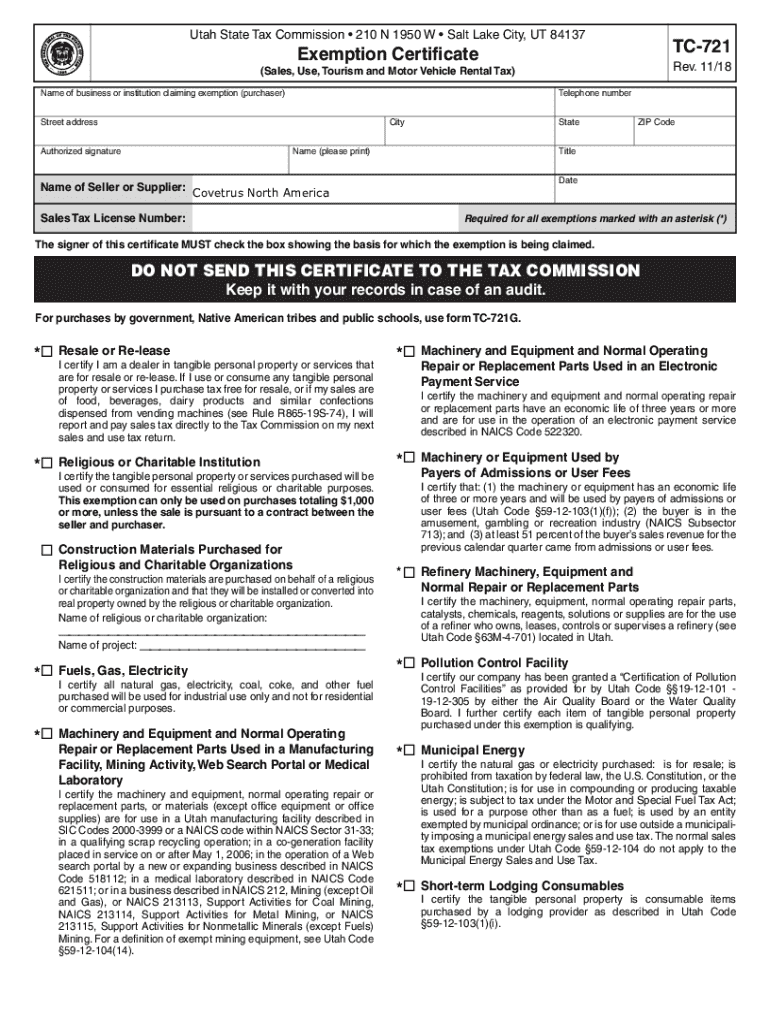

Get the free Motor Vehicle Rental TaxesUtah State Tax Commission

Get, Create, Make and Sign motor vehicle rental taxesutah

Editing motor vehicle rental taxesutah online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor vehicle rental taxesutah

How to fill out motor vehicle rental taxesutah

Who needs motor vehicle rental taxesutah?

Understanding Motor Vehicle Rental Taxes in Utah

Understanding motor vehicle rental taxes in Utah

Motor vehicle rental taxes in Utah play a critical role in regulating the rental vehicle industry while ensuring that the state generates revenue to support various public services. These taxes are levied on anyone who rents out motor vehicles, ranging from traditional cars to recreational vehicles, impacting both rental companies and their clients. Comprehending these taxes is essential not only for compliance but also for effective financial planning.

Compliance with Utah's state tax laws is paramount for vehicle rental businesses. Non-compliance can lead to hefty fines and sanctions, so it’s crucial for rental companies to stay informed about current regulations. For renters, these taxes can add to the overall cost of renting a vehicle, influencing rental decisions especially in tourism-centric areas where visitors may be less familiar with the additional fees.

Tax commission responsibilities and regulations

The Utah State Tax Commission plays an integral role in administering motor vehicle rental taxes, overseeing compliance, and ensuring that businesses follow the relevant tax codes. This body is responsible for implementing tax regulations, collecting revenues, and providing essential guidance to rental vehicle operators. Rental businesses must navigate this bureaucracy effectively to sustain operations without legal hiccups.

Understanding the key regulations surrounding motor vehicle rental taxes is critical for all involved parties. The tax rates can vary based on several factors, including vehicle type and location, making it necessary for rental companies to keep abreast of applicable laws and the Utah tax code. Failure to comply with these regulations can result in audits and financial penalties.

Determining rental tax rates

Determining the rental tax rates in Utah involves understanding a complex web of factors. Currently, the state imposes a base rental tax rate that can vary depending on the county or city of the rental business. For instance, urban areas with higher tourist traffic such as Salt Lake City often have increased rates compared to more rural regions. This fluctuation is significant as it directly influences the final cost of rentals for individuals.

Several factors influence these tax rates beyond location. Vehicle type is crucial; different vehicles, such as SUVs, luxury cars, or vans, can have distinctly different rental tax implications. Rental companies must meticulously calculate these rates to ensure they’re compliant and can accurately inform customers. Here are some simplified examples of how taxes are calculated based on specific rental conditions.

Exemptions and adjustments

Certain exemptions may apply to motor vehicle rentals in Utah. These could include rentals for government use, specific non-profit organizations, or rentals that are a part of an educational program. Understanding the criteria behind these exemptions can save rental businesses considerable amounts in taxes while ensuring they remain compliant with state regulations.

Applying for tax exemptions typically requires detailed documentation and an understanding of applicable tax codes. Rental companies should stay updated with legislative changes, as temporary tax adjustments can affect rental practices. For instance, during economic downturns or crises like the COVID-19 pandemic, the Utah government has occasionally enacted temporary tax relief measures for businesses, impacting how rentals are taxed.

