UT Tax Sentry Tax Organizer 2014 free printable template

Show details

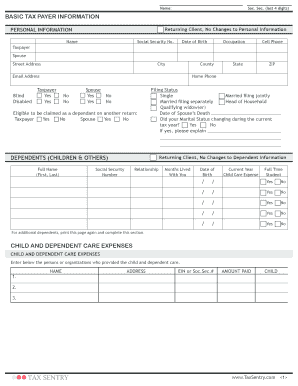

Tax Organizer

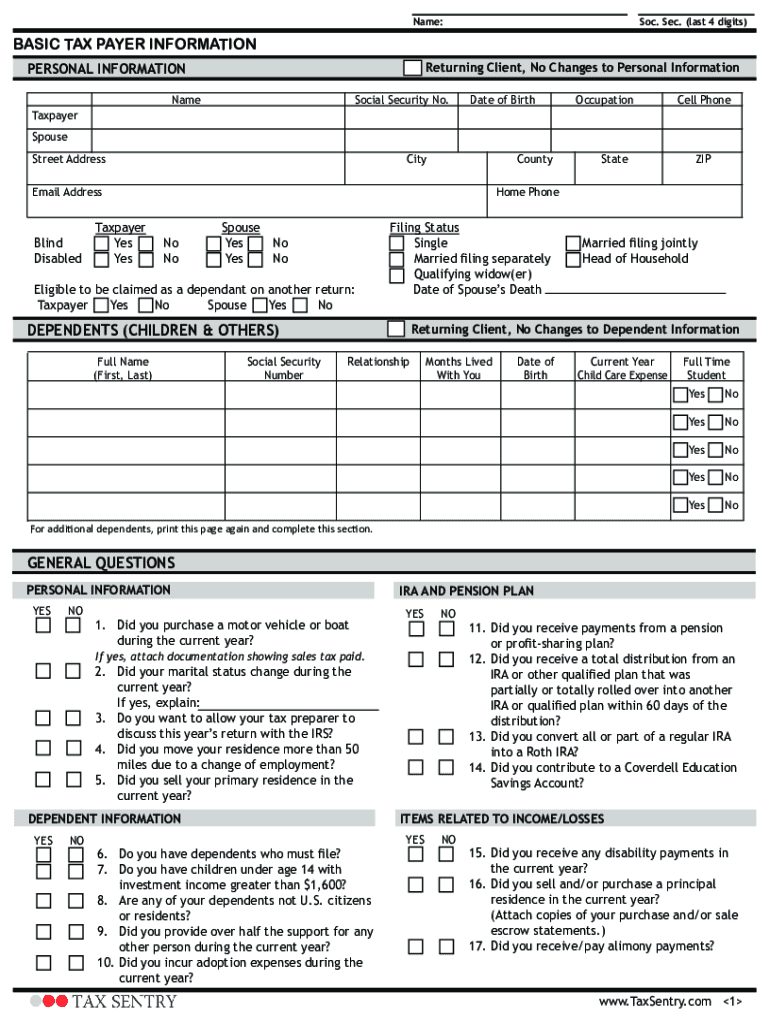

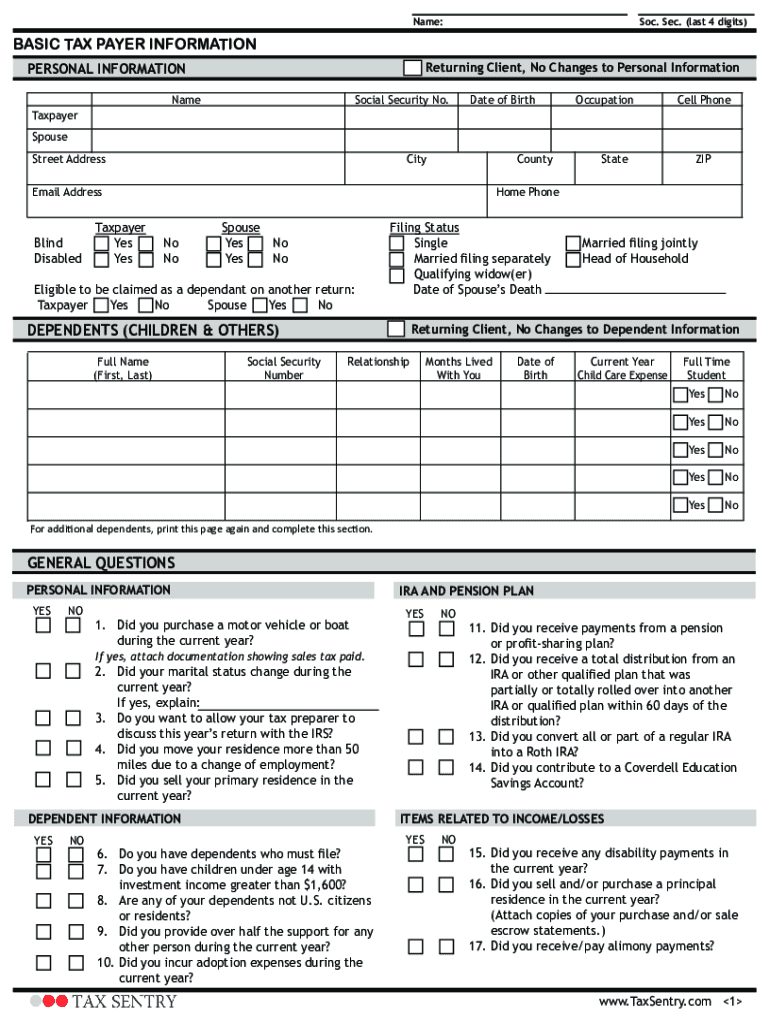

The Tax Organizer should be completed and sent to your tax preparer with your tax information. Any tax

