Get the free Instructions for Form RV-3 Rental Motor Vehicle, Tour ...

Get, Create, Make and Sign instructions for form rv-3

How to edit instructions for form rv-3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form rv-3

How to fill out instructions for form rv-3

Who needs instructions for form rv-3?

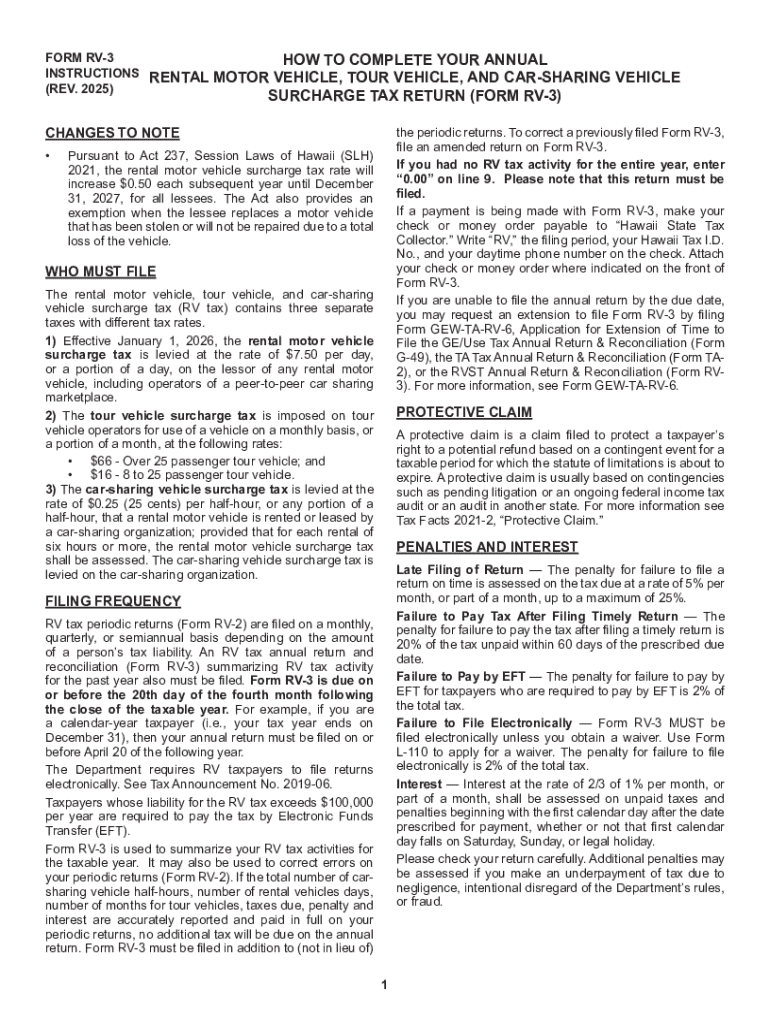

Instructions for Form RV-3

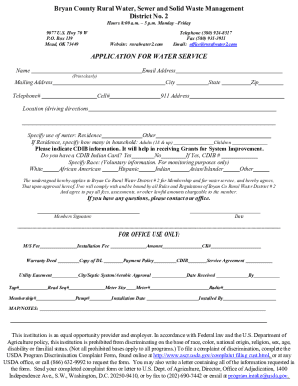

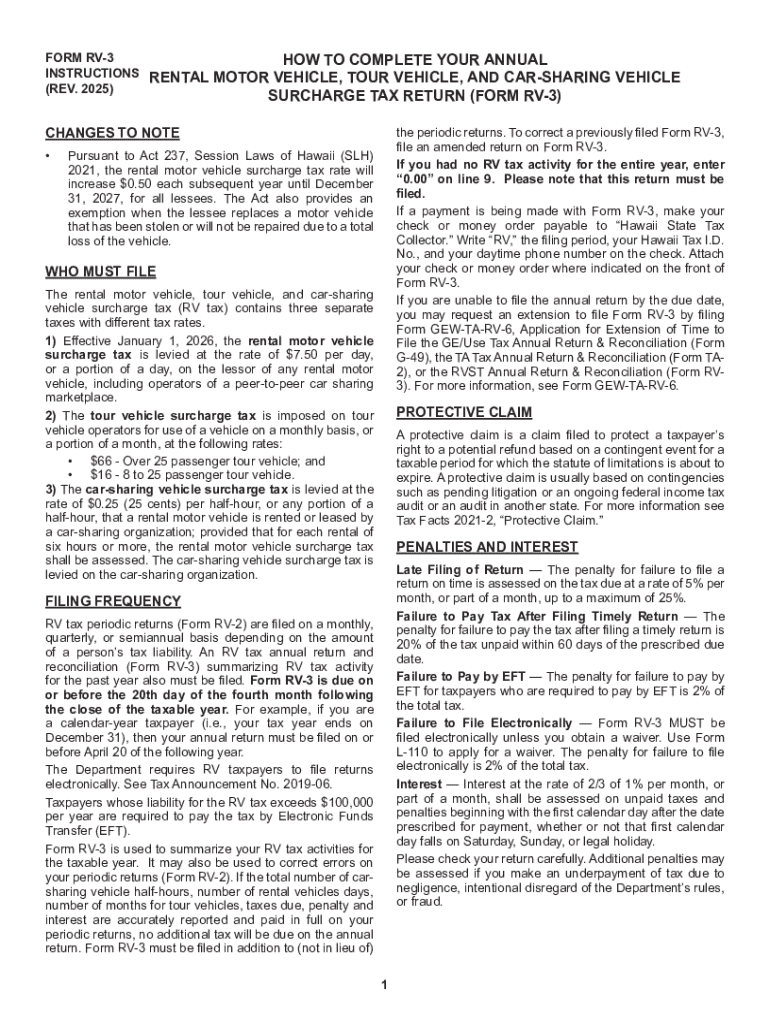

Overview of Form RV-3

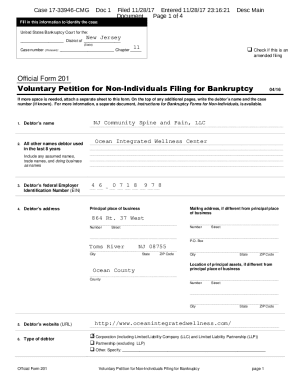

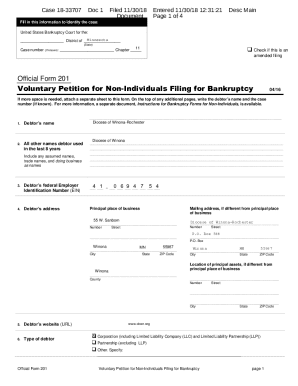

The RV-3 form plays a significant role in tax filings, specifically concerning surcharge taxes on vehicles in Hawaii. It's essential for businesses and individuals who own or operate vehicles subject to surcharge. The primary purpose of the RV-3 form is to calculate and report these surcharges, ensuring compliance with state regulations. By correctly filing this form, taxpayers preserve their eligibility for various deductions and maintain their standing with tax authorities.

