Get the free Official Bankruptcy FormsEastern District of New York

Get, Create, Make and Sign official bankruptcy formseastern district

Editing official bankruptcy formseastern district online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official bankruptcy formseastern district

How to fill out official bankruptcy formseastern district

Who needs official bankruptcy formseastern district?

Official Bankruptcy Forms - Eastern District Guide

Understanding bankruptcy forms: Eastern District overview

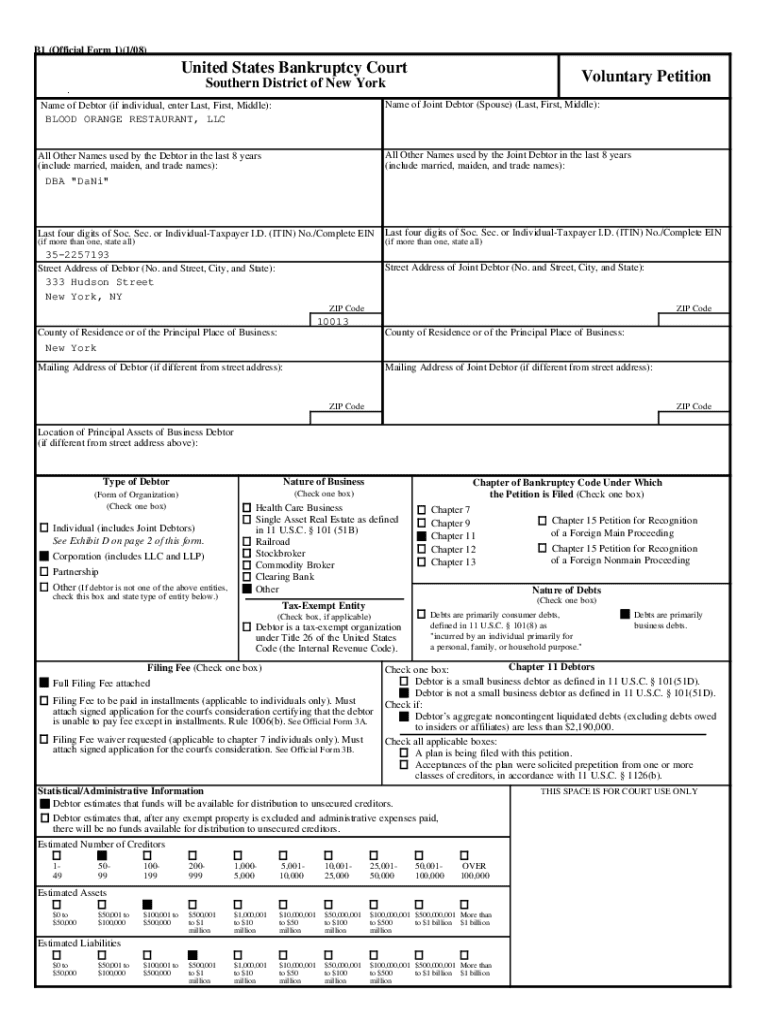

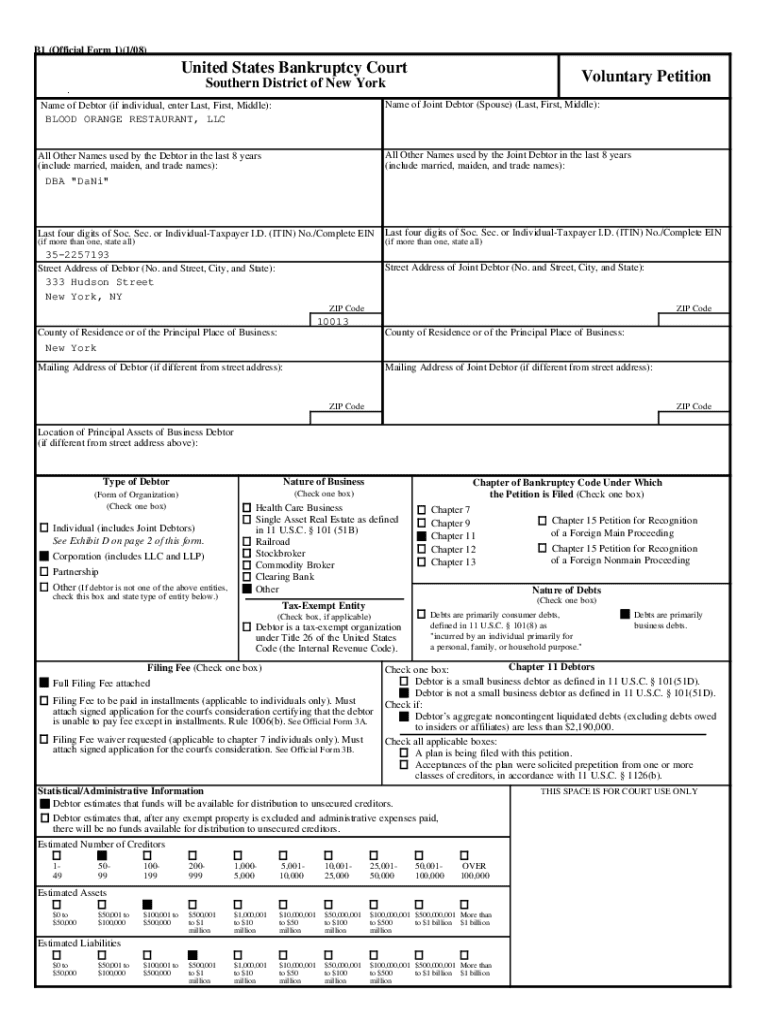

Bankruptcy forms are crucial documents that individuals or organizations must complete to petition the court for bankruptcy protection. In the Eastern District, these forms have specific requirements tailored to the local court rules and procedures. Understanding the nuances of these forms is essential for a successful filing.

Utilizing official forms in the Eastern District of Wisconsin, which encompasses areas like Milwaukee and Green Bay, ensures compliance with local regulations. The Eastern District court has distinct protocols that must be followed to effectively navigate the bankruptcy process. Familiarity with these procedures will enhance your chances of a smooth filing and management of your bankruptcy case.

Types of bankruptcy forms in the Eastern District

The Eastern District offers various types of bankruptcy forms based on the chapter of bankruptcy being filed. Primarily, individuals file under Chapter 7 or Chapter 13, each having unique requirements and forms. Understanding these specific forms is crucial for any filers.

Chapter 7 bankruptcy forms

Filing for Chapter 7 bankruptcy necessitates a set of required forms, including the Petition for Bankruptcy, Schedules A through J, and Statement of Financial Affairs. It's essential to include information detailing all debts, assets, income, and monthly expenses.

Chapter 13 bankruptcy forms

When filing for Chapter 13 bankruptcy, filers must complete several forms, including the Chapter 13 Plan, which outlines the repayment strategy for debts over three to five years. Distinctively, Chapter 13 focuses on restoring financial stability through structured payments, unlike the liquidation approach of Chapter 7.

Other relevant forms may include those for adversary proceedings, motions, and applications essential in navigating potential disputes or additional filings necessary throughout the bankruptcy process.

Where to find official bankruptcy forms

