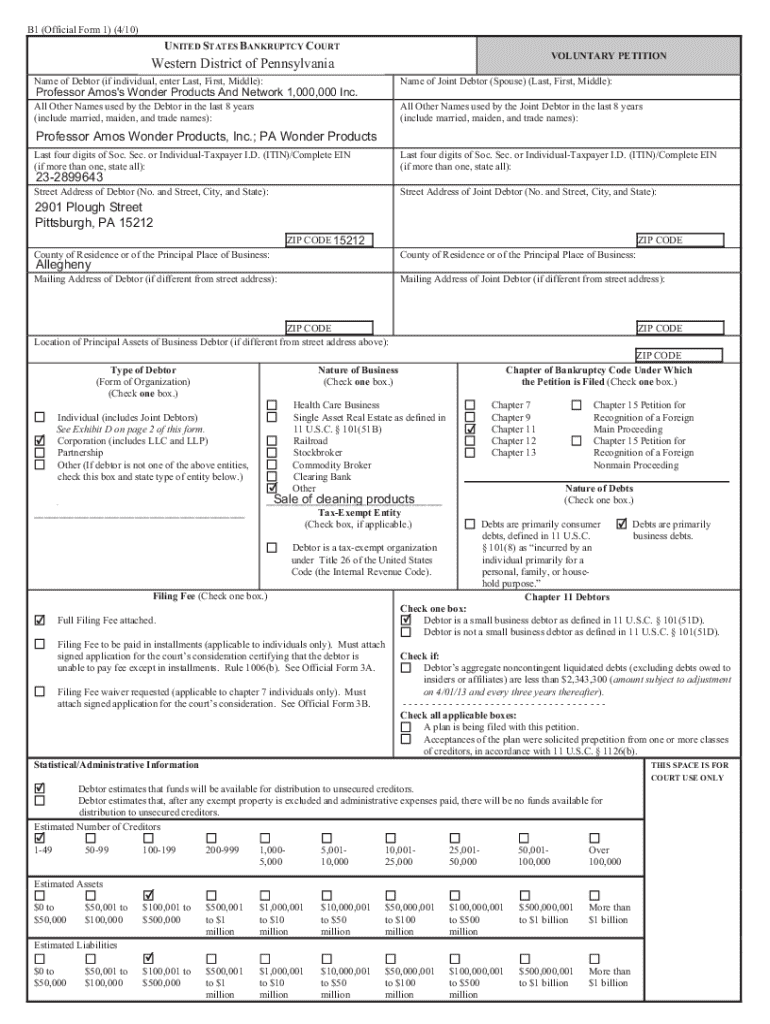

Get the free United States Bankruptcy Court Western District of Pennsylvania

Get, Create, Make and Sign united states bankruptcy court

Editing united states bankruptcy court online

Uncompromising security for your PDF editing and eSignature needs

How to fill out united states bankruptcy court

How to fill out united states bankruptcy court

Who needs united states bankruptcy court?

Understanding United States Bankruptcy Court Forms: A Comprehensive Guide

Understanding the United States Bankruptcy Court

The United States Bankruptcy Court plays a crucial role in the financial recovery process for individuals and businesses overwhelmed by debt. Bankruptcy is not merely a last resort; it serves as a structured method for individuals to address their financial obligations while offering a fresh start. The Bankruptcy Court is tasked with overseeing this process, ensuring fair treatment of creditors while enabling debtors to reorganize their financial lives.

In essence, the purpose of Bankruptcy Courts involves adjudicating bankruptcy cases, resolving disputes between creditors and debtors, and deciding on the discharge of debts. By functioning within federal jurisdiction, these courts maintain uniformity in the laws governing bankruptcy across all states, providing a consistent legal framework for debt management.