return prepared by Tax Sentry requires the submission of a completed Tax Organizer.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT Tax Sentry Tax Organizer

Edit your UT Tax Sentry Tax Organizer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT Tax Sentry Tax Organizer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT Tax Sentry Tax Organizer online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT Tax Sentry Tax Organizer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT Tax Sentry Tax Organizer Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT Tax Sentry Tax Organizer

How to fill out UT Tax Sentry Tax Organizer

01

Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

02

Enter your personal information, such as your name, address, and Social Security number.

03

Complete the income section by inputting the details from your gathered financial documents.

04

Fill out the deductions and credits section, including any applicable deductions like mortgage interest, student loan interest, or contributions to retirement accounts.

05

Review all entered information for accuracy.

06

Compile any supporting documentation to attach if necessary.

07

Submit the organizer to your tax preparer or use it as a guide for filing manually.

Who needs UT Tax Sentry Tax Organizer?

01

Individuals preparing their own taxes who want to stay organized.

02

Self-employed individuals needing to track income and expenses.

03

Families looking to maximize their deductions and credits.

04

Anyone who wants to prepare for a meeting with a tax professional.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay taxes if I make over 100K?

Your marginal tax rate or tax bracket refers only to your highest tax rate—the last tax rate your income is subject to. For example, in 2022, a single filer with taxable income of $100,000 will pay $17,836 in tax, or an average tax rate of 18%.

Why do you need to do a tax return if you earn over 100k?

It boils down to a loss of 1 of tax-free Personal Allowance for each 2 over 100,000 of the adjusted net earnings. Things can get complex, which is why the HMRC requires that you file a tax return to make everything clear.

How do I file taxes on stock trades?

How to file Income Tax Return for Stock Market transactions? Income Tax e-filing step 1: Login to the Income Tax portal. In the Dashboard section click on File Now. ITR filing step 2: Choose the Assessment Year 2022-23 to file your taxes for the Financial Year 2021-22.

What do I owe in taxes if I made $120000?

If you make $120,000 a year living in the region of California, USA, you will be taxed $38,515. That means that your net pay will be $81,485 per year, or $6,790 per month.

Do you only pay tax on profit?

Primarily, your business will be taxed on its profits (the net amount of money it makes after losses and expenses).

Who pays income tax?

Most income is subject to income tax, including income from employment, self-employment, private and state pensions, investments and property rental. Income from certain savings products, and many state benefits, are not subject to income tax.

How do I avoid paying taxes if I make over 100K?

Tax Breaks For Income Over 100K Above the Line Deductions. Contributions to Health Savings Account. Traditional IRA Contributions are Tax-Deductible. Contributions to a Qualified Retirement Account. Charitable Donations Meeting the Requirements of the Law. Below the Line Deductions.

What to do when your salary reaches 100K?

6 Things You Must Do When Your Salary Reaches $100,000 Eliminate High-Interest Debt. Maximize Retirement Contributions. Update Your Expense Plan. Fund Your Emergency Fund. Open a Brokerage Account. Have an Investing Strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my UT Tax Sentry Tax Organizer directly from Gmail?

UT Tax Sentry Tax Organizer and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify UT Tax Sentry Tax Organizer without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your UT Tax Sentry Tax Organizer into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the UT Tax Sentry Tax Organizer in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your UT Tax Sentry Tax Organizer directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is UT Tax Sentry Tax Organizer?

UT Tax Sentry Tax Organizer is a tool designed to help individuals collect and organize their tax-related information, making the filing process easier and more efficient.

Who is required to file UT Tax Sentry Tax Organizer?

Individuals who are preparing to file their state taxes in Utah are required to use the UT Tax Sentry Tax Organizer to ensure all necessary information is documented.

How to fill out UT Tax Sentry Tax Organizer?

To fill out the UT Tax Sentry Tax Organizer, individuals should collect all relevant financial documents, follow the provided prompts, and input their income, deductions, and credits accordingly.

What is the purpose of UT Tax Sentry Tax Organizer?

The purpose of the UT Tax Sentry Tax Organizer is to streamline the tax preparation process by providing a structured format for individuals to gather all necessary financial information in one place.

What information must be reported on UT Tax Sentry Tax Organizer?

The UT Tax Sentry Tax Organizer requires reporting of personal information, income sources, deductions, credits, and any other financial data relevant to the tax year's filing.

Fill out your UT Tax Sentry Tax Organizer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT Tax Sentry Tax Organizer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.