Get the free Documenting Cash Receipts - tarriverbaptist

Show details

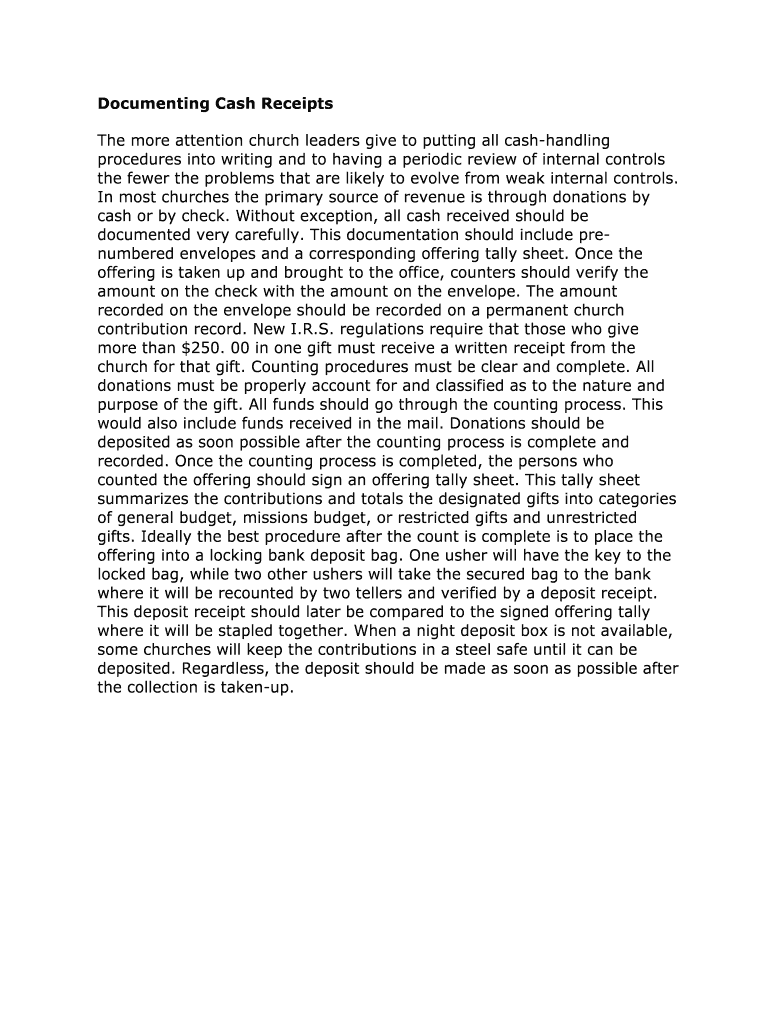

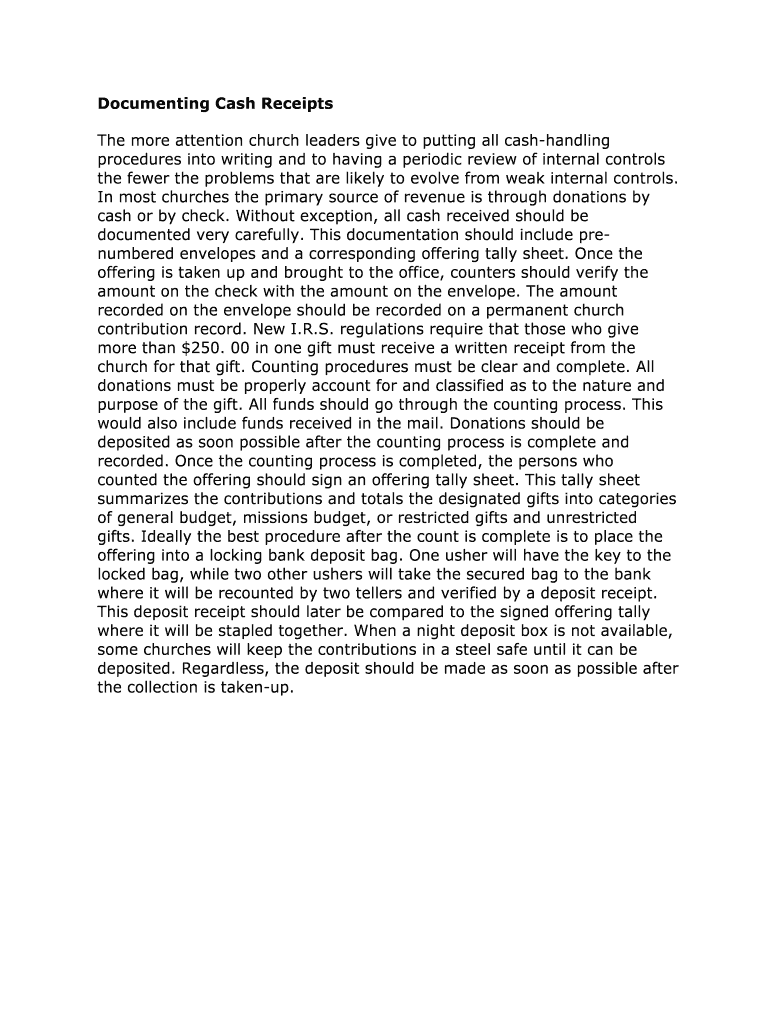

Documenting Cash Receipts The more attention church leaders give to putting all cash-handling procedures into writing and to having a periodic review of internal controls the fewer the problems that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign documenting cash receipts

Edit your documenting cash receipts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your documenting cash receipts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit documenting cash receipts online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit documenting cash receipts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out documenting cash receipts

01

To fill out documenting cash receipts, start by gathering all relevant information related to the transaction, such as the date, the amount received, and the source of the payment.

02

Next, identify the purpose of the cash receipt. Is it for a sale, a service provided, or a donation? Clearly indicate this on the receipt form to ensure accurate record-keeping.

03

Provide a description or itemized list of what the payment is for. Include details such as product names, quantities, or any other pertinent information that helps identify the transaction.

04

If applicable, note any taxes or discounts applied to the payment. This information is crucial for accurate accounting and tax purposes.

05

Include your business's name, contact information, and logo on the cash receipt. This not only adds professionalism but also helps with customer communication and recall.

06

Indicate the payment method used, whether it was cash, credit card, check, or any other form of payment. This information is necessary to keep track of payment trends and facilitate reconciliations.

07

Ensure that all the necessary fields on the cash receipt are filled out correctly and legibly. Mistakes, missing information, or illegible handwriting can cause difficulties when reconciling accounts or dealing with customer inquiries.

08

