UT Tax Sentry Tax Organizer 2016-2026 free printable template

Show details

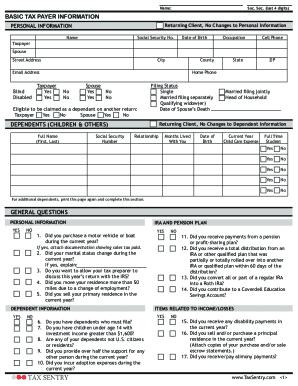

Tax Organizer

The Tax Organizer should be completed and sent to your tax preparer with your tax information. Any tax

return prepared by Tax Sentry requires the submission of a completed Tax Organizer.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT Tax Sentry Tax Organizer

Edit your UT Tax Sentry Tax Organizer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT Tax Sentry Tax Organizer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT Tax Sentry Tax Organizer online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT Tax Sentry Tax Organizer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT Tax Sentry Tax Organizer Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT Tax Sentry Tax Organizer

How to fill out UT Tax Sentry Tax Organizer

01

Gather all your financial documents such as W-2s, 1099s, and any other income-related forms.

02

Review the sections on the tax organizer and determine which categories apply to your financial situation.

03

Fill in personal information at the top, including your name, address, and Social Security number.

04

List all sources of income in the designated section, ensuring to accurately report amounts from all documents.

05

Complete the deductions section by reporting any qualifying expenses, including charitable donations, mortgage interest, and medical expenses.

06

If applicable, fill out any additional information regarding credits or specific tax situations.

07

Review your completed organizer for accuracy, making sure all fields are filled out completely.

08

Submit the organizer to your tax preparer or keep it for your personal records.

Who needs UT Tax Sentry Tax Organizer?

01

Individuals preparing their taxes who want to streamline the process.

02

Tax professionals assisting clients in organizing their financial information.

03

Anyone subject to tax filing requirements, including freelancers and self-employed individuals.

04

Individuals looking to maximize their deductions and credits for the tax year.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay taxes if I make over 100K?

Your marginal tax rate or tax bracket refers only to your highest tax rate—the last tax rate your income is subject to. For example, in 2022, a single filer with taxable income of $100,000 will pay $17,836 in tax, or an average tax rate of 18%.

Why do you need to do a tax return if you earn over 100k?

It boils down to a loss of 1 of tax-free Personal Allowance for each 2 over 100,000 of the adjusted net earnings. Things can get complex, which is why the HMRC requires that you file a tax return to make everything clear.

How do I file taxes on stock trades?

How to file Income Tax Return for Stock Market transactions? Income Tax e-filing step 1: Login to the Income Tax portal. In the Dashboard section click on File Now. ITR filing step 2: Choose the Assessment Year 2022-23 to file your taxes for the Financial Year 2021-22.

What do I owe in taxes if I made $120000?

If you make $120,000 a year living in the region of California, USA, you will be taxed $38,515. That means that your net pay will be $81,485 per year, or $6,790 per month.

Do you only pay tax on profit?

Primarily, your business will be taxed on its profits (the net amount of money it makes after losses and expenses).

Who pays income tax?

Most income is subject to income tax, including income from employment, self-employment, private and state pensions, investments and property rental. Income from certain savings products, and many state benefits, are not subject to income tax.

How do I avoid paying taxes if I make over 100K?

Tax Breaks For Income Over 100K Above the Line Deductions. Contributions to Health Savings Account. Traditional IRA Contributions are Tax-Deductible. Contributions to a Qualified Retirement Account. Charitable Donations Meeting the Requirements of the Law. Below the Line Deductions.

What to do when your salary reaches 100K?

6 Things You Must Do When Your Salary Reaches $100,000 Eliminate High-Interest Debt. Maximize Retirement Contributions. Update Your Expense Plan. Fund Your Emergency Fund. Open a Brokerage Account. Have an Investing Strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete UT Tax Sentry Tax Organizer online?

pdfFiller has made it simple to fill out and eSign UT Tax Sentry Tax Organizer. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in UT Tax Sentry Tax Organizer?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your UT Tax Sentry Tax Organizer to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit UT Tax Sentry Tax Organizer straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing UT Tax Sentry Tax Organizer, you need to install and log in to the app.

What is UT Tax Sentry Tax Organizer?

UT Tax Sentry Tax Organizer is a tool designed to help individuals and businesses organize their tax information effectively and efficiently for tax filing purposes.

Who is required to file UT Tax Sentry Tax Organizer?

Individuals and businesses who have income, deductions, or credits that need to be reported for tax purposes may be required to file the UT Tax Sentry Tax Organizer.

How to fill out UT Tax Sentry Tax Organizer?

To fill out the UT Tax Sentry Tax Organizer, gather all necessary financial documents, follow the sections of the organizer carefully, and provide accurate information based on your tax situation, ensuring to review for any missing entries.

What is the purpose of UT Tax Sentry Tax Organizer?

The purpose of the UT Tax Sentry Tax Organizer is to streamline the tax preparation process by collecting and organizing relevant financial information, ultimately simplifying the filing process.

What information must be reported on UT Tax Sentry Tax Organizer?

The information that must be reported on the UT Tax Sentry Tax Organizer includes personal identification details, income sources, deductions, credits, and any other relevant financial details related to tax obligations.

Fill out your UT Tax Sentry Tax Organizer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT Tax Sentry Tax Organizer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.