Get the free Company End of Year Letter to Customer Child Care

Get, Create, Make and Sign company end of year

How to edit company end of year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out company end of year

How to fill out company end of year

Who needs company end of year?

Understanding the Company End of Year Form: A Comprehensive Guide

Understanding the company end of year form

The company end of year form is a crucial document that organizations use to summarize their annual financial performance. This form serves the purpose of consolidating various financial data, enabling the management to evaluate the year’s profits, revenues, and expenses against their forecasts. It is paramount for companies not only for internal analysis but also for complying with government regulations and preparing for tax submissions.

Complete and accurate completion of the company end of year form is vital for year-end financial reporting. It plays a significant role in ensuring that all the necessary financial information is disclosed to stakeholders and regulatory bodies, thereby fostering transparency. Furthermore, stakeholders rely on the accuracy of this form to make informed decisions about investment and resource allocation.

Who needs to fill out the company end of year form?

The necessity of filling out the company end of year form is universal across different business entities, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Every entity that generates income or is subject to tax reporting must complete this form annually, regardless of its size or revenue. Ensuring legal compliance is especially critical for small businesses, which often face stringent regulations and potential penalties for oversight.

However, there are exceptions. For instance, nonprofit organizations have different reporting requirements, while certain newly established businesses may not need to file for their initial year if they haven’t commenced operations. Each department within a company, such as HR and Accounting, plays a role in the process, pulling necessary employee data, benefit expenses, and financial records to complete the form accurately.

Preparing to complete the company end of year form

Before diving into the completion of the company end of year form, it’s essential to gather all the necessary documents and information. The preparation phase sets the foundation for accuracy and efficiency. Begin by compiling your financial statements, including balance sheets, income statements, and cash flow statements, as these will provide the financial summary required for the form.

Additionally, employee-related information such as wages, benefits, and contributions to retirement plans must be organized. Use checklists to track collected data, ensuring nothing is overlooked. Efficient organization of financial data, such as categorizing income sources and expenses, can make the completion process smoother and more systematic.

Step-by-step guide to filling out the company end of year form

Completing the company end of year form can be broken down into manageable steps that ensure thoroughness and compliance. By following these essential actions, you can guarantee that your form is filled out correctly.

Common challenges when completing the company end of year form

Filling out the company end of year form can present challenges that disrupt the process. One prevalent issue is the misclassification of income and expenses, which can lead to discrepancies in financial reporting. Businesses often lack adequate record-keeping practices, making it difficult to produce accurate data necessary for the form.

Moreover, addressing discrepancies becomes an added complexity, particularly during audits or financial reviews. Companies must have systematic approaches in place to resolve inconsistencies in reporting, which may require additional documentation or clarification from payroll and HR departments.

Tips for avoiding penalties and ensuring compliance

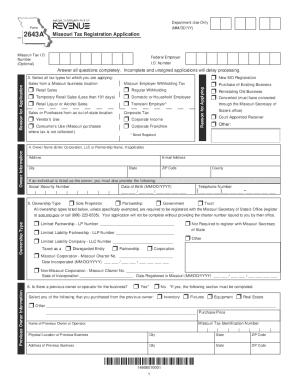

To avoid penalties when completing the company end of year form, it's vital to familiarize yourself with IRS regulations regarding income and expenses. Staying updated on changes in tax law can help your business maintain compliance and minimize risks. Establish a timeline that includes critical deadlines and adhere to filing dates set by regulatory authorities.

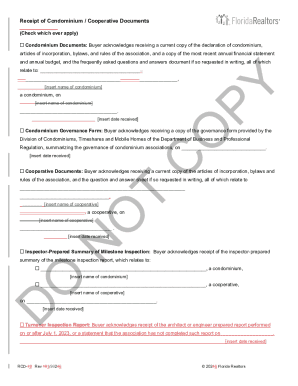

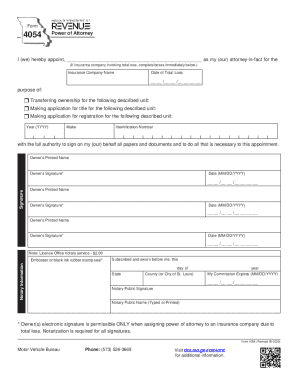

Implementing effective document management practices with tools such as pdfFiller can enhance your workflow. Use PDF editing and management features to ensure accuracy and completeness in your submissions while safeguarding against errors that could lead to penalties.

Utilizing PDF tools for form completion

Leveraging technology simplifies the process of completing the company end of year form. pdfFiller provides various features that streamline document management, allowing for easier editing, signing, and collaboration. Utilizing these tools can significantly enhance the efficiency of your workflow.

With pdfFiller, users can access and edit the company end of year form seamlessly from any internet-enabled device. The platform’s features facilitate e-signing, enabling teams to collaborate effectively, eliminating the hassle of physical document exchanges and allowing for timely submissions.

Best practices for maintaining year-end financial records

To ensure smooth processing during year-end, implementing best practices for maintaining financial records is crucial. Regular organization and updating of your records throughout the year can prevent a rush to gather documents as the final accounting phase approaches. Establish a consistent filing system for all financial documents, utilizing both digital and physical storage solutions.

In addition, using cloud-based solutions can enhance accessibility and security for sensitive financial information. By regularly reviewing your company’s financial performance against set benchmarks, you can identify potential issues early, allowing your business to make adjustments throughout the year and ensuring that your company end of year form reflects accurate financial health.

The role of software in streamlining year-end processes

The use of software tools has revolutionized how businesses manage their year-end processes. Document management platforms like pdfFiller provide an integrated solution that not only simplifies the filling and signing of the company end of year form but also allows for enhanced collaboration among team members. An overview of these platforms reveals functionalities that streamline various parts of form completion.

When comparing pdfFiller with other software tools, the ease of use and features specifically designed for collaboration and document management stand out. Intelligent HCM solutions embedded within these platforms aid companies in planning payroll options while ensuring compliance with unemployment tax and other financial regulations, allowing businesses to focus on growth rather than paperwork.

FAQs about the company end of year form

Clarifying common questions regarding the company end of year form can enhance understanding and compliance. One prevalent query is what to do if the filing deadline is missed. In such cases, it's advisable to file as soon as possible to mitigate penalties and rectify any potential flaws in your tax obligations. Companies can also amend their forms if errors are discovered post-submission, ensuring they maintain compliance.

Additionally, many wonders how long they need to keep records related to their company end of year form. As a best practice, retain these records for at least seven years, ensuring adequate time for audits and reviews from government entities. Maintaining comprehensive documentation strengthens financial reporting and supports the preparation of future annual filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify company end of year without leaving Google Drive?

How do I complete company end of year online?

How do I make changes in company end of year?

What is company end of year?

Who is required to file company end of year?

How to fill out company end of year?

What is the purpose of company end of year?

What information must be reported on company end of year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.