Get the free Correspondent Extended Rate Lock Agreement - Gateway Mortgage

Show details

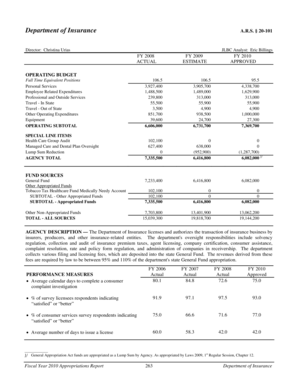

Correspondent Extended Rate Lock Agreement Date: Loan Number: Borrower Name(s): Term of Loan (months): Property Address: Lock Period: Loan Amount: $ Lock Period: Max interest Rate: Float Down Fee:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign correspondent extended rate lock

Edit your correspondent extended rate lock form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your correspondent extended rate lock form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing correspondent extended rate lock online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit correspondent extended rate lock. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out correspondent extended rate lock

How to Fill Out Correspondent Extended Rate Lock:

01

Gather all necessary information: Start by collecting all the required information for the correspondent extended rate lock. This includes the borrower's name, loan number, property address, and contact information.

02

Review the current interest rates: Before filling out the correspondent extended rate lock, make sure to review the current interest rates. This will help you determine whether locking in the rate is beneficial or if it's more advantageous to wait.

03

Complete the rate lock form: Fill out the correspondent extended rate lock form accurately and completely. Provide the requested information such as loan details, interest rate, lock-in period, and any applicable fees.

04

Submit the form to the appropriate department: Once the form is filled out, submit it to the relevant department or individual within your company. Make sure to review the submission process and follow any specific instructions provided.

05

Keep a copy for your records: It's essential to keep a copy of the correspondent extended rate lock form for your records. This will serve as proof of the lock-in agreement and can be referred to in the future if needed.

Who Needs Correspondent Extended Rate Lock:

01

Borrowers looking for interest rate protection: The correspondent extended rate lock is beneficial for borrowers who want to protect themselves from potential interest rate increases. By locking in a specific rate, they can ensure that their mortgage payment remains the same even if market rates rise.

02

Those anticipating a longer closing period: The correspondent extended rate lock is particularly useful for borrowers who anticipate a longer closing period. By locking in the rate, they can secure a fixed interest rate for a prolonged period, providing stability throughout the home buying process.

03

Borrowers seeking financial certainty: Some borrowers prefer the peace of mind that comes with knowing the exact interest rate they will be paying. The correspondent extended rate lock provides this certainty, allowing borrowers to accurately budget for their mortgage payments.

Remember to consult with a mortgage professional or loan officer to determine if a correspondent extended rate lock is appropriate for your specific circumstances. They can guide you through the process and provide personalized advice based on your financial goals and market conditions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in correspondent extended rate lock?

The editing procedure is simple with pdfFiller. Open your correspondent extended rate lock in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the correspondent extended rate lock in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your correspondent extended rate lock and you'll be done in minutes.

How do I fill out correspondent extended rate lock on an Android device?

Use the pdfFiller mobile app and complete your correspondent extended rate lock and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is correspondent extended rate lock?

Correspondent extended rate lock is a guarantee from a lender to hold a specific interest rate for a correspondent for an extended period of time, typically longer than the standard rate lock period.

Who is required to file correspondent extended rate lock?

Correspondents who want to secure a specific interest rate for a longer period of time are required to file correspondent extended rate lock.

How to fill out correspondent extended rate lock?

Correspondent extended rate lock can be filled out by providing the required information about the loan, the desired interest rate, and the requested lock period.

What is the purpose of correspondent extended rate lock?

The purpose of correspondent extended rate lock is to protect correspondents from fluctuations in interest rates and ensure that they can secure a favorable rate for their clients.

What information must be reported on correspondent extended rate lock?

Correspondent extended rate lock must include details about the loan, such as the loan amount, property type, and borrower information, as well as the desired interest rate and lock period.

Fill out your correspondent extended rate lock online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Correspondent Extended Rate Lock is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.