WV DoR IT-141 2009 free printable template

Show details

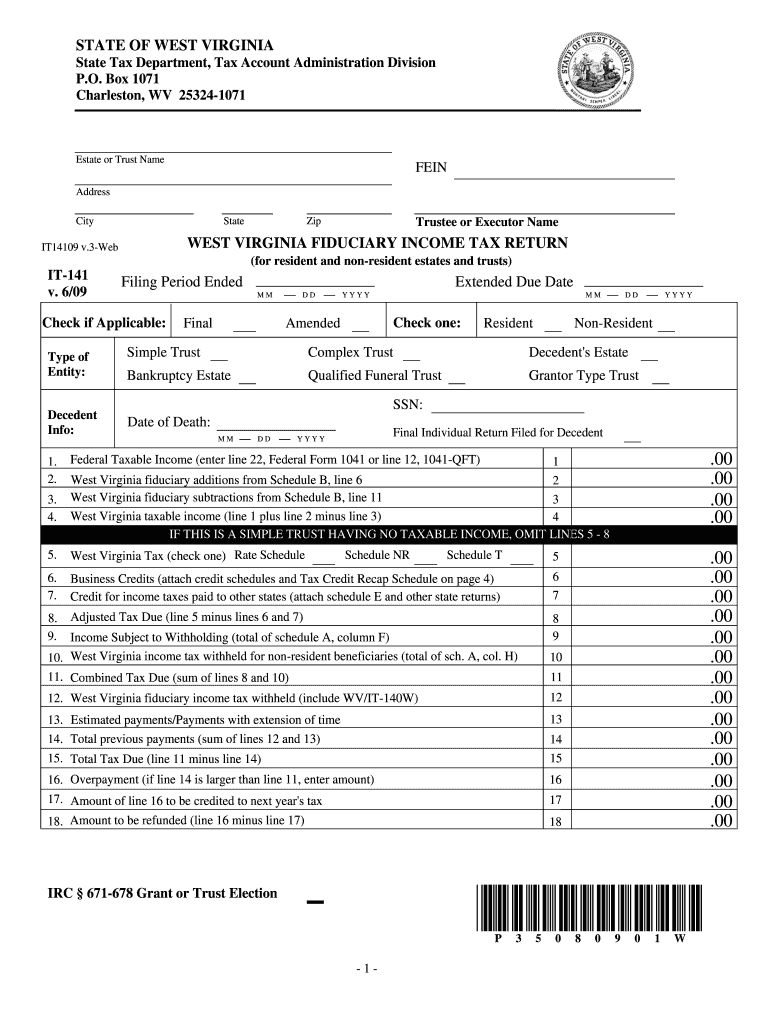

STATE OF WEST VIRGINIA State Tax Department, Tax Account Administration Division P.O. Box 1071 Charleston, WV 253241071 Estate or Trust Name FEIN Address City State Zip Trustee or Executor Name WEST

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WV DoR IT-141

Edit your WV DoR IT-141 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WV DoR IT-141 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV DoR IT-141 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WV DoR IT-141

How to fill out WV DoR IT-141

01

Obtain the WV DoR IT-141 form from the West Virginia Department of Revenue website or at your local tax office.

02

Enter your personal information, including your name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) in the appropriate section.

04

Fill in your total income for the tax year, including wages, interest, and other sources.

05

List any deductions or exemptions that apply to you, as per West Virginia tax regulations.

06

Calculate your taxable income by subtracting deductions from your total income.

07

Determine your tax liability using the tax tables or rates provided by the state.

08

Include any credits you may be eligible for to reduce your tax owed.

09

Sign and date the form at the bottom, certifying that the information provided is true.

10

Submit the completed form to the West Virginia Department of Revenue by the due date.

Who needs WV DoR IT-141?

01

Individuals who reside in West Virginia and need to report their state income for tax purposes.

02

Taxpayers who have earned income within the state boundaries.

03

Residents claiming deductions, exemptions, or credits on their state income tax.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a WV tax return?

If you are domiciled in West Virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to West Virginia.

What is West Virginia tax form it 140?

Use the IT-140 form if you are: A full-year resident of West Virginia. A full-year non-resident of West Virginia and have source income. Considered a part-year resident because you moved into or out of West Virginia.

Can you file an extension for West Virginia state taxes?

A request for an extension to file must also be submitted by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday. Taxpayers requesting an extension will have until Monday, October 16, 2023, to file. Please note that an extension to file is not an extension to pay.

What is WV tax form 141?

A trustee may file a single, composite Form IT-141 for all qualified funeral trusts of which he or she is the trustee by marking the IT-141 as a Qualified Funeral Trust Composite. Generally, a qualified funeral trust included on a composite must have a calendar year as its tax year.

Is West Virginia automatic extension?

If you have an approved Federal tax extension (IRS Form 4868), you will automatically receive a West Virginia tax extension.

What is the WV tax extension form?

Complete WV Form 4868, include a Check or Money Order, and mail both to the address on WV Form 4868. Even if you filed an extension, you will still need to file your WV tax return either via eFile or by paper by Oct.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WV DoR IT-141?

WV DoR IT-141 is a tax form used by individuals in West Virginia to report their income and calculate their state income tax liability.

Who is required to file WV DoR IT-141?

Individuals who have a legal obligation to file a state income tax return in West Virginia, typically those with taxable income or who meet certain income thresholds, are required to file WV DoR IT-141.

How to fill out WV DoR IT-141?

To fill out WV DoR IT-141, gather necessary financial documents, complete the form with accurate income and deduction information, and follow the filing instructions provided by the West Virginia Division of Revenue.

What is the purpose of WV DoR IT-141?

The purpose of WV DoR IT-141 is to allow residents and non-residents of West Virginia to report their income and calculate the appropriate amount of state tax owed.

What information must be reported on WV DoR IT-141?

WV DoR IT-141 requires reporting income details, deductions, tax credits, and other relevant financial information necessary for determining state tax liability.

Fill out your WV DoR IT-141 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV DoR IT-141 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.