Jurisdictional overview

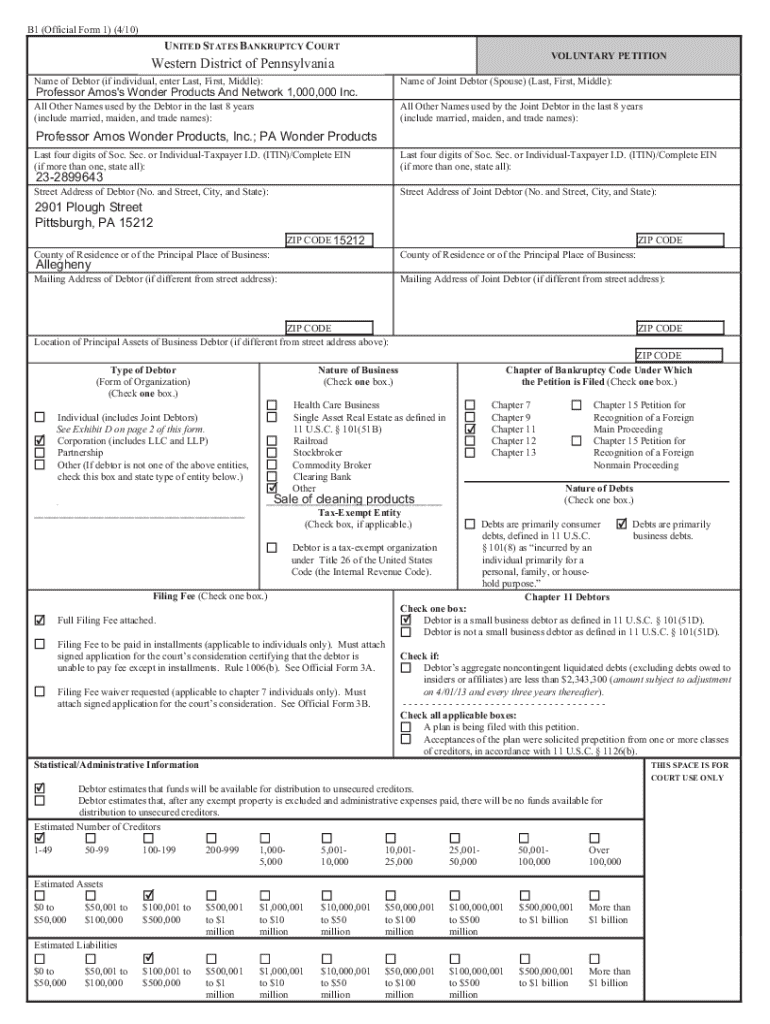

Bankruptcy law in the U.S. primarily involves three types of filings under Chapters 7, 11, and 13 of the Bankruptcy Code. Chapter 7 allows for the liquidation of non-exempt assets to pay creditors, while Chapter 11 is generally utilized by businesses seeking to reorganize their debts while maintaining operations. Chapter 13, on the other hand, offers individuals the chance to develop a repayment plan to pay back all or part of their debts over time. Each chapter has distinct implications for how assets, liabilities, and creditor relationships are handled.

The jurisdiction of U.S. Bankruptcy Courts is federal, but local courts exist within specific districts, allowing for localized rule variations. Debtors must navigate these local regulations when filing, emphasizing the importance of understanding both the overarching federal guidelines and the specific states’ rules.

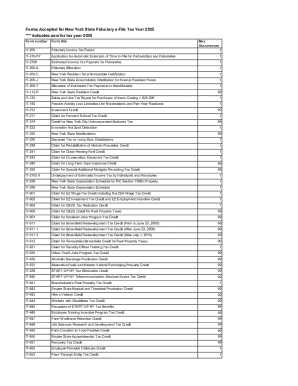

Key forms of the United States Bankruptcy Court

Navigating the landscape of bankruptcy court forms can feel overwhelming, but familiarizing yourself with the essential documents can streamline the process significantly. Several forms are frequently used across different types of bankruptcy cases, and knowing their purpose is crucial for effective filings.

Commonly used bankruptcy forms include:

In addition to these common forms, many jurisdictions also require local bankruptcy forms that cater specifically to state laws and procedures. These local forms vary significantly based on where you file, making it essential to research and utilize the specific requirements of your district.