Finally, make a duplicate copy of the cash receipt for your records and provide the original copy to the customer or the payer. This maintains a paper trail and serves as proof of payment if any disputes arise.

As for who needs documenting cash receipts, anyone who receives cash payments as part of their business or organizational activities should document cash receipts. This includes small business owners, nonprofit organizations, self-employed individuals, freelancers, and even individuals who receive occasional cash payments, such as babysitters or fitness trainers. Proper documentation helps with accurate bookkeeping, tax compliance, and financial reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

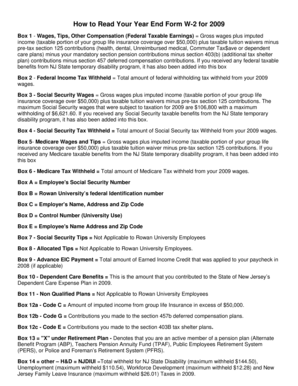

What is documenting cash receipts?

Documenting cash receipts is the process of recording and keeping track of all payments received in cash.

Who is required to file documenting cash receipts?

Businesses and individuals who receive cash payments are required to file documenting cash receipts.

How to fill out documenting cash receipts?

Documenting cash receipts can be filled out by recording the date, amount received, source of payment, and any additional notes.

What is the purpose of documenting cash receipts?

The purpose of documenting cash receipts is to have a record of all cash payments received for accounting and reporting purposes.

What information must be reported on documenting cash receipts?

Information such as the date of receipt, amount received, source of payment, and any relevant details must be reported on documenting cash receipts.

How can I edit documenting cash receipts from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including documenting cash receipts, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send documenting cash receipts to be eSigned by others?

When you're ready to share your documenting cash receipts, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit documenting cash receipts on an Android device?

You can make any changes to PDF files, such as documenting cash receipts, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your documenting cash receipts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Documenting Cash Receipts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.