Get the free 529 college savings plan enrollment form - Financial Advisor bb

Show details

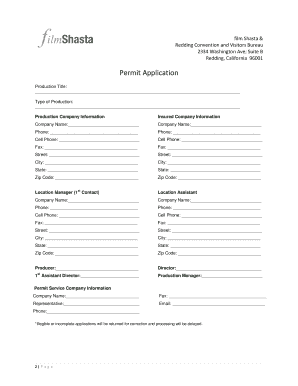

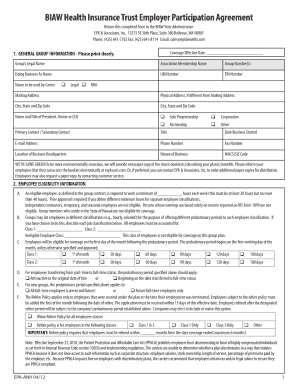

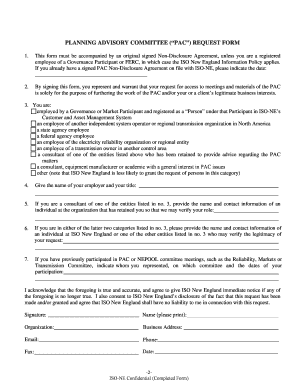

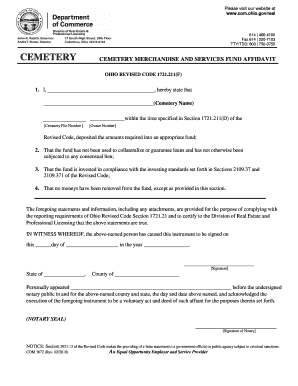

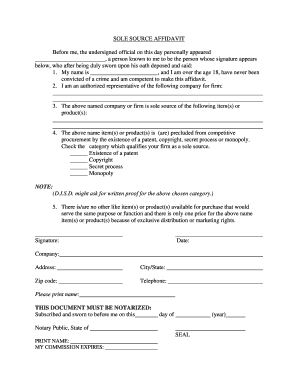

Reset Form 529 COLLEGE SAVINGS PLAN ENROLLMENT FORM Instructions: Please type or print unless a signature is specifically requested. You must complete a separate enrollment form for each beneficiary.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 529 college savings plan

Edit your 529 college savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 529 college savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 529 college savings plan online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 529 college savings plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 529 college savings plan

How to fill out 529 college savings plan?

01

Research and understand the 529 plan: Start by gathering information about different 529 plans available in your state or any other state that offers tax advantages. Learn about the eligibility requirements, contribution limits, investment options, and any applicable fees.

02

Determine your savings goals: Consider your financial situation and determine how much you can afford to save for higher education expenses. Set clear goals for the future educational expenses of your beneficiary, whether it's your child, grandchild, or even yourself.

03

Choose a 529 plan: Compare different 529 plans based on factors such as fees, investment options, and historical performance. Select the plan that aligns with your savings goals and offers the features that suit your needs.

04

Open the 529 account: Once you've chosen the plan, complete the necessary paperwork to open the account. This typically involves providing personal information, such as your name, address, social security number, and the beneficiary's information.

05

Decide on the contribution amount: Determine how much you want to contribute to the 529 account regularly. Many plans allow you to automate contributions through payroll deductions or automatic transfers from your bank account. Set up the contribution method that works best for you.

06

Invest your contributions: Depending on the 529 plan, you'll have a range of investment options to choose from, such as age-based portfolios or individual investment funds. Consider your risk tolerance and time horizon when selecting the investments that will help your savings grow over time.

07

Monitor and manage your account: Keep track of your 529 account regularly, review investment performance, and make adjustments if needed. Stay informed about any updates or changes to the plan's terms and conditions. Be aware of how the funds are being used and if they align with your goals.

Who needs a 529 college savings plan?

01

Parents: Parents who want to save for their child's future education expenses can greatly benefit from a 529 plan. It allows them to save money in a tax-advantaged account specifically designed for higher education costs, providing a head start for college or other qualified education expenses.

02

Grandparents: Grandparents can also contribute to a 529 plan on behalf of their grandchildren. It can be a tax-efficient way for grandparents to transfer wealth to future generations while supporting their grandchildren's educational aspirations.

03

Adults planning to pursue further education: Individuals who plan to return to school or pursue graduate studies can use a 529 plan to save and invest for their continuing education expenses. This enables them to take advantage of potential tax benefits while preparing for their educational goals.

In summary, filling out a 529 college savings plan involves researching and understanding different plans, setting savings goals, choosing a plan, opening an account, deciding on contributions, investing wisely, and actively managing the account. This type of savings plan is beneficial for parents, grandparents, and individuals planning to pursue higher education.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 529 college savings plan?

The 529 college savings plan is a tax-advantaged investment account designed to encourage saving for future college expenses.

Who is required to file 529 college savings plan?

Parents, grandparents, or any individual looking to save for a beneficiary's college education can open and contribute to a 529 college savings plan.

How to fill out 529 college savings plan?

To fill out a 529 college savings plan, individuals need to choose a plan, select investment options, and designate a beneficiary.

What is the purpose of 529 college savings plan?

The purpose of a 529 college savings plan is to help families save for future education expenses in a tax-efficient manner.

What information must be reported on 529 college savings plan?

Individuals must report their contributions, withdrawals, and changes to the beneficiary on their 529 college savings plan.

How can I send 529 college savings plan for eSignature?

Once your 529 college savings plan is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find 529 college savings plan?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 529 college savings plan in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the 529 college savings plan in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your 529 college savings plan and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your 529 college savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

529 College Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.