Get the free LEG. FINANCE

Get, Create, Make and Sign leg finance

Editing leg finance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out leg finance

How to fill out leg finance

Who needs leg finance?

Leg Finance Form: A Comprehensive How-to Guide

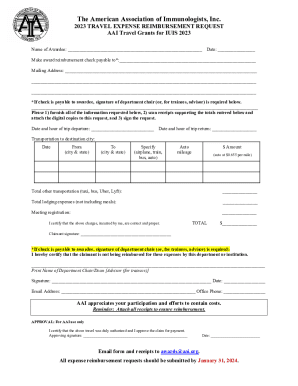

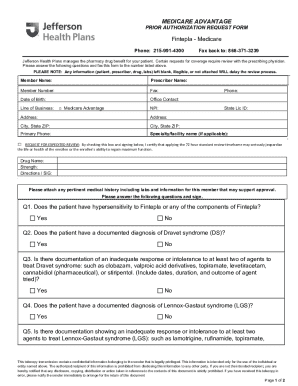

Overview of the Leg Finance Form

The leg finance form is a crucial document used in the realm of financial management, allowing individuals and organizations to report their financial data accurately. Its primary purpose is to ensure transparency and compliance with legislative requirements. In essence, it acts as a standardized means of presenting financial information to relevant authorities.

The importance of the leg finance form extends beyond mere compliance; it plays a vital role in the organization's financial health by facilitating informed decision-making. By ensuring that proper records are maintained and submitted, stakeholders including financial managers, auditors, and regulatory bodies can assess the fiscal status and operational efficiency of an organization.

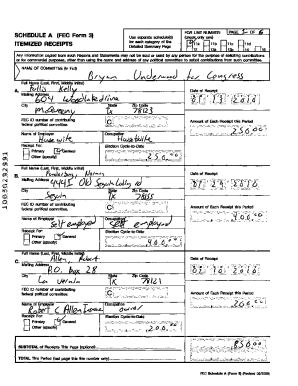

Types of Leg Finance Forms

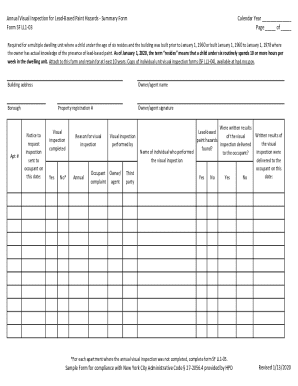

Various leg finance forms cater to different financial situations and reporting requirements. Common types include annual financial statements, income tax forms, and budget proposals, each serving a distinct function in fiscal management.

Choosing the appropriate leg finance form is crucial as it affects the accuracy of reported data and its interpretations. For instance, while an annual financial statement provides an overview of financial performance for the year, a budget proposal enables stakeholders to foresee future financial allocations and needs.

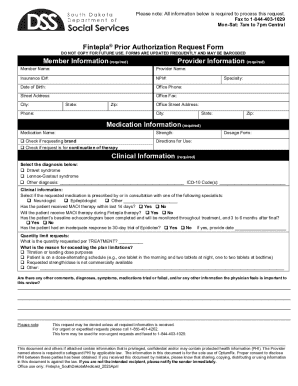

Preparing to fill out the leg finance form

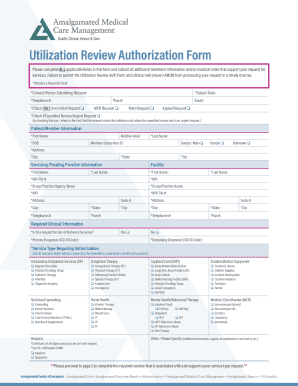

Before diving into completing the leg finance form, gathering essential documents is paramount. Identification documents such as driver's licenses or Social Security cards can establish personal or organizational identities. Meanwhile, financial records, including bank statements and tax returns, provide necessary data to fill out the form accurately.

Moreover, understanding the legal language commonly found in these forms is critical. Terms like 'fiscal year,' 'net worth,' and 'liabilities' can be confusing. Familiarizing yourself with these concepts not only aids in completing the form correctly but also enhances your financial literacy and boosts your confidence in managing finances.

