Get the free 1099 form nc

Show details

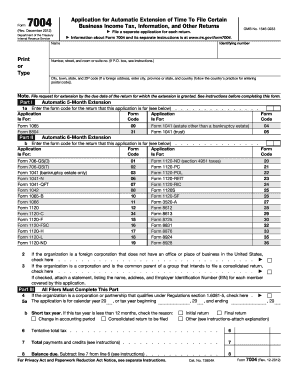

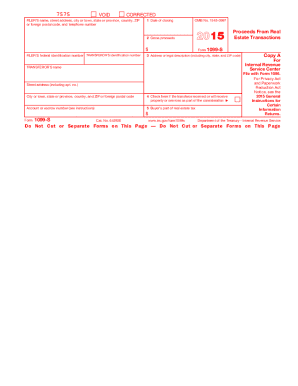

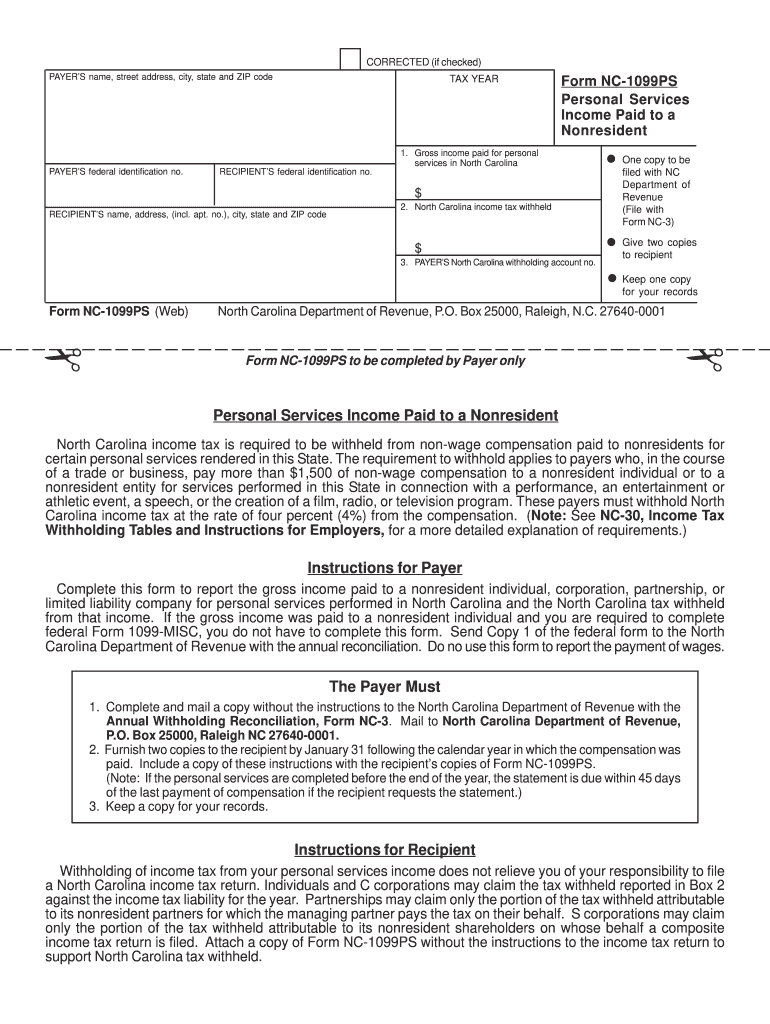

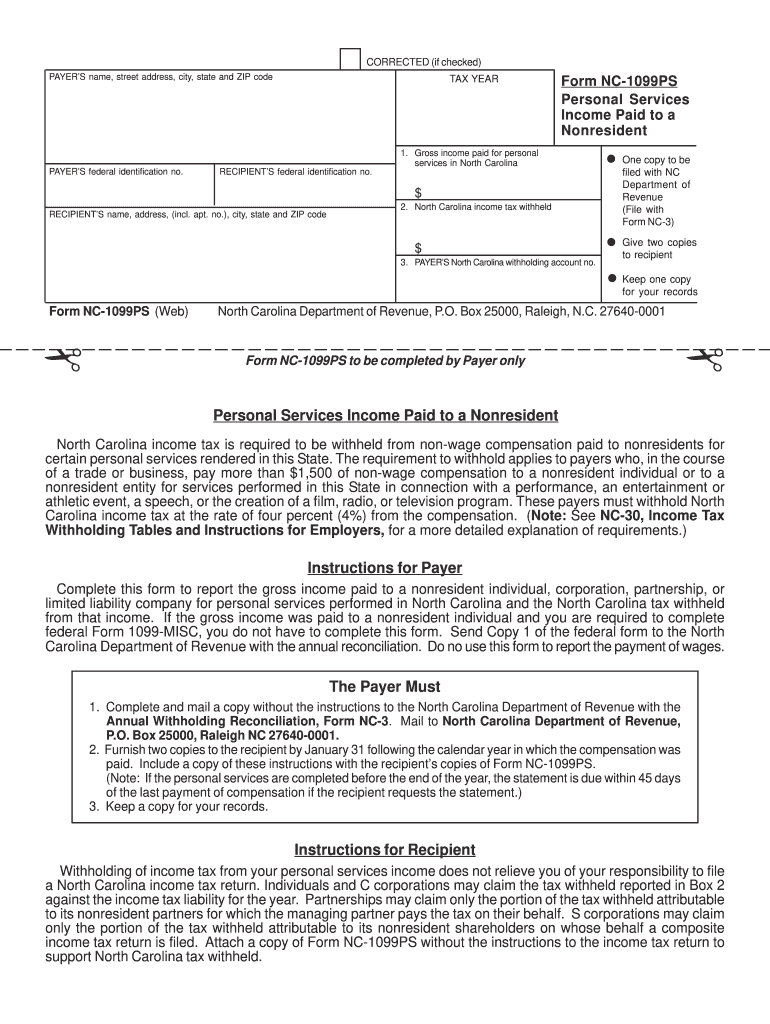

CORRECTED (if checked) PAYER S name, street address, city, state and ZIP code TAX YEAR Form NC-1099PS Personal Services Income Paid to a Nonresident 1. Gross income paid for personal services in North

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nc 1099 form

Edit your 1099 form nc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1099 form nc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1099 form nc online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1099 form nc. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1099 form nc

How to Fill out Form NC-1099PS Personal Services:

01

Start by entering your personal information. This includes your full name, address, and social security number. Make sure to double-check the accuracy of this information.

02

In the "Payer Information" section, provide details about the company or individual who paid you for your personal services. This includes their name, address, and federal employer identification number (EIN).

03

Next, you need to report the amount of money you received for your personal services. This should be entered in the "Gross Amount Paid" box. Be sure to include any additional compensation such as commissions or tips.

04

If you had any federal income tax withheld from your payments, indicate the amount in the "Federal Income Tax Withheld" box. This is the amount that was already deducted from your earnings for tax purposes.

05

If you qualify for any deductions or exemptions, such as the Work Opportunity Credit or empowerment zone employment credit, provide the necessary information in the designated sections. Consult the instructions for Form NC-1099PS to determine eligibility for these credits.

06

Fill out the "Recipient's State Identification Number" section if applicable. This is typically required if you are fulfilling personal services within a specific state that requires a state identification number for reporting purposes.

07

Finally, review all the information provided on the form for accuracy and completeness. Ensure that you have signed and dated the form before submitting it to the appropriate recipient.

Who Needs Form NC-1099PS Personal Services?

01

Individuals who have received payments for personal services and were not classified as employees by the payer may need to fill out Form NC-1099PS. It is commonly used by independent contractors, self-employed individuals, and freelancers.

02

Payers who have made payments for personal services to non-employees also need to provide this form to the recipients and file it with the appropriate tax authorities. This ensures that accurate tax reporting is maintained for both parties involved.

03

Form NC-1099PS is essential for reporting income and ensuring compliance with tax regulations. It enables the recipient and payer to properly report and pay taxes on personal service income, maintaining transparency and accountability within the tax system.

Fill

form

: Try Risk Free

People Also Ask about

Does NC require nonresident withholding?

I am a nonresident employee of a North Carolina company. Is my employer required to withhold N. C. income taxes from my wages? Yes. A nonresident employee is subject to N. C. withholding tax on any part of his wages paid for services performed in this State.

