NY DTF ST-120 2011 free printable template

Show details

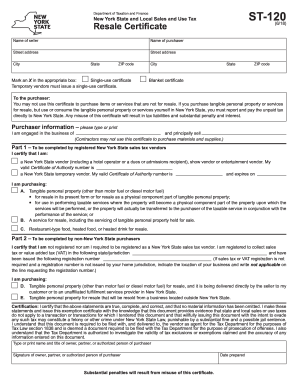

New York State Department of Taxation and Finance New York State and Local Sales and Use Tax Resale Certificate Name of seller Street address City State ZIP code ST-120 (1/11) Name of purchaser Street

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-120

Edit your NY DTF ST-120 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-120 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF ST-120 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY DTF ST-120. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-120 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ST-120

How to fill out NY DTF ST-120

01

Begin by downloading the NY DTF ST-120 form from the New York State Department of Taxation and Finance website.

02

Fill in your name, address, and taxpayer identification number at the top of the form.

03

Indicate the type of purchase you are making by checking the appropriate box.

04

Provide detailed information about the seller, including their name and address.

05

Specify the nature of the transaction and any applicable exemptions.

06

Sign and date the form to certify that the information provided is accurate.

Who needs NY DTF ST-120?

01

Any purchaser who is buying goods or services in New York State and wishes to claim a sales tax exemption.

02

Businesses purchasing items for resale or non-profit organizations making tax-exempt purchases.

Fill

form

: Try Risk Free

People Also Ask about

What is NY ST 120 form?

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid. Certificate of Authority issued by the Tax Department and is making.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

How do I fill out a resale certificate in NY?

2:55 8:33 How To Fill Out ST-120 New York State Resale Certificate - YouTube YouTube Start of suggested clip End of suggested clip Number is blank. So if you're a new york state vendor. You click that one. And then you put in yourMoreNumber is blank. So if you're a new york state vendor. You click that one. And then you put in your certificate of authority number right here.

Who qualifies for sales tax exemption in NC?

In North Carolina, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several examples of exemptions to the state sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals which are used in research and development.

Does New York have resale certificates?

New York Resale Certificate (Form ST-120) Once your business is registered with the state and has a certificate of authority, you may use a resale certificate to purchase items without paying sales tax, as long as you intend to resell them and collect sales tax from buyers.

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NY DTF ST-120 online?

pdfFiller has made filling out and eSigning NY DTF ST-120 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the NY DTF ST-120 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your NY DTF ST-120 in minutes.

How can I edit NY DTF ST-120 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing NY DTF ST-120.

What is NY DTF ST-120?

NY DTF ST-120 is a sales tax exemption certificate used in New York State to exempt certain purchases from sales tax.

Who is required to file NY DTF ST-120?

Individuals or businesses making tax-exempt purchases in New York State are required to file NY DTF ST-120.

How to fill out NY DTF ST-120?

To fill out NY DTF ST-120, provide the purchaser's name, address, and the type of exemption being claimed along with the seller's details.

What is the purpose of NY DTF ST-120?

The purpose of NY DTF ST-120 is to allow qualifying purchases to be made without paying sales tax by documenting the exemption status.

What information must be reported on NY DTF ST-120?

NY DTF ST-120 must report the purchaser's name, address, the seller's information, the nature of the exempt transaction, and the reason for the exemption.

Fill out your NY DTF ST-120 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-120 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.