Get the free Estate Planning Checklist: Documents & To-Dos

Get, Create, Make and Sign estate planning checklist documents

Editing estate planning checklist documents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate planning checklist documents

How to fill out estate planning checklist documents

Who needs estate planning checklist documents?

Estate Planning Checklist Documents Form: Detailed Guide

Understanding estate planning: Why it matters

Estate planning is essential for anyone wanting to secure their legacy and dictate how their assets and affairs are handled after they pass away. By adhering to a well-structured estate planning checklist documents form, you ensure that your wishes regarding health, family, and financial matters are respected and enacted. Without such planning, your estate could fall into disarray, potentially leading to family disputes or assets being distributed contrary to your desires.

Furthermore, failing to create an estate plan can have dire consequences, including higher taxes or prolonged legal battles over your estate. Contrary to common myths, estate planning is not just for the wealthy or older adults; it applies to anyone who wants to plan for their future, health, and financial well-being. Misconceptions can prevent many people from taking this crucial step towards securing their futures.

The ultimate estate planning checklist: A step-by-step guide

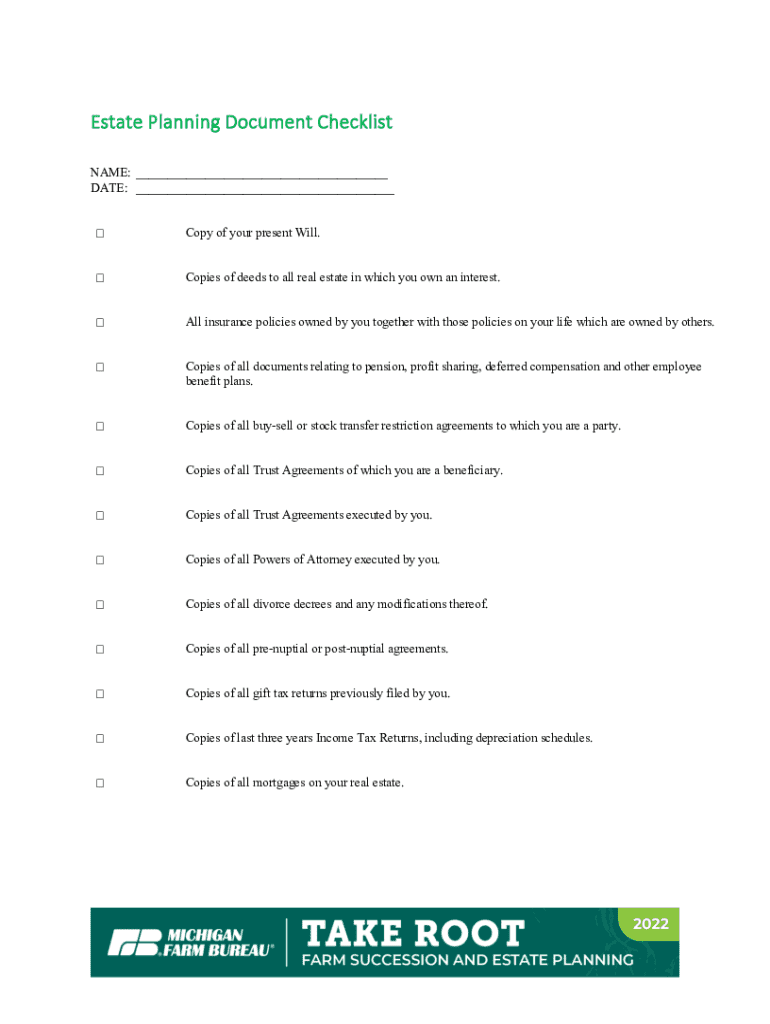

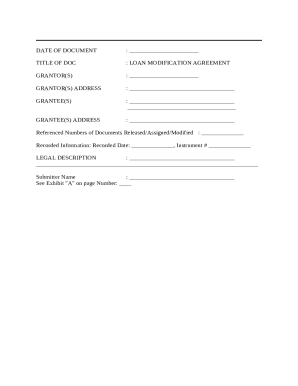

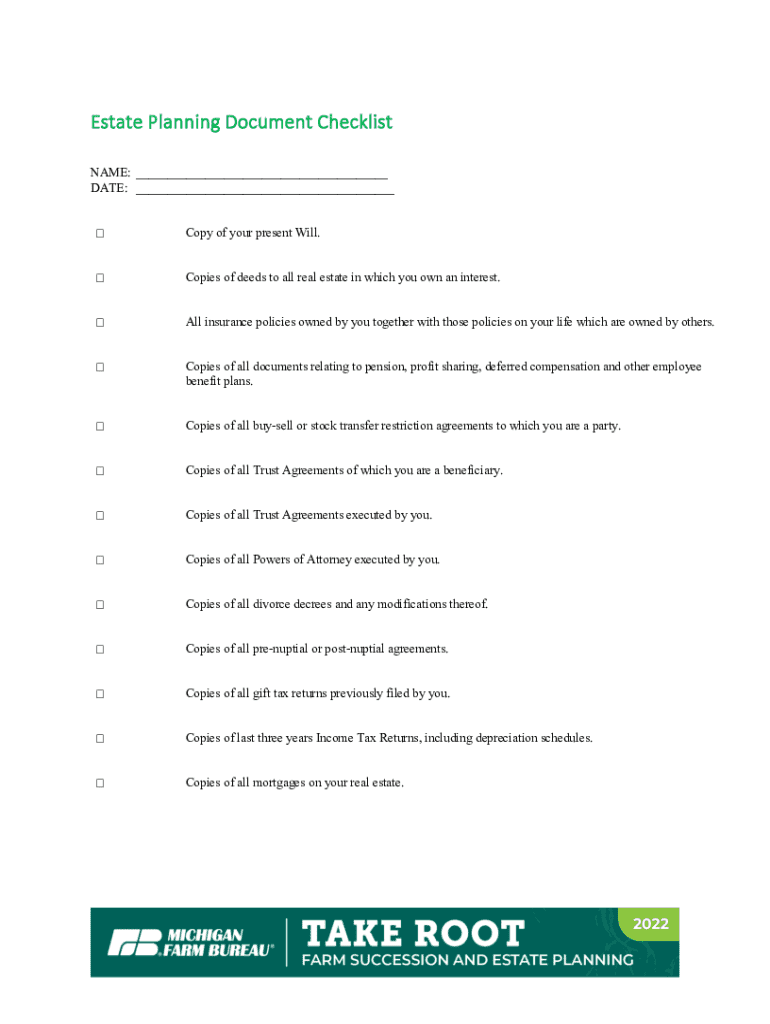

A comprehensive checklist for estate planning helps individuals and families gather the necessary documentation and information to ensure all of their desires are duly recorded. The checklist typically comprises two main categories: personal and financial documents, each containing essential components like a will, trust, and power of attorney.

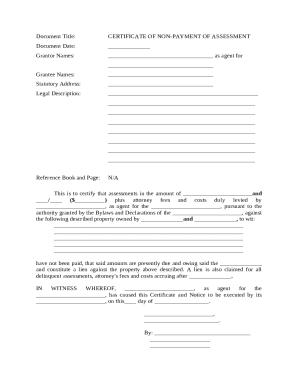

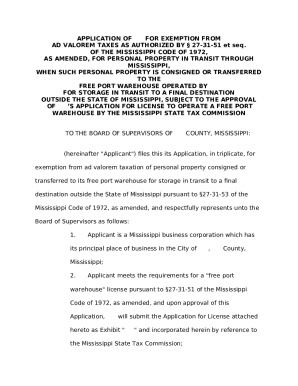

Additionally, organizing your assets and debts is paramount. Compile a detailed inventory of all valuable items, including real estate, investments, and personal belongings. This prepares your heirs for an easier transition and minimizes confusion.

