DoD MCCS Okinawa Financial Planning Worksheet 2007-2026 free printable template

Show details

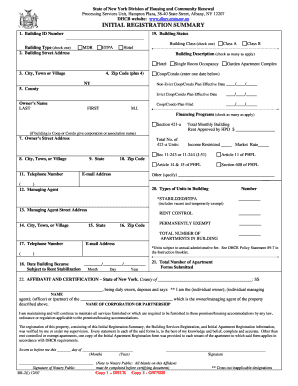

PAGE Financial Planning Worksheet Date SSN Rate Name Age Pay Grade Yrs. In SVC. Date Reported/PRD (Transfer) Marital Status Spouses Name Age Spouses Place of Employment Number of Children and Ages

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign DoD MCCS Okinawa Financial Planning Worksheet

Edit your DoD MCCS Okinawa Financial Planning Worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DoD MCCS Okinawa Financial Planning Worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DoD MCCS Okinawa Financial Planning Worksheet online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit DoD MCCS Okinawa Financial Planning Worksheet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out DoD MCCS Okinawa Financial Planning Worksheet

How to fill out DoD MCCS Okinawa Financial Planning Worksheet

01

Gather your income statements, including pay stubs, bonuses, and any other sources of income.

02

List all your monthly expenses, such as rent, utilities, groceries, transportation, and entertainment.

03

Identify any outstanding debts and record their monthly payment amounts.

04

Calculate your total income and total expenses to find your net income.

05

Utilize the worksheet sections for savings goals and emergency funds.

06

Review and adjust your budget as necessary, prioritizing essential expenses and savings.

Who needs DoD MCCS Okinawa Financial Planning Worksheet?

01

Active duty military personnel stationed in Okinawa.

02

Family members of service members seeking to manage their finances.

03

Anyone involved in the DoD community looking to improve their financial literacy.

04

Individuals planning for major financial decisions, such as buying a house or starting a family.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file form 941 or 944?

Generally, employers are required to file Forms 941 quarterly. However, some small employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less for the year) may file Form 944 annually instead of Forms 941.

What is a form 945 used for?

Sections 3402, 3405, and 3406 of the Internal Revenue Code require taxpayers to pay over to the IRS federal income tax withheld from certain nonpayroll payments and distributions, including backup withholding. Form 945 is used to report these withholdings.

What is the 945 form used for?

Sections 3402, 3405, and 3406 of the Internal Revenue Code require taxpayers to pay over to the IRS federal income tax withheld from certain nonpayroll payments and distributions, including backup withholding. Form 945 is used to report these withholdings.

What is the tax liability on Form 1040?

Thus, total tax liability represents the taxpayer's total federal income tax bill for the tax year. A taxpayer's total tax liability is found on line 24 of the Form 1040. Most taxpayers make periodic tax payments throughout the year via income withholdings that are credited against their federal income tax liability.

What is the tax liability on my tax return?

Your total tax liability is the combined amount of taxes you owe the IRS from income tax, capital gains tax, self-employment tax, and any penalties or interest. This also includes any past-due taxes that you haven't paid from previous years.

What is the 941 and 945 form?

Forms 940, 941, 943, 944, and 945 are filed by a business using payroll and/or bookkeeping software and are used to reconcile and verify correct remittance of payroll taxes due by the employer as well as taxes that were withheld from employees' paychecks.

How do you calculate tax liability on 1040?

How to calculate tax liability from taxable income. Your taxable income minus your tax deductions equals your gross tax liability. Gross tax liability minus any tax credits you're eligible for equals your total income tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my DoD MCCS Okinawa Financial Planning Worksheet in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your DoD MCCS Okinawa Financial Planning Worksheet and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete DoD MCCS Okinawa Financial Planning Worksheet online?

pdfFiller has made it simple to fill out and eSign DoD MCCS Okinawa Financial Planning Worksheet. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in DoD MCCS Okinawa Financial Planning Worksheet without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your DoD MCCS Okinawa Financial Planning Worksheet, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is DoD MCCS Okinawa Financial Planning Worksheet?

The DoD MCCS Okinawa Financial Planning Worksheet is a tool designed to assist military personnel and their families in assessing their financial situation and planning for their future financial needs. It provides a structured format for tracking income, expenses, savings, and financial goals.

Who is required to file DoD MCCS Okinawa Financial Planning Worksheet?

Military personnel stationed in Okinawa and their families are typically required to file the DoD MCCS Okinawa Financial Planning Worksheet as part of their financial readiness program and to ensure proper management of their finances.

How to fill out DoD MCCS Okinawa Financial Planning Worksheet?

To fill out the DoD MCCS Okinawa Financial Planning Worksheet, individuals should begin by gathering all relevant financial information, including income statements, bills, and bank statements. They should then list their income sources, expenses, savings goals, and any debts. The worksheet should be filled out accurately, reflecting manageable and realistic financial planning.

What is the purpose of DoD MCCS Okinawa Financial Planning Worksheet?

The purpose of the DoD MCCS Okinawa Financial Planning Worksheet is to help individuals and families create a comprehensive financial plan. It aims to promote financial awareness, facilitate budgeting, and ensure that military personnel are financially prepared for various situations they may face.

What information must be reported on DoD MCCS Okinawa Financial Planning Worksheet?

The information that must be reported on the DoD MCCS Okinawa Financial Planning Worksheet includes total monthly income, fixed and variable expenses, debts, savings contributions, financial goals, and any other relevant financial data that would impact the overall financial planning process.

Fill out your DoD MCCS Okinawa Financial Planning Worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DoD MCCS Okinawa Financial Planning Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.