Understanding who needs to file the RV-3 form is crucial. Typically, any business or individual operating vehicles that meet specific criteria must complete this form. This includes those involved in commercial transportation, rental services, or any enterprise utilizing taxable vehicles. Additionally, keeping abreast of key deadlines is essential; the RV-3 form is often due at the end of the tax year, typically around April 20th, requiring early preparation and diligence.

Detailed instructions on filling out Form RV-3

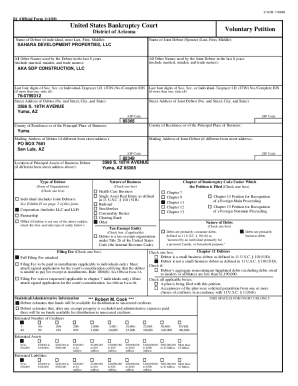

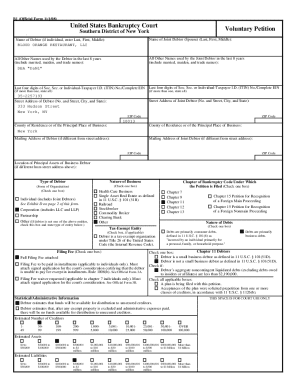

To ensure accuracy when filling out Form RV-3, understanding its structure is paramount. The first section requires personal and business information, including your name, address, and business identification number (BIN). Always confirm that these details match your documents to avoid processing delays.

