Get the free New SMSF &

Show details

Level 1, 290 Coventry Street (PO Box 2085) South Melbourne Vic 3205 pH: (03) 9092 9400 Fax: (03) 9092 9440 DBA dbalawyers.com.AU www.dbalawyers.com.au DBA Lawyers Pty Ltd ACN 120 513 037 NEW COMPANY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new smsf ampamp

Edit your new smsf ampamp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new smsf ampamp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new smsf ampamp online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new smsf ampamp. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new smsf ampamp

How to fill out a new SMSF ampamp:

01

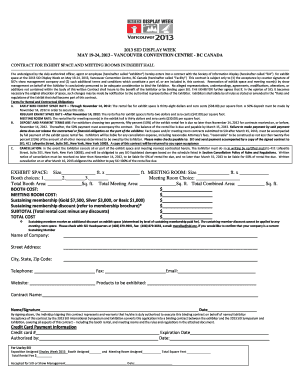

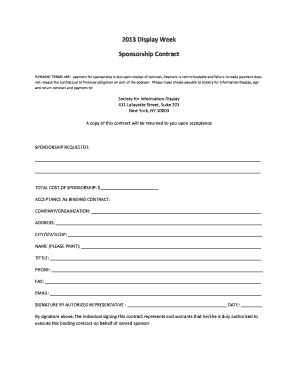

Understand the purpose: Before filling out the new SMSF ampamp, it is essential to understand the purpose of this document. A new SMSF ampamp is generally used to establish a self-managed superannuation fund (SMSF) and contains crucial information about the fund, its trustees, and beneficiaries.

02

Gather necessary information: To fill out the new SMSF ampamp, you will need certain information handy. Collect details such as personal identification documents of trustees and beneficiaries, contact information, tax file numbers, and financial details related to the SMSF.

03

Complete the first section: The first section of the new SMSF ampamp usually requires basic information about the trustees. Fill out the names, addresses, dates of birth, and contact details of each trustee. Ensure accuracy as this information will be legally binding.

04

Provide beneficiary details: The new SMSF ampamp may also require providing beneficiary information. State the names, addresses, and relationship to the trustees for each beneficiary. It is important to update this section regularly, especially if there are changes or additions to the beneficiaries.

05

Declare trustee declarations: Trustees will need to make declarations in the new SMSF ampamp, acknowledging their roles, responsibilities, and commitment to comply with relevant laws and regulations. Read and complete these declarations carefully, ensuring they are accurate and truthful.

06

Include financial details: The new SMSF ampamp will require information about the SMSF's financial aspects. This may include details such as the fund's bank account number, investment strategy, and intended contributions. Provide accurate and up-to-date information to ensure compliance with superannuation regulations.

07

Seek professional advice if necessary: Filling out a new SMSF ampamp can involve legal and financial considerations. If you are uncertain about any section or have complex circumstances, it is advisable to seek professional advice from an accountant, financial advisor, or SMSF specialist to ensure compliance and accuracy.

Who needs a new SMSF ampamp:

01

Individuals interested in establishing a self-managed superannuation fund (SMSF): The new SMSF ampamp is primarily required by individuals who wish to create an SMSF rather than opting for a traditional super fund. This allows greater control over investment decisions, flexibility, and potential tax benefits.

02

Trustees and beneficiaries: Both trustees and beneficiaries of the SMSF will need to have a new SMSF ampamp as it serves as a legal document outlining their roles, responsibilities, and entitlements. It is crucial for all parties involved to have a comprehensive understanding of the SMSF's rules and regulations.

03

Financial advisors and professionals: Financial advisors and professionals, who assist clients in managing their superannuation and retirement planning, may also need to be familiar with the new SMSF ampamp. They can provide guidance and support in correctly filling out the document, ensuring compliance with legislative requirements.

Overall, the new SMSF ampamp serves as a vital document for individuals interested in establishing an SMSF and outlines the necessary information for effective fund management. It is essential to fill it out accurately, seek guidance if needed, and regularly update relevant sections to comply with respective laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out new smsf ampamp on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your new smsf ampamp from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit new smsf ampamp on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute new smsf ampamp from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out new smsf ampamp on an Android device?

On Android, use the pdfFiller mobile app to finish your new smsf ampamp. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is new smsf ampamp?

New smsf ampamp stands for New Self-Managed Super Fund Annual Return.

Who is required to file new smsf ampamp?

All self-managed super fund (SMSF) trustees are required to file the New SMSF ampamp.

How to fill out new smsf ampamp?

To fill out the New SMSF ampamp, trustees need to gather all relevant financial information and complete the required sections in the annual return form provided by the Australian Taxation Office.

What is the purpose of new smsf ampamp?

The purpose of New SMSF ampamp is to report the financial status and transactions of a self-managed super fund to the Australian Taxation Office.

What information must be reported on new smsf ampamp?

Information such as the fund's assets, income, expenses, contributions, and member details must be reported on the New SMSF ampamp.

Fill out your new smsf ampamp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Smsf Ampamp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.