Get the free Form 943 Worksheet

Get, Create, Make and Sign form 943 worksheet

How to edit form 943 worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 943 worksheet

How to fill out form 943 worksheet

Who needs form 943 worksheet?

Comprehensive Guide to the Form 943 Worksheet Form

Understanding Form 943

Form 943 is specifically designed for agricultural employers to report annual federal income tax withholding, Federal Insurance Contributions Act (FICA) taxes, and additional employee taxes for farmworkers. Unlike other tax forms, such as Form 941, which is filed quarterly, Form 943 captures a full year’s worth of information concerning agricultural workers. This distinction is critical for employers in the farming sector.

The importance of Form 943 cannot be overstated; it ensures that agricultural employers comply with federal tax regulations relevant to their specific workforce. This focus not only streamlines reporting for seasonal and full-time agricultural workers but also aligns the tax obligations of farm employers with their unique operational needs.

What you need to fill out Form 943

Filling out Form 943 requires specific pieces of essential information to ensure accurate and compliant reporting. First, you will need your Employer Identification Number (EIN), which acts as a unique identifier for your business. Additionally, you must provide payroll information, including gross wages, tips, and any other forms of compensation paid to your employees. Furthermore, details about your farmworkers, including their Social Security numbers and the amount of taxes withheld, are critical.

To streamline the completion of Form 943, gather relevant documents and data beforehand. Compile previous payroll records, tax liabilities, and a summary of payments made throughout the year. This will simplify the data entry process and ensure you don’t miss any crucial information that could affect your tax standing.

Filing timeline for Form 943

The filing timeline for Form 943 is critical for agricultural employers to maintain compliance with tax obligations. Generally, Form 943 is due on January 31 of the following year for which it reports. If you file electronically, you may qualify for a deadline extension until the end of February, but planning ahead is always advisable to avoid last-minute complications.

Understanding tax payment schedules is equally important. Employers must ensure that they are making timely payments alongside their filings to avoid penalties. Late filings can result in hefty fines, and consistent issues can trigger audits by the IRS.

Instructions for completing the Form 943

Completing Form 943 involves several detailed steps to ensure that all required sections are accurately filled. Start by entering your employer details, including your EIN and business name. Next, on successive lines, report total wages, tips, and other compensation paid to employees, followed by specific withholding amounts for federal income tax, Social Security tax, and Medicare tax.

After tallying these amounts, check for potential exemptions and adjustments that may apply to your specific situation—this could include any previous year's overpayment or qualifying credit adjustments. A common mistake includes misreporting numbers; therefore, double-check calculations for accuracy, and don’t forget to sign and date the form in the designated section.

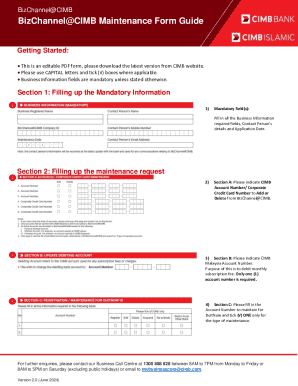

Utilizing pdfFiller for your Form 943 worksheet

To simplify the process of completing and managing Form 943, pdfFiller offers robust tools designed for ease of use. By accessing the pdfFiller platform, you can find editable Form 943 templates. These templates allow you to fill out the form, perform edits, and ensure your document meets all federal requirements without hassle.

The platform also features electronic signature options, enabling you to sign the form digitally and send it directly to your tax agency. Furthermore, collaborative tools within pdfFiller enhance team productivity; multiple users can work on the same document in real time, resolving potential errors and miscommunications.

Exploring recent updates to Form 943

It is crucial for agricultural employers to stay informed about changes to Form 943, particularly as annual tax legislation can introduce new requirements or alter existing ones. For the latest tax year, updates may include adjusted withholding rates or revised reporting standards. Keeping an eye on official IRS communications or reliable tax news sources can help you navigate these changes effectively.

The impact of legislative changes can significantly influence your compliance strategy and financial planning. If any major amendments occur, resource guides provided by pdfFiller and other professional tax services can be invaluable in adapting quickly and efficiently.

Frequently asked questions about Form 943

Many employers have questions about the applicability of Form 943. One common inquiry is whether Form 943 applies only to agricultural employers or if other businesses should utilize it. The answer is straightforward—this form is specifically for agricultural employers with farmworkers, making it a unique requirement for this sector.

Another frequent question relates to penalties for errors made on Form 943. Misreporting can lead to financial penalties and complications with the IRS, making it vital to double-check all entries. If a mistake is made after filing, employers can amend a filed Form 943 by submitting the corrected form along with an explanation for the changes.

Comparative analysis: choosing between Form 943 and Form 941

Understanding the contexts in which each form should be utilized is essential for employers. Form 943 is focused on agricultural businesses and is used annually, while Form 941 is for most other types of businesses and is filed quarterly. This difference is key; agricultural businesses have unique payroll structures that benefit from the specific guidelines outlined in Form 943.

When deciding between these forms, consider factors such as your business type, size, employee count, and payroll structure. Smaller agricultural businesses with fewer employees might find Form 943 easier to navigate, while larger operations may need more detailed reporting mechanisms through Form 941.

Switching providers for payroll services

Recognizing when it might be time to change payroll providers is crucial for maintaining efficient and compliant payroll processing. Signs include excessive errors in payroll processing, a lack of customer service responsiveness, or a failure to keep up with technological advancements that facilitate easier tax filings.

When comparing features between popular payroll services, focus on aspects like user interface, customer support, compliance tracking, and integration with other business systems. Consider how pdfFiller can enhance your document management experience through its easy-to-use interface and efficient workflow capabilities.

Recent articles on tax compliance for agricultural businesses

Engaging with articles and publications tailored to agricultural businesses can provide fresh insights into tax compliance strategies and regulations. Current publications often highlight best practices for navigating new tax changes or offer expert opinions on emerging tax issues faced by agricultural employers.

These articles can serve as a valuable resource for understanding the landscape of agricultural tax compliance, and they often discuss the practical implications of legislation on your responsibilities as a farm employer.

Visual tools and resources available on pdfFiller

pdfFiller provides a suite of visual tools and resources that make the process of filling out the Form 943 more intuitive and user-friendly. Interactive checklists guide you through each step of completion, ensuring no detail is overlooked. Video guides can further assist in navigating specific sections of the form, reducing the chance of errors.

In addition to these guides, templates are available to streamline your overall tax preparation process. These resources allow business owners to focus on their farming operations while ensuring compliance with their tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 943 worksheet from Google Drive?

How can I send form 943 worksheet for eSignature?

How do I make changes in form 943 worksheet?

What is form 943 worksheet?

Who is required to file form 943 worksheet?

How to fill out form 943 worksheet?

What is the purpose of form 943 worksheet?

What information must be reported on form 943 worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.