The surcharge tax calculations section is where most users spend significant time. Begin by identifying taxable vehicles; this includes any vehicle that has been registered for use in Hawaii. For calculating surcharge amounts, reference the state's current surcharge rates that apply to your vehicle classification. This may involve consulting the state’s tax guidelines to ensure you don’t miss any updates or changes.

Selecting the right reporting year is another critical step. You should ensure that the tax year you are filing for matches your records, particularly if there have been changes in your vehicle list throughout the year. If you've offloaded any vehicles or acquired new ones, double-check that the form reflects these updates accurately.

Lastly, focus on the reconciliation section. It's vital to reconcile your reported figures with your records. Common mistakes often include miscalculation, omitting vehicles, or discrepancies in the reported taxable amount. To mitigate these issues, keep a separate log that details all your vehicle transactions throughout the year.

Editing and customizing your RV-3 form

pdfFiller offers a convenient platform for editing and customizing your RV-3 form. To begin editing, upload your form into the pdfFiller interface. You can import your existing files directly or create a new document using their template options.

One of the powerful features of pdfFiller is its text modification tools. Users can easily adjust wording, fill in fields, or remove unnecessary sections with a few clicks. Furthermore, accurate edits are achievable through autofill options that quickly populate fields based on previous entries, saving time and ensuring consistency.

Signing and submitting Form RV-3

Once your RV-3 form is completed, you will need to sign it. pdfFiller supports eSigning, which streamlines the signature process. To eSign your document, simply click on the signature field where you need to sign, follow the prompts to create or upload your signature, and place it accordingly within the document.

It's crucial to understand the validity of electronic signatures. eSignatures in pdfFiller are legally binding, ensuring your submitted form meets legal standards. After signing, you'll have multiple submission methods available. You can choose the online submission option via the state's tax portal for immediate processing, or alternatively, you can opt to mail your RV-3 form if you prefer traditional filing methods.

Managing your RV-3 documentation

Effective management of your RV-3 documentation goes beyond the submission. Using cloud storage options, such as those integrated within pdfFiller, can help keep your RV-3 submissions organized. This enables easy access and retrieval whenever needed, ensuring that all documentation is kept securely. Moreover, sticking to a version control system will aid in tracking changes made to your form over time.

When collaborating with your team on submissions, it’s beneficial to set specific permissions for document access. This prevents unauthorized changes while allowing key members to make necessary edits. Real-time collaboration tools within pdfFiller also facilitate discussions, comments, and feedback directly on the document, enhancing teamwork and reducing miscommunication.

Common questions and troubleshooting

Filing Form RV-3 can lead to several questions and issues. Common problems include submission errors due to missing information, incorrect calculations, and technical difficulties during the online submission process. It’s essential to stay informed about these issues to avoid delays or penalties. pdfFiller provides a helpline and support resources to assist with these concerns.

In the case of submission problems, addressing technical issues immediately is crucial. If your submission is mistakenly rejected or your calculations are flagged, backtrack your entries to identify inaccuracies. Do not hesitate to reach out to support for specific guidance tailored to your situation.

Related documents and additional forms

Filing Form RV-3 often requires additional related documents for comprehensive tax reporting. Familiarity with other required tax forms can ease your filing process, especially forms that align with your business operations and vehicle use. pdfFiller provides links to download these necessary forms and ensure complete compliance.

Moreover, recognizing state-specific additional filing requirements can make filing more straightforward. Each state may have variations in surcharge tax, necessitating specific adjustments in how the RV-3 is completed. Reviewing these regulations before beginning your filing will save time and prevent errors.

Linked topics for deeper understanding

In addition to understanding the RV-3 form, diving deeper into related topics such as surcharge taxes in Hawaii can provide critical insights into your tax obligations. Resources on business tax compliance help ensure you're not only filing correctly but also maximizing potential deductions available for licensed vehicles.

Insights into vehicle tax deductions and credits may also uncover additional savings opportunities. Staying informed on these matters equips you to navigate the complexities of tax filing more effectively, positioning your business for long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my instructions for form rv-3 in Gmail?

How do I edit instructions for form rv-3 in Chrome?

Can I create an electronic signature for the instructions for form rv-3 in Chrome?

What is instructions for form rv-3?

Who is required to file instructions for form rv-3?

How to fill out instructions for form rv-3?

What is the purpose of instructions for form rv-3?

What information must be reported on instructions for form rv-3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.