What is the NC partnership nonresident withholding rate?

North Carolina GS 105‐163.1 and GS 105‐163.3 requires income tax to be withheld at the rate of 4% from payments of more than $1,500.00 paid during a calendar year to nonresident individuals or nonresident entities for personal services performed in North Carolina in connection with a performance, an entertainment or

What is the tax rate for partnerships in NC?

Partnerships are not subject to North Carolina income tax, ( Sec. 59-84.1(b), G.S.) unless the partnership elects to pay the optional pass-through entity tax. ( 105-154.1, G.S.) The partners report their share of the income, losses, and credits from the entity or business on their North Carolina income tax return.

Do I have to file 1099s with the state of North Carolina?

A federal Form 1099- MISC statement that reports North Carolina income tax withheld must be filed with the Department as a part of a payer's annual report filing requirement. To file a NC-1099PS or NC-1099ITIN, follow the 1099-MISC format in the IRS Pub.

What form do I use for non resident income tax in North Carolina?

If you were a Nonresident or Part-Year Resident and received income from North Carolina sources, complete Form D-400 Schedule PN, 2022 Part-Year and Nonresident Schedule to determine the percentage of total gross income from all sources that is subject to North Carolina tax.

What is North Carolina non resident withholding tax?

I am a nonresident employee of a North Carolina company. Is my employer required to withhold N. C. income taxes from my wages? Yes. A nonresident employee is subject to N. C. withholding tax on any part of his wages paid for services performed in this State.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1099 form nc in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 1099 form nc along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit 1099 form nc online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your 1099 form nc and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my 1099 form nc in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 1099 form nc and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is form nc-1099ps personal services?

Form nc-1099ps personal services is a tax form used to report income earned from personal services in North Carolina.

Who is required to file form nc-1099ps personal services?

Individuals or businesses who have paid for personal services in North Carolina are required to file form nc-1099ps.

How to fill out form nc-1099ps personal services?

To fill out form nc-1099ps personal services, you will need to provide information about the payment made for personal services, including the name and address of the recipient.

What is the purpose of form nc-1099ps personal services?

The purpose of form nc-1099ps personal services is to report income earned from personal services and ensure compliance with tax regulations in North Carolina.

What information must be reported on form nc-1099ps personal services?

The information that must be reported on form nc-1099ps personal services includes the total amount paid for personal services and the name and address of the recipient.

Fill out your 1099 form nc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1099 Form Nc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.