FL Tourist Development Tax Return - Brevard County 2015 free printable template

Show details

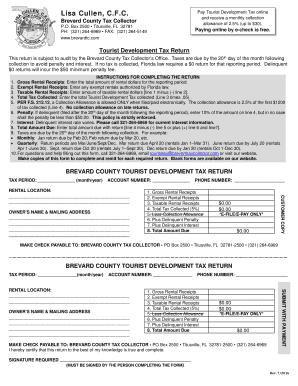

BREVARD COUNTY TOURIST DEVELOPMENT TAX RETURN TAX PERIOD: (please enter month & year) SUBMIT WITH PAYMENT DELINQUENT IF NOT POSTMARKED BY: the 20th of the month following the month the tax was collected

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL Tourist Development Tax Return

Edit your FL Tourist Development Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL Tourist Development Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL Tourist Development Tax Return online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit FL Tourist Development Tax Return. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL Tourist Development Tax Return - Brevard County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL Tourist Development Tax Return

How to fill out FL Tourist Development Tax Return - Brevard

01

Begin by downloading the FL Tourist Development Tax Return form for Brevard from the official website or obtain a physical copy.

02

Fill out your personal information in the designated fields, including your name, business name, and contact information.

03

Insert the reporting period for which you are filing the tax return.

04

Calculate the total rental income earned during the reporting period and enter it in the appropriate section.

05

Determine the tax rate applicable to your rental income and calculate the total tax due.

06

Complete any additional sections required, such as exemptions or deductions, if applicable.

07

Review all entries for accuracy and completeness before submitting.

08

Sign and date the form where indicated.

09

Submit the completed tax return either online or by mailing it to the designated tax authority.

Who needs FL Tourist Development Tax Return - Brevard?

01

Anyone who rents out short-term accommodations in Brevard County, including vacation rentals, hotels, or other lodging facilities.

02

Property owners who are required by law to report and pay the Tourist Development Tax.

03

Businesses involved in the rental of properties within Brevard County that collect rental income from tourists.

Fill

form

: Try Risk Free

People Also Ask about

What is the phone number for the Brevard County tourist development tax?

Attn: Tourist Tax Dept. Applications may be obtained from our main office located at 400 South St., 6th Floor, Titusville, FL 32780 or for more information contact our office at (321) 264-6969 or (321) 633-2199.

Is there a tourist tax in Florida?

Must I, as a homeowner, charge tourist development tax on my own residence, or other units that I own? Yes, you must charge the 5 percent tourist development tax, as well as 6.5 percent Florida sales tax. Please contact the Florida Department of Revenue at (239) 338-2400 for information on Sales Tax.

Do tourists pay sales tax in Florida?

Florida law allows for a Tourist Development Tax. Individual counties may impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, RV parks, condominiums, or timeshare resorts for a term of six months or less.

What is Duval tourist development tax?

The TDT is paid by the tenants or guests and is not a tax on the property owner. The TDT is in addition to the 7.5% taxes collected for sales and use which is remitted to the State of Florida, Department of Revenue (DOR). A transient rental carries a total tax rate of 13.5%.

How much is tourist development tax in Florida?

The Tourist Development Tax (also referred to as tourist tax, bed tax or resort tax) is a 6% charge on the revenue from rentals of six months or less. (The tax increased to 6% on 10/1/2022.) This tax is in addition to the state sales tax (7% in Sarasota County).

What is the tourist tax in Brevard County Florida?

What is the Tourism Tax? The Tourist Development Tax, also known as a "bed tax", currently adds a 5% tax to short-term rentals (six months or less) of hotels, motels, apartment hotels, rooming houses, RV parks, and condominiums in Brevard County.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my FL Tourist Development Tax Return directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your FL Tourist Development Tax Return and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in FL Tourist Development Tax Return?

With pdfFiller, the editing process is straightforward. Open your FL Tourist Development Tax Return in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I fill out FL Tourist Development Tax Return on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your FL Tourist Development Tax Return from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is FL Tourist Development Tax Return - Brevard?

The FL Tourist Development Tax Return for Brevard is a form that businesses operating in Brevard County must file to report the collection of tourist development taxes from rental properties or accommodations offered to visitors.

Who is required to file FL Tourist Development Tax Return - Brevard?

Any person or business that rents or leases accommodations in Brevard County for a period of six months or less is required to file the FL Tourist Development Tax Return.

How to fill out FL Tourist Development Tax Return - Brevard?

To fill out the FL Tourist Development Tax Return, you need to provide details such as your business information, total gross receipts from rentals, the total tax collected, and any applicable exemptions. The form can typically be obtained online or from the Brevard County Tax Collector's office.

What is the purpose of FL Tourist Development Tax Return - Brevard?

The purpose of the FL Tourist Development Tax Return is to collect taxes that support tourist-related projects, facilities, and programs in Brevard County, helping to enhance the local tourism infrastructure and economy.

What information must be reported on FL Tourist Development Tax Return - Brevard?

The information that must be reported includes the total amount of rentals collected, the tourist development tax rate applied, any exemptions claimed, net taxable sales, and the total amount of tourist development taxes collected during the reporting period.

Fill out your FL Tourist Development Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL Tourist Development Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.