Steps to apply for a sales-related tax account

To operate legally, rental businesses in Utah must apply for a sales-related tax account through the Taxpayer Access Point (TAP). This online service by the Utah State Tax Commission simplifies the registration process. To apply, businesses will need specific information including their Federal Employer Identification Number (FEIN), business structure details, and estimated monthly revenue. A well-prepared application ensures a smoother registration experience.

Common mistakes when applying include incomplete forms or misinformation. Rental operators should take meticulous care not to overlook any section of the application, as missing data can lead to delays or denials. Once submitted, applications undergo a verification process before companies receive their tax account numbers, allowing them to comply with rental tax regulations.

Filing motor vehicle rental taxes

Filing motor vehicle rental taxes involves understanding specific reporting requirements and deadlines. Depending on the annual revenue of a rental business, the filing frequency could be either monthly or quarterly. Knowing whether to file monthly or quarterly is essential for cash flow management, and accurately reporting taxable revenues is critical to ensure compliance and avoid penalties.

Common errors in filing can include miscalculating the tax owed or failing to report all taxable rentals. If mistakes are discovered after submission, corrective measures can be taken using the appropriate forms, demonstrating the importance of diligence and accuracy in tax filings. Thankfully, document management platforms like pdfFiller can simplify record-keeping and ensure that submissions remain organized and accessible.

Payment procedures

Upon filing, rental companies must remit their motor vehicle rental taxes according to specified payment procedures. Utah offers several accepted payment methods, including electronic transfers, credit card payments, and checks, providing flexibility to businesses. Knowing the payment deadlines is also crucial, as late payments can result in fines and additional interest charges.

Late payments can be especially detrimental, adding up significantly over time. Rental companies should manage their cash flow carefully to ensure timely payments and maintain a good standing with the Utah State Tax Commission. Staying aware of tax liabilities and corresponding deadlines establishes a reliable payment pattern, reducing the risk of inadvertently facing penalties.

Forms and publications related to motor vehicle rental taxes

Filing motor vehicle rental taxes requires the completion of specific forms, tailored to meet Utah's standards. One key document is the Motor Vehicle Rental Tax Return form, which rental companies must fill out accurately to report taxable revenues. Additionally, other forms may be necessary depending on the nuances of a business's operations, including exemption applications.

Utah's government provides various online publications outlining regulations, tax guidelines, and filing instructions. Accessible resources help rental businesses stay compliant and understand their obligations fully. Maintaining meticulous records of all tax documentation and correspondence with the state is crucial, as it aids in resolving potential discrepancies during audits or inquiries.

Legal framework: statutes and rules

The legal framework governing motor vehicle rental taxes in Utah comprises a set of statutes and rules structured to define the tax obligations of rental companies. Key laws include provisions in the Utah Code Title 59, which details how rental taxes are applied and collected. Staying informed of any changes in legislation is crucial for compliance, as the tax landscape can shift with new state budgets or economic initiatives.

The Utah Department of Revenue plays an essential role in enforcing these regulations and offers resources to assist businesses in adhering to the laws governing motor vehicle rentals. Staying updated with changes in legislation can help companies avoid potential pitfalls and legal complications related to tax compliance.

Navigating problems and disputes

Rental companies may occasionally face disputes regarding motor vehicle rental taxes or specific regulations. Common issues include misinterpretations of tax responsibilities or audits triggered by discrepancies in reported revenues. To effectively navigate these situations, companies should maintain a transparent relationship with the Utah State Tax Commission and be prepared to provide supporting documentation.

Guidance on dispute resolution can typically be found on the state tax commission’s website. Establishing open lines of communication can greatly assist in resolving concerns expediently. Furthermore, resources are available through professional tax advisors who can provide insights into resolving disputes effectively, ensuring businesses can remain compliant while protecting their interests.

Leveraging pdfFiller for motor vehicle rental tax documents

Using pdfFiller’s document management tools can greatly streamline the process of creating and editing forms related to motor vehicle rental taxes. From filling out the Motor Vehicle Rental Tax Return to submitting exemption applications, pdfFiller provides an intuitive interface that simplifies compliance efforts for rental businesses. The platform's easy eSign feature enables quick signing of documents, ensuring all submissions are timely and accurate.

Additionally, pdfFiller allows for collaboration among teams working on tax-related documentation, enhancing overall efficiency. Its cloud-based solution means that critical documents are accessible from anywhere, which aligns perfectly with the digital-first approach of today's businesses. By embracing pdfFiller, rental companies can enhance compliance while enjoying a more manageable workflow.

Interactive tools for simplifying renters' responsibilities

Making informed choices is a crucial part of renting a vehicle, and interactive tools can significantly help renters understand their tax obligations. Online tax calculators tailored for Utah's rental taxes can aid individuals in estimating potential expenses before completing a reservation. Additionally, resources like FAQs and educational videos help renters navigate the complexities of rental taxes.

Education on rental tax responsibility is vital for both rental companies and their clients. Various platforms also provide community engagement opportunities where individuals can share insights and experiences, helping create a more informed rental market. Together, these tools foster a better understanding of the rental tax environment and ensure that both parties meet their respective responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find motor vehicle rental taxesutah?

How do I edit motor vehicle rental taxesutah straight from my smartphone?

Can I edit motor vehicle rental taxesutah on an Android device?

What is motor vehicle rental taxesutah?

Who is required to file motor vehicle rental taxesutah?

How to fill out motor vehicle rental taxesutah?

What is the purpose of motor vehicle rental taxesutah?

What information must be reported on motor vehicle rental taxesutah?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.