Finding official bankruptcy forms in the Eastern District is streamlined through several resources. The primary source for accessing these forms is the official court website, which provides direct links to downloadable forms tailored for your specific bankruptcy filing.

Official court website resources

You can directly visit the Eastern District's official court website where all the necessary forms are available. These documents are updated to align with current legal standards, ensuring that you’re using the most accurate versions.

pdfFiller: Your ultimate resource

In addition to the court website, pdfFiller serves as a powerful tool for managing your bankruptcy forms. It allows easy editing, online signing, and sharing capabilities, simplifying the journey for individuals and teams involved in the bankruptcy process.

Filling out your bankruptcy forms: Step-by-step instructions

Successfully completing your bankruptcy forms begins with thorough preparation. You need to gather personal and financial details, including income statements, tax returns, and any existing debts. Accurate record-keeping at this stage is vital for successful submission and eventual approval.

Completing Chapter 7 forms

For Chapter 7 filings, ensure you accurately report income and expenses. Special consideration must be given to the means test, which determines eligibility for Chapter 7 bankruptcy. It’s advisable to consult with a bankruptcy attorney to avoid common pitfalls and make sure that your forms reflect your financial situation accurately.

Completing Chapter 13 forms

When preparing Chapter 13 forms, focus particularly on the repayment plan. You must itemize your disposable income, detailing how much you can afford to pay creditors monthly. Making accurate calculations is crucial, as inaccurate figures may lead to plan rejection.

Common mistakes to avoid

Common mistakes include failing to provide complete financial disclosures, miscalculating income or expenses, and inaccuracies in listing debts. Make sure to double-check completed forms and, where possible, consult with a bankruptcy attorney for verification.

Editing and managing your bankruptcy forms

Post-completion, managing your bankruptcy forms is just as critical. Utilizing pdfFiller not only allows for easy editing but also facilitates collaboration. If you are working with a bankruptcy attorney or financial advisor, they can review and provide input directly in the platform, ensuring that everything is accurate before submission.