Step-by-step instructions for completing the leg finance form

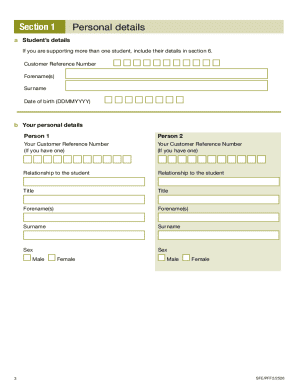

Completing the leg finance form can be a straightforward process if you follow organized steps. Start with Section 1, where you'll enter basic information about the individual or entity submitting the form. This typically includes names, contact details, and information regarding your financial institution.

Moving on to Section 2, you'll provide a detailed breakdown of your financial information. Accurately report all sources of income, expenses, and particularly, valuation assessments, which help in understanding the net worth. Ensure all figures are current, as outdated information could lead to misrepresentations.

Section 3 includes supplementary details that might require additional disclosures, such as pending lawsuits or other legal considerations. Finally, in Section 4, conduct a thorough review. This critical step helps identify errors or areas needing clarification before submission.

Utilizing interactive tools on pdfFiller

Engagement in filling out leg finance forms can significantly be enhanced through interactive tools provided by platforms like pdfFiller. These tools offer step-by-step guidance, simplifying the often complex filling process. An auto-fill feature can further alleviate the burden, allowing users to quickly input repetitive information.

Benefits of using pdfFiller specifically for leg finance forms include cloud-based access, which supports on-the-go filling. This is particularly advantageous for individuals and teams who need to work collaboratively from different locations, sharing real-time updates and comments, ultimately streamlining the completion process.

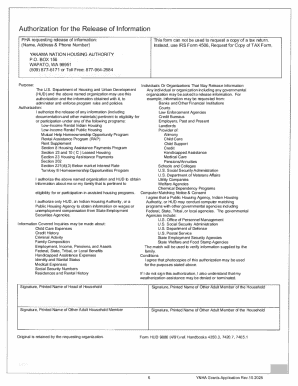

Editing and signing the leg finance form

After completing the leg finance form, editing may be necessary to ensure all information is correct. pdfFiller provides smart editing tools that enable seamless modifications without losing original formatting. Users can adjust numerical entries, add notes, or make comments that clarify complex financial data.

Furthermore, digital signatures hold legal weight today, ensuring that the signed document is valid and compliant. Legally accepted signing methods include e-signatures facilitated by pdfFiller, which provide security and a clear record of the signer's intent, crucial for maintaining integrity in financial dealings.

Managing and storing your completed leg finance form

Once the leg finance form is completed and submitted, managing and storing the document is equally important. Best practices include utilizing cloud solutions for storage, which provides ease of access and reduces risks associated with physical storage. Additionally, it's wise to keep several versions of the document, thereby enabling you to track changes and ensure that you can refer back to prior data if necessary.

With pdfFiller, sharing options are robust. Users can send forms securely to necessary stakeholders, setting access controls and permissions where needed. This ensures that sensitive information remains protected while still facilitating collaboration.

Case studies: Successful implementation of the leg finance form

Examining real-life examples of organizations that have effectively utilized the leg finance form underscores its utility. A small non-profit used it to streamline their annual financial report, which led to improved transparency with stakeholders and a substantial increase in funding opportunities.

Similarly, a local business compiled accurate budgets using this form, enabling them to adjust financial strategies based on detailed assessments. Analyzing these outcomes reveals that organizations with disciplined use of leg finance forms not only enhance their compliance but also improve their overall financial management and strategic planning.

Common challenges and solutions

Despite its importance, completing the leg finance form can often present challenges. Commonly encountered issues include misunderstanding certain sections or overestimating financial projections, both of which can lead to errors in submission. Recognizing these common pitfalls is the first step to addressing them effectively.

Utilizing the support resources available through pdfFiller can mitigate many of these problems. With an extensive FAQ section and customer support readily accessible, users can quickly find answers to their pressing questions and streamline their experience in filling out the leg finance form.

Future trends in leg finance forms

As technology continues to evolve, its impact on financial documentation is pronounced. The future of leg finance forms will likely see increasing automation and digitization, streamlining processes and reducing human error significantly. Standardization across forms will also improve compliance and facilitate easier understanding across various sectors.

Furthermore, the role of cloud-based solutions like pdfFiller will only grow, allowing for better document management efficiency. These platforms offer tools that not only help with completing forms but also with tracking regulatory changes, ensuring users remain compliant even as laws evolve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get leg finance?

How do I fill out leg finance using my mobile device?

How do I edit leg finance on an iOS device?

What is leg finance?

Who is required to file leg finance?

How to fill out leg finance?

What is the purpose of leg finance?

What information must be reported on leg finance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.