines the time frame during which services were rendered or products were delivered. Accurate billing is foundational for maintaining trust and clarity in financial transactions.

Understanding the components of the bills form

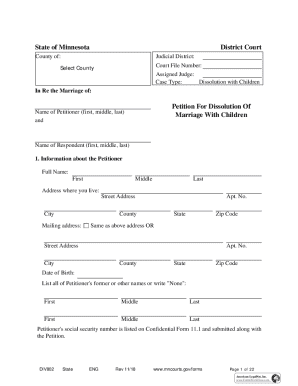

To effectively use the bills 1981 - 1982 form, it’s vital to understand its components, which include header information, line items, tax implications, and payment instructions.

The header typically contains contact information for both parties involved, setting the stage for the transaction. Each line item represents a separate charge or service, complete with descriptions for clarity. Statutory tax considerations and instructions on how to remit payments make this form indispensable.

Familiarity with common terms enhances understanding. For instance, terms like 'net amount due' and 'due date' carry significant weight in financial discussions.

How to fill out the bills 1981 - 1982 form

Filling out the bills 1981 - 1982 form can seem daunting, but with a step-by-step process, it becomes manageable.

Firstly, gather all required information and necessary documents such as previous billing statements and contracts. It is also essential to have personal or business details readily available, ensuring every entry is current and accurate.

Common errors include mis-entering amounts, neglecting to account for tax, or missing the due date. Best practices suggest submitting the form well ahead of deadlines, choosing either electronic or paper methods based on your preference.

Editing and managing your bills form

Managing your bills form is simplified through platforms like pdfFiller, which allows for easy online editing.

By uploading your bills form directly to pdfFiller, you can quickly access robust editing tools. These tools let you modify text, add fields, and make essential adjustments without returning to the original document.

Organizing your documents effectively is also necessary. Implement folder structures that make sense to you and follow naming best practices to maintain an organized digital workspace.

E-signing the bills 1981 - 1982 form

E-signing adds an important layer of security and authenticity to the bills 1981 - 1982 form. It legitimizes your document while ensuring both parties are protected in transactions.

Using pdfFiller, the process to e-sign is straightforward. Once your form is ready, you can add an e-signature securely and conveniently.

Collaborating on the bills form

Collaboration is vital when managing the bills 1981 - 1982 form, especially when multiple stakeholders are involved. pdfFiller provides tools that enable teams to work together efficiently.

Real-time editing features allow different users to make changes instantly, promoting transparency and reducing miscommunication.

Managing your submissions and follow-ups

Post-submission management of the bills 1981 - 1982 form is essential. Keeping track of submitted forms ensures that all billing statements are accounted for, reducing the risk of oversights.

Organizing follow-ups can also prevent delays in payment or further actions. Address common issues such as requests for additional information or revisions proactively.

FAQs about the bills 1981 - 1982 form

Understanding frequently asked questions can enhance your experience with the bills 1981 - 1982 form, helping clarify common concerns.

For instance, inquiries regarding the implications of regulatory changes on billing practices can be addressed thoroughly. Potential impacts should inform your approach to managing your billing.

Interactive tools and resources

For added convenience, pdfFiller offers a range of interactive tools to users needing to work with the bills 1981 - 1982 form.

Templates simplify the setup process, while calculators assist in estimating totals effectively. Checklists guide you to ensure that all required sections are accurately completed.

Conclusion: Empowering document management with pdfFiller

The bills 1981 - 1982 form represents a pivotal tool for effective billing management. Using pdfFiller to streamline your document processes brings unparalleled benefits. From filling out and editing forms to secure e-signatures and collaborative features, pdfFiller emerges as a comprehensive solution.

Embrace the efficiencies that pdfFiller offers to not only simplify the submission of your bills forms but also enhance the management of all your business documents. Harness technology for better control and oversight over your billing cycles and engagement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify bills 1981 - 1982 without leaving Google Drive?

How can I edit bills 1981 - 1982 on a smartphone?

How do I fill out the bills 1981 - 1982 form on my smartphone?

What is bills 1981 - 1982?

Who is required to file bills 1981 - 1982?

How to fill out bills 1981 - 1982?

What is the purpose of bills 1981 - 1982?

What information must be reported on bills 1981 - 1982?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.