Step-by-step guide to filling out bankruptcy court forms

Filling out bankruptcy court forms correctly is fundamental for ensuring a smooth application process. The first step is collecting essential personal and financial information. Key details you need to gather include:

Once you've gathered the necessary information, you can start filling out the official bankruptcy forms. Each form has its own set of requirements:

Detailed instructions for popular forms

For example, the Chapter 7 Petition Form requires inputs about your debts and assets, including detailed statements regarding your financial activities. It’s essential to be accurate to avoid complications.

Similarly, the Chapter 13 Repayment Plan outlines how you plan to repay creditors over a designated period. You need to demonstrate that your proposed plan is feasible and meets creditor requirements.

Lastly, the Notice of Bankruptcy Case Filing must clearly indicate the necessary details about your case and deadlines, ensuring all parties involved are adequately informed.

Interactive tools for completing bankruptcy forms

Creating, editing, and managing bankruptcy court forms can be daunting. However, tools such as pdfFiller provide intuitive, interactive solutions that simplify the form-filling process. With pdfFiller, users can effortlessly edit PDFs online, enabling seamless updates to their forms without the hassle of printing and re-scanning documents.

Features available in pdfFiller include collaborative tools that let teams work together on documents in real-time. This aspect is particularly beneficial for individuals who may be filing jointly or for families navigating these complex legal waters together.

Signing and submitting bankruptcy forms

The signing process for bankruptcy forms is easily facilitated through electronic signatures, which are legally recognized in U.S. bankruptcy proceedings. This not only saves time but also allows for compliant submission regardless of your physical distribution.

Here's how to execute the electronic signing process:

After successfully signing your forms, consider the submission options available. You can choose to submit your forms online, file them in-person at your local court, or send them through regular mail. Be aware of important deadlines and filing tips to ensure your case progresses efficiently.

Managing bankruptcy documents post-filing

Once you've filed your bankruptcy forms, organization becomes key to managing the next steps of your journey. Newly minted bankruptcy documents can accumulate quickly, so it’s advisable to follow best practices for document management. Keep all paperwork related to your case, including creditors' correspondence, court notices, and filed forms, organized chronologically.

You can enhance your oversight using available tracking tools to monitor your bankruptcy case’s progress. These tools can alert you to any upcoming court dates or deadlines, ensuring that you remain proactive as your repayment plan or case unfolds.

Common concerns arise when navigating this process, leading many to questions around filing procedures, potential liabilities related to their assets, or updates about their case status. Consulting with local legal aid can provide additional support.

Additional support resources

Seeking assistance during bankruptcy proceedings can significantly ease the burdens of filing and the emotional weight often associated with financial distress. Local legal aid services provide access to resources and professionals who can guide you through the specific requirements of your case.

Connecting with bankruptcy attorneys is another vital step in navigating this landscape. Legal representation can help clarify rights and responsibilities, ensuring you avoid potential pitfalls during the filing process. It's important to choose an attorney familiar with the nuances of local bankruptcy law.

Finally, consider tapping into online support forums and communities where individuals share their experiences and insights. Engaging with others who find themselves in similar circumstances can alleviate feelings of isolation and empower you with additional knowledge and strategies.

Conclusion: Empowering your bankruptcy journey with pdfFiller

Utilizing a cloud-based platform like pdfFiller can streamline and enhance your experience. As you navigate the intricacies of bankruptcy courts and familiarize yourself with the myriad of forms, the importance of effective document management cannot be overstated.

In summary, remember these quick tips for successful bankruptcy filing: meticulous record-keeping, knowledge of jurisdictional requirements, proficiency in using available tools, and seeking proper legal guidance. Such strategies can empower you to take meaningful steps towards regaining control over your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send united states bankruptcy court for eSignature?

Can I create an electronic signature for signing my united states bankruptcy court in Gmail?

How do I fill out united states bankruptcy court on an Android device?

What is united states bankruptcy court?

Who is required to file united states bankruptcy court?

How to fill out united states bankruptcy court?

What is the purpose of united states bankruptcy court?

What information must be reported on united states bankruptcy court?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.