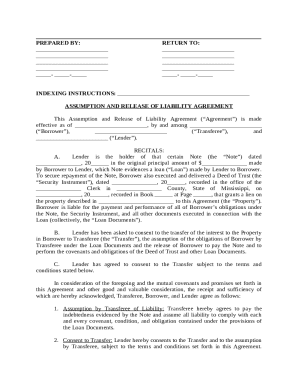

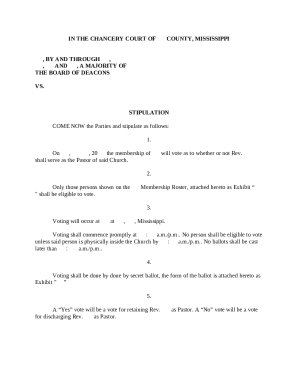

Essential estate planning documents

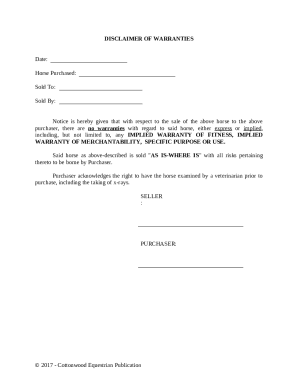

Understanding the purpose of essential estate planning documents can make the process less daunting. Here’s a deeper dive into specific documents you need to consider.

Pitfalls can arise during preparation for estate planning. Many overlook the importance of ensuring these documents are legally binding, regularly updated, or fail to involve family members in discussions about your wishes, potentially leading to misunderstandings and disputes.

Interactive tools for document creation and management

To facilitate the estate planning process seamlessly, pdfFiller offers interactive document tools that simplify form filling and document management. These tools enable users to upload existing documents, utilize templates, and edit fields with ease.

Cloud-based solutions, like pdfFiller, enhance accessibility and collaboration, enabling individuals to manage their estate planning documents from any location. This flexibility allows family members and advisors to access the documents as needed, which can further prevent miscommunication and ensure everyone is on the same page.

Streamlining the estate planning process

Before filling out important documents, gathering all necessary information can streamline the estate planning process. Create a checklist of your assets, debts, specific wishes, and potential guardians.

Collaboration is also crucial; discussing your plans with family members or legal professionals helps clarify your wishes and iron out any concerns. Moreover, it is crucial to review and update your estate plan regularly. Life changes—such as marriage, divorce, the birth of a child, or significant financial changes—can all necessitate an update to your estate planning documents.

Case studies: Successful estate planning examples

Examining real-life scenarios accentuates the significance of comprehensive estate planning. For instance, one family navigated a potential conflict over a family property after their father unexpectedly passed away. Without a will, the property was left to an estranged sibling, leading to prolonged legal disputes.

Conversely, another family proactively outlined their estate plan, ensuring an equitable distribution of assets and clear instructions for healthcare decisions. This advanced planning brought peace during a time filled with grief.

These examples highlight that thorough and thoughtful estate planning can prevent family disputes, safeguard cherished assets, and provide clarity during challenging transitions.

Frequently asked questions (FAQ)

As you navigate the process of creating an estate plan, you might have several questions. Here are answers to some common inquiries:

Key takeaways: Mastering your estate planning

In summary, mastering your estate planning checklist documents form is crucial for ensuring your wishes are honored and your loved ones are cared for. An organized approach not only protects against potential conflicts but also secures your legacy for future generations. Starting today can deeply impact how your life and assets are managed in the future.

Related topics for further exploration

If you're interested in more about estate planning, consider exploring the role of trusts in estate planning, strategies for minimizing estate taxes, and setting up digital asset management to protect your online presence.

Testimonials: User experiences with pdfFiller

Users have shared positive experiences about utilizing pdfFiller for their estate planning needs. Individuals and legal teams alike appreciate the user-friendly features and excellent customer support that make the process simple and efficient.

Connect with us

Stay connected with pdfFiller for the latest updates on estate planning best practices. Follow us on social media and subscribe to our newsletter to receive valuable insights directly to your inbox.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my estate planning checklist documents in Gmail?

Where do I find estate planning checklist documents?

Can I create an electronic signature for signing my estate planning checklist documents in Gmail?

What is estate planning checklist documents?

Who is required to file estate planning checklist documents?

How to fill out estate planning checklist documents?

What is the purpose of estate planning checklist documents?

What information must be reported on estate planning checklist documents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.