AU NAT 3092 2015 free printable template

Show details

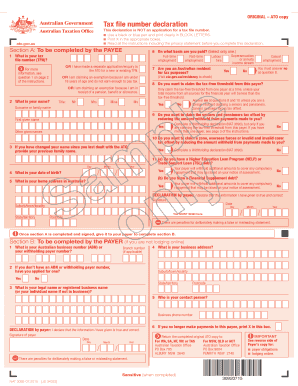

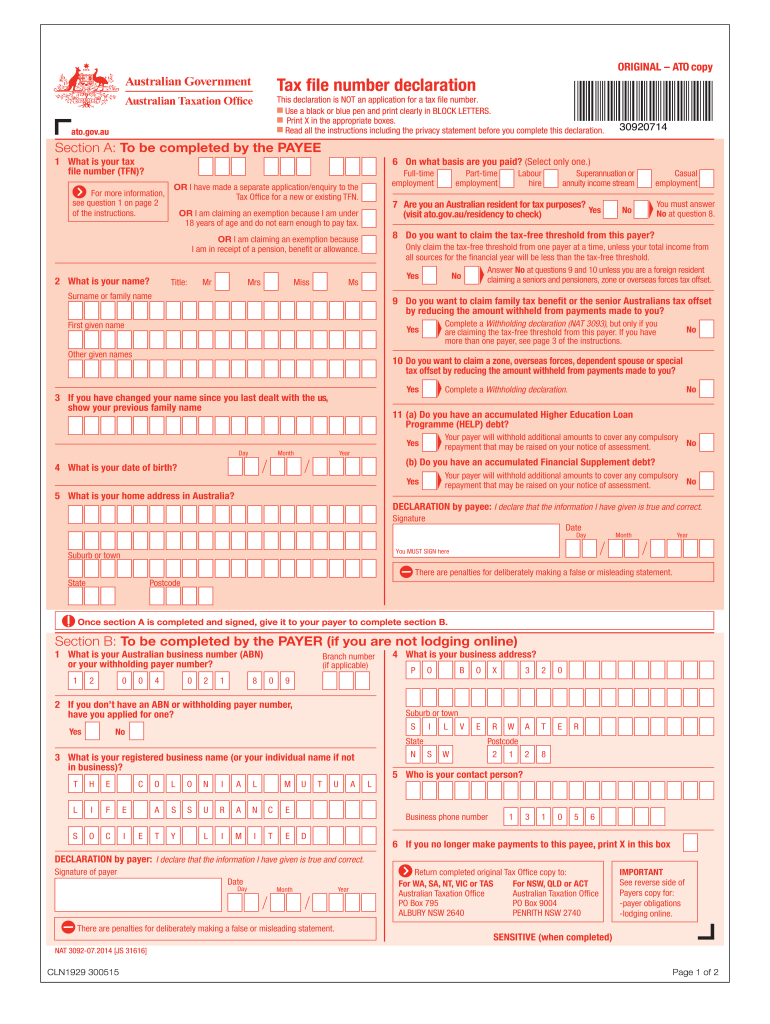

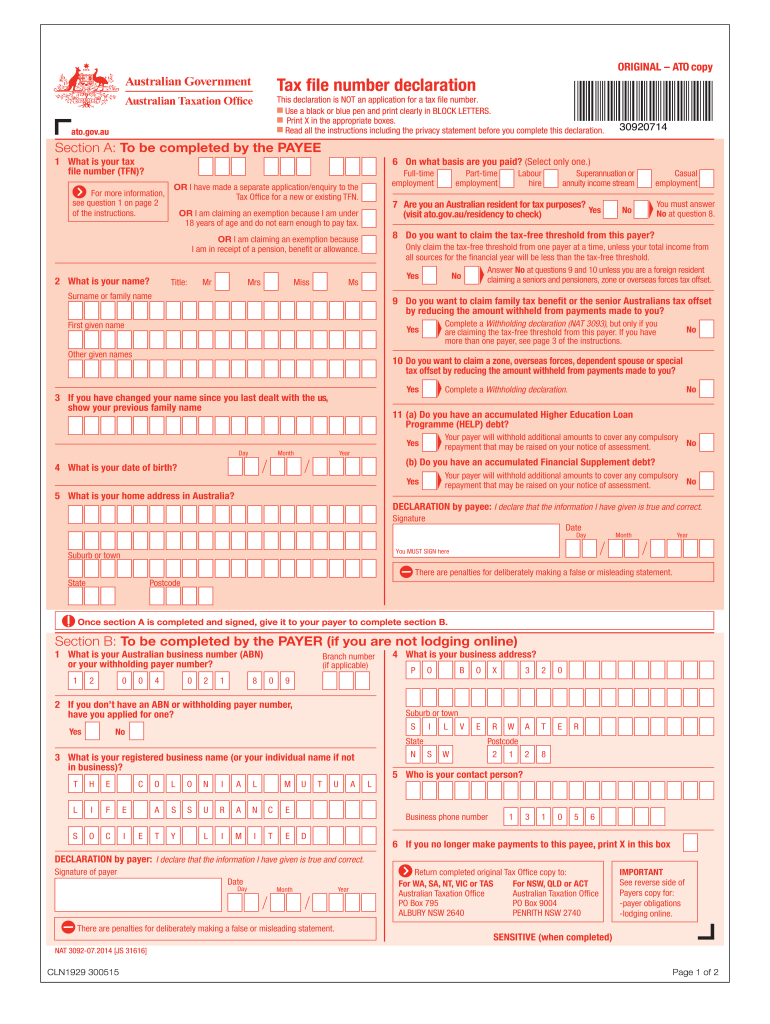

ORIGINAL ATO copy Tax LE number declaration This declaration is NOT an application for a tax LE number. Use a black or blue pen and print clearly in BLOCK LETTERS. Print X in the appropriate boxes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU NAT 3092

Edit your AU NAT 3092 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU NAT 3092 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU NAT 3092 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AU NAT 3092. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NAT 3092 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU NAT 3092

How to fill out AU NAT 3092

01

Obtain the AU NAT 3092 form from the official website or relevant authority.

02

Fill out your personal details, including your name, address, and date of birth.

03

Provide any relevant identification documents as instructed.

04

Specify the purpose of your application in the designated section.

05

Ensure that all fields are completed accurately to avoid delays.

06

Review the form for any errors or omissions.

07

Submit the completed form according to the provided instructions, either online or by mail.

08

Keep a copy of the submitted form for your records.

Who needs AU NAT 3092?

01

Individuals applying for a visa or immigration status in Australia.

02

People who require a specific assessment related to their residency.

03

Those who need to provide evidence of their identity or circumstances to Australian authorities.

Fill

form

: Try Risk Free

What is nat 3092 tax file declaration form?

NAT 3092-07.2016. Instructions and form for taxpayers. Tax file number. declaration. Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you.

People Also Ask about

Can I file taxes from 5 years ago?

Filing Back Tax Returns Remember, you can file back taxes with the IRS at any time, but if you want to claim a refund for one of those years, you should file within three years. If you want to stay in good standing with the IRS, you should file back taxes within six years.

What is the TFN declaration for?

A TFN declaration applies to payments made after the declaration is provided to you. The information provided on this form is used to determine the amount of tax to be withheld from payments based on the PAYG withholding tax tables we publish.

