Free Financial Planner Word Templates

What are Financial Planner Templates?

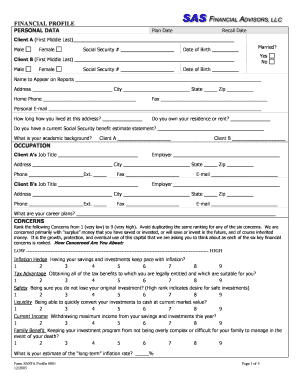

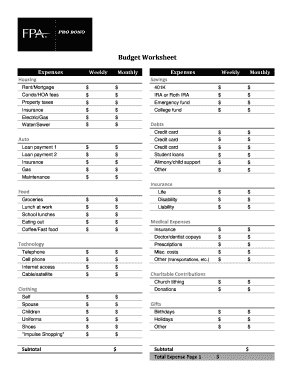

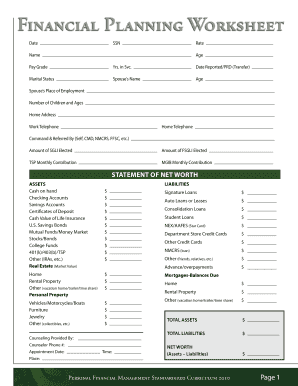

Financial Planner Templates are pre-designed documents that help individuals and businesses organize their financial information and plan for their future. These templates typically include sections for income, expenses, savings, investments, and goals.

What are the types of Financial Planner Templates?

There are several types of Financial Planner Templates available to suit different needs and preferences. Some common types include:

Personal Financial Planner Templates

Business Financial Planner Templates

Retirement Financial Planner Templates

Budgeting Financial Planner Templates

How to complete Financial Planner Templates

Completing Financial Planner Templates is easy and straightforward. Follow these simple steps to efficiently fill out your template:

01

Gather all your financial information, including income, expenses, savings, and investments.

02

Enter the relevant data into the designated sections of the template.

03

Review the completed template to ensure accuracy and make any necessary adjustments.

04

Save the document or print it out for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Financial Planner Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the main difference between financial planner and financial advisor?

A financial advisor is a general term that can be applied to anybody who helps you manage your money. This could include an employee of your financial institution, a stockbroker or an insurance agent. A financial planner is a type of advisor who helps you create a plan to reach your long-term financial goals.

What Is the Difference Between a Financial Planner and a Financial Advisor?

While the distinction between financial advisor and financial planner may be murky for consumers, many financial professionals have a clear idea of what it means to be an advisor versus a planner. Advisors are often focused on investment management, while planners take a more holistic approach to help clients.

Is paying a financial planner worth it?

Ultimately, whether or not a financial advisor will be worth your money depends on your specific situation and the financial advisor you choose to team up with. If they align with your goals, listen to your needs and act in your best interests, they will most likely be a good financial investment.

Which is better a financial planner or advisor?

For example, if you have short-term issues or need assistance with specific questions or investments, a financial advisor can usually be a big help. However, if you want support for developing a comprehensive long-term plan for your finances, you may be better off working with a financial planner.

What is the difference between a financial planner and a financial advisor?

What Is the Average Fee for a Financial Advisor? The average fee for a financial advisor generally comes in at about 1% of the assets they are managing. The more money you have invested, however, the lower the fee goes.

Should I hire a financial advisor and financial planner?

Financial planning Expert financial advice can be invaluable if: you need help making certain decisions. you want to make sure your tax and general household finances are in order. you're dealing with financial issues that can become complex and time consuming.