Using pdfFiller for document editing

pdfFiller makes the editing process straightforward. You can upload completed PDF forms, make changes as required, and save them for future submissions. The platform supports various file formats and allows for easy document management and organization.

eSigning your bankruptcy forms

One of the significant advantages of using pdfFiller is the ability to eSign your bankruptcy forms digitally. Digital signatures are not only legally valid but also save time and streamline the filing process. This feature allows you to maintain a comprehensive and organized filing system without the need for physical paperwork.

Filing your bankruptcy forms: The process

Once your documents are prepared, understanding how to properly file them is next. The Eastern District offers electronic filing options through the court's e-filing system, which many find to be more efficient than in-person submission.

How to submit forms to the court

For electronic filing, create an account on the court's efile page to begin the submission process. Follow the instructions provided to ensure that your forms are correctly uploaded. If you prefer the traditional method, in-person submissions can be made at your local bankruptcy court.

Confirmation of filing

After filing your forms, expect confirmation from the court. Monitoring for this confirmation is essential, as it validates that your bankruptcy case has been officially initiated. Additionally, keep a copy of all submitted documents for your personal records.

Understanding the aftermath: What happens next?

Once your bankruptcy forms have been filed, a series of post-filing procedures take effect. This includes mandatory credit counseling, which must be completed before your case can advance. You're also required to attend a Meeting of Creditors, also known as the 341 Meeting, where your creditors may question you about your finances.

Keep in mind, following your bankruptcy filing; tracking the case progress is crucial. Many courts provide online portals where you can view the status of your case as it proceeds through the judicial system.

Fees associated with bankruptcy filing in the Eastern District

Filing for bankruptcy in the Eastern District incurs various fees. A standard Chapter 7 filing fee is approximately $335, while a Chapter 13 filing fee is close to $310. Understanding these figures is essential for budget planning, especially when considering the costs involved in a bankruptcy case.

Payment plans for filing fees

For individuals unable to pay the filing fees upfront, the court allows for payment plans. In many cases, you can request to pay in installments, reducing the immediate financial burden associated with filing for bankruptcy.

Waivers and reductions: Who qualifies?

Certain individuals may qualify for fees waivers based on income criteria. Understanding if you meet these qualifications can alleviate some of the financial stress associated with bankruptcy filings. It is advised to consult legal assistance to navigate these options effectively.

Essential tips for successfully navigating the bankruptcy process

Successfully navigating the bankruptcy process requires diligence and attention to detail. Best practices include meticulous documentation, ensuring that all financial records are up-to-date and accurately reflect your current financial situation.

Maintaining accurate records will streamline the process and minimize any potential legal complications. Moreover, consistently reviewing and organizing paperwork can help maintain clarity and an organized approach throughout your bankruptcy journey. Seeking networking support can also be beneficial.

How pdfFiller enhances your bankruptcy filing experience

Choosing pdfFiller enhances your experience by providing a user-friendly interface for document management. Its features are designed specifically for bankruptcy forms, streamlining each step of the filing process from editing to signing.

This platform not only allows individuals to manage documents efficiently but also empowers users with tools that facilitate collaboration with attorneys, ensuring that all aspects of your filing are addressed comprehensively.

Benefits of choosing pdfFiller for document management

The main benefits include ease of access to templates, the capability to fill forms electronically, and the option to secure documents. Furthermore, pdfFiller ensures that all essential features tailored to financial difficulties and bankruptcy filings are at your disposal, making the process seamless and less stressful.

Success stories: Users who simplified their process with pdfFiller

Numerous users have reported that pdfFiller helped them navigate their bankruptcy filings efficiently. By utilizing the platform’s features, they were able to eliminate confusion, save time, and ultimately achieve better outcomes in their bankruptcy cases.

Bonus section: FAQs on Eastern District bankruptcy forms

Navigating the complexities surrounding bankruptcy forms can generate numerous questions. Common queries often arise regarding document requirements, filing processes, and timelines crucial for ensuring your case proceeds without issues.

Informative answers to these questions can significantly enhance comprehension of the bankruptcy filing process. For individuals who may find themselves struggling or who have questions specific to their situation, seeking professional help from a Chapter 13 bankruptcy attorney can provide the clarity needed to move forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my official bankruptcy formseastern district in Gmail?

How do I edit official bankruptcy formseastern district online?

How do I complete official bankruptcy formseastern district on an iOS device?

What is official bankruptcy forms eastern district?

Who is required to file official bankruptcy forms eastern district?

How to fill out official bankruptcy forms eastern district?

What is the purpose of official bankruptcy forms eastern district?

What information must be reported on official bankruptcy forms eastern district?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.