Can I file my 2015 taxes in 2021?

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return's original due date.

Can I still file my 2015 taxes in 2021?

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return's original due date.

Can I eFile 2015 tax returns?

More In Tax Pros Prior Year Returns – MeF allows filing of prior year 1040 returns. As a new tax form type is added to the MeF platform, tax returns will be accepted for the current tax year only. As subsequent tax years are added to the system, MeF will accept the current tax year and two prior tax years.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AU NAT 3092 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your AU NAT 3092 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit AU NAT 3092 in Chrome?

Install the pdfFiller Google Chrome Extension to edit AU NAT 3092 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I edit AU NAT 3092 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing AU NAT 3092, you can start right away.

What is AU NAT 3092?

AU NAT 3092 is an Australian taxation form used for reporting specific information regarding tax obligations, typically in relation to the Australian Business Number (ABN) and the taxation status of an entity.

Who is required to file AU NAT 3092?

Entities that are registered for an Australian Business Number (ABN) and are required to report certain taxation information are mandated to file AU NAT 3092.

How to fill out AU NAT 3092?

To complete AU NAT 3092, individuals must provide details such as their ABN, relevant taxation information, and any other required financial details as specified in the form's instructions.

What is the purpose of AU NAT 3092?

The purpose of AU NAT 3092 is to ensure that businesses and individuals report their taxation details accurately and timely to comply with Australian tax laws and regulations.

What information must be reported on AU NAT 3092?

The information that must be reported on AU NAT 3092 includes the entity's ABN, income details, deductions, and any other relevant taxation information as required by the Australian Taxation Office (ATO).

Fill out your AU NAT 3092 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU NAT 3092 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.