Get the free Your Home Loan Checklist - Bank of America

Show details

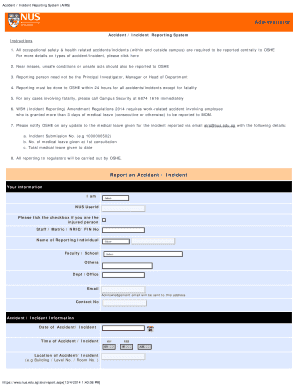

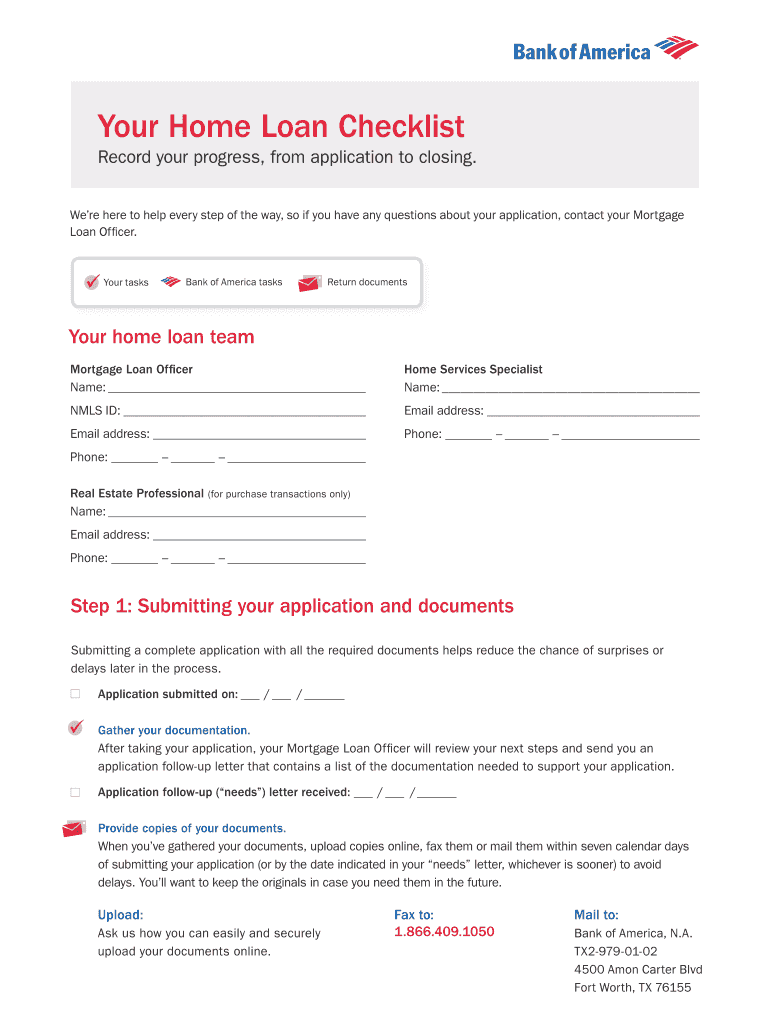

Your Home Loan Checklist Record your progress, from application to closing. Were here to help every step of the way, so if you have any questions about your application, contact your Mortgage Loan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your home loan checklist

Edit your your home loan checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your home loan checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

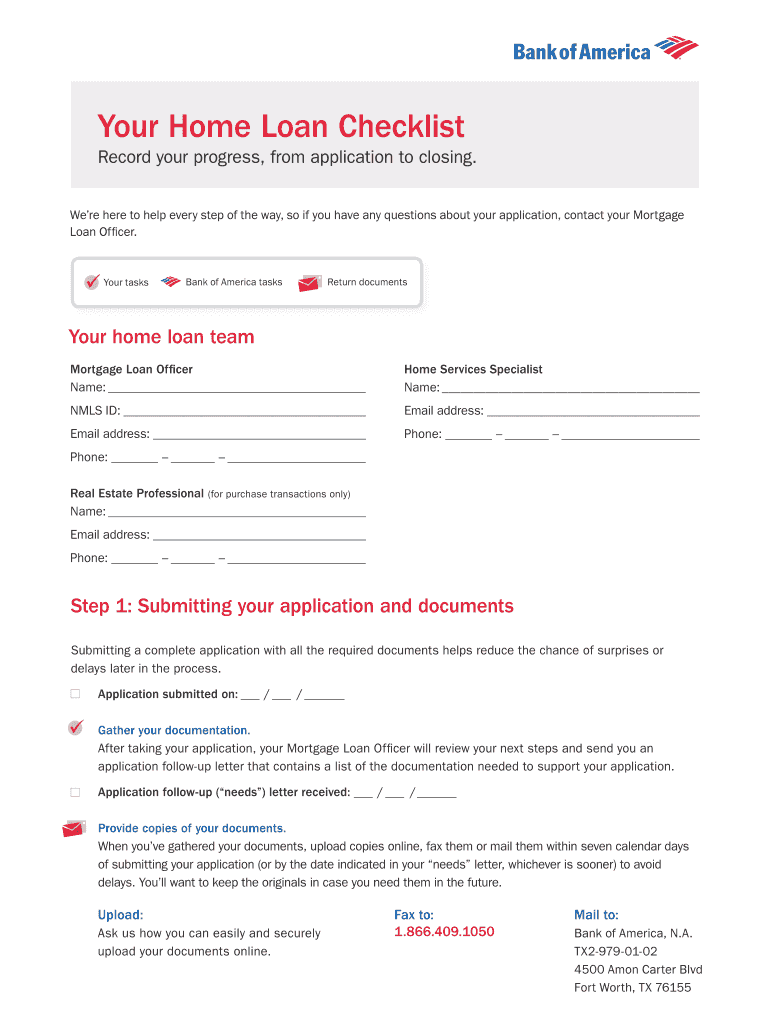

Editing your home loan checklist online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit your home loan checklist. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your home loan checklist

01

Start by gathering all the necessary documents for your home loan checklist. This may include proof of income, bank statements, tax returns, identification documents, and any other required financial information.

02

Organize your documents in a systematic manner, making it easier for the lender to review and process your loan application. Label each document clearly and arrange them in the order specified by the checklist.

03

Carefully read through the checklist to ensure you understand each requirement. It's important to follow the instructions precisely to avoid any delays or complications during the loan approval process.

04

Complete any necessary forms or applications that are part of the checklist. Make sure to fill them out accurately and thoroughly, double-checking for any errors or missing information.

05

Gather any additional supporting documents that may be required, such as proof of assets, employment verification letters, or information about other debts or obligations. Include these documents with your checklist to provide a comprehensive picture of your financial situation.

06

Review your checklist and documents one final time before submitting them to the lender. Look for any inconsistencies, missing documents, or incomplete information. It's always a good idea to have someone else review your checklist as well, to catch any mistakes or oversights.

07

Submit your completed home loan checklist and accompanying documents to the lender as instructed. Keep copies of everything you submit for your own records.

Who needs your home loan checklist?

01

First-time homebuyers: Those who are new to the homebuying process can benefit from a home loan checklist as it helps them stay organized and ensures they provide all the necessary documents for loan approval.

02

Current homeowners looking to refinance: Homeowners who are considering refinancing their existing mortgage can use a home loan checklist to gather the required documents for the refinancing application.

03

Individuals applying for a home equity loan or line of credit: Those who are seeking additional funds using the equity in their home can utilize a home loan checklist to gather the necessary documents for this type of loan application.

04

Potential homebuyers: Even if you haven't started the official homebuying process yet, it's never too early to start preparing. A home loan checklist can help you gather the required documents and be ready to apply for a mortgage when you find your dream home.

05

Anyone seeking pre-approval: If you're interested in getting pre-approved for a home loan, a checklist can help you gather the necessary documents to show lenders your financial stability and improve your chances of being pre-approved.

In conclusion, a home loan checklist is useful for anyone in the homebuying or refinancing process, ensuring all the necessary documents are gathered and organized for a smooth and efficient loan application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the your home loan checklist form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign your home loan checklist and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit your home loan checklist on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share your home loan checklist from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out your home loan checklist on an Android device?

On an Android device, use the pdfFiller mobile app to finish your your home loan checklist. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is your home loan checklist?

Your home loan checklist includes documents such as proof of income, tax returns, credit score, employment history, and asset statements.

Who is required to file your home loan checklist?

Borrowers who are applying for a home loan are required to file their home loan checklist.

How to fill out your home loan checklist?

To fill out your home loan checklist, gather all required documents and information, and carefully follow the instructions provided by your lender.

What is the purpose of your home loan checklist?

The purpose of your home loan checklist is to ensure that you meet the necessary requirements for obtaining a home loan.

What information must be reported on your home loan checklist?

Information such as income, employment history, credit score, assets, and liabilities must be reported on your home loan checklist.

Fill out your your home loan